Cloud Computing, a Major Tech Trend in Finance This Year, Also in Singapore

by Fintech News Singapore April 17, 2020Many financial institutions are already using cloud-based software-as-a-service (SaaS) applications for business processes, but 2020 is set to be the year that adoption accelerates, experts and industry participants say.

Cloud computing: one of the biggest trends of 2020

Cloud computing has been named among 2020’s biggest fintech trends with public cloud poised to becoming the dominant infrastructure model, PwC says. Today, financial institutions are leveraging cloud for processes that might be considered non-core, but as application offerings improve, the technology is expected to become the way that core activity is processed, with deployment in areas such as consumer payments, credit scoring, and statements and billings for asset managers’ basic current account functions.

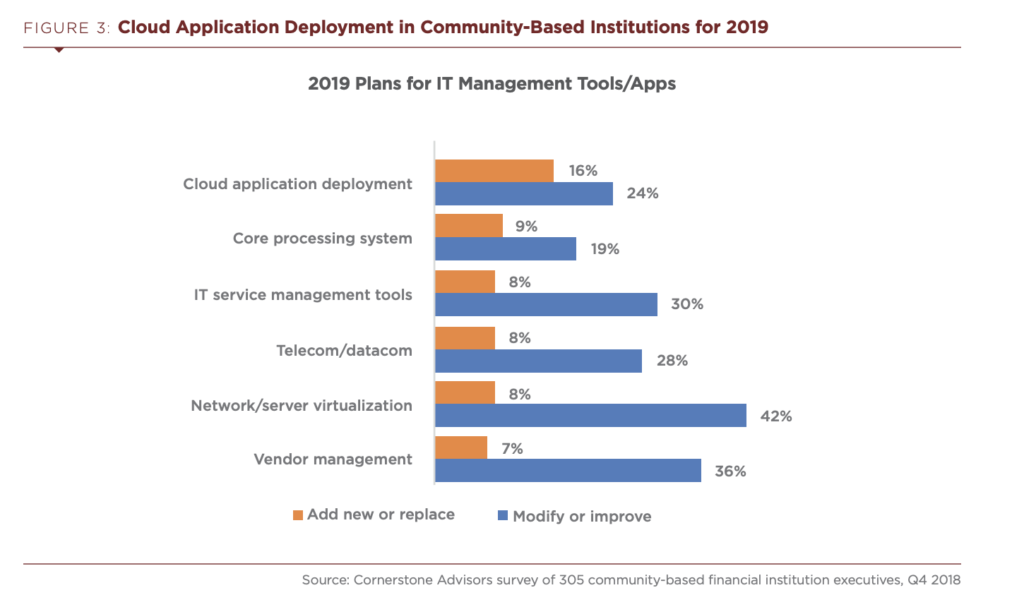

Echoing PwC’s predictions for 2020, a study by Cornerstone Advisors found financial institutions are looking to ramp up development of cloud computing technologies this year. According to the research, a quarter of financial institutions are planning to invest in or implement cloud computing technologies in 2020. 40% say they’ve already done so, and half of them will enhance or modify what they’ve got.

Refinitiv, a global provider of financial markets data and infrastructure, believes that evolving customer expectations and changing business models driven by the rise of platform businesses will push demand for cloud computing further in the year ahead. This is mainly due to today’s tech-savvy customers are demanding a frictionless, high quality and highly personalized experience, expectations that businesses can only fulfill by embracing big data, machine learning (ML) and the cloud, the company says.

The growing importance of data

In a report released in April 2019, Finastra delves into some of the trends that will be driving the banking industry towards the cloud.

The research cites banks’ growing appetite for AI. In order for AI tools and technologies to be powerful and reach their full potential, banks will have to turn to and rely on data sources from third parties, partners and vendors. Bringing all that data in-house will not be a feasible option and, in many cases, won’t be an option at all. Hence, cloud computing will become more inevitable and necessary, the report says.

Another major trend is the “platformification” of analytics. Over the next five to ten years, Finastra predicts that data and analytics services will be provided “as-a-service” by open platforms that aggregate analytics tools, data sources and data management services. This will force even more financial institutions to move to cloud computing in order to enhance their analytics capabilities, the report says.

Finally, the third and finally trend is the emergence of “financial health.” In the future, financial institutions will compete on who would best improve consumers’ financial health and performance, and this will require more integration of both data and services between players in the banking ecosystem. This will further force more financial institutions to the cloud, the report says.

