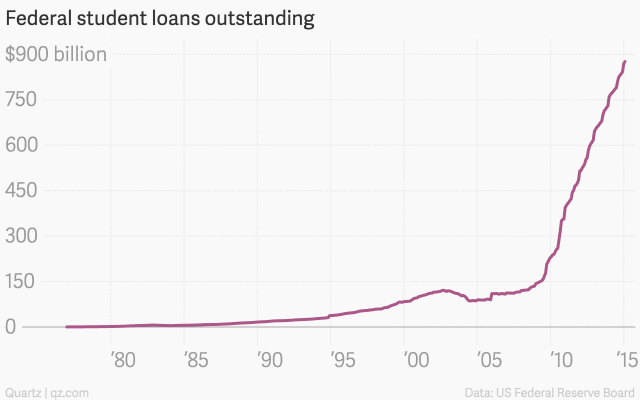

The financial crisis in 2007 had a series of impacts. First, there was the emergence of a new FinTech era lead by technology players. Second, we had an explosion (+700%) of student debt levels in the US, reaching US$875 billion and estimated to reach as high as US$1.16trillion.

(Side note: as a reminder, the subprime mortgages amounted to US$1.3 trillion in 2007, with the difference that student loans in the US are outside the scope/protection of bankruptcy law – this raises the possibility of a systemic risk).

Recently, Amazon Prime announced that it is now providing students with a new perk: discounted loans! In a nutshell, Wells Fargo, the US’ largest bank and 2nd largest student loans originator, will provide between 0.5% and 0.75% discount on interest rates for students using Amazon Prime.

In my opinion, this is a smart way for Amazon to have cheap customer acquisition since student loans (together with their underlying risk + regulatory capital) are originated by Wells Fargo, whilst Amazon pockets a fee of US$88/student without exposure to the new product provided. This is very similar to how Alibaba rather use a credit score to sell you a hotel room instead of a loan, aiming to provide a single financial lifestyle platform.

Beyond the headlines, this news about #AmazonLoan made me reflect on three further points:

– Student Debt: From educational inflation to alternative learning

– Entrepreneurship @Uni: Start Early before it’s too late

– Value Exchange & Millennials: Your data wanted for their real cash

Student Debt: Is education another sector that needs change?

As mentioned at the start of the article, student debt has reached historically high levels, pushing FinTech start-ups to provide better financial management tools for Millennials and leaving students to their own creativity during graduation:

For the handful of countries providing free university education, this debate might seam irrelevant. However, I would not pass as currently student debt is combined with student under & unemployment impacting these otherwise free education systems. The student debt crisis is growing as a result of a (mis)conception that student debt will be offset by premium graduate earnings. Indeed, a recent UK report by the Intergenerational Foundation cited by the BBC mentioned that:

The current £100,000 graduate earnings premium so often touted equates to an ‘annual bonus’ of just £2,222 over 45 years of work and is wiped out once National Insurance and income tax are taken into account.

As with most surveys, statistics are subject to interpretation and can be widely contested. However, there seems to be a consensus that higher education debt is only justifiable if one joins a top 20 university and, if not, vocational training as promoted by the German model should be preferred. Unfortunately, this is a simplistic way out and in times of economic uncertainty, the perceived security of a degree from a higher education institution seems to overshadow cold statistical calculations about the the actual benefit of being a university graduate.

Part of the answer could be found in combining the new opportunity offered by Massive Open Online Courses (MOOC) as well as the professional experience found in start-ups, which are regarded as the new MBAs. Both provide a demonstration that educational material is now both more accessible (e.g. the whole of MIT’s undergrad program can be accessed here for free) and that professional experience in a start-ups has become even easier to gain, as the number of start-ups have never been that high. Indeed, learning (university) is one thing, understanding (work) is another. As the joke goes: “A good lawyer knows the law; a great lawyer knows the judge” and this only happens with experience.

It must be noted that whilst you should value the experience in a start-up, don’t expect your time as an entrepreneur to (always) pay off your debt – 90% of start-ups fail and most likely you (or your startup) won’t be the exception. Entrepreneurship also comes at a direct personal cost, often reflected on the founders’ life quality, so don’t expect it all to be fun, most likely it will suck be hard.

Build or join a start-up at university, you are broke anyway!

Second, the #AmazonLoan story reminded me of my first start-up, VillageDigs, that I created in 2008 when I was an undergraduate student. Like most start-ups, VillageDigs’ origin can be traced to a famous quote: “Necessity is the mother of invention”. Students are typically broke and I wanted to use student volumes (e.g. 20’000 students / campus) as a bargaining tool to negotiate additional and unique discounts for them, helping with their financial lives (similar to the Wells Fargo/Amazon deal).

