FinTech is undeniably one of the most promising industries in recent time. Find out the most discussed topics and what you should not miss.

The Blockchain Technology

It is only a matter of time before the broader financial services and banking industries shift to blockchain and network-based approaches. Blockchain, as a pure platform technology, will maybe able to cut out the middlemen (or middle companies) everywhere. Because of that, many fintech entrepreneurs and experts constantly discuss topics such as: What does Blockchain matter? What are the various Blockchain concepts – sidechains, hyperledger, public or private blockchain? Who are the major players? What are they building or what sectors are they targeting? What is the investors’ perspective on blockchain startups? What are the latest notable blockchain startups?

It’s time to become part of the digital revolution and join the network and platform-emerging world.

Free passes to join Lynk Webinars: Blockchain – Connecting the Dots. 6 top-notch speakers from their respective fields – the Chief Data Scientist from IBM Watson IoT, top executives from pioneer companies like Consensys, Blockstream, Coinsilium and Ethereum foundation and more. Register for your free pass to join the webinars by completing this form or find more information.

Digital Finance and Commerce & Digital Payments

After affecting all sectors of commerce, the digital revolution has now hit the financial sector, a sector that is protected by a specific regulatory environment. From fundamental peer-to-peer transfers to savings, loans and credit to products that leverage social media, eCommerce and smartphone penetration, the transformation has been moving forward greatly for the past years. Additionally, advancements in digital technology continued to shape the payments industry in 2016 as mobile, online and other digital forms of digital payments moved.

– Join the obal fintech industry leaders to share best practices and learn about the latest trends in Internet finance at the largest conference featuring internet finance leaders from both China and the West: Lang Di Fintech Conference this July in Shanghai. Don’t forget to enter code FNS16VIP to get 15% discount for ticket registration.

– Explore the many issues surrounding the transition to the next generation of digital finance & commerce (DFC) services across Southeast Asia at Mondato Summit Asia this September in Bangkok, Thailand. Special offer: apply code FintechSN25 to get 25% discount for ticket purchasing.

Lending

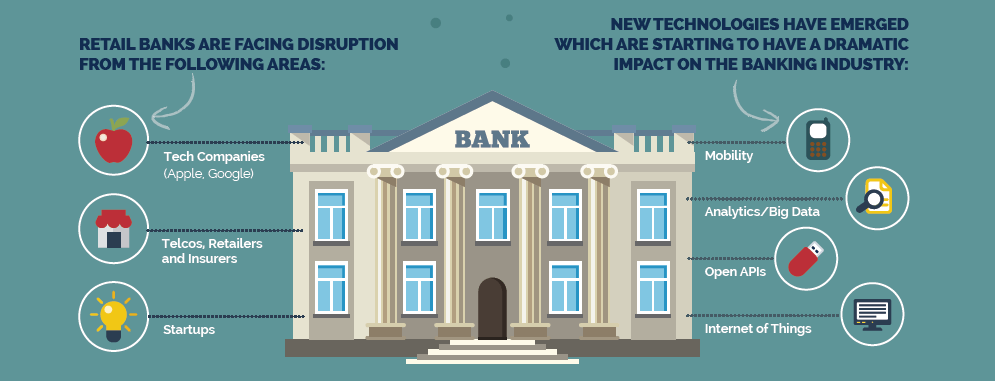

Alternative lending models are transforming the banking sector, creating both competitive threats and evolutionary opportunities for financial institutions in Asia. But with an estimated 4,000 firms challenging banks in every product line, the level of disruption facing the financial industry has reached a tipping point, as this infographic shows:

Banks and FinTechs have strengths that are complementary and which should be leveraged to create a stronger central financial experience for customers. While FinTechs excel in agility, innovation and exploiting new technology, banks offer capital, deep customer bases and expertise in working with regulators.

Discover how to adapt to FinTech disruption at Asia’s only event focused on innovation in digital lending: Next Generation Lending Asia Summit 2016 in Singapore this July. Sign up now with code 27190.001_FTN10 to get 10% discount for event tickets

Customer’s banking experience

Customer experience is of paramount importance in all industries. A new mobile generation of consumers, the rise of direct pay and online financial services, and an increase in banking service fees all contribute to an on-going shift in how banking organizations service their customers. In order to optimize its customer experience, a banking organization must understand the needs and behaviors of its customers. A positive and effortless customer experience can result in increased customer satisfaction, loyalty, advocacy and greater customer lifetime value.

Attend the 4th Annual Customer Experience Management Asia in Singapore this September and find your next step in the customer centric journey. Special offer for Fintech News Singapore readers: Sign up now with code ISG_FTN to get 15% discount when registering!

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.