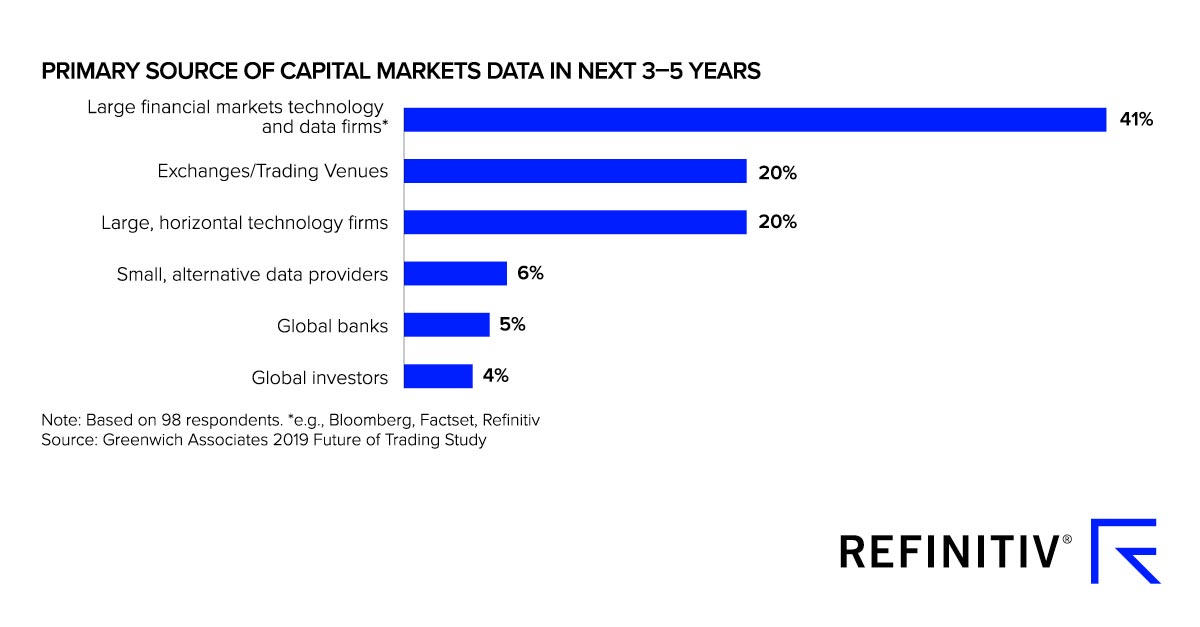

Echoing other experts and professionals, Michael Chin, managing director and global head of trading proposition at Refinitiv, argues that data in the financial services industry, and most particularly financial markets, has never been more valuable.

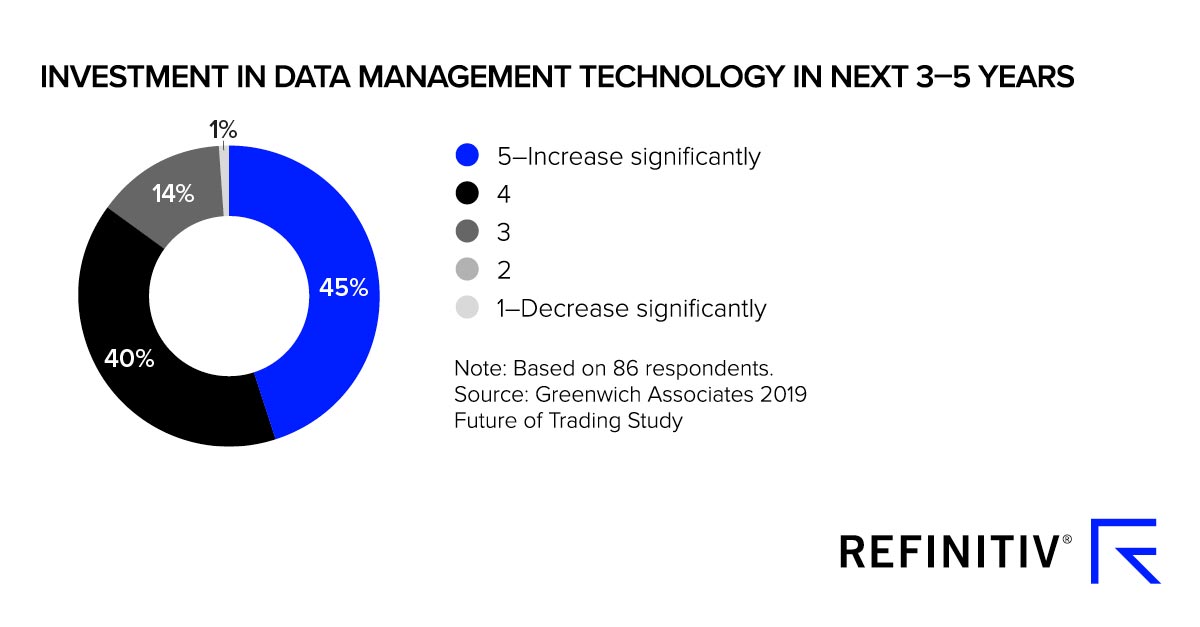

In a blog post released in February, Chin shares findings from a research his company conducted in partnership with Greenwich Associates which found that an overwhelming 85% of banks, investors and capital markets service providers are planning to increase spending on data management.

Investment in data management technology in the next three to five years, Refinitiv, February 2020

In this changing landscape where financial data will become more and more critical, large market data aggregators like Refinitiv will have a key role to play. Because of their power to find, ingest, normalize, aggregate and then redistribute data with high degrees of accuracy and latency, they will act as the primary source of data for trading desk, overshadowing exchanges and trading venues, the research found.

In response to growing demand from the financial services industry for data being delivered through the cloud, Refinitiv launched in February its Tick History dataset on Google Cloud Platform (GCP). Tick History is an archive of historical tick data drawn from the company’s real-time content, with data going back as far as 1996. It covers over-the-counter (OTC) and exchange-traded instruments from more than 500 trading venues and third-party contributors.

By making Tick History available via GCP, customers have been given the possibility to access, query and analyze Refinitiv’s extensive archive of pricing and trading data using the ML capabilities of Google Cloud’s BigQuery, allowing them to work across large datasets remotely, and enjoy a reduced infrastructure spend and storage, the company says.

Covid-19 Fast Tracking Cloud Webinar

In case you are interested to explore how COVID-19 is fast-tracking the move to the cloud, click here to register for a webinar taking place on April 28th 11AM SGT/ 1PM AEST.

Featured image credit: Pixabay