As the world’s fourth most populous country in the world, with more than 60% of its population of working age, Indonesia has unique economic potential. However, one of the key elements needed for the country to reach its full economic potential is access to financing, according to a recent PwC report.

In a report titled Indonesia’s Fintech Lending: Driving Economic Growth Through Financial Inclusion, the firm points out Indonesia’s large pool of financially underserved individuals and micro, small and medium-sized enterprises (MSMEs), stressing that the traditional financial services industry’s incapacity to serve these segments of the population represented a unique opportunity for fintech lending.

Overcoming the challenges faced by traditional lenders

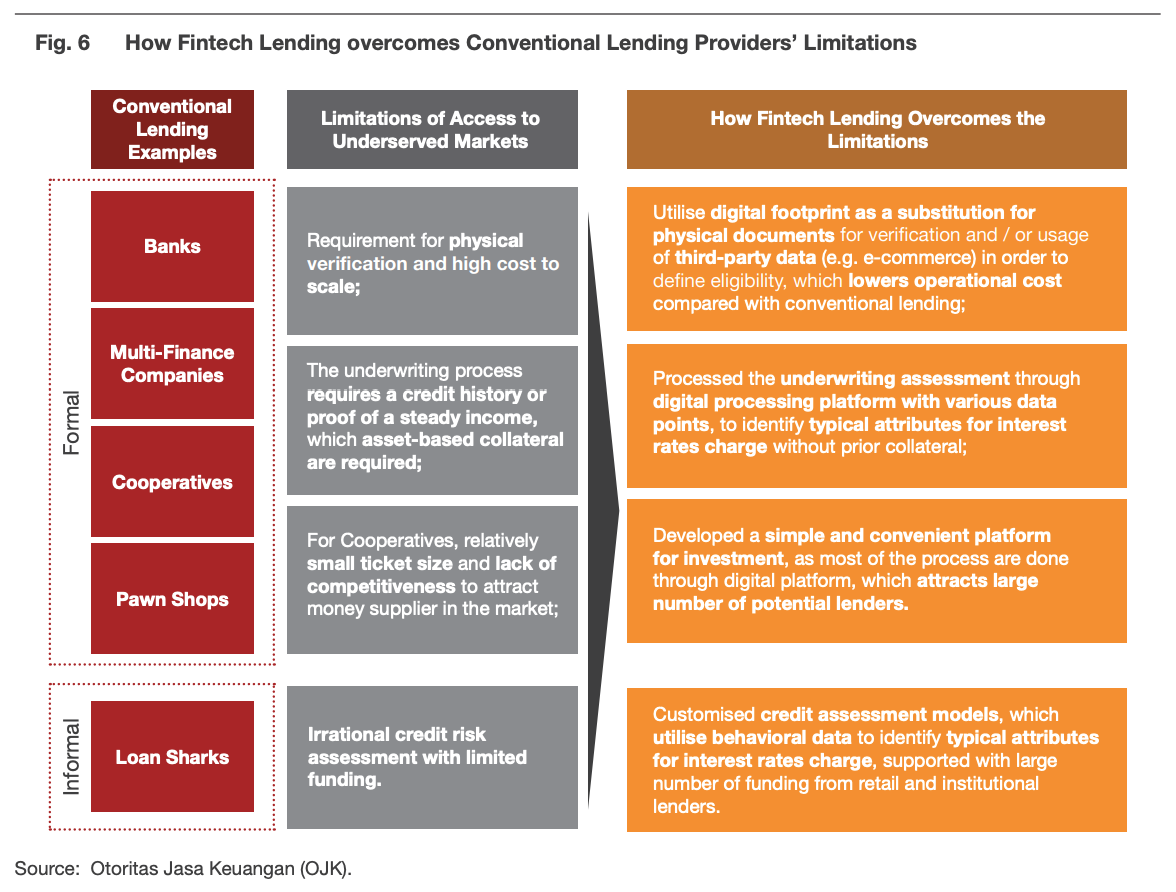

Infrastructure and risk management have been among the main reasons conventional lending providers have had difficulties in providing credit access to untapped individuals and MSMEs.

