Top 10 Upcoming Fintech Webinars for Those Located in Asia to Attend

by Fintech News Singapore May 20, 2020With COVID-19 continuing to put a toll on the global economy and disrupt the live event business, webinars and virtual meetups have surged in number over the past months to provide professional and industry participants with the opportunity to connect and network.

For fintech professionals located in an Asian time zone, we have rounded up the 10 best digital banking and fintech webinars from May 20.

Cyber Security Threat Landscape for Fintechs and Financial Institutions

Nov 18, 2020, 10:00 SGT

Cyber security is a growing headache for any knowledge intensive business including fintech, PE, hedge funds and other financial institutions (FIs). Such firms are faced with compliance obligations to protect their high value sensitive data as regulated by the Monetary Authority of Singapore; however, they also have low cyber security budgets and limited IT staff. In 2020, ransomware and email compromise are among some of the top cyber threats businesses commonly face. These attacks often rely on human weakness, and COVID-19 is a perfect opportunity for fraudsters to act.

Join this discussion-based event to ask us anything about cyber and listen to war stories from experienced practitioners who assist companies daily with prioritizing valuable resources. Our experts will explain where things went wrong and what the threat landscape for the fintech industry may look like under the current COVID-19 situation and beyond.

Speakers

- Paul Jackson, Managing Director and Asia Pacific Leader, Cyber Risk

- Louisa Vogelenzang, Associate Managing Director, Identity Theft and Breach Notification

- David Klopp, Associate Managing Director, Cyber Risk

- Richard Davies, Associate Managing Director, Cyber Risk

Register here: https://bit.ly/32fjJ5N

Facing the Future: Digital Assets Growth Post COVID-19

May 20, 2020, 21:00 – 22:00 PM SGT

On May 20, Diamante Blockchain will be hosting a webinar exploring the future of blockchain and digital assets post-COVID-19. The online event will bring together preeminent leaders from Asia, Europe, and the US for a thought provoking panel discussion.

The webinar will introduce the core concepts behind blockchain-based tokenization and will include discussion on the macro financial and technological trends that are contributing to the exponential growth in decentralized finance.

Participants will get to learn how businesses are using blockchain technology to digitize value and streamline asset management across industries, including secure, scalable and fast asset transfer across borders, fractionalized ownership of real-world assets, tokenized micro-economies, and accountable, transparent governance systems.

How to Apply Design Thinking in Data Science

May 21, 2020, 3:00 PM SGT

Refinitiv’s Learn-It-All-Labs virtual lab session will take place on May 21 and will focus on design thinking. In this session, the company will share its design thinking skills and explain how it has applied them to a real-life project called the Data Access Tool.

Key takeaways will include a deep dive into what design thinking actually means, the difference between traditional thinking and design thinking, how to apply a design thinking to a project, and more.

Fintech for Health: The Rise of Digital Payments under COVID-19

May 21, 2020, 16:00 PM – 17:30 SGT

The use of digital or cashless payments have seen a sharp rise under COVID-19 with mobile money becoming a way to not just pay for products but also to avoid the transmission of the SARS-CoV2 virus. Increasingly, digital technologies are being used to abide by social distancing policies and prevent further spread of the virus.

The Rise of Digital Payments under COVID-19 online event, the first in a series of Fintech for Health webinars, aims to share how the digital payments industry has changed rapidly in response to the pandemic, and why it makes more sense than ever to integrate digital payments platforms with healthcare financing and delivery platforms.

Speakers for this event will include representatives from Access Health International Southeast Asia, CGAP, MetLife Foundation, Alliance for Financial Inclusion, and MicroSave Consulting.

FutureBanking presents: How blockchain is changing the world

May 22, 2020, 12:00 – 13:30 BST (19:00 – 20:30 SGT)

For this webinar, leading female blockchain experts will share how this cutting edge technology is set to impact many industries.

Participants will get to learn how blockchain can solve pain points in a number of businesses, what new products to expect in 2020, and more.

Panelists on the night will include Mame-Yaa Bonsu, founder of MYB Ventures, a fintech and blockchain advisory; Dr Amber Ghaddar, founder of AllianceBlock; Dr. Tara Shirvani, disruptive technologies global lead at the European Bank for Reconstruction and Development (ERBD); Dr Maria G. Vigliotti, founder of Sandblocks Consulting, and CEO of Grabdase; Jane Orafu, founder of Bitcoin Mandates; and Paulette Watson, founder and managing director of Academy Achievers.

The new normal: Working capital finance after COVID-19

May 27, 2020, 14:00 PM – 15:00 PM SGT

The COVID-19 pandemic has the potential to create a seismic shift in global supply chains and how the associated finance is provided. Whole industries, with processes previously reliant on in-person, physical interactions and documents, have had to shift to virtual working almost overnight, while suppliers face increased uncertainty around receivables and liquidity.

