Millennials to Hold 5 Times More Wealth in 2030 — Banks Are Struggling to Attract Them

by Fintech News Singapore October 16, 2019The market for investing is changing rapidly and incumbents are struggling to satisfy the needs and expectations of younger generations of investors, according to a report by tech market intelligence firm CB Insights.

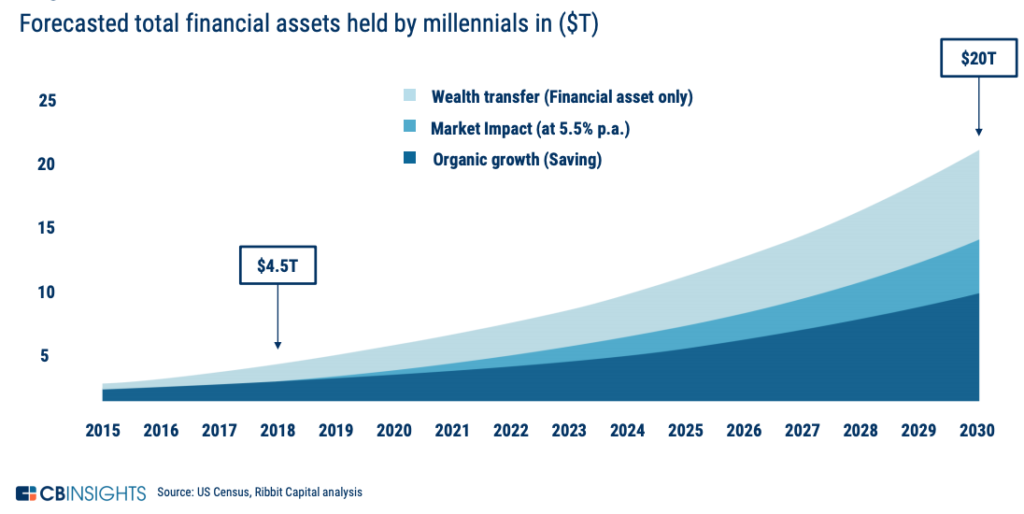

By 2030, Millennials are expected to hold five times as much wealth as they do today, controlling as much as US$20 trillion of assets globally. Their parents, the baby boomers, are set to pass down another US$30 trillion by 2050 in North America alone.

Forecasted total financial assets held by millennials in ($T), How Do You Win the Next Generation of Investors?, CB Insights, June 2019

Yet, when it comes to investing, Millennials and younger generations investors have expectations that differ greatly from their predecessors’ and traditional financial institutions still struggle to come up with products that actually appeal to them.

This is according to a report by CB Insights, titled How Do You Win the Next Generation of Investors?, which explores how traditional wealth management firms versus their fintech counterparts have performed in attracting younger generation investors.

Incumbents Aren’t Meeting Mobile UI & UX Expectations

According to the report, most incumbents aren’t meeting the expectations of the younger generation of investors, and still have a hard time developing mobile apps with great user experience (UX) and user interface (UI), a key to acquiring and engaging next generation customers.

