FSI’s Future Is Autonomous, Oracle Wants to Help You Navigate it

by Fintech News Singapore November 10, 2018Going to the Singapore Fintech Festival? Good. Staying up to date on the latest services and transformative technologies is more important now than ever, because the future of the financial services industry has never before been so uncertain.

A rapidly changing landscape

Distribution has changed from a vertically integrated model to a digital presence model. Fintech organizations are creating entirely new types of services and changing customer expectations.

To those privy, it is obvious this change is not driven purely by ambitious startups, many big tech companies are throwing their hats in the ring.

Big tech companies like Amazon are increasingly behaving more like a bank by offering quasi-deposit services, credit cards and business loans. Further strengthening their play they’ve also secured partnership with the likes of JP Morgan.

One does not have to look far to see these threats closing in, nearer to home, Tencent has deployed a myriad of financial services from WeChat Pay to WeSure and it’s backed by their strong numbers of over a billion active monthly users and 14 billion corporate accounts

Its closest competitor Ant Financial grew out of the shadows of Alibaba, its market cap can easily place it as the 10th largest bank in the world — bigger than Goldman Sachs and Barclays combined.

All this doom and gloom, what now?

Faced with unprecedented innovation and scale, financial services companies must ask themselves what unique value they will be able to offer moving forward.

As one of the global leaders in the banking technology space, we thought it would be worthwhile to speak to Mark Smedley, Industry VP, Global Financial Services of Oracle to get a sense of what Oracle’s game plans are to address this new world.

Mark tells Fintech News Singapore that in recognition of these challenges, they will be putting together events during the much anticipated Singapore Fintech Festival 2018.

