In 2017/18, the total market capitalization of cryptocurrency markets reached all-time highs. At the same time, certain projects like BitConnect made their name as one of the most prominent ICO scams.

Therefore, a stain remains on the digital asset industry from the accumulation of failed projects and subpar investment returns since the peak of the Bitcoin bubble just over two years ago. While we take issue with those specific findings, as “pracademics” operating at the intersection of practice and academia, we hope to contribute to a solution of this systemic problem in the emerging digital asset industry.

To further investigate the need for a better disclosure framework, we conducted a poll amongst 76 industry experts.

We were astounded to find that 83% of participants stated that they do not believe utility token issuers disclose enough information to their stakeholders.

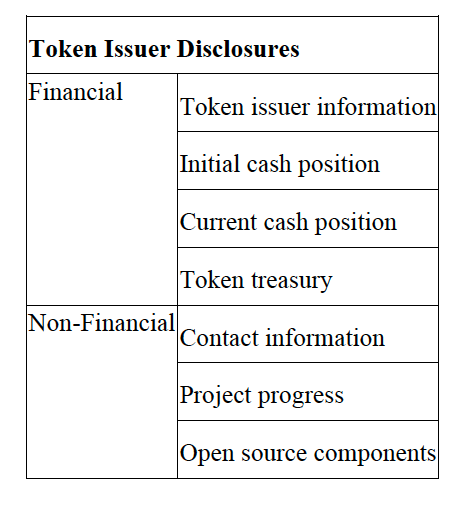

We propose simple, actionable advice based on our experiences and observations to create a useful tool for cryptographic entrepreneurs currently engaged in bringing their decentralized projects to life. The result is a short essay posting seven easy-to-follow recommendations for disclosure. They increase financial and non-financial transparency for utility token issuers, buyers, intermediaries, and regulators. On the financial side, we outline precisely the minimum details to be revealed about token issuer information, initial and current cash positions, and token treasury information. Non-financial information includes contact information, project progress updates, and open-source software elements. In our essay, we provide four case studies that support our belief in the utility of these recommendations.

Information asymmetries in financial markets are not a new phenomenon. Our central thesis is:

If cryptocurrency and utility token issuers want to list their tokens on public markets, they should provide basic levels of transparency.

Such disclosures increase stakeholder confidence, enable more sound decision making and, most importantly, attracts new market participants.

Increasing transparency is a long-term positive for projects and, more importantly, it is essential to the long-term growth of the entire digital asset industry. These minimum disclosure recommendations may increase stakeholder confidence, enable more sound decision making, and attract new market participants.

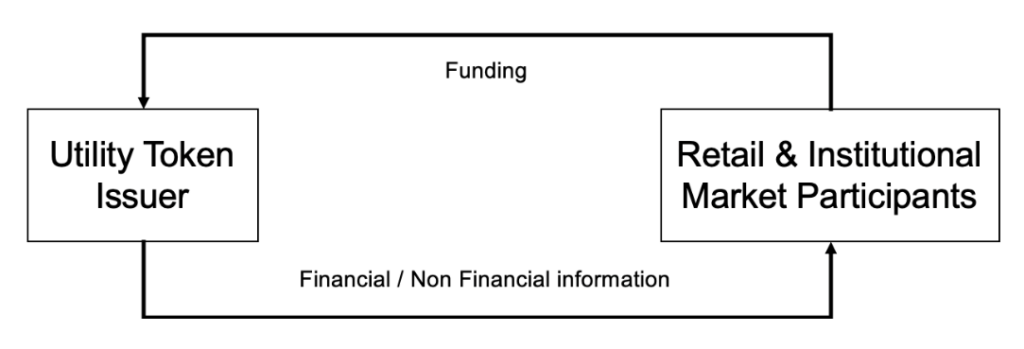

A basic but informative view of the funding and information flows present in the issuer-buyer relationship underpins our recommendations.