This had brought digitalization and new technologies into sharp focus, with a new normal for collaboration and ecosystem integration for working capital finance coming into existence.

In this exclusive virtual event, Finastra’s transaction banking team in the Asia-Pacific region will discuss what the new normal for working capital finance looks like, and explore how Finastra can help businesses embrace a collaborative, ecosystem-based approach to working capital finance. Participants will also get to ask their questions in an interactive Q&A session.

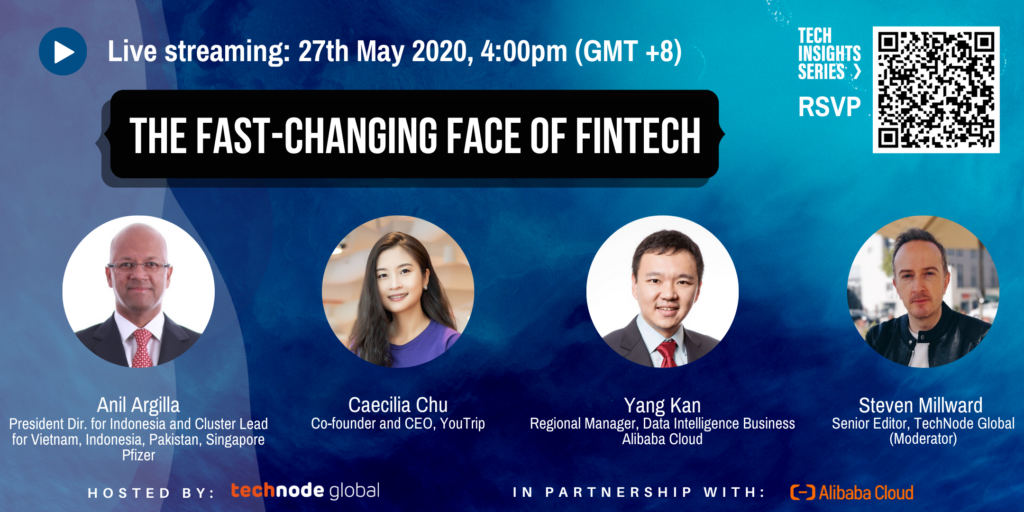

Tech Insights: The fast-changing face of fintech

May 27, 2020, 16:00 – 17:00 SGT

While many companies face an existential threat from the COVID-19 crisis, some sectors are poised to thrive during the economic downturn and also in a future heavily reliant on digital solutions.

Fintech plays a critical role as the coronavirus pandemic limits the face-to-face interaction. Fintech companies will now have to step up their efforts in facilitating access to financial services, and drive the change in which businesses interact with one another. However, not all fintech companies possess advantages in the post-crisis market.

In this webinar, hosted by TechNode Global and part of the Tech Insights series, speakers representing the likes of YouTrip, Pfizer, and Alibaba Cloud will shine a light on the opportunities, pitfalls, and latest innovations from across the finance ecosystem which are moving forward in unprecedented times.

Europe & Asia: Use of Open Banking

May 27, 2020, 18:30 – 19:30 SGT

On May 27, experts from Standard Chartered Bank, Zuhlke Engineering, and Upside will gather for an Evening Talks @Zuhlke webinar to discuss the emerging use and new opportunities brought in by open banking.

This webinar is intended to provide business leaders in the financial sector with a perspective on the evolving open banking situation and discuss how they can rethink business models and strategies, work with ecosystem partners, and leverage on digital solutions and services to better serve their customers’ needs.

On this panel discussion, the experts will take in questions from the audience and discuss topics around:

- What can we learn from what has been done in UK?

- State of open banking in Asia

- Expert insights, solutions, and experience of working/building open banking solutions

- Challenges of building open banking solutions in each region

- Use cases of open banking across borders

- Technology readiness and regulators

AI and business ethics in financial markets – The AI book

May 27, 2020, 13:00 – 13:40 BST (20:00 – 20:40 SGT)

The AI book by Fintech Circle was published on May 7, 2020. In the book, Dan Liebau, founder of Singapore-based Lightbulb Capital, and Tiffany Wong, manager at Deloitte, explore the key business ethics issues that arise with the widespread use of artificial intelligence (AI) and machine learning (ML). This includes fairness, privacy, transparency, explainability and accountability, building on a number of key principles and focus by governments and regulators. Practical solutions are also recommended to operationalize these principles.

In this interactive webinar, Wong will give a brief account of the discussions outlined in the book, followed by a Q&A session.