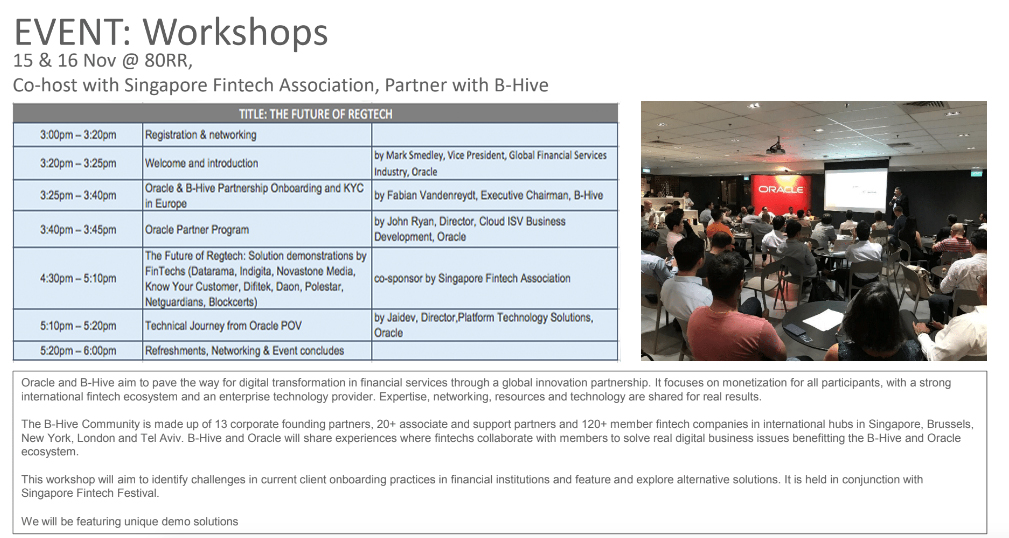

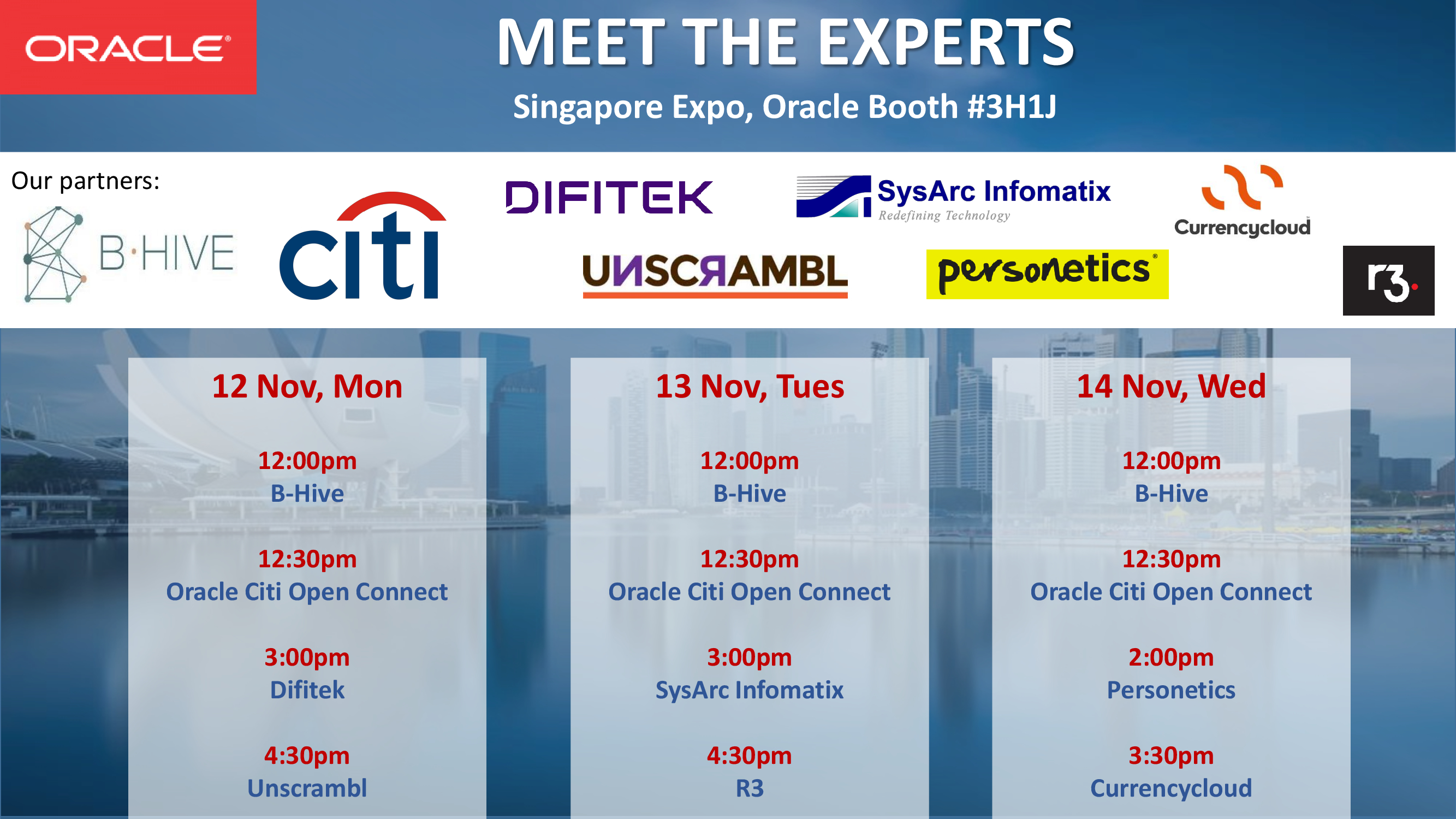

Done in collaboration with B-Hive Oracle will be introducing several key events to address these pressing issues namely “Meet the Experts” , “the Future of Regtech” and ” The Accelerated Evolution of the Bank” within the Singapore Fintech Festival 2018

Meet the Experts

Featuring experts from incumbent banks and disruptive startups, visit Oracle’s booth at #3H1J to learn how your bank can form fintech partnerships that will address real digital challenges and create an effective way to monetise for all parties.

The Accelerated Evolution of the Bank

What does the future look like? The experts will tell you (or maybe even scare you) with their prediction, market outlook and effective strategy to navigate this tumultuous new landscape.

The Future of RegTech

Held in the Fintech Hub at Robinson Road, this 2 days session will take deep dive into all things regtech — cutting through the noise and helping you determine the role of RegTech in your digital roadmap. To attend this session you’ll need to register here

Register HERE

A detailed outline of the workshop can be found below:

Mark quipped that, these days it’s hard to tell when your vendor will be your competitor tomorrow, he emphasized that that Oracle will always be there as a transformation partner for the financial services industry and never a competitor.

He added that Oracles hopes to assist the FSI organisations radically change their business and ensure its survival through these events organised at the Singapore Fintech Festival 2018