Thailand Has The Potential To Become A Key ASEAN Fintech Hub, Says EY

by Fintech News Singapore August 5, 2019Boasting a large population of unbanked, high mobile and Internet penetration, and robust macroeconomic growth, Thailand has what it takes to become Southeast Asia’s next fintech powerhouse, according a new report by EY.

A further testament supporting that notion is the fact that even the bestselling author, award winning speaker and fintech expert Brett King is moving to Thailand.

Fintech Thailand: Factors driving its growth

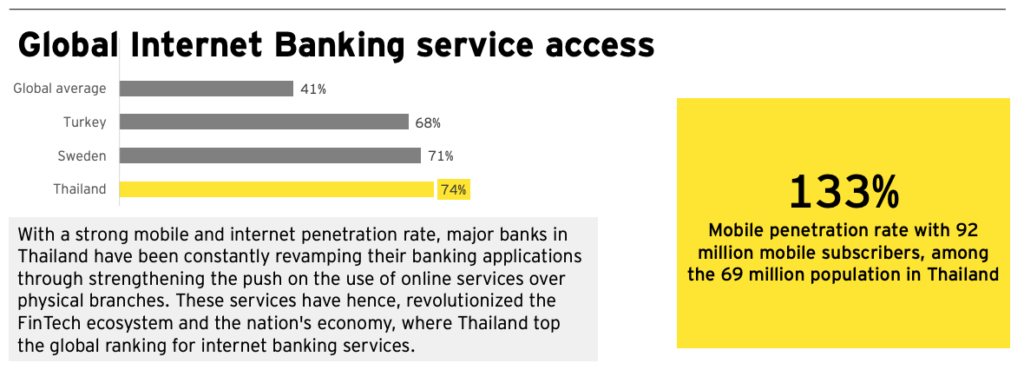

Among the key factors driving the growth of fintech in Thailand, EY’s Thailand Fintech Landscape Report cites the country’s high Internet penetration rate, the highest in ASEAN with 83.5%, as well as the large pool of underbanked people (22%), which have been increasingly demanding affordable, convenient fintech solutions.

Global Internet Banking services access, Thailand Fintech Landscape Report, EY 2019

Thai banks have actively participated and contributed to the development and growth of fintech by launching initiatives of their own, as well as sourcing and funding accelerators.

These include incubators and accelerators such as Innohub Vision, launched in 2017 by Bangkok Bank, and RISE, a corporate innovation accelerator by the venture arm of Krungsri Bank.

Kasikorn Vision, the investment arm of Kasikorn Bank, has a total budget of US$245 million that prioritizes investments in fintech and e-commerce, and Digital Venture DVA, the venture capital (VC) arm of Siam Commercial Bank, was launched in 2016 to make strategic investments in high technology startups and ventures capital funds around the world including Golden Gate Ventures, Nyca Partners, Dymon Asia Ventures and Arbor Ventures.

The government has also introduced several initiatives to help startups get funding and financially support them. These include a US$570 million venture fund to aid the local startup ecosystem, as well as tax exemptions to VCs and corporates funds for their investments in selected businesses.

Government support

According to the report, Thailand scores high in terms of regulatory openness and advancements. The document cites “accommodating policies” and initiatives that have been put in place to foster fintech innovation.

It notes for instance the collaboration between Thailand and Singapore on a digital payment system linkage set to go live by the first half of 2020.

In August 2018, the Bank of Thailand (BOT), the country’s central bank, launched Project Inthanon, a collaboration with eight banks in Thailand and technology partner R3, to design and develop a proof-of-concept prototype for wholesale funds transfer issuing wholesale Central Bank Digital Currency. (Wholesale CBDC).

There are also several regulatory sandboxes available in Thailand. These cover different aspects of financial services.

The BOT Sandbox is open to fresh, never-seen-before innovation in areas including QR payments, and cross-border payments. The companies stay in the sandbox for six to 12 months.

The Securities and Exchange Commission (SEC) Sandbox allows selected companies to test know-your-customer (KYC) technologies for a maximum of one year under the supervision of the regulator.

The OIC Sandbox allows insurers, agents and insurtech players to beta-test insurtech products.

Finally, F13 helps fintech startups test and validate their product/service with real customers.

The report says all these initiatives and policies are centered on the Thailand 4.0 plan, a nationwide strategy focusing on high-tech industries and innovation.

The plan aims to increase research and development (R&D) expenditure to 4% of GDP, increase economic growth rate to 5 – 6% within five years, and increase national income per capita from US$5,470 in 2014 to US$15,000 by 2032.

Despite the favorable landscape for fintech development and though Thailand ranks 8th among the best tech outsourcing hubs globally, the shortage of tech talent is a key challenge in the country. Out of the 400,000 positions available, only 2.5% of graduates are able to fulfill the technological skillset requirement, the report says.

To address this issue, the National Reform, Strategy and Reconciliation Committee (NRSRC) has approved the “Smart Visa,” a simplified and fast track procedure that grants four-year visas for four types of foreign talents: investors, startup entrepreneurs, high-level executives and highly-skilled individuals.

Nascent but growing

Thailand’s fintech sector is poised for strong growth, especially in areas such as digital payments, blockchain, and peer-to-peer (P2P) lending, the report says.

It notes the rise of fintech adoption, stating that digital payment transactions surged by 83% from 2016 to 5.87 billion in 2017. Thailand digital payment ratio has increased to above 10% of total payment transactions.

Today, 62% of the total Thai population are making electronic banking transactions, the report says.

Some of Thailand’s most notable fintech startups include Omise, a payment solutions and real-time fraud detection provider, Jitta, an investing solution, MoneyTable, a platform that simplifies financial analysis, Finnomena, an online platform to get expert advice on investments in the public market, FlowAccount, a cloud-based bilingual accounting platform for small and medium-sized enterprises (SMEs), Masii, an online comparison platform, and Sunday Insurance, an insurtech startup.

The fintech industry is represented by the Thai Fintech Association, an organization established in July 2016 aimed at facilitating network and connections among the fintech space. Key contributions of the association include the creation of the F13 regulatory sandbox.

Featured image: Thailand Fintech Landscape Report, 2019, EY