Wong, which currently manages Deloitte’s digital and technology risk team, specializes in technology risk and is involved in multiple technology transformation, associated with enabling technologies such as AI and cloud. She is a CFA charter holder, a chartered accountant, and currently co-leads the CFA UK AI and machine learning working group.

How fintechs are predicting the future with smart analytics

May 28, 2020, 11:00 – 12:00 BST (18:00 – 19:00 SGT)

On May 28, Fintech North, in partnership with Netpremacy, and Google, will be hosting an exclusive webinar, giving participants an insight into how fintechs are using smart analytics to power the business and understand their customer base.

Participants will get to understand what trends Google has seen, and how their customers use tools such as Big Query to power the business forward. They’ll hear from Rich Asby and Egbert IJsseldijk as they discuss how Google helps customers leverage their technology in partnership with Netpremacy and get the most out of the solutions they provide.

Participants will also hear from industry-leading finechs on how they are using Googles analytics tools to understand the business, help predict the future and make informed decisions on what new additions and enhancements they need to make to their offering.

Post COVID Recovery: Building a Distributed Team in the Philippines (Promoted Webinar)

June 4, 2020, 11:00 SGT

Build a Backoffice Operation in the Philippines to Support your Business

Already a 24.7 USD Billion industry in the Philippines, IT-BPO continues to deliver talent to a large growing Tech Industry.

Join us for a Webinar on Thursday, June 04 at 11 AM (GMT +8) as key experts discuss how to build and scale an English-speaking back-office team, while saving 70% on labor costs.

Future of Payments in South East Asia

Available for On-Demand Viewing

With digital payments expected to exceed over US$ 1 trillion by 2025, it is evident South East Asia is a hotbed for payments innovation.

From near-instant international money transfers to the proliferation of digital wallets, the future for payments in this region certainly looks bright.

In the not so far future, the existence of central-bank backed digital currencies puts the concept of money into question.

But with great convenience also comes new vectors of risks and privacy concerns as well. How can the industry push the barriers of innovation without compromising the users?

Register here

Live Webinar: Bring Trust to Blockchain for South East Asia

June 25, 2020, 9:30 SGT

Blockchain applications have been adopted by business across financial institutes, government, and other sectors.

Join Thales and Deloitte for an hour and learn about South East Asia blockchain deployments by Deloitte, and how Thales brings trust to blockchain developments.

Register here

How Banking Has Changed for Good: Becoming an Intelligent Financial Services Player

July 9, 2020, 14:00 – 15:00 SGT

Join IDC, Finastra and thought-provoking leaders from WeLab and the banking industry as we discuss the findings of a newly released IDC InfoBrief to examine ways banks have responded to the new normal and the best way forward:

- 2020 and beyond, going into Asia Pacific trends in 2021

- What must banks do now during the accelerated disruption to be part of the banking industry of the future?

- How to evolve into an intelligent player in the market

- Ways to synthesize emerging technology with legacy systems and maximize the potential of an interconnected digital ecosystem

Register here

Fintech Fireside Asia Ep #1: A Look Behind AMTD’s Regional Ambitions

July 20, 2020, 11:00 SGT

This is the first episode of Fintech Fireside Asia where we sit down for a chat with the top fintech personalities around Asia.

For this episode, we’re joined by Calvin Choi, Chairman AMTD Group.

The name AMTD is plastered across headlines recently from launching Airstar Bank one of Hong Kong’s first virtual banks, to millions of dollars contributed into supporting the Singaporean fintech ecosystem and their acquisition spree which included names like PolicyPal, Capbridge and FOMO Pay.

What is the ambition and vision behind these big moves? We speak to Calvin to find out more

Register here

Reimagining Customer Experience of FinTech

Aug 20, 2020, 15:00 HKT

Customers expect seamless, intuitive, and personalized interactions when it comes to managing their money. It’s the overall exchange that counts, and that exchange needs to work for all players involved—customers and service providers—across every channel and step of the journey.

Financial services companies of all kinds are using programmable communications to build outstanding customer journeys that drive loyalty and customers experiences.

Due to COVID-19, people are spending more time online to have the services.

Joining Vonage how they accelerate your business and protect both companies and customers

- Programmable digital communications optimize the customers experiences along the whole journey

- SMS, Voice, Video, Social Media – Multi-channel touch points with your customers

- Anti-fraud of the fake users to protect FinTech companies and reduce the operation cost

- 2FA(2-Factor-Authentication) secures every customer’s transaction and make your companies trusted

Register here: https://bit.ly/2WFTuCK

Increase your Online Conversion Rate with EMV 3-D Secure Technology

Aug 26, 2020, 15:00 SGT

Join this free webinar to discover how PSPs, acquirers and merchants in South East Asia benefit from EMV 3-D Secure technology!

