Regtech, the younger cousin of fintech has quickly risen out of fintech’s shadow and stand on its own two feet. In Asia, this is perhaps no more apparent than it is in Singapore.

Not purely a compliance play

Regtech involves a whole gamut of solutions which is chiefly aimed at solving regulatory challenges through technology. However one would be mistaken to think that its sole purpose is compliance, in some instances RegTech can actually enable superior customer experience.

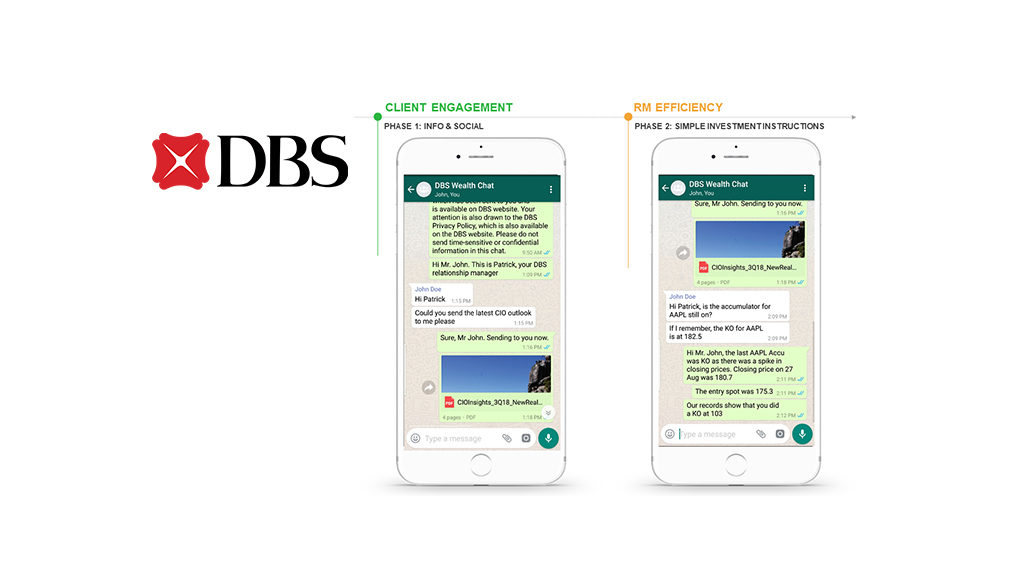

Take for example DBS’s new banking service which enables their wealth clients to interact with DBS relationship managers through Whatsapp and WeChat. Developed in partnership with regtech startup FinChat, it is anticipated to save DBS 10,000 man-hours and speedier delivery to clients while meeting rigorous regulatory requirements.

Initiatives from the regulator

Singapore’s commitment to regtech was also reflected in Ravi Menon, Managing Director, Monetary Authority of Singapore’s speech during the launch of the 2018 Singapore Fintech Festival.

In his speech, he shared the 6 core focus on the developing the fintech ecosystem, half of which are closely related to regtech namely; Identity/KYC, data governance and platforms for innovation. While platforms for innovation is broad category that is not exclusive to regtech, it is likely to contain some elements of it.

On the e-KYC front, Singapore has shown leadership in its MyInfo initiative, which is a digital service that enables citizens to authorize 3rd party access to their data.

Working off the back of this initiative, MAS and Govtech started a pilot with 4 banks last year to enable consumers to open bank accounts using MyInfo. Fast forward to today, Singaporeans can open bank accounts or apply for credit cards online instantly thanks to this initiative. According to Ravi, more than 20 financial institutions are now using MyInfo to provide more than 110 digital financial services.

Since then, several initiatives by industry trade groups have been launched to boost regtech development in the city state. In May 2019, the Singapore Fintech Association (SFA) launched a regtech sub-committee to promote the industry and inked a memorandum of understanding with the Australia-based Regtech Association to better engage with the regtech ecosystem in the region. That same month, the regtech committees of the fintech associations of Singapore, Hong Kong and Japan jointed launched the APAC Regtech Network to enhance cross-border collaboration on regtech education and implementation across APAC.

Who are playing in this space?

AiDA Technologies focuses on AI and ML-based predictive analytics and intelligent systems. These systems provide solutions to augment the ability of human experts to make decisions based on large volumes of information.

Apiax combines exceptional legal and compliance expertise with outstanding technological capabilities. Together, we build a lean yet comprehensive RegTech solution that makes it radically simple for companies to comply with regulations. Apiax is a pioneer in turning written regulations into digital compliance rules and deliver a product that is perfectly suited for the open banking- and API-economy. Today, Apiax has a team of more than 30 experienced professionals with offices in Zurich, London, and Lisbon.

Apvera is a provider of automated threat intelligence solutions which helps organizations detect, prevent and predict real-time behavioral threat anomalies.

Backpack offers all-in-one backend office SaaS solutions to help financial services firms maximise operational efficiency and spur revenue growth. Solutions include CRM tailored for financial services, compliance solutions, payment aggregators, marketing software & API marketing, 360 Reporting & BI.

