Tag "wealth management"

Salesforce’s Findings Show That Consumers Crave Better Experiences from Their Bank

In Singapore, competition in the financial services industry is heating as customers grow frustrated with underwhelming digital experiences and are becoming more and more open to switching providers. A new global survey conducted by customer relationship management (CRM) provider Salesforce

Read MoreTop 5 Transformative Fintech Spaces to Watch in 2023

Unlike a lot of the next-generational technology that have thus far failed to live up to their full purported transformational abilities, the disruptive potential of financial technology (fintech) has been more evident in numerous practical use cases. And in 2023,

Read MoreSingapore Poised to Become a Wealthtech Powerhouse

Singapore’s wealthtech sector is growing at a fast pace. Amid soaring venture funding and booming adoption of robo-advisors, the city-state is on a path to becoming a leading wealthtech hub in Asia-Pacific (APAC), a new report by KPMG and Endowus,

Read MoreMillennials to Hold 5 Times More Wealth in 2030 — Banks Are Struggling to Attract Them

The market for investing is changing rapidly and incumbents are struggling to satisfy the needs and expectations of younger generations of investors, according to a report by tech market intelligence firm CB Insights. By 2030, Millennials are expected to hold

Read More7 Wealthtech Solutions from Europe That Singaporean Banks Should Know

The wealth management sector is facing tremendous changes fueled by technology and changing customer expectations. Wealthtech, which stands for wealth and technology, has become one of the hottest sub segments of fintech with companies in the space raising over US$12.2

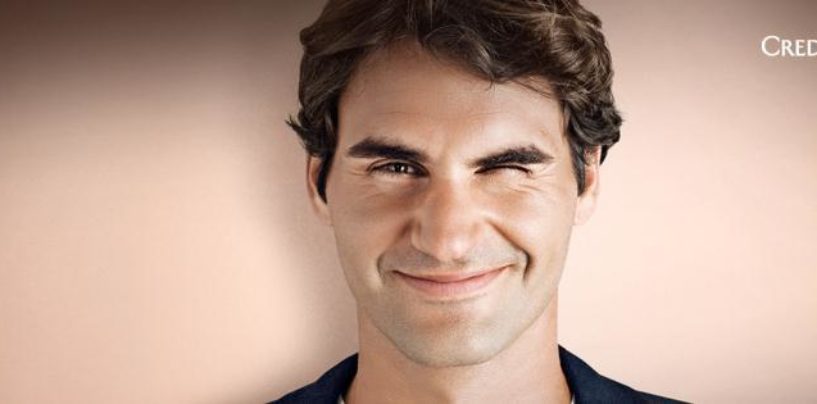

Read MoreRoger Federer Featured in CS Digital Private Banking , Canopy Partnership Promo

Credit Suisse is using the face of its global ambassador and tennis superstar Roger Federer to promote its Digital Private Banking, including the partnership with Singapore fintech company Canopy. Federer signed a 10-year deal with Credit Suisse in 2009 to be

Read MoreFirst Digital Onboarding in Singapore Robo-Advisor

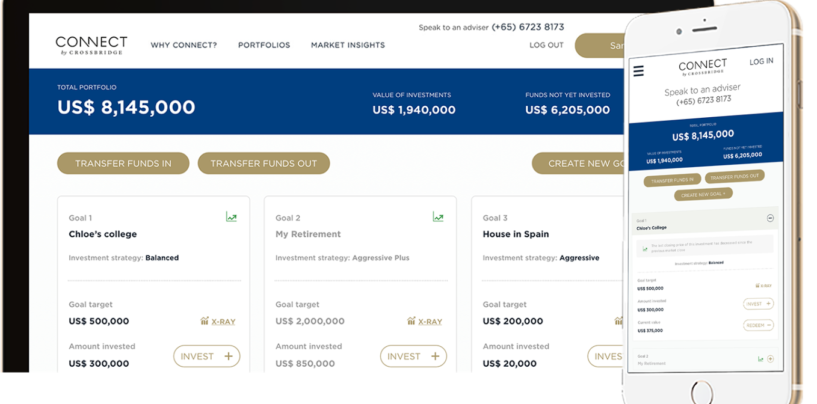

Crossbridge Capital, an established wealth management firm serving ultra-high net worth investors globally, today announced important updates to its CONNECT by Crossbridge digital platform, Singapore’s first and largest functioning robo-advisor. In another Singapore first for the wealth management industry, CONNECT

Read MoreOCBC Bank is First Bank in Southeast Asia to Pilot Robo-Advisory Service

OCBC Bank claims to be the first bank in Southeast Asia to pilot a robo-advisory service. Time starved investors will be able to invest in diversified portfolios of stocks and ETFs, using automated, algorithm based portfolio management advice. The platform

Read MoreRobo-Advisors Poised to Take Off in Singapore and Hong Kong

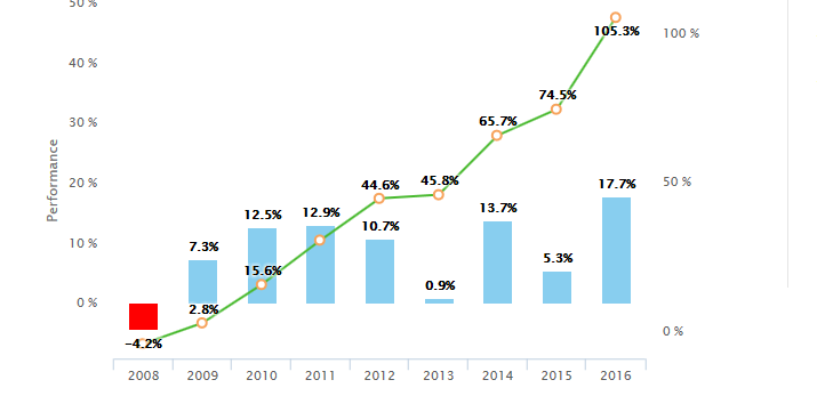

Automated investing services, also known as robo-advisors, are growing rapidly as they seek to provide customers with low-cost portfolios designed accordingly to each investor’s risk tolerance. According to Cerulli Associates, a financial services research firm, assets under management of robo-advisors

Read More