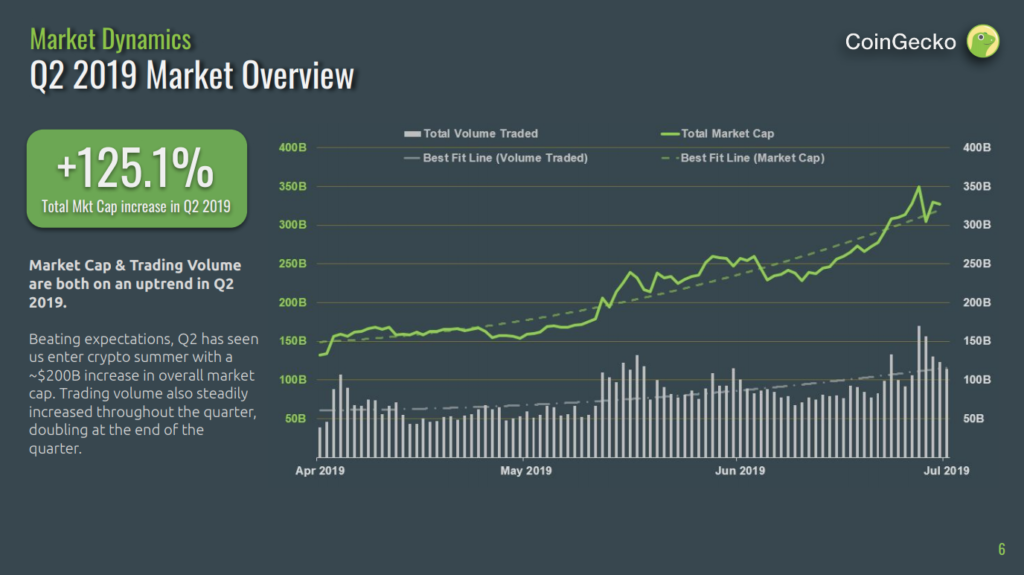

“Crypto summer” is finally here as the industry once again enters the mainstream, according to a new report by CoinGecko, a cryptocurrency market data aggregator. According to the 2019 Quarter 2 Cryptocurrency Report, the quarter witnessed an astonishing 125% increase in crypto market capitalization.