The usage of mobile devices for online shopping has grown exponentially in the region. Customers expect seamless online shopping within the comfort of their favorite device. Fraudsters, on the other hand, are trying to take advantage of the increase in e-commerce transactions across different devices.

The EMV 3-D Secure technology lets e-commerce players offer superior customer experience while keeping fraudsters at bay.

In this webinar, we will show PSPs, merchants and acquirers how to use the EMV 3-D Secure technology to:

- Increase conversion rates using risk-based authentication

- Decrease transaction abandonments by reducing friction for users and

- Improve the overall shopping experience using native authentication screens

- Benefit from liability shifts and protect your revenues

During the webinar, you will learn how version 2.0 improves over 3-D Secure 1.0 and how to take advantage of the scheme mandates to reap the benefits of the 2.0 technology.

Register here: https://bit.ly/3fHzzdk

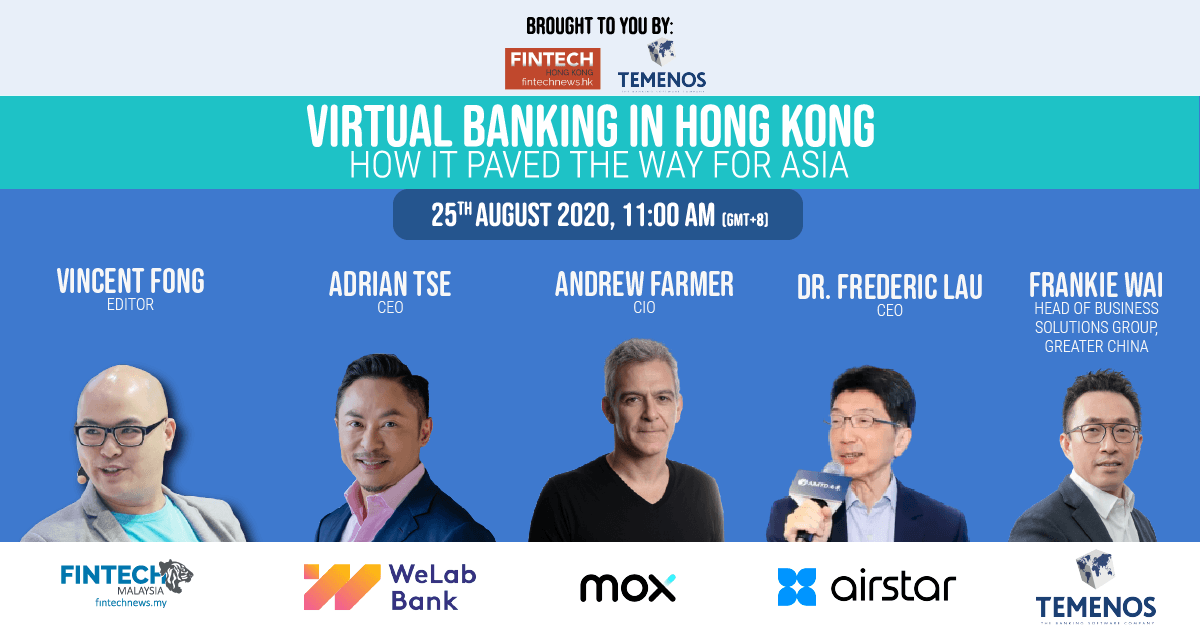

Hong Kong Virtual Banking Webinar

Aug 25, 2020 11:00 HKT

This is especially true in the South East Asian region with Singapore, Indonesia, Philippines and Malaysia each at different stages of creating regulation for virtual banks.

With several of the virtual banks having already launched in Hong Kong, what happens in this market will likely set the tone for virtual banks for the rest of the region.

Join us for this webinar to understand the Hong Kong virtual banking landscape and how it will impact other Asian markets.

Register here

Open Innovation Day 2020

Sept 16, 2020, 16:00 SGT

Open Innovation Day is an online interactive event for C-level leaders in banking and wealth management, addressing technology and digital strategy hot topics for 2020.

CREALOGIX will present new research into the crucial role of Innovation in strengthening established financial brands, inviting attendees to share their own views and visions of what digital success looks like in the decade ahead.

Join CREALOGIX’s CEO and over 200 senior banking and wealth leaders on Wednesday 16th September 2020, 10 am – 12 pm CET for a live discussion on top trends in banking innovation – including:

- Conversational banking

- Open banking and the API economy

- Personal finance optimisation

- Taking advantage of the fintech ecosystem

Registration now open – save your spot today!