In Southeast Asia’s Virtual Banking Race, Incumbents Might Have An Early-Mover Advantage

by Fintech News Singapore March 16, 2020In Southeast Asia, the imminent entrance of virtual banks is set to shake up the banking industry. But despite the potential disruption these are expected to bring, incumbent banks have a lead in the digital banking race, according to a new report by S&P Global Market Intelligence.

By teaming up with local partners to gain new customers, introducing innovative features and services, and streamlining the onboarding process, incumbent banks that have launched stand-alone digital outfits “are steadily acquiring an early-mover advantage,” the firm said.

In Indonesia, Digibank by DBS Bank from Singapore has incorporated self-service banking solutions such as an artificial intelligence (AI)-powered virtual assistant, as well as a budget optimizer that helps customers do their budgeting, track expenses and analyze purchasing trends. Digibank has also simplified the loan application process by digitalizing it, allowing approvals to be granted within 60 seconds, and last year, it launched a new platform to offer non-collateral loans called KTA Instant. Digibank runs on the Finacle core banking solution by Infosys.

Meanwhile, Jenius, by Indonesia’s Bank Tabungan Pensiunan Nasional (BTPN), is a mobile banking application that makes it quick and easy for customers to manage their finances using their smartphones. Some of Jenius’ innovative features include $Cashtag, which enables customers to use their names as their account identifier, and Set It, which allows users to transfer money to anyone on their contact list. They can also use Pay Me to make payment requests, and Split Bill to divide bills easily between friends. Jenius is powered by the core system of Finastra Group.

In Vietnam, Timo and YOLO, both powered by Vietnam Prosperity Joint-Stock Commercial Bank (VPBank), provide customers with a full range of financial services, but also integrate other services catered to daily needs such as transportation, travel, entertainment and restaurant reservations.

Targeting the unbanked

Digital banks in Southeast Asia have also articulated their strategies around the large population of unbanked in the region. Leveraging technology and digital platforms, these have focused on streamlining onboarding, as well as providing products that cater to the special needs of this population, the report says.

CIMB Bank PH in the Philippines and Jenius in Indonesia, for example, offer an end-to-end remote account-opening experience through features such as selfie verification and video calls to confirm the users’ identity.

For other digital banks, however, identity authentication is still required at physical venues, but some have streamlined the onboarding process notably by introducing biometric technology. At United Overseas Bank (UOB)’s TMRW bank in Thailand and DBS Digibank in Indonesia, customers must visit a biometric verification booth with their identity card to complete their application, the report notes.

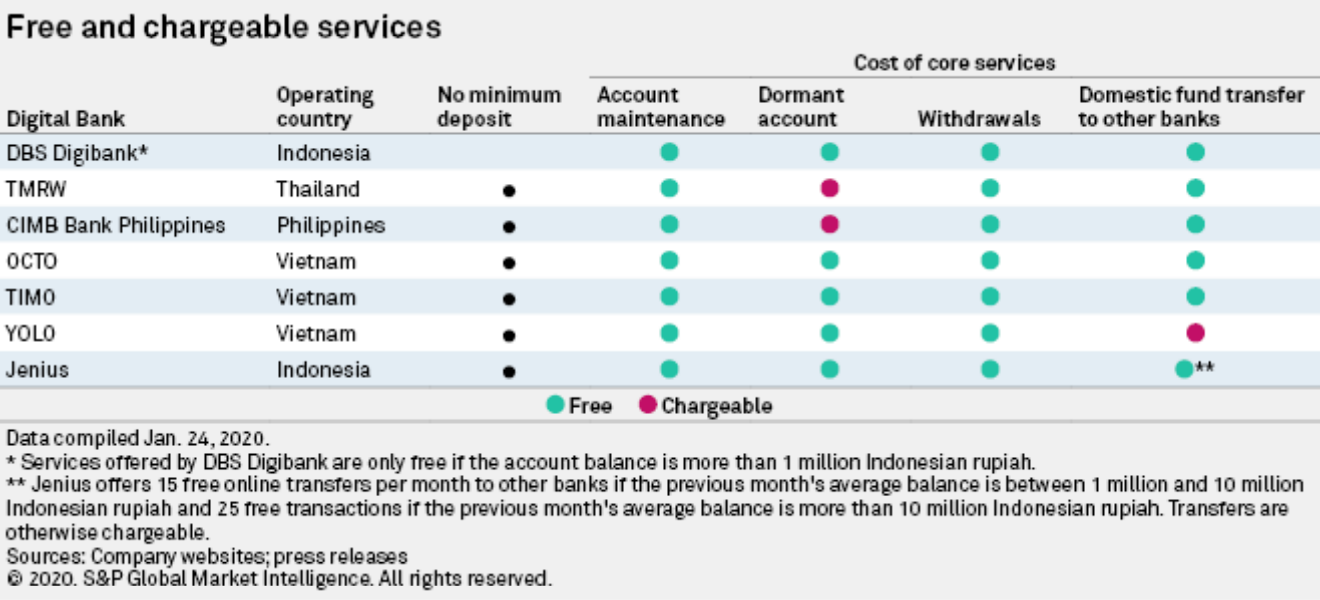

Several of these banks offer no-fee savings accounts without a mandated minimum balance, as well as complimentary services such as cash withdrawals and domestic fund transfers to other banks, it says.

