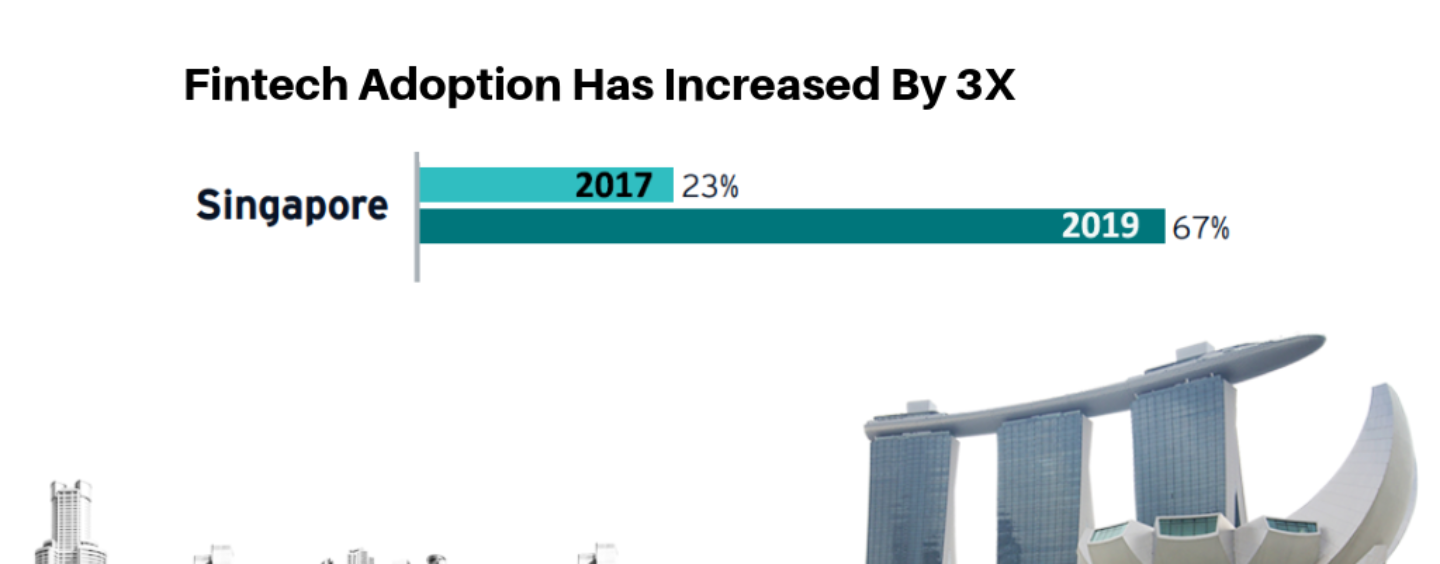

Singapore’s Fintech Adoption Has Increased by Almost Three Times in Just Two Years

by Fintech News Singapore June 26, 2019In just two years, the rate of Fintech adoption among Singapore consumers has almost tripled, according to the EY Global FinTech Adoption Index 2019.

Singapore’s adoption rate jumped from 23% to 67% between 2017 to 2019. The jump positions Singapore as a leader across Asia-Pacific, though the region’s overall adoption rate is nothing to scoff at (64% in 2019, from 33% in 2017).

However, Mainland China and India still has the higher rate of consumer fintech adoption globally (87%) respectively, according to EY’s Global Fintech Adoption Index 2019.

Adoption By Your Average Citizen

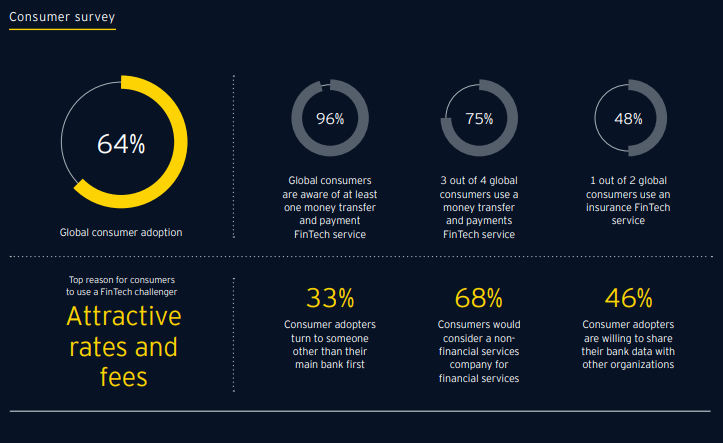

Globally, an average 89% of consumers are aware of the existence of in-store mobile phone payment platforms and 82% are aware of peer-to-peer payment systems and non-bank money transfers. Availability of these FinTech services is even more accentuated in Mainland China with 99.5% of consumers aware of money transfer and mobile payment services.

The figure above proves that globally, consumers do not need much education about payment and fintech services, and any slowdowns in adoption may boil down to the caliber of a particular payment fintech, or down to a consumer’s lack of interest. Slightly less but still a significant number of consumers (75%) globally have used a money transfer and payments fintech service, which is a commendable conversion rate.

However, insurance adoption via fintech still lags behind. Only 1 out of 2 global consumers user insurance fintech services. This could either mean the non-adopters are either comfortable with their existing insurance servicing, or that they are among the large swaths of uninsured populations.

In emerging Asian markets, property insurance penetration was only at 1.1% in 2018. India, Philippines and Indonesia showcases a feeble 0.5% – 0.6% insurance penetration, compared to Asia’s developed countries—though the latter only had an average insurance penetration level of 2.4%.

Insurtech has the potential to gap these deficiencies, and it seems like the sector still has a lot to left to do.

Adoption By Businesses and SMEs

It goes without saying that customers have no way to use fintech if the businesses they interact with on a regular basis do not adopt the relevant fintech technologies. However, customers have come to expect quicker and more convenient financial services, so there is a pressure on existing business models to disrupt themselves and innovate, especially within financial services.

Traditional banks, insurers and wealth managers are disrupting their own propositions by offering digitally accessible and technology-forward services. Findings from the index showed 27% ranked pricing as their top priority and 20% picked the ease of opening an account while choosing a fintech service.

Crucially, nearly all SMEs (97%) acknowledged that they need help when it comes to deciding whether to adopt a new service or technology.

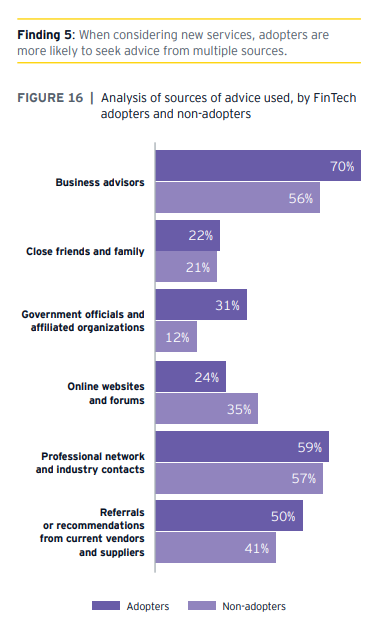

Fintech adopters are more likely than non-adopters to seek advice broadly—another sign that adopters are better informed and operate like larger organizations.

When SMEs were asked how many sources they’d consult before getting in bed with a fintech, 71% of adopters said they would seek advice from three sources, compared with 52% of non-adopters.

Because adopters cast a wider net when seeking advice, fintech providers have the opportunity to reach them through more touchpoints. Fintech adopters turn most often to business advisors, such as lawyers and accountants, for advice, while non-adopters tend to rely more often on their professional network and industry contacts. Adopters are more likely than non-adopters to seek advice from government officials.