The recommendations aim to provide a guide for the ecosystem and community-driven operating models to co-exist with current for-profit corporate models. We encourage readers to engage with the precise wording and associated tables present in our essay. Here we provide a summary list.

With recommendations 1-4, we aim to improve financial transparency.

1. Token Issuer Information

Disclosing issuer entity details helps token buyers discern underlying motivations. Issuer incorporation documentation should be shared. The functionality of the token should also be explained. These disclosures hold the founding team accountable, creating value for the token holder.

2. Initial Cash Position

Today, the industry overly relies on third-party data providers to scrutinize financial data. This information is often incomplete and inconsistent across offerings, making it impossible to compare them and underlining the desperate need for an industry standard. Issuers should disclose the total amount received from their initial offering in US dollars, as well as the amount retained in cryptocurrency versus the amount converted to fiat currency. Publishing these data points enables prospective token buyers to make more informed decisions.

3. Current Cash Position

The amount of fiat funds available to the project heavily influences the project’s risk profile because cryptocurrencies are not accepted as a means of payment with most suppliers. The respective amounts currently held in fiat currency and cryptocurrency should regularly be disclosed. Sharing these data points enables prospective token buyers to make more informed decisions.

4. Token Treasury

Utility token and cryptocurrency issuers sometimes retain significant stakes in their token. This token treasury is allocated towards community development, software development, user incentivization and team compensation. The wallet addresses associated with the treasury should be disclosed. Interested stakeholders could then directly investigate blockchain transactions in real-time via a blockchain explorer. With this disclosure, the issuer decreases the risk of fraudulent activity.

With recommendations 5-7, we intend to improve non-financial transparency.

5. Contact Information

Stakeholders should be confident in their ability to inquire about the project honestly. Telegram and e-mail are the minimum customer service channels. Community managers in such chats should be available for at least eight hours a day. The longest any token holder should wait before a considered response is 48 hours during the business week. Shorter response times impart even more confidence. On the whole, feedback from engaged community members benefits projects.

6. Project Progress

Stakeholders should be enabled to make informed decisions based on project progress. Because token value, in the long run, depends on network or protocol usage, the team should regularly provide updated information about meeting short-term and long-term goals. Mapping out a timeline for the execution of the team’s ideas increases accountability. It renders a complicated technical process into terms that mostly non-technical investors can easily understand.

7. Open Source Components

The open-source paradigm has proven its ability to promote network effects in the developer community. By definition, the open-source code should drive communities that are incentivized by utility tokens. As such, a publicly accessible software repository, with code and associated documentation, should be maintained. Code should be published regularly so that savvy token buyers can compare the advancement of publicly available software versions to published roadmaps.

We summarize our minimum disclosure recommendations in a table:

The wholesale importation of traditional public market practices is neither advised nor warranted. Instead, we observe the utility token and cryptocurrency markets with fresh eyes and a view to support issuers, their intermediaries and buyers alike. We believe that increasing the consistency of the amount of simple information-rich project disclosures is the best means to provide the kindling to expand the blockchain industry as a whole.

Our brief case studies also indicate that encouraging the industry toward these practices may also have a positive effect on token prices. It is in the best interest of cryptocurrency and utility token issuers to incorporate these practices, but exchanges and information service providers have a responsibility in creating more transparency, too. We would hope that they incorporate our recommendations into their listing rules.

A more comprehensive discussion of the importance of these minimum disclosure requirements and the case-studies mentioned above can be found in our working paper here.

Author:

Nicholas Krapels is Adjunct Professor in Strategy and Entrepreneurship at SKEMA Business School, China. Twitter: @shanghaipreneur

Daniel Liebau is Founding Director at Lightbulb Capital and Affiliate Faculty Member at Singapore Management University. Twitter: @liebauda

This post is adapted from their paper, “An Essay on Minimum Disclosure Requirements for Cryptocurrency & Utility Token Issuers,” available on SSRN.

This article first appeared on https://sites.law.htduke.edu/thefinregblog/; Featured image credit: Pixabay