UOB Asset Management (UOBAM) has launched UOBAM Invest, a robo-advisory mobile app that offers retail investors in Singapore personalised and dynamic investment portfolios. The mobile app is the retail version of the UOBAM Invest online portal, which was first launched in 2018 for corporate investors in Singapore.

Retail investors can start investing using UOBAM Invest from S$1 and there are no account opening or closing fees. The advisory fee is 0.8 % per annum for investment amounts of S$25,000 and below, and 0.6 % per annum for investment amounts above S$25,000.

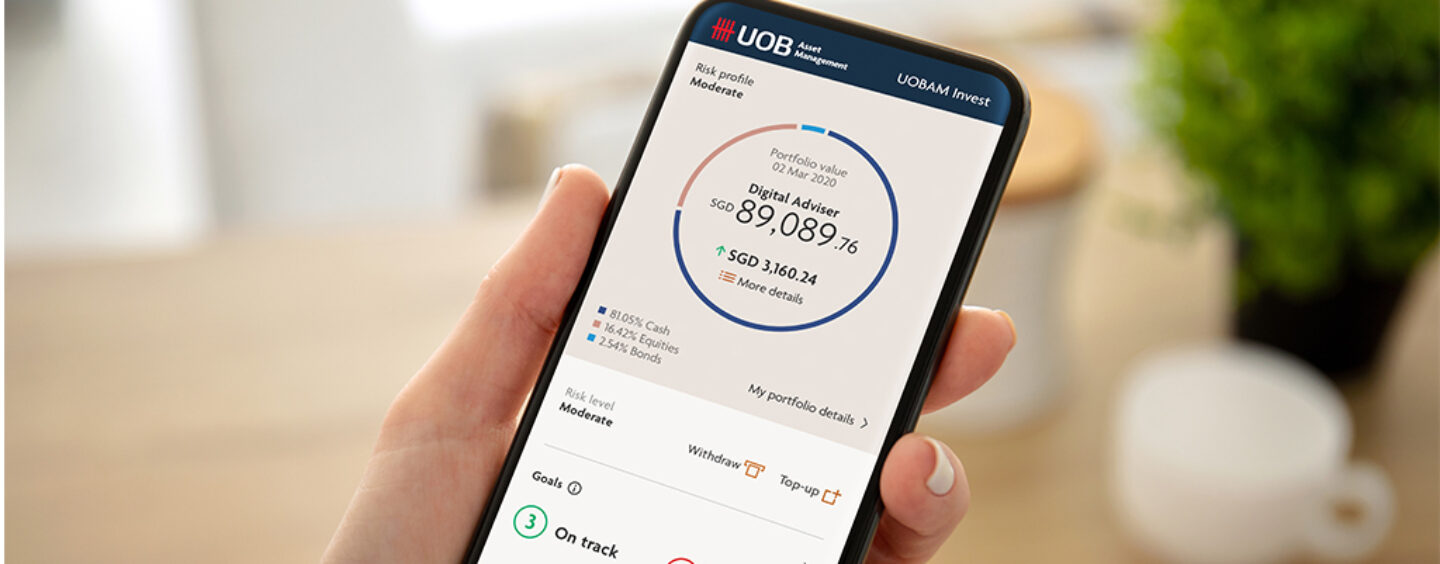

UOBAM Invest’s key service is said to be the Digital Adviser, a portfolio planner that enables retail investors to invest in personalised investment portfolios generated based on their risk profile and aggregate financial goals. They added that instead of pre-built static portfolios, its portfolios are dynamic.

This means that retail investors can fine-tune the investment portfolios by changing their goals, contributions, duration and risk tolerance level. They will also be able to see the success probability of achieving their desired returns.

The new service is integrated with MyInfo and PayNow which enables easy account opening and payment.

Thio Boon Kiat

“UOBAM is the first regional asset management firm to offer a robo-adviser with personalised portfolios for retail investors. Given the current market volatility from the impact of the COVID-19 pandemic, we want to bring the benefits of our risk-based approach – one that is trusted by institutional investors – to more retail investors through UOBAM Invest.”

said Mr Thio Boon Kiat, CEO of UOBAM.