Crossbridge Capital, an established wealth management firm serving ultra-high net worth investors globally, today announced important updates to its CONNECT by Crossbridge digital platform, Singapore’s first and largest functioning robo-advisor.

In another Singapore first for the wealth management industry, CONNECT has “cut the paperwork” and will allow for digital onboarding of Accredited Investors* – making it even easier to use and to invest on the platform.

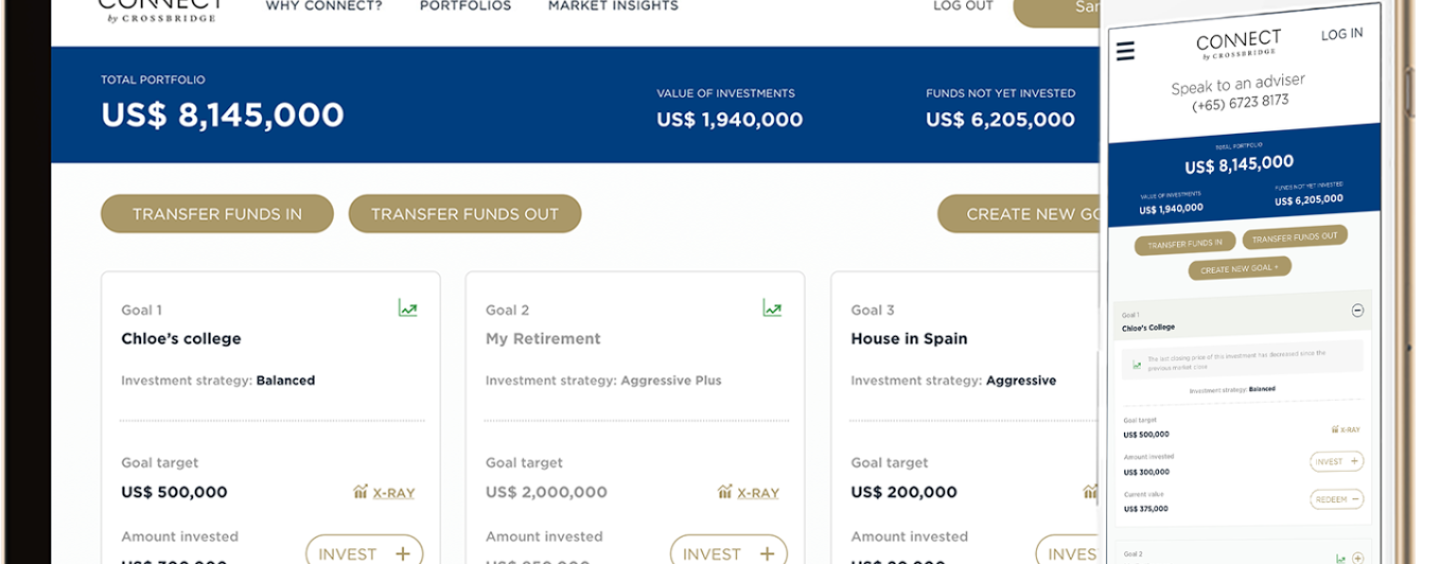

“CONNECT was designed to be an intuitive digital tool that provides an authentic wealth management experience for accredited investors of all experience levels.

We provide tools, content and a goalsbased investment solution online that empower investors to take control of their financial future, and provide access to the same Crossbridge Capital investment experts that provide advice and counsel to our ultra-high net worth clients,”

said Charlie O’Flaherty, Partner and Head of Digital Strategy & Distribution at Crossbridge Capital.

“Today’s updates will significantly speed-up the onboarding process while ensuring that the very best standards of customer identification and verification are maintained.”

” We launched CONNECT in November because we believe that many clients are now looking for high quality investment options online and have been underserved by the existing choices available in the market. Early interest from clients and partners has been tremendous,”

added Tarek Khlat, CoFounder and Group Chief Executive Officer of Crossbridge Capital.

Digital onboarding will streamline the user sign-up journey by utilising e-sign technology for all required documentation. It will not require manual submission of documents or a physical visit to Crossbridge Capital’s office to complete sign-up, making sign-up as easy as possible for investors.

The CONNECT platform has also introduced greater access and connectivity to Crossbridge Capital’s in-house investment talent and advice, which currently advises on over US$3 billion of client assets. Clients will be able to access a live chat and dedicated helpline in which they will be able to reach experienced human advisors from the Crossbridge Capital investment team.

Interested users will also be able to retrieve regular market insights from Crossbridge Capital’s Chief Investment Officer, Manish Singh, or view videos that were designed to ease and accompany the new CONNECT user journey.

Together with Morningstar, the leading global investment research firm, Crossbridge Capital has developed for CONNECT a series of portfolios built around specific risk-return profiles – each with an exposure of up to 12 asset classes. Based on their investment goals – from real estate to financial security, CONNECT clients will be able to efficiently access and manage their investments with a single transaction, and benefit from a professionally structured portfolio that is actively rebalanced to ensure that investments remain aligned with clients’ personal risk preferences.

A key feature of CONNECT by Crossbridge is its simple, efficient, and transparent fee structures with no commissions, administrative fees, brokerage fees or hidden charges. CONNECT portfolios include fees of up to a maximum of just 1.25% per annum, depending on the investment choices made.

“Digital platforms are increasingly offering wider access to investments and eliminating hidden costs that can significantly erode the returns on investment portfolios. CONNECT is designed to offer a premium wealth management experience for a mass-affluent investor without the associated high or hidden fees,”

Khlat added.

Note: Accredited investors include individuals whose net personal assets exceed S$2 million or whose income in the preceding 12 months is not less than S$300,000 [Source: Monetary Authority of Singapore]. Digital on-boarding will be applicable in most but not all cases for Singapore Accredited Investors.