Posts From Fintech News Philippines

Coinbase Users Can Now Send Money Via Email, Social Media, Messaging Apps

Cryptocurrency exchange Coinbase has upgraded its Wallet service, introducing features that significantly simplify and accelerate the process of sending money globally. This enhancement enables users to transfer funds via a variety of platforms, including widely-used messaging apps like WhatsApp, iMessage,

Read MoreCIMB Philippines Closes 2022 With Strong Performance in Deposits, Lending Portfolios

Digital banking services provider CIMB Bank Philippines has ended the year 2022 with a strong performance on both its deposits and lending portfolios. CIMB Bank PH reached its all-time high cash-in transaction value of PHP 128 billion in 2022, 68%

Read MoreRevolut Introduces an In-App Educational Feature for Its Singapore Users

Revolut, a global financial super app with more than 20 million customers worldwide, has launched an in-app educational module to help its Singaporean users learn more about the specific risks, nature and characteristics of cryptocurrencies. The new ‘Learn’ feature is

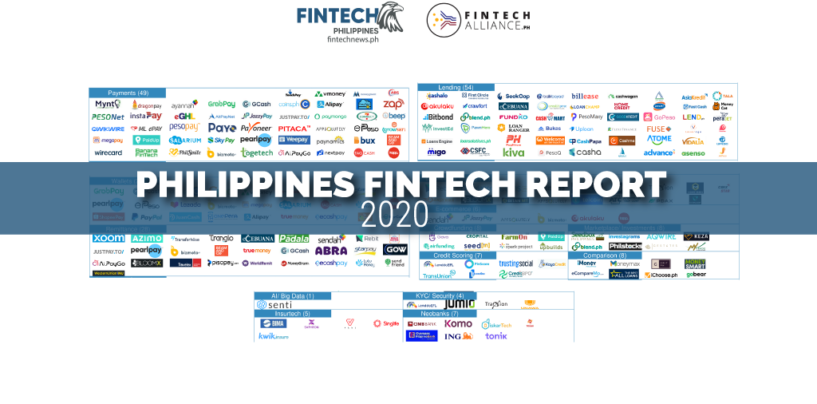

Read MoreFintechnews.ph Launches Fintech Philippines Report and Map 2020

2019 saw a boom for the Philippines’ digital payments space, where e-money transactions jumped to 36% to reach PHP 760 billion in value, the strongest rise across all payments transaction types. E-money transactions growth surpassed credit card and debit card

Read MoreBSP’s Governor Diokno to Lead the Launch of Digital Retirement Account

Bangko Sentral ng Pilipinas (BSP) Governor Benjamin E. Diokno will lead the virtual launch of the Digital Personal Equity and Retirement Account (PERA), said the regulator in a media statement issued earlier today. PERA is a voluntary retirement account that

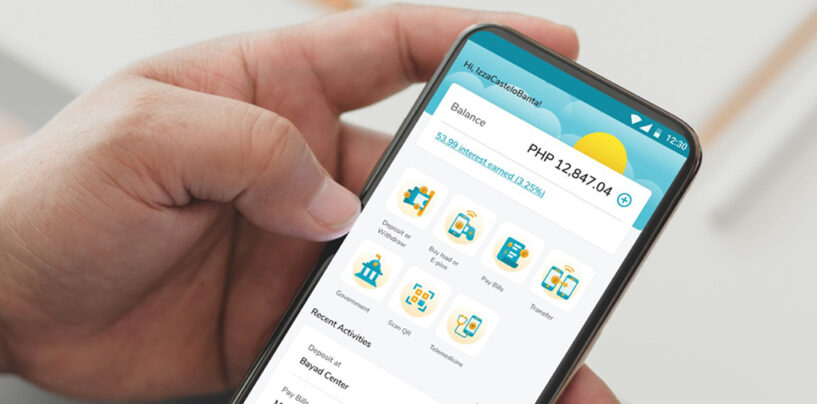

Read MoreNearly 1.5M Underbanked Filipinos Onboarded With RCBC’s DiskarTech App

With over 2 million mobile app downloads in two months, Rizal Commercial Banking Corporation (RCBC) has pushed for digital adoption, recording more than 1.43 million new accounts onboarded digitally during the lockdown. An estimated 610,000 DiskarTech basic deposit account holders

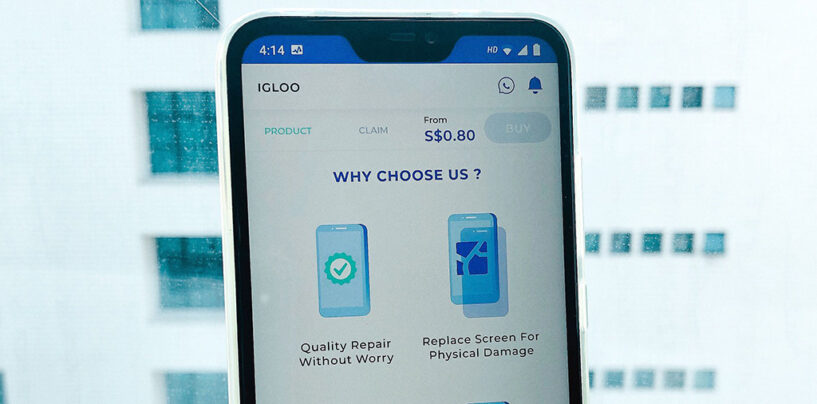

Read MoreInsurtech Platform Igloo Lands Partnership With Union Bank and Akulaku for Micro-Insurance

Igloo, Singapore-headquartered insurtech firm, announced partnerships with Union Bank of the Philippines and Indonesia’s Akulaku to offer micro-insurance policies. Akulaku is one of Indonesia’s most well-funded fintech startups who is best known for their “buy now, pay later” service. Igloo

Read MorePhilippines’ RCBC and DTI To Enable Digital Payments For Micro-Businesses

Rizal Commercial Banking Corporation (RCBC) and the Department of Trade and Industry (DTI) has partnered to create DiskarTech’s NegosyanTech programme to digitalise community-based microenterprises in every barangay nationwide through partnership and ecosystem building. More than 1.3 million sari-sari stores (a

Read MoreRCBC’s Diskartech Reaches 1 Million Downloads

DiskarTech, powered by Rizal Commercial Banking Corporation (RCBC), has reached one million downloads just 38 days from its market launch. It was also ranked second overall amongst mobile apps in the country by Google Play Store and Apple Store and

Read MorePhilippines Central Bank Joins Digital Currency Race

Bangko Sentral ng Pilipinas (BSP), the Philippines’ central bank, has created a committee to look at the feasibility and policy implications of issuing its own digital currency, governor Benjamin E. Diokno said on July 29. “We have to first look

Read More