5 Emerging Fintech Startups from Indonesia to Watch in 2020

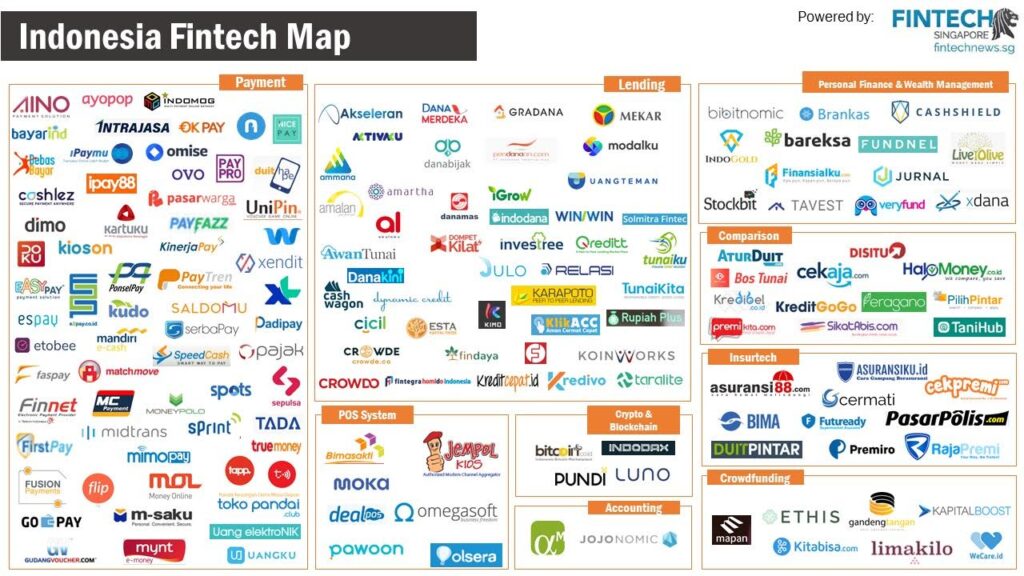

by Fintech News Indonesia March 26, 2020The Indonesian fintech industry witnessed steady growth in 2019 with several companies in the sector reaching notable scale and recognition. Ovo, a digital wallet, emerged as the country’s fifth startup unicorn, while several others, including Akulaku, a consumer installment loan platform, Kredivo, a digital credit platform, and Modalku, a crowdfunding platform for small and medium-sized enterprise (SME) financing, reached valuations of over US$100 million, according to DSResearch’s Fintech Report 2019.

With Indonesia’s fintech sector reaching new highs, we look today at six Indonesian fintech startups to watch out for in 2020. These startups are either fairly new or have remained in the dark so far, but have made significant strides in 2019, including raising funding from notable investors, launching new products and services, or gaining notable recognition.

Pluang

Founded in 2016, Pluang, formerly EmasDigi, provides digital micro-savings products with the mission of democratizing financial products for Indonesians.

The startup raised more than US$3 million in its Series A funding round from Go-Ventures, the venture capital arm of Indonesian ride-hailing firm Go-Jek, in September 2019, which it said it will use to launch new products including fixed return products and US dollar savings. Pluang provides only one right now, a gold savings product.

Indonesia’s fintech industry is primarily made of startups operating in the payments and lending sectors, and Pluang is one of the few startups in the country that’s trying to improve savings.

Alami

Established in late-2017, Alami started as an aggregator platform focused on the Islamic market in 2018 before expanding to providing small and medium-sized enterprise (SME) financing in 2019 after receiving regulatory approval from Otoritas Jasa Keuangan (OJK), the Indonesian Financial Services Authority.

In November 2019, Alami raised an undisclosed amount of investment commitment led by Golden Gate Ventures, with participation from Agaeti Ventures and RHL Ventures. It said it would the fresh funding to support talent acquisition and product development as well as strengthen its operational structure.

As of March 2020, Alami had disbursed over US$7.5 million in sharia-compliant financing to SMEs. The startup now plans to become a digital bank.

Halofina

Founded in 2017, Halofina is a goal-based robo-advisor platform. The platform helps users manage their personal finance based on their goals, lets them receive investment strategy recommendations from artificial intelligence (AI), and allows them to invest directly from the mobile app.

Halofina raised pre-Series A funding from Mandiri Capital Indonesia and European venture capital firm Finch Capital in November 2019, which it said it will use to develop its online financial services platform.

Halofina will start its Series A round at the end of Q2 2020, and in the meantime, plans to increase its user base to 500,000 users over the next year, develop a premium subscription program, and provide them better financial advice.

Pintek

![]()

Established in 2018, Pintek is a fintech platform providing loans focused on the educational sector, targeting students from kindergarten up to postgraduate education, as well as those in informal education programs specifically vocational courses. Borrowers can apply for loans from IDR 3 million (US$218) to IDR 500 million (US$36,439) with tenures of up to two years.

SoCap, Pintek’s parent company, raised pre-Series A funding in November 2019 which it plans to use to “drive technological and financial innovation needed to support Indonesia’s education sector to achieve international standards for the country’s economic development.”

As of January 2020, the company had channeled more than IDR 27 billion (US$1.9 million) in loans to 1,700 students across 25 provinces in Indonesia. Going forward, it plans to expand its product offering and partnership coverage. By the end of 2020, the company wants to have the number of borrowers and loans disbursed grow by at least 10x.

SuperAtom

Founded in 2018, SuperAtom is a technology company that provides financial services designed for the Southeast Asian region. The startup received approval from the OJK in 2018 and launched that same year, UangMe, a P2P consumer lending platform.

SuperAtom raised US$24 million in a funding round led by Gobi Partners through the Meranti ASEAN Growth Fund in September 2019. The startup is currently preparing its expansion to the Philippines as it recently obtained the relevant financial license from the Philippines Securities and Exchange Commission.

SuperAtom is incubated by and a spun off from Cheetah Mobile, a Beijing-headquartered mobile Internet company.

You can check the Indonesia Fintech Report 2018 here.