Disrupting Individual Insurance Segments

We have seen how technology had disrupted traditional business. The most classic example is when Grab entered the taxi industry caused many traditional taxi drivers to either use its service or content with less bookings. This disruption is also happening in the insurance industry and the technology behind it is called Insuretech.

In this article, we have a look at how traditional insurance companies are reinventing themselves in Singapore and also the various Insuretec that had emerged in Asia. Within the insurance field, there are broadly 7 functions which the insurance industry goes through and each of them provides an opening for Insuretec to disrupt their existing business model.

Source: TCS

We would show you how different Insuretec are targeting different segments and how they intend to make a difference. Before that we would be looking at how traditional insurance companies are trying to keep up with their more nimble competition.

Aviva – Keeping Up With Insuretec Challenge

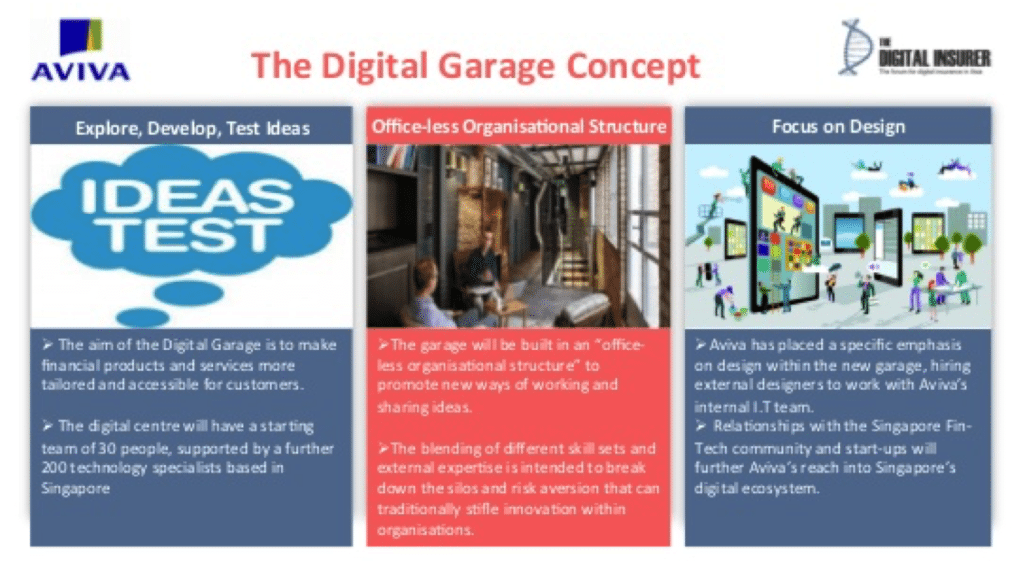

Aviva is a household name in Singapore especially well known for its SAF group insurance product. Even so, it is not immune to the pressures of Insuretec. Executive chairman for Aviva Asia and global chairman for Aviva Digital, Chris Wei spearheaded Aviva’s digital response by setting up ‘Digital Garage’ in Singapore and London.

Source: Slideshare

Digital Garage would have 100 core team and supported by 200 technology specialists to support its innovation drive. It would turn radical ideas into prototype that can be test drive before being implemented. It would also seek to digitalize the business for Aviva so as to better service their customers and also to seek outside collaborators who can bring their digital skills to Aviva.

The Singapore office at Armenian Street may be newly launched in December 2015 but it would have to challenge the entrenched business mindset. Aviva is a large and complex organization and it remains to be seen if they can overcome the inertia even if they come up with the solutions.

Fitsense – Exercise For Cheaper Premium

In contrast to Aviva, this is a name which you had not heard of. That is fine because it is a startup and it remains to be seen if it would be the next Google. Fitsense is a business that seeks to reduce your insurance premium if you agree to wear physical wearables that would track your physical activity and connect it with your mobile phones.

Source: Fitsense

Fitsense had teamed up with the National University of Singapore (NUS) School of Public Health to come up with the research necessary to price the risk for insurance across different age group and genders. Regular physical activity can reduce risk of chronic disease by 75% and mortality by 33%.

Source: Fitsense

They would work with insurance companies with the data that they had collected to give you a better premium. In other words, the more active you are, the less risk you present to the insurance companies. Hence you would pay less premium when compared to the couch potato whose favourite activity is to eat fatty potato chips and watch television.

FitSense is leveraging on the recent popularity of fitness tracking wearables and mobile app to harness personal data. With these data, FitSense provides the data analytics capability for insurance companies and this Singaporean company is being nominated for the European FinTech Awards 2016.

Claim Di – Easier Claims For Auto Accident

Have you been in a car accident before? I hope not but it does happen once in a while especially in the less regulated roads of Thailand. In Thailand, if you get into an minor accident, it can take up to 3 hours before the insurance companies can send their representatives to you. The core insurance product of Claim Di is simply to simplify the auto accident claims process.

For a minor accident, there are basically 2 scenarios, with and without third party. If your car hit the tree, it is just between the tree and you so there are no third party. If your car hits another car, it is considered that a third party is involved.

If there is no third party involved, it is simple. You can just take a photo and upload it. With advanced data analytics, the app can access the damage and simultaneously book your appointment with the car repair garage. The insurance company would receive the claim and approve the repair charges.

Source: Claim Di

If a third party is involved, as long as both of you have the same app, both parties can shake their phones and the same case would be logged. The photos would have to be taken and uploaded.

Based on its simple and effective features, Claim Di won US$2 million of funding from venture capitalist to expand its product to Malaysia, Korea and Japan. Revenue is expected to jump from $560,000 to US$5.6 million this year with these expansion plan.

eBaoCloud – Superior Products & Sales Cloud Platform For Insurance

eBaoCloud is a cloud computing software that allows insurance company to use their cloud service to develop and deploy new products faster than normal. eBaoCloud is a Chinese software collaboration between eBaoTech and Alibaba Cloud.

It is aiming to revolutionalize the insurance business by building a superior insurance platform that would shorten product development from the current 3 – 6 months to 1 -2 months. Insurance companies can also sell their products through the platform and be supported by data analytics on their sales performance.

Source: eBaoTech

The key risk for insurance companies is that they would then be dependent on eBaoCloud for access to their insurance platform. If there is a service disruption, they would not be able to do anything about it. Furthermore if they are too reliant, they are in a weaker position if eBaoCloud were to rise prices in the future.

That said, this is the world’s first Internet Insurance Cloud platform and it shows how effective it can be if technology companies were to focus on developing superior platforms as it would their core strength. Before the advancement of cloud computing to distribute this technology in a cost effective manner, insurance companies are forced to develop them in house and buy other components themselves, often at substandard performance.

Conclusion

So far, we have seen how incumbents like Aviva are responding to the threat of Insuretec by taking on new digital initiatives. So far, the 3 Insuretec of Fitsense, Claim Di and eBaoCloud are complimentary to the existing insurance business.

Fitsense aims to reduce premiums through exercise, Claim Di wants to make auto accident claims easier and eBaoCloud wants insurance companies to use its superior cloud service for faster product development and sales.

All 3 companies add value to the insurance processes do not threaten the existence of insurance companies but merely seek to twit their business models. In the next article, we will be looking at 3 Insuretec that are directly threatening the traditional insurance business like how Grab is threatening the taxi industry by providing a platform for private cars to double up as taxis.