But fintech lending players, which leverage digital technology, innovative business models and novel approaches, are able to address the challenges that conventional lending providers face and achieve wider coverage within remote areas. These have the unique opportunity to tackle the credit gap, the report says.

Using innovative approaches such as online-to-offline (O2O) channels as well as alternative data for credit assessment, fintech lenders are able to reach people who are “credit invisible.”

Digital identity and footprint are used as a substitute for physical documents to define eligibility, which lowers operational costs, while digital platforms are designed to give retail and institutional investors greater access to investment opportunities, the report says.

Furthermore, different business models, such as peer-to-peer (P2P) versus institutional-to-peer lending, as well as productive versus consumption loans, are matching different risk appetites for lenders with different risk levels of borrowers to fulfill the borrowing needs of the broader segments of Indonesia’s society.

via Indonesia’s Fintech Lending: Driving Economic Growth Through Financial Inclusion, PwC, July 2019

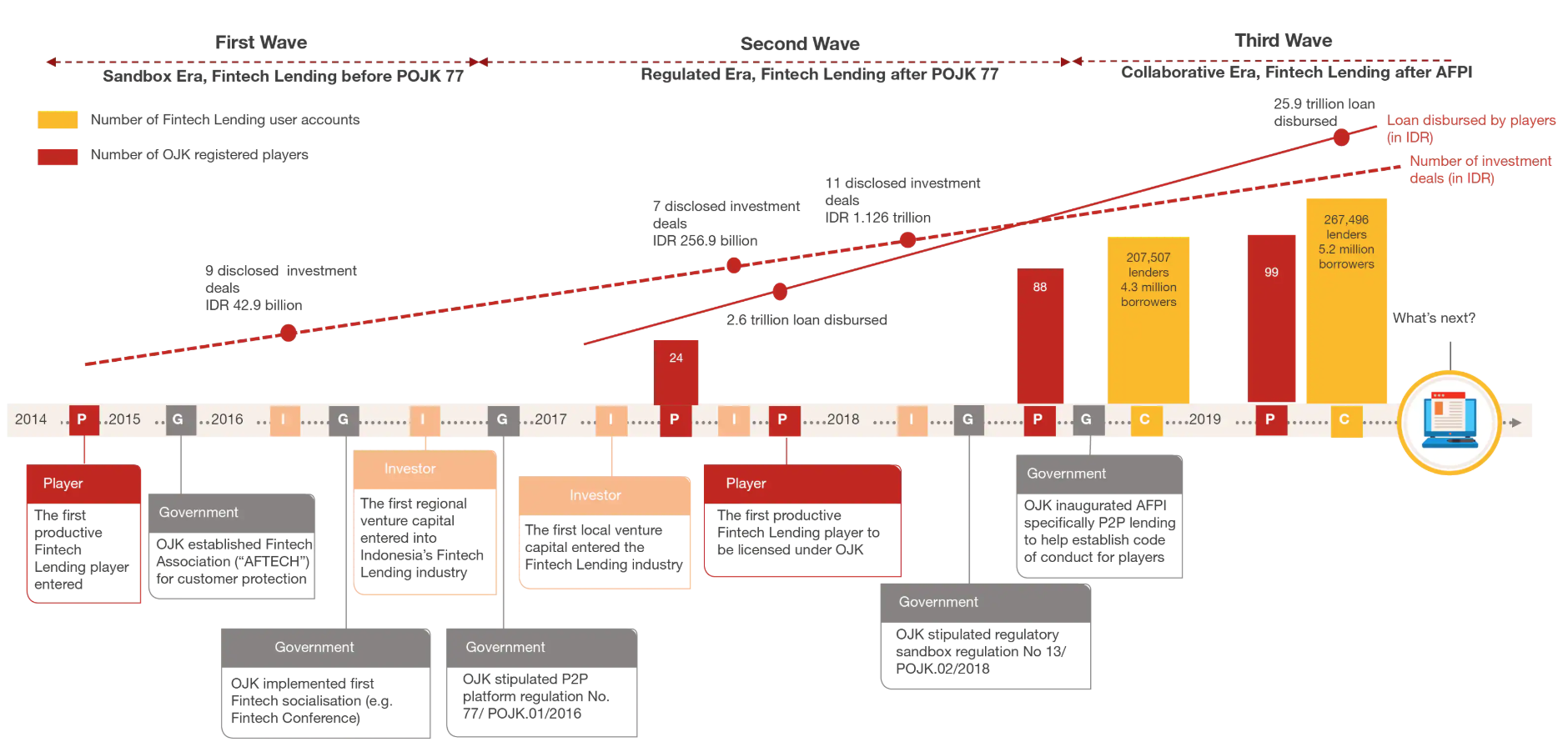

Entering the “Third Wave”

According to the report, Indonesia’s fintech lending industry has entered the “Third Wave,” which is characterized by greater collaboration.

The start of this new era in the country’s fintech lending landscape was marked by the establishment of the self-regulating organization known as the Indonesian Fintech Lenders Association (AFPI), which has become the center of collaboration between players and regulators, the report says.

Moving on, the sector is expected to witness a greater number of acquisitions as well as partnerships.

via Indonesia’s Fintech Lending: Driving Economic Growth Through Financial Inclusion, PwC, July 2019

PwC estimates fintech lending will reach IDR 223 trillion (US$15 billion) of accumulative loan disbursements in 2020, growing by 214% from 2018 to 2020.