Why should a student need to show their student card to get a 10% merchant discount? Instead, once validated (e.g. with university email address) and registered on VillageDigs, they could buy the needed books (or pizza) automatically with the reduction already applied at the checkout. We even had 0-2-0 component, as the Vdigs Card was meant to provide automatic discount at the point of sale, with instant cashback. This was important because I didn’t want VillageDigs’ benefits to only be limited to online purchases, especially since 70%+ of transactions still happen in shops and not on e-commerce platforms. Eventually, I ended up like 90% of all other start-ups, experiencing a second famous quote:

Vision without execution is Hallucination – Henry Ford

VillageDigs was never to be, but its idea went on. Amazon eventually created Prime Student, providing unique discounts for this niche market (here was the exit opportunity…), Just Eat eventually IPOed and card-linked marketing became a huge sales channel. Part of the failure of my first startup came from the fact that I didn’t execute properly on the vision it was founded upon. However, my desire to positively change the lives of my peers hasn’t changed. I wrote about a Manifesto for Hong Kong’s youth and how FinTech can help achieve that mission, and eventually had the chance and I am proud to know the team at Neat, one of the SuperCharger alumni, whose vision is to empower Hong Kong’s Students.

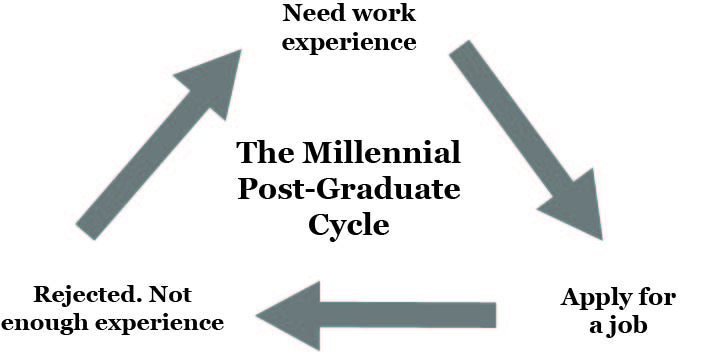

My start-up’s failure served me with a great experience that would allow me to break the graduate cycle shown above. I gained professional experience running a company, albeit shortly, which provided maturity, insights and focus in a way that would otherwise be hard to get. My, realistic, advise to students is to join or build a start-up whilst at university: your cost of failure is limited (excluding if you do a Friends & Family Investment Round) and your upside for learning is high.

For those who want to be entrepreneurs, start early. You should know overnight success is a myth and that it takes 10+ years instead to build a successful business. For the ones wishing to be in the corporate world, you should still gain experience in a start-up – trust me you will build the necessary transferable skills for multi-tasking, managing stress and hitting deadlines.

Millennials wealth: Immediate Data and future Income

Looking beyond the student debt problem and discount loan solution, this #AmazonLoan news reminded me of the desire of corporates to engage with Millennials (which might be so 1990, as the Gen Z are coming…).

Indeed, whilst comparatively to previous generations Millennials are cash poor, there is apparently a potential untapped market of US$30 trillion and importantly we are going to (or will) spend it differently. Indeed, behind this large addressable market hide a few realities: on the downside, our generation has more debt and less assets; however, we are much more technologically-equipped and price-conscious.

As digital natives, technology is a natural extension of our personalities. The Millennial Disruption Index illustrated that we are more critical of banking services (1 in 3 would switch banks), but also more willing to have a tech firm, Like Amazon or Google, to provide us with financial services. However, this doesn’t mean we do not fundamentally like banks, we simply expect them to do more. Banks are therefore, gradually, adapting. However, I would argue that instead they should fully rethink their approach, in the (adjusted) words of Bud Caddell:

Having a digital strategy is the wrong starting point. Instead one needs to have a strategy in a digital world

In the meantime, startups are making the most of the banks’ time lag for adaptation. So far over 126 FinTech start-ups have raised about US$2.89 billion to cater for this market. Perhaps this delay will turn into good timing as PwC expects Millennials to represent +50% of the workforce by 2020.

While the above looks at Millennials as a market opportunity, I strongly believe that we are similarly market shapers. I previously wrote how 2007 impacted our generation and why we should have a say on how the future of finance should be. Of course this needs to be collaborative and we should act as bridges, sharing our values, enthusiasms but also market understanding.

Young graduates can combine the financial and regulatory understanding of senior entrepreneurs with their own forward-looking vision and knowledge of the(ir) market. In that respect, Barclays recently introduced a reverse mentoring program where young associates provide their opinion to senior management on how to best digitize and grow the business.

Let’s not understand this as simply an epiphenomeonon, but instead consider it as FinTech having its Apollo moment right now. A set of young entrepreneurs and graduates are stepping into one of the very last sectors of the economy that they have not reshaped: finance, in the same way that the Moon was the ultimate frontier for the previous generation.

Our contribution and input is needed because most of the new business models will be data-driven. As Data becomes the new oil, we need to be comfortable on how information is shared. It raises important questions about privacy and data sovereignty and we ought to be consulted as the industry develops itself.

=====

This article is part of a bi-monthly blog series (e.g. Brexit: Impact of passports, TechFin: Data is the New Oil, FinTech: Manifesto for Hong Kong’s Youth).

This article first appeared on LinkedIn Pulse