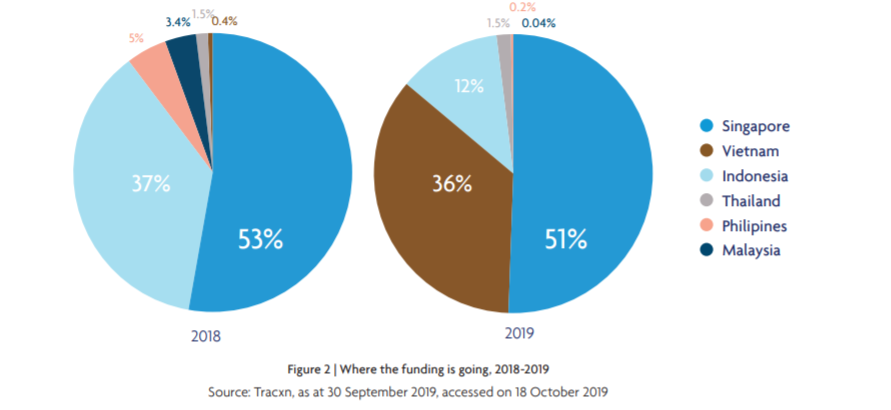

Singapore Accounts for over 50% of Fintech Funding in ASEAN

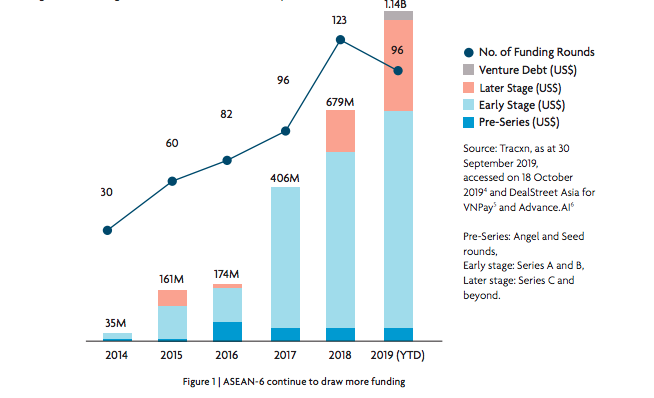

by Fintech News Singapore November 13, 2019Funding into ASEAN has grown more than 30 times since 2014, reaching a new high of US$1.14 billion as at end September 2019, according to a recent report published by UOB. The growth in fintech continues unabated, as more investors and fintech firms set their sights on the opportunities from ASEAN’s strong economic fundamentals, including its large unbanked and underbanked population.

While other ASEAN countries have accelerated the development of their domestic Fintech sector, it is Singapore, with its more mature Fintech scene, that continues to attract the most funding within ASEAN. Of total funding in 2019 to date, more than half (51 per cent) of total funding went into Singapore. Singapore also continues to be the preferred base of FinTech firms, home to 45 per cent of firms in ASEAN.

Varying levels of funding maturity for FinTech firms across ASEAN

Based on UOB’s survey findings, fintech firms operating in ASEAN are generally optimistic about meeting their existing and future funding needs, with almost half of those surveyed confident of raising more than US$10 million for their next funding round.

In Singapore, Fintech firms are maturing as many graduate from pre-series stage to later stage funding. Funding for Singapore-based FinTech firms was also spread more evenly across all Fintech categories, with insurtech, payments and personal finance leading the way.

In Indonesia, investors focused on alternative lending firms, fuelled by strong demand for credit from the country’s rising middle class. Investors sought opportunities in Malaysian fintech firms developing solutions in payments, finance and accounting; while in Thailand, investors channelled their funds into InsurTech and investment tech firms. In Vietnam, investors favoured payments, which is common for economies in the early stages of developing a FinTech sector.

Featured image credit: Unsplash