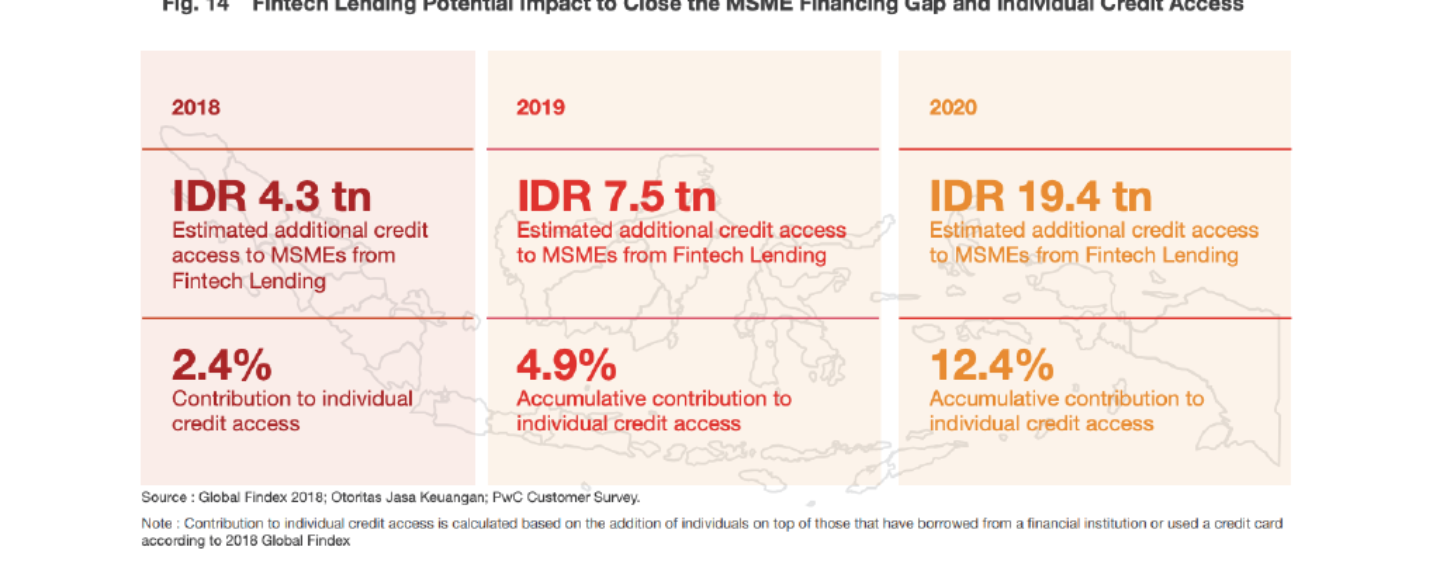

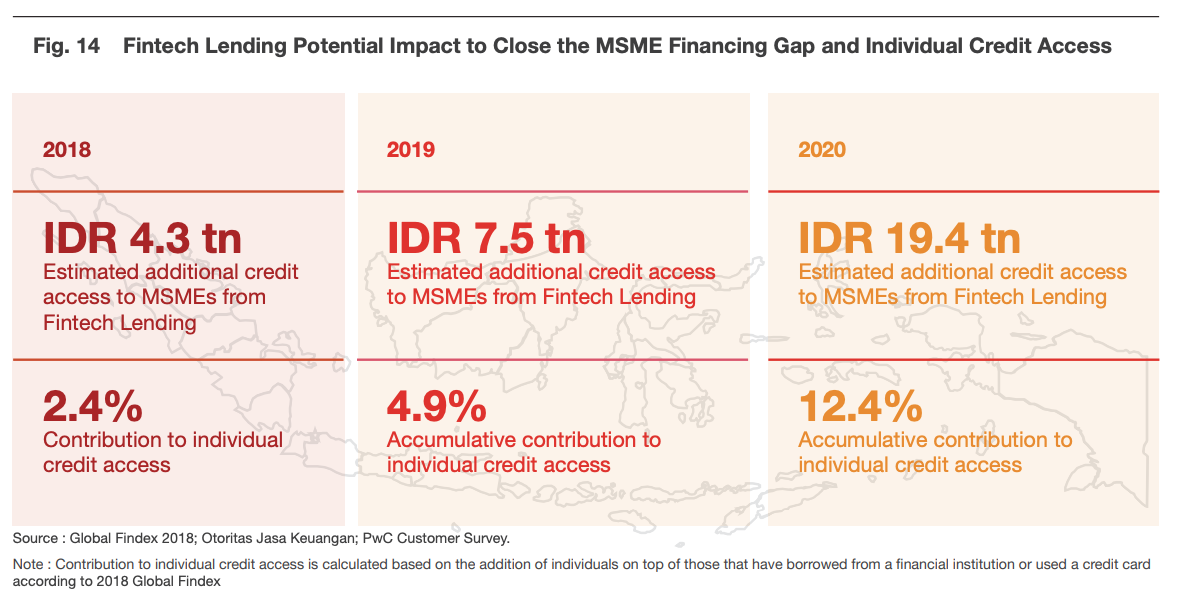

By 2020, fintech lending has the potential to add IDR 19.4 trillion (US$1.3 billion) to the MSMEs financing gap, while increasing credit access for individuals by 12,4%, the report says.

via Indonesia’s Fintech Lending: Driving Economic Growth Through Financial Inclusion, PwC, July 2019

Key drivers of this growth include mobile phone subscription growth, which will continue to support the awareness and adoption of fintech lending, the increasing number of use cases of fintech lending as a result of greater collaboration between industry stakeholders, and the development of supportive IT infrastructure and digital identification solutions resulting in wider coverage and faster know-your-customer (KYC) processes.

Indonesia’s fintech lending ecosystem currently counts more than 267,000 lenders and 5.2 million borrowers, according to PwC. The country’s 99 registered players have so far disbursed IDR 25.9 trillion (US$1.8 billion) worth of loans.

The top ten fintech lending platforms in Indonesia, according to KPMG, are Akseleran, Amartha, Crowde, Crowdo, Danamas, Gradana, Investree, KoinWorks, Mekar and Modalku.