Posts From Fintech News Philippines

RCBC’s Diskartech Tops Google Play’s Free Finance Apps, Surpassing Gcash and PayMaya

DiskarTech, Rizal Commercial Banking Corporation’s (RCBC) virtual bank has claimed the top spot among free finance apps in Google Play for Android users in the first month since its launch. As for users of iOS devices, DiskarTech ranks second among

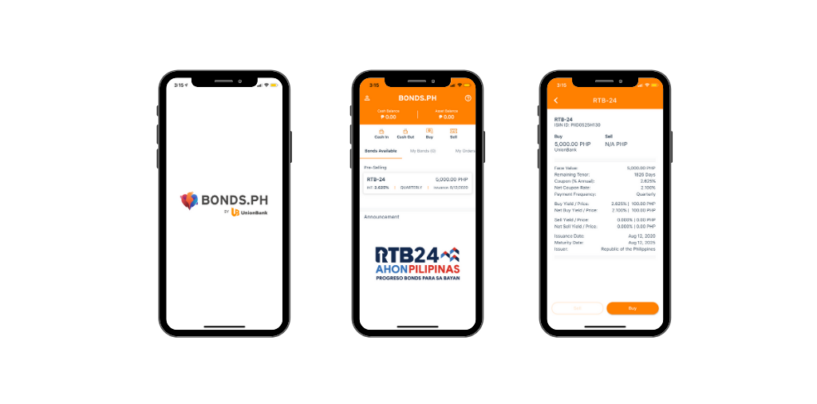

Read MorePhilippines Launches Blockchain-Based App for Bond Investment with UnionBank and PDAX

The Philippine Bureau of the Treasury (BTr), together with Union Bank of the Philippines (UnionBank) and Philippine Digital Asset Exchange (PDAX), launches an app for the distribution of retail treasury bonds enabled by Distributed Ledger Technology (DLT). The app, called

Read MoreDiskartech’s Taglish Digibank App Sees 8 Downloads by Filipinos Every Minute

Barely three weeks after its launch, more unbanked and underserved Filipinos are now downloading the country’s first and only Taglish inclusion super mobile app, DiskarTech. Taglish refers to the Philippine language Tagalog infused with American English terms that has been

Read MoreCIMB’s Digital Bank in Philippines Poised for 500% Growth in 2020

CIMB Bank Philippines is foreseeing a 500% increase in their deposit balances by end-year, following a reported 160% surge of average cash-in per customer in the second quarter of 2020. Their momentum for customer acquisition stood strong throughout April to

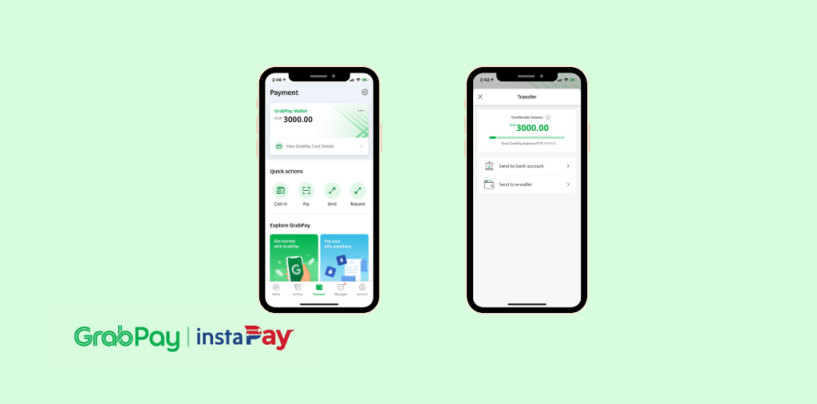

Read MoreGrabPay Philippines Enables Instant Fund Transfers with InstaPay

GrabPay announced today the introduction of instant fund transfers in the Philippines within its e-wallet. This new feature is made possible thanks InstaPay, an initiative from Bangko Sentral ng Pilipinas (BSP) to enable payment interoperability. The introduction of this feature

Read MorePhilippines Social Security to Digitise Payments Using E-Wallets and Bank Transfers

The Philippines Social Security System (SSS) has started paying funeral benefit claims through the banks and other alternative payment channels as the pension fund shifts its transactions online. Effective 22nd June 2020, funeral benefits will no longer be released through

Read MorePhilippines’ Department of Agriculture Enlists PayMaya for Loan Disbursement

The Department of Agriculture’s has announced the use of PayMaya, a mobile wallet under the purview of PLDT, to disburse loans for their Kapital Access for Young Agripreneurs (KAYA) financing program through the “KAYA” cash card. The initiative was formally

Read MorePhilippines’ Digital Bank tonik Announces Partnership With Mastercard

Fresh off raising their US$ 21 Million Series A round, tonik announced today a partnership with Mastercard, which will allow its users access to Mastercard’s global network. This will enable its users to make payments anywhere with any merchants who

Read MoreASEAN Financial Innovation Network (AFIN) Lands Partnership with Fintech Alliance.PH

Filipino fintech players can expect a boost from their regional counterparts as local trade association Fintech Alliance.ph inks a deal with the ASEAN Financial Innovation Network (AFIN). The two parties yesterday agreed in a signed memorandum of understanding to promote

Read MoreFICO Survey: Filipinos Showing Greater Acceptance for Biometrics

FICO, a global analytics software firm, has released its Consumer Digital Banking Survey, which found a notable percentage of Filipinos are not taking the necessary precautions to protect their passwords and logins when banking online. The study found that only 53% are using

Read More