Banks, Financial Services Firms and Insurers Open Innovation Labs in Singapore

by Fintech News Singapore July 6, 2016Innovation takes a lot of time and resources. Large firms and corporations often rely on innovation labs to research, experiment and help them integrate emerging innovations into their businesses.

Image by ra2studio via Shutterstock.com

Innovation labs are specific buildings or departments dedicated to working on prototypes and fleshing out ideas. By having a dedicated space to experiment, organizations can explore unconventional, even radical ideas in hopes of inspiring changes or new opportunities that could enhance its business.

During the past years, banks and financial institutions have opened innovation labs in Southeast Asia and most particularly in Singapore to explore emerging technologies. Citi was among the first banks to do so, launching in January 2011, the Citi Innovation Lab in Singapore.

Said to be the first lab of its kind to be established in the country, the Citi Innovation Lab in Singapore aims at leveraging cutting-edge technologies to engage Citi’s institutional clients and deliver innovation products. Citi Innovation Lab recently won an award for its Citi Working Capital Analytics solution at the 2016 FinTech Innovation Awards in London.

Another front-runner is MasterCard, which launched in early-2012 a MasterCard Lab in Singapore focusing on researching and developing new payment solutions including emerging payments, chip, contactless, mobile and e-commerce. Back then, the firm said it intended to use Singapore’s first class infrastructure and unrivalled quality of life to source and attract talent, including senior level executives from around the world.

Citi and MasterCard aren’t the only bank and financial services firm to have settled innovation labs in the city-state. As Singapore is looking to become the world’s first Smart Nation and has taken the steps to create a Smart Financial Center, the Monetary Authority of Singapore has been supportive of fintech innovation, welcoming foreign corporations and initiatives to foster development in financial technologies.

HSBC launched in October 2015 the HSBC Singapore Innovation Lab, the bank’s first dedicated and strategic space for fintech innovation in Asia Pacific. The lab focuses on corporate banking needs in payments, trade and supply chain, particularly for companies with a regional focus, and aims at fostering greater collaboration between the bank and corporates.

HSBC Singapore Innovation Lab, via https://globalconnections.hsbc.com/

But the year 2016 may well be the year of innovations labs as a growing number of banks are looking to harness Singapore’s strategic location and high-skilled labor force to boost fintech developments.

Most recently, Leonteq, a fintech provider for investment and pension solutions, launched the Teqlabs innovation lab facility in Singapore in partnership with Singapore’s Economic Development Board (EDB).

Leonteq said it intends to leverage on EDB’s university network to get the “best human capital resources from Singapore’s top universities.”

Earlier this year, Standard Chartered Bank announced the opening of the eXellerator, the bank’s innovation lab located in Singapore.

“Singapore’s strategic location at the heart of the ASEAN region and its vibrant fintech ecosystem makes it the logical location for [Standard Chartered Bank] to base our new global innovation lab,” Anju Patwardhan, global chief innovation officer at Standard Chartered, said in a statement. “This is where we can tap the depth of knowledge and talent, as well as work with local universities and research organizations, to help drive the bank’s innovation agenda.”

Over the past few years, Standard Chartered has been actively pursuing its innovation agenda, making significant progress in the digital space. Noteworthy examples include its partnership with DBS Bank and Singapore’s Infocomm Development Authority (IDA) to complete a proof-of-concept for an application of blockchain technology for trade finance invoicing. Another example is Standard Chartered’s multi-award winning mobile banking app, Straight2Bank, a fully-integrated Internet banking platform which the bank launched in a number of countries around the world.

Another major player that has recently opened an innovation lab is Visa. Visa’s Singapore center focuses on developing next-generation payment methods for the Asian market. It is the firm’s second facility, after the one in San Francisco. Visa said it plans to open more centers over the next couple years in cities such as Dubai, Sao Paulo, Bangalore and Miami.

Alongside the financial services industry, insurance businesses, too, are interested in exploring how cutting-edge technologies can be used to provide then with greater efficiency as well as delivering better customer experience.

German Allianz, one of the world’s largest insurance companies, launched its Asia Lab in Singapore in May. The lab, Allianz’ first innovation hub in Asia, aims at harnessing digital innovation and advanced analytics to deliver solutions for the group’s 18 million customers in Asia.

Allianz’ Asia Lab launch (from left to right): Allianz Asia Pacific chief executive Mr Sartorel, MAS chief fintech officer Mr Mohanty, Allianz Asia Pacific chief operating officer Ruediger Schaefer, Allianz Asia Pacific head of data science Raymond Au and Allianz regional manager of innovation Roman Braendli. Image via Allianz

With a starting team of ten technology specialists and data scientists, Allianz’ Asia Lab focuses on developing innovation customer products in the areas of connected healthcare, mobility and smart city-living. It said it intends to work closely with Asian startups, ventures and institutions to research and develop innovative market concepts and prototypes.

“Asia is really leap-frogging technology and Asian consumers are adapting to technology and digital offers very fast,” George Sartorel, regional CEO of Allianz Asia-Pacific, said in a statement. “We strongly believe that we have every chance of building a new digital insurance model right here in Asia.”

The lab was established with the support of MAS. According to Leong Sing Chiong, assistant managing director of MAS, Allianz’ Asia Lab “will directly contribute to MAS’ strategy to pursue innovation-led growth, and reaffirm Singapore’s position as a leading insurance market.”

“Allianz’s initiative will help to provide cutting-edge insurance solutions for Asian consumers, and deepen Singapore’s innovation ecosystem. We look forward to continued collaboration with Allianz, and to supporting their digital initiatives,” Chiong said.

Featured image: The Merlion fountain lit up at against the Singapore skyline by Vincent St. Thomas, by http://www.shutterstock.com/pic-220380898

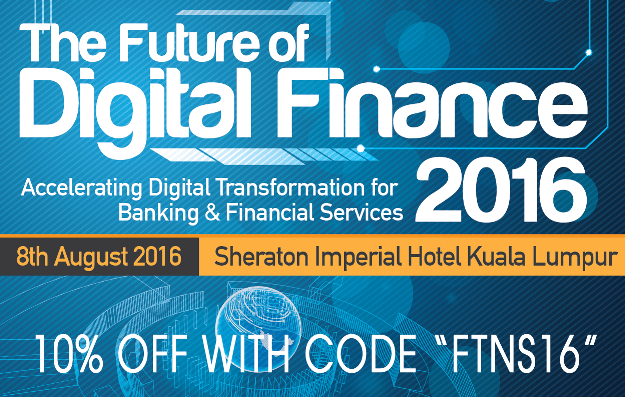

Advertisment:

Join The Future of Digital Finance 2016 to meet international digital leaders, key decision makers from domestic and international players plus ground-breaking new start-ups. Don’t forget to quote FTNS16 when reserving your seat to get 10% discount. Call +603 2260 6500 or email to admin@thomvell.com NOW!