The Cagayan Economic Zone Authority (CEZA), a Philippine government-owned and-controlled corporation tasked to develop the “fintech city” in the country, is planning to limit to 25 the number of licenses it issues to cryptocurrency exchanges.

CEZA administrator and CEO Raul Lambino disclosed the plan in the recent Global Blockchain Summit where he also noted that the investment promotion agency (IPA), which he also supervises, is in the process of crafting regulations that will protect those investing in cryptocurrency.

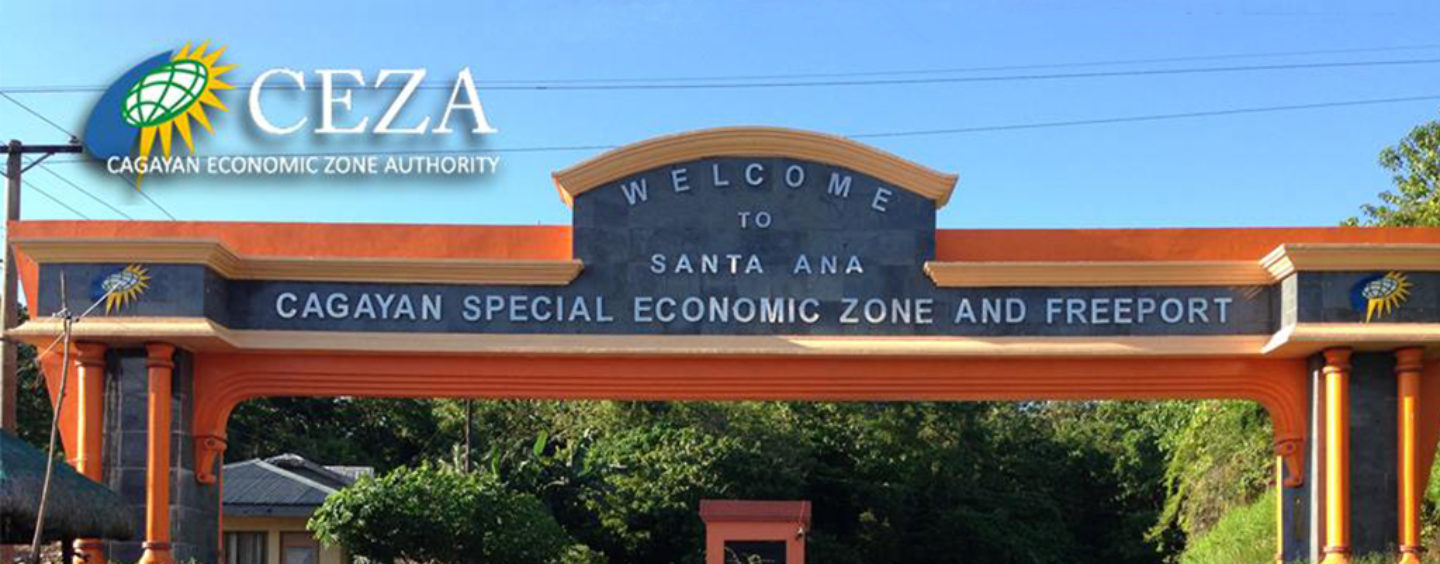

CEZA is mandated to manage and supervise the Cagayan Special Economic Zone and Free Port (CSEZFP) development, where the upcoming $100 million fintech city will be built. The new business hub will house a fintech startup incubator, cryptocurrency mining farm, cryptocurrency exchange, and a blockchain center.

CEZA has so far signed agreements with 22 global fintech and blockchain firms that expressed their interests to locate at the CSEZF.

Although CEZA will only issue 25 licenses, each exchange will have 20 to 30 sub-licenses for traders and brokers, according to Lambino, in a report by the Philippine News Agency.

“If they have ICO we will have to find if their ICO is asset-backed because this what we are saying that there are many scammers. If they offer in the market their initial [digital] coin, they may be able to convince 50 unsuspecting investors and promise them the sun and the moon. This is the Ponzi scheme. We are not going to allow it,” Lambino said.

Ponzi scheme refers to a fraudulent investment activity, a get-rich-quick bogus investment deal.

In its bid to protect the public against Ponzi schemes, CEZA’s regulations will also include licensing of ICO projects. It also included in its main rules that licensee’s will have to commit to invest $1 million over a period of two years, physically locate some level of their core operations in the zone (fintech city), have safisfactory KYC and AML practises in place, among others.