CoinGecko 2019 Quarter 2 Cryptocurrency Report

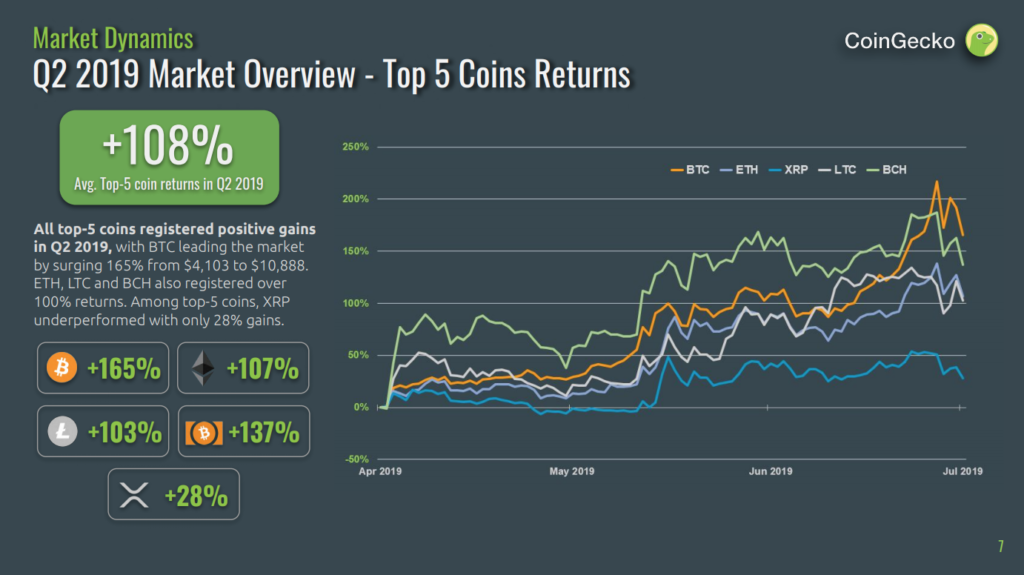

Bitcoin led the market with a rise of 165% in value from US$4,103 to $10,888, and dominance growing from 54.6% to 65%. Ether, litecoin and bitcoin cash also saw strong growth with over 100% returns.

CoinGecko 2019 Quarter 2 Cryptocurrency Report

The market revival comes after a long and painful 18 months of market decline in which bitcoin slumped by almost three-quarters. Many hedge funds investing in cryptocurrencies recorded astronomical losses and some even shut up shop.

“Crypto summer is undeniably upon us as we see the industry enter the mainstream consciousness again, in part due to Facebook’s recent announcement of Libra,” said Bobby Ong, co-founder of CoinGecko.

In June, the crypto industry came under the spotlight when Facebook unveiled its Libra cryptocurrency project, a stablecoin initiative with a vision to create “a simple global currency and financial infrastructure that empowers billions of people.”

Libra project is backed by more than 25 organizations including Visa, Mastercard, PayPal, Uber, Spotify and Vodafone, and overseen by Switzerland-based non-profit organization the Libra Association.

Initial exchange offerings (IEOs) continue to gain traction

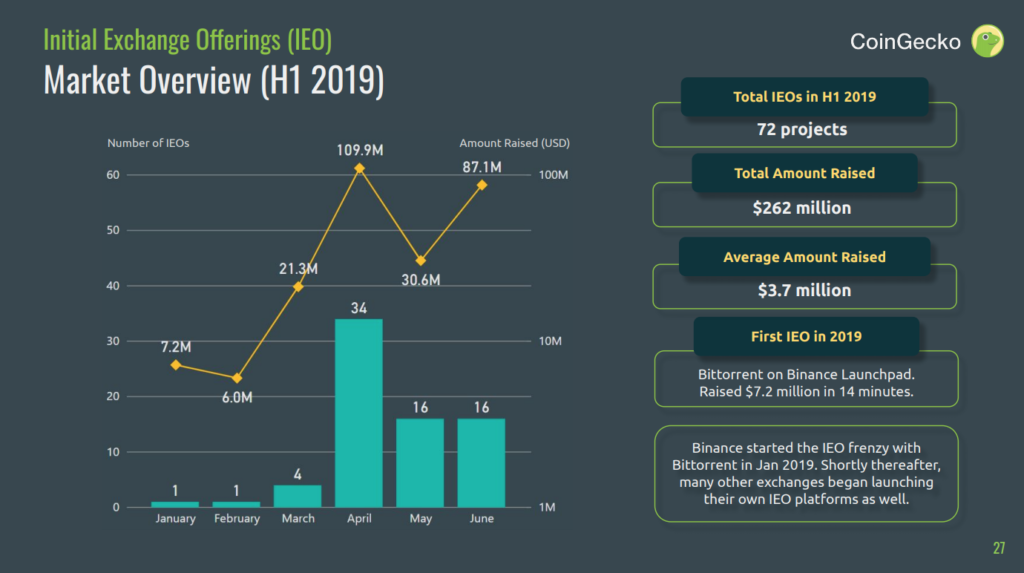

The IEO trend continued to grow throughout Q2 2019, and peaked in April with 34 campaigns and US$109.9 million raised in a single month, according to CoinGecko.

CoinGecko 2019 Quarter 2 Cryptocurrency Report

IEOs are a byproduct of initial coin offerings (ICOs), but unlike ICOs, they are conducted over cryptocurrency trading platforms and exchanges. For a fee, these cryptocurrency exchanges act as middlemen and perform functions such as due diligence, know-your-customer (KYC) screening, marketing and selling tokens to customers.

