Philippines Launches Blockchain-Based App for Bond Investment with UnionBank and PDAX

by Fintech News Philippines July 28, 2020The Philippine Bureau of the Treasury (BTr), together with Union Bank of the Philippines (UnionBank) and Philippine Digital Asset Exchange (PDAX), launches an app for the distribution of retail treasury bonds enabled by Distributed Ledger Technology (DLT).

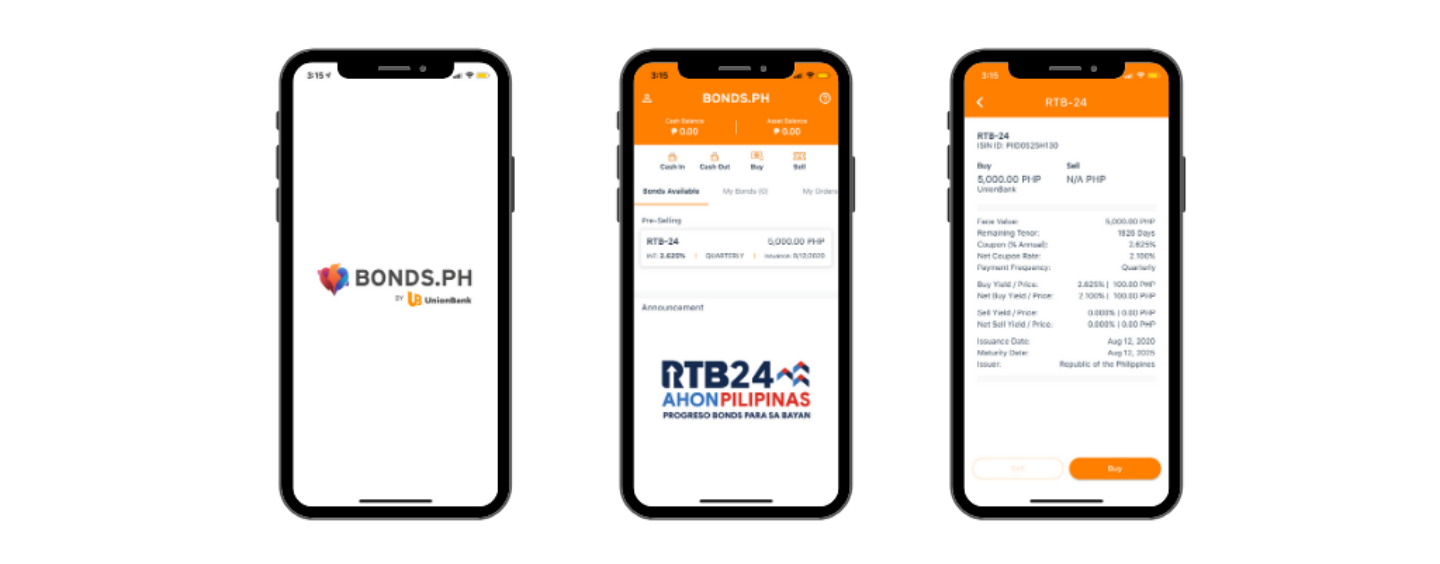

The app, called Bonds.PH, claims to make bond investing easy. It is blockchain-enabled with transactions recorded on a DLT-based registry in addition to the existing system.

Leveraging DLT enables immutable and tamper-proof record-keeping. As such, DLT reduces manual verification and simplifies reconciliation bringing down processing time and costs.

Filipinos, including the unbanked and overseas workers, can invest in retail treasury bonds by downloading the app which is completely digital and available 24/7. They can make their investments using e-wallets, online banking and over-the-counter purchases for as low as USD 100.

BTr sanctioned the initiative as a first step to determine if leveraging DLT would enable retail treasury bond distribution to the unbanked feasible and economically viable.

Rosalia V. De Leon

Philippine National Treasurer Rosalia V. De Leon said,

“The launch of Bonds.PH paves the way for all Filipinos, particularly the unbanked, to easily and affordably invest in the BTr’s newest retail treasury bond, RTB-24 or the Progreso Bonds. The mobile app presents a compelling opportunity for all to invest and help the Republic raise funds for economic recovery and COVID-19 response.”

The Philippine SEC is among the more progressive regulators in the world having released rules on crowdfunding, as well as draft rules on digital assets and digital exchanges.

Meanwhile, the Philippine Central Bank, Bangkok Sentral ng Pilipinas’ (BSP), lauded the initiative for its impact on inclusive prosperity,

Benjamin Diokno

“Given our advocacy to accelerate the digital delivery of financial services while deepening financial inclusion, we view Bonds.PH as a welcome addition to the expanding suite of available financial products serving wide market segments via innovative delivery channels and bridging the financially excluded,”

said BSP Governor Benjamin Diokno.