CashShield is an online enterprise risk management company that helps companies manage their payment fraud risks and prevent hostile account takeovers. It utilises real-time pattern recognition and passive behavioural biometrics to screen transactions.

Headquartered in Singapore, Centenal is a fintech company providing digital operation and compliance solution for wealth managers. Centenal’s award-winning CRS Expert is the first-of-its-kind regulation engine that transforms the Common Reporting Standard, a complicated international legislation, into a digital regulation rule, saving 98% compliance time.

Compliy is an artificial intelligence (AI) web platform built on Asia Pacific (APAC)’s largest financial regulatory database. The solution simplifies and automates regulatory change management by empowering compliance teams with extensive access to multiple regulatory data sources across APAC while using AI to extract and share valuable insights, and then quickly identify key compliance actions. Compliy is headquartered in Ho Chi Minh City, Vietnam, with an office in Singapore.

Cynopsis is a Singaporean regtech company that aims to help fintechs reduce the cost of regulatory compliance, in particular anti-money laundering (AML) counter-terrorism financing (CTF) and know-your-customer (KYC), through SaaS products.

Datarama uses mapping tools to mine information sources for conducting complex risk profiling and due diligence in emerging markets. Sources are mined to uncover ultimate beneficiary ownership, political links and business development opportunities, for example.

Dathena is a provider of data governance software based on machine learning algorithms. By allowing customers to sift through their data, they are able to identify, classify and categorise it, ensuring consistent & accurate regulatory compliance.

Deep Identity provides a comprehensive and unique solution to address identity governance and administration (IGA), compliance management and data governance requirements. The company offers a layered approach that enables better visibility and controls, ultimately automating compliance management in a cost effective manner. Deep Identity is headquartered in Singapore with an office in India.

Edgelab empowers private banks to achieve long-term success by providing them technology solutions with unprecedented value. With its extensive risk analytics, compliant with MAS, banks can deliver appropriate investments for their clients and automate regulatory controls and reports. Edgelab’s technology is modular, API-based and fully customizable, creating a simple way to integrate into existing systems. The company has offices in Switzerland and Singapore.

FinChat’s compliance monitoring software helps regulated enterprises capture all employee communications conducted via smartphone applications, then store the data in secured servers. This data can be retrieved anytime for the purposes of fraud detection, audit trails, dispute resolution, etc.

FinChat’s compliance monitoring software helps regulated enterprises capture all employee communications conducted via smartphone applications, then store the data in secured servers. This data can be retrieved anytime for the purposes of fraud detection, audit trails, dispute resolution, etc.

GRC Solutions is a leader in the online compliance training market in the Asia Pacific region, providing an award-winning compliance training technology, Salt Compliance, which helps hundreds of companies navigate complex legal and regulatory environments and build resilient organizational cultures. The company also produces customized eLearning courses for clients. GRC Solutions has offices in Sydney, Melbourne, Perth, Brisbane, New York and Singapore.

IMTF, a company founded in 1987, provides fintech solutions and regulatory compliance software to banks, financial institutions and other industries globally. IMTF is one of the most comprehensive providers in the regtech space, offering innovative and reliable software solutions that enable clients to increase efficiency achieving significant cost reductions with assured compliance. IMTF is headquartered in Switzerland with offices in India, Luxembourg, Austria, the United Arab Emirates (UAE), Ireland and Singapore.

Jewel Paymentech develops intelligent risk technologies for the banking and electronic payments industry by using AI, machine learning technology, and predictive analytics.

Merkle Science is a deep-tech startup based out of Singapore. The company provides infrastructure to help blockchain companies, crypto-exchanges, investment funds, banks, and government agencies perform due diligence on the blockchain. Merkle Science’s risk and blockchain monitoring solution allows companies to detect and prevent illegal use of cryptocurrencies, monitoring all incoming and outgoing crypto transactions to ensure that corporates are not transacting with blockchain addresses linked to illicit behavior.

Established in 2007, NetGuardians is a leading Swiss fintech and regtech company helping more than 50 Tier 1 to Tier 3 banks worldwide to fight financial crime. NetGuardians has gained worldwide recognition for its fraud detection and risk attenuation solutions developed by experts specializing in risk. Its main innovation is its ability to detect fraud before it happens via behavioral analysis technology. NetGuardians is headquartered in Yverdon, and has offices in Kenya, Poland, and Singapore, with more expansion planned.

Silent Eight uses Machine Learning and Natural Language Processing to screen customers and monitor transactions to combat money laundering and terrorist financing.

Scalend offers business intelligence software that provides real-time analytics and visual insights for banks and FIs. It provides data-driven analytics solutions for payments, lending, retail banking, insurance, and capital markets.

Incorporated in November 2014, Tookitaki provides enterprise software solutions that create sustainable compliance programs for the financial services industry. The company has developed solutions to prevent money laundering, terror financing and automate large-scale banking reconciliations. Tookitaki is headquartered in Singapore with offices in Charlotte, North Carolina, the US, and Bangalore, India.

Vasco provides security solutions such as two-factor authentication & transaction data signing for businesses & government agencies. Its tools further secures access to data and cloud applications.