IEOs took off this year, and since Binance set the trend with the introduction of Binance Launchpad in November 2017, a horde of companies has followed suit including Huobi, Bitfinex, OKEx and Bittrex.

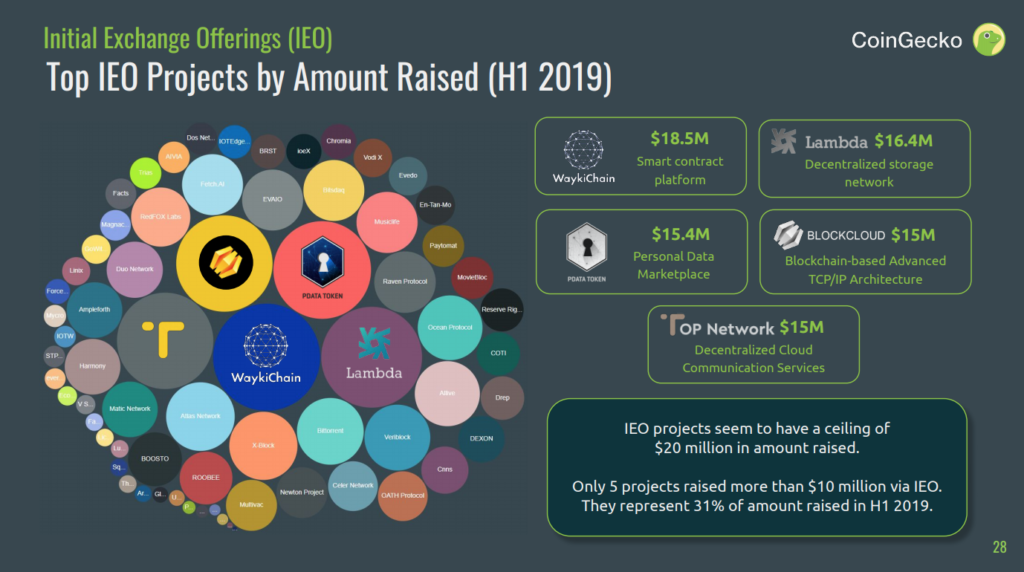

Today, more than 25 IEO platforms exist, according to CoinGecko.