Free and chargeable services, S&P Global Market Intelligence, February 2020

Partnerships with local tech companies

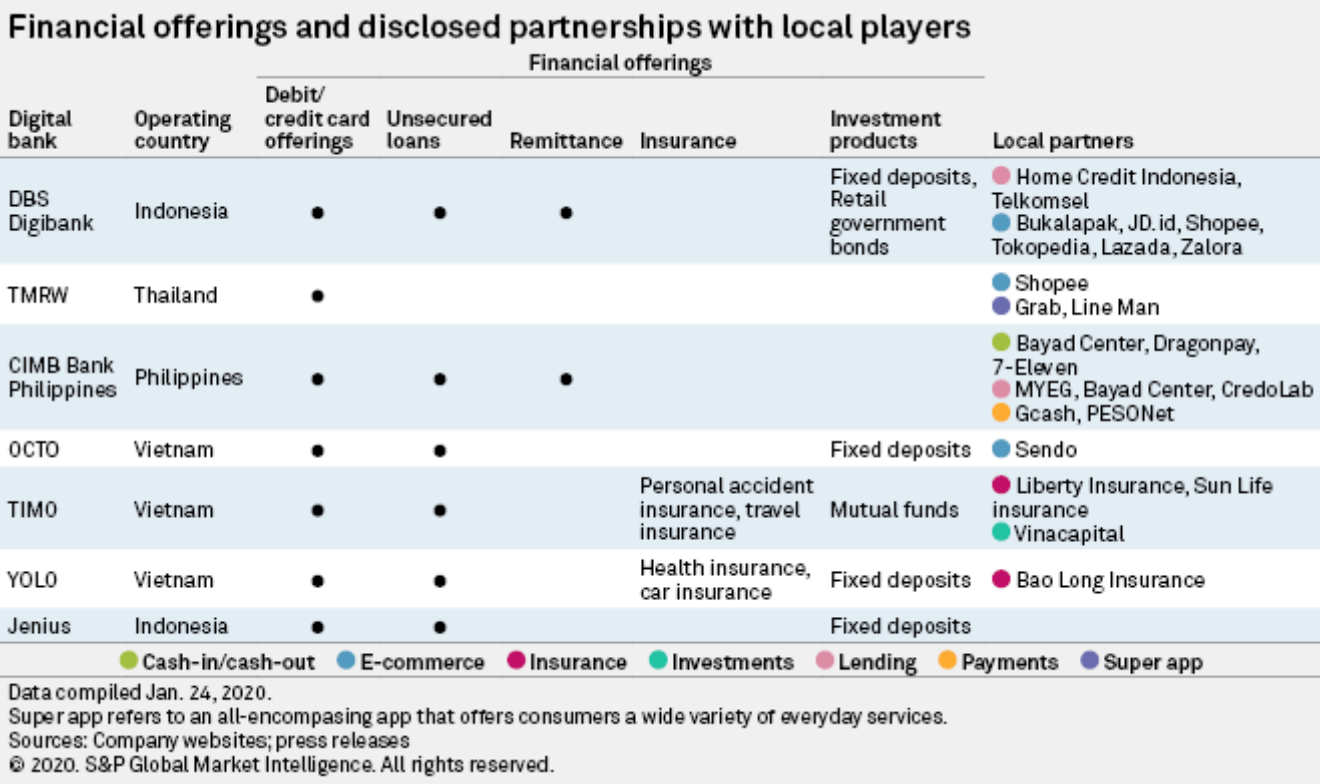

Digital banks in Southeast Asia have also teamed up with local partners to gain scale and acquire new customers.

The report notes the case of UOB’s TMRW bank in Thailand which has established referral programs with Shopee, Grab and Line Man to encourage their customers to open accounts. The strategy has allowed the bank to acquire an average of 2,000 new account holders per month since inception, the report says, citing Finews.asia.

Malaysia’s CIMB integrated its CIMB Bank PH services in the Philippines into the GCash app, allowing the mobile wallet’s users to open a savings account termed GSave. This collaboration between CIMB and GCash saw the bank acquiring 500,000 GSave users within six months of operations, according to the bank.

Financial offerings and disclosed partnerships with local players, S&P Global Market Intelligence, February 2020

Southeast Asia is gearing up for the launch of the region’s first independent virtual banks as central banks and regulators in jurisdictions including Singapore, Malaysia, and most likely Thailand in the near future, are opening up their banking industries to new entrants.

Singapore will be issuing up to five digital banking licenses to non-bank players. Meanwhile, Malaysia released its virtual banking licensing framework in December 2019 and is expected to accept applications this year. Finally, Thailand is reportedly studying the possibility of licenses for digital banks.

Featured image credit: Unsplash