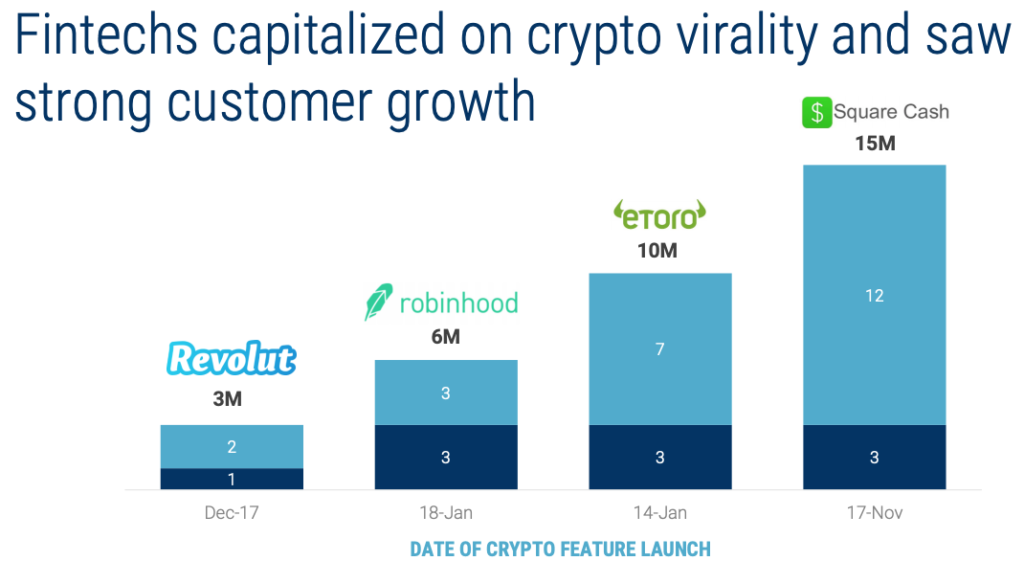

The report cites the examples of successful fintech mobile apps like Robinhood, a commission-free investing app, Acorns, a platform that merges the robo-advisor model with an automated savings tool, Stash, which allows users to incrementally invest small amounts, as well as Square’s mobile payment service the Cash App. The Cash App has been praised for being “geniusly simple” and “perfect for any occasion” and currently ranks first in the Apple App Store and counts some 15 million active users.

In comparison, the TSB Mobile Banking app, by TSB Bank, ranks poorly in the App Store with reviews that qualifies it as “clucky” and “too messy.” And JP Morgan, which launched its digital bank, Finn, in 2018, closed it just one year later.

Finn, a no-fee banking brand designed to meet the financial needs of younger customers, was mainly available via a mobile app, which many users were very disappointed with.

How Do You Win the Next Generation of Investors?, CB Insights, June 2019

New asset classes

Besides offering a great mobile experience, fintechs are also experimenting with new asset classes that interest Generation Z and Millennial investors such as cars, physical goods, as well as art and music.

The Rally Rd. investment app, for example, allows small investors to invest in rare collectibles and luxury cards. YieldStreet provides a platform for making alternative investments in areas like real estate, marine/shipping, legal finance and commercial loans. And StockX is a platform for buying and selling sneakers and other apparel that works similar to a stock market where buyers place bids and sellers place asks.

Expanding their products and services

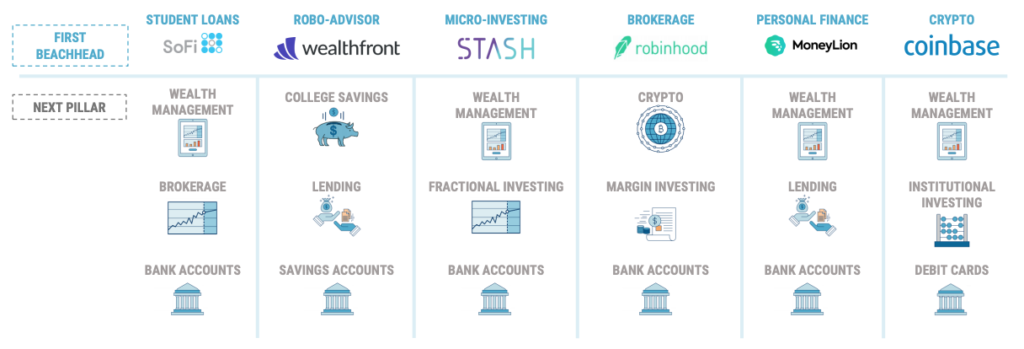

Another key trend among wealthtech and fintech startups is how they’ve rapidly expanded their products and services, moving from being mono-line to multi-line, the report says.

Social Finance (SoFi) for example started as a platform for student loan refinancing before moving toward full-scale banking. Coinbase began as a cryptocurrency exchange for retail customers and later expand into institutional investment, wealth management and debit cards.

Fintech moves from mono-line to multi-line, How Do You Win the Next Generation of Investors?, CB Insights, June 2019

Among the main strategies employed by fintechs, the report cites the use of gamification as well as capitalizing on the crypto frenzy to attract users. Fintechs have also partnered with small banks to launch debit cards.

Fintechs capitalized on crypto virality and saw strong customer growth, How Do You Win the Next Generation of Investors?, CB Insights, June 2019