CoinGecko 2019 Quarter 2 Cryptocurrency Report

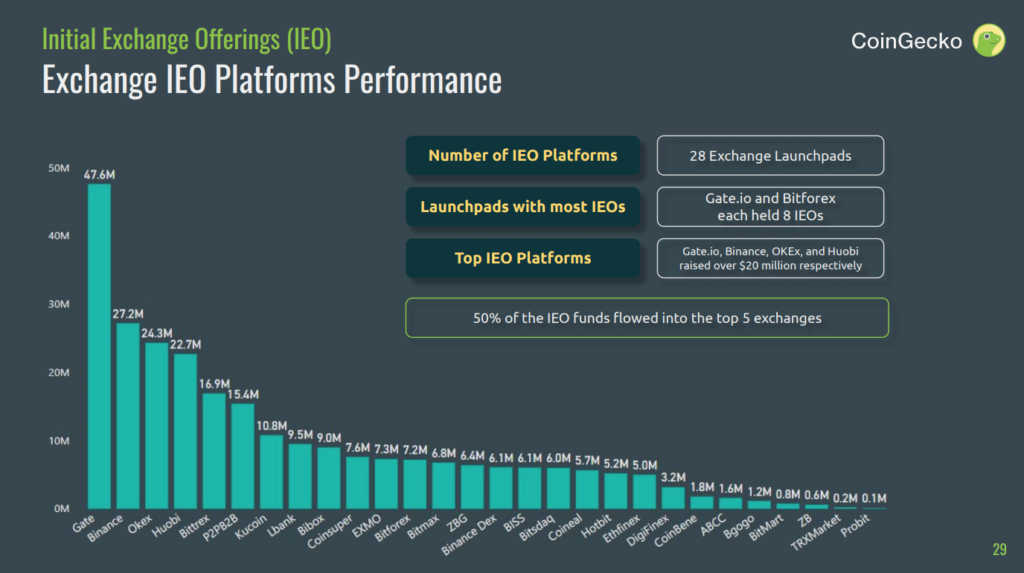

In the first half of 2019, a total of US$262 million was raised through 72 IEOs. One of this year’s most notable IEO is Bittorrent, which raised US$7.2 million in 14 minutes.

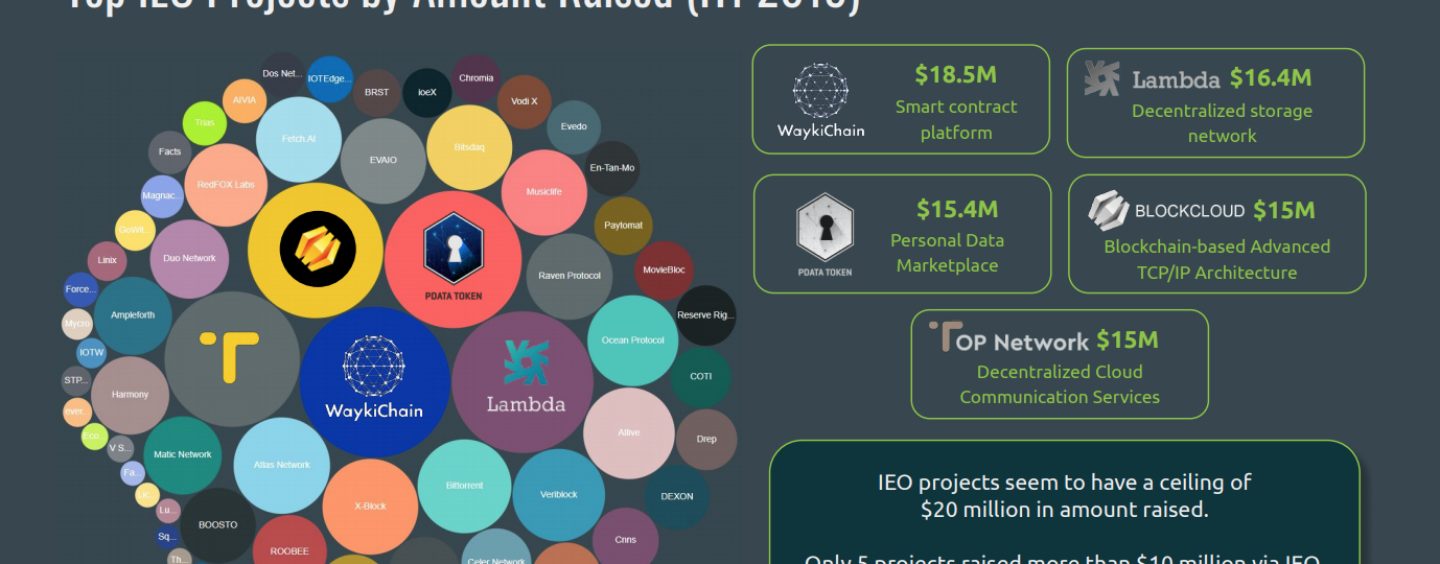

Top IEO campaigns in H1 2019 include WaykiChain (US$18.5 million), Lambda (US$16.4 million), PData Token (US$15.4 million), and Blockcloud (US$15 million).

