Posts From Tom Noda

Philippine Based Crypto Startup PDAX Receives Funding Boost from BitMEX

Philippines Digital Asset Exchange (PDAX), a locally based cryptocurrency exchange platform recently received an undisclosed sum of funding from BitMEX Ventures. This news follows a recent investment by Consensys into PDAX. According to BitMEX co-founder and CEO Arthur Hayes, they

Read MorePhilippines’ Ayala Corp Raising US$150-M Fund for Disruptive Early-Stage Startups

The Ayala Corporation, Philippines’ oldest conglomerate, is raising a new venture capital fund worth US$150 million, dedicated towards investing into early stage startups engaged in e-commerce, as well as what the company deems as disruptive technologies; like fintech, healthtech, artificial intelligence,

Read MorePhilippines Approves 3 More Crypto Exchanges Amid Soaring Bitcoin Prices

Bangko Sentral ng Pilipinas has green-lit another 3 cryptocurrency exchanges to operate in the Philippines. The new licensed firms include Bexpress Inc, Coinville Phils Inc. and Aba Global Philippines Inc. This brings the total number of licensed cryptocurrency exchange in

Read MoreNew Partnership Enables Filipinos to Get Salaries in Their Gcash Wallet

Singapore-based payroll services provider Excelity Global has partnered with Philippine mobile money wallet GCash to allow disbursement of salaries and reimbursements in an employee’s GCash account. This feature is directly integrated with Excelity’s payroll clients through the GCash App and

Read MorePhilippines’ Cryptocurrency Enabled Wallet Can Now Accept Western Union Transfers

Blockchain-based financial services company Coins.ph and Western Union have teamed up to allow the fintech startup’s five million customers receive international and domestic money transfers directly into their mobile wallets in the Philippines. The collaboration was announced following news of

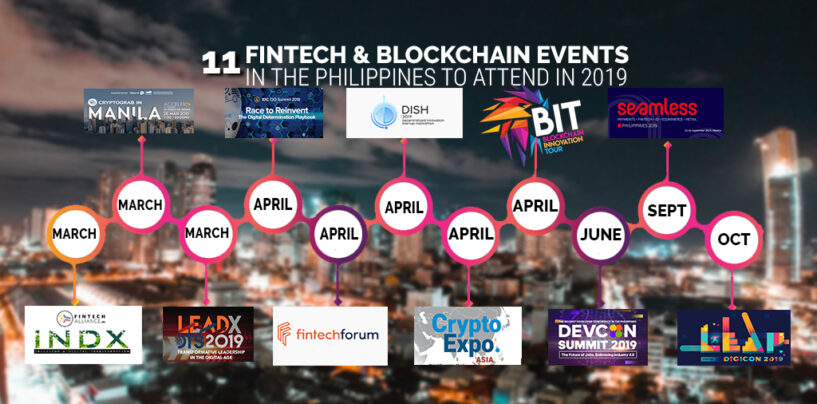

Read More11 Fintech and Blockchain Events in the Philippines to Attend in 2019

Philippines is described by some as a hidden gem in the South East Asian fintech scene, our previous Fintech Philippines 2018 report demonstrates that this archipelagic nation has all the recipes in place for a booming fintech sector. A similar

Read MoreSaphron Raises SGD 1.35 M to Tackle Financial Inclusion in the Philippines

Manila-based insurtech startup Saphron has raised SGD1.35 million seed fund coming from fintech-focused VC fund Sage, and Talino Labs, a venture lab that supports companies engaged in digital transformation. Founded recently by solutions architect Francisco “Kiko” Reyes Jr, Saphron plans

Read MoreConsenSys Ventures Backs Philippine Crypto Trading Startup PDAX

Crypto-exchange platform Philippine Digital Asset Exchange (PDAX) has raised an undisclosed amount of investment made by ConsenSys Ventures, the venture capital arm of US-based blockchain software firm ConsenSys. Founded in 2017 by Nichel Gaba, Krystian Kucharzyk, and Yang Yang Zhang,

Read MorePhilippine-based Blockchain Ticketing Startup Raises Capital for SEA Expansion

Singapore’s diversified group of companies Citystate Group made a seed investment in Ticket2Me, a blockchain-powered ticketing startup from the Philippines. The startup is now gearing for business expansion in Southeast Asia. Ticket2Me raised $350,000 in fresh capital and reportedly plans

Read MoreRipple Backs Philippine-Focused Remittance Firm SendFriend in $1.7M Funding

SendFriend, a Philippine-focused remittance market startup, has raised up to US$1.7 million capital in a venture round backed by blockchain giant Ripple also known as the cryptocurrency XRP. Other leading investors include the MIT Lab, Mastercard Foundation, Barclays, Techstars, Mahindra

Read More