CoinGecko 2019 Quarter 2 Cryptocurrency Report

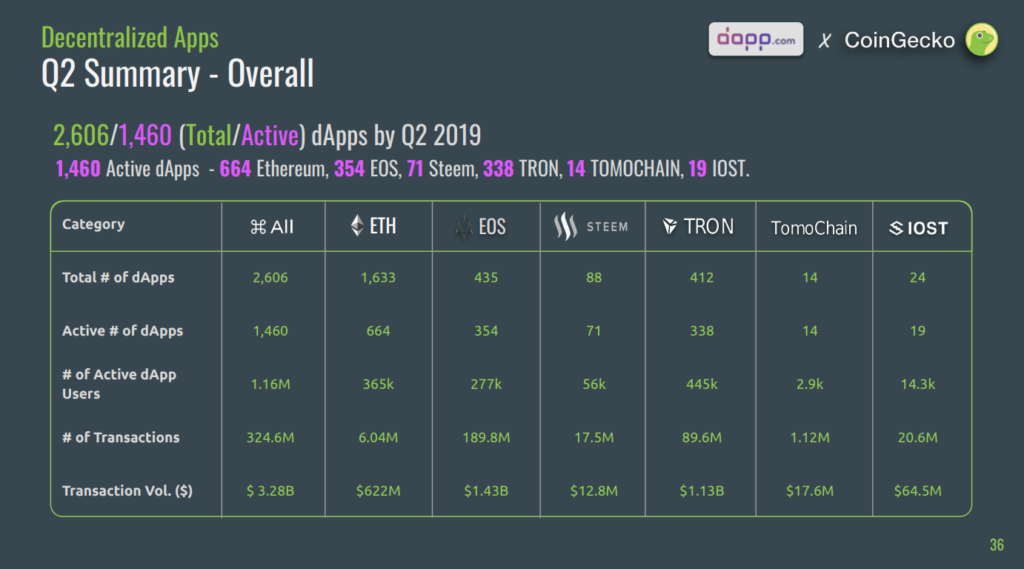

The report also gives an overview of the decentralized application (DApp) landscape.

There are currently more than 2,600 DApps, though only 1,460 DApps are active. Most DApps (1,633) run on Ethereum, followed by EOS (435), Steem (88) and Tron (412).

DApps are used by some 1.16 million users and have recorded more than 324 million transactions worth US$3.28 billion, so far.

CoinGecko 2019 Quarter 2 Cryptocurrency Report

Crypto exchange hacks on the rise

The research also found that the cryptocurrency market significantly grew in Q2 with a total of 302 exchanges being added to the CoinGecko platform over the past 18 months. But as the industry gets more and more crowded, exchange hacks have also gotten more sophisticated with even top exchanges like Binance falling victim to heists.

In May, news broke that hackers had withdrew 7,000 bitcoins worth about US$40 million via a single transaction in what Binance qualified as a “large scale security breach,” according to a Bloomberg report. The hackers used several techniques including phishing and viruses to obtain a large amount of user data.

An in mid-January, New Zealand-based company Cryptopia suffered a major hack, which a blockchain data analytics firm estimated to have resulted in the loss of US$16 million in ether and ERC-20. The company later went into liquidation and filed for bankruptcy protection in the US.

Most recently, Remixpoint, which runs Japanese exchange Bitpoint, discovered that about 3.5 billion yen (US$32 million) worth of cryptocurrencies had gone missing under its management, according to a report by the Guardian. About 2.5 billion yen (US$23 million) worth of the missing cryptocurrencies was customer funds.

Other significant heists in H1 2019 include Bithumb’s US$13 million hack, Gatehub’s US$10 million hack and Bitrue’s US$4 million hack.

Besides thefts, several exchanges also closed down in H1 2019, including QuadrigaCX, Gatecoin and Liqui. Three India-based exchanges, namely Coindelta, Coinome, Koinex, were forced to shutdown by the Reserve Bank of India.

In light of the recent increase of exchange hacks and growing demand for more secure trading platforms, decentralized exchanges have recently risen in popularity, the research says. One such platforms is Binance DEX, a decentralized exchange developed on top of the Binance Chain.