With a population of over 100 million people, an Internet penetration rate of 46.5% and a mobile phone penetration rate of 87%, the Philippines is believed to be a growth area for fintech solutions and ventures, notably considering its emerging tech-savvy middle class and its large population of underbanked people.

According to a research paper by Fintechnews, there are currently 48 million active social media users and 41 million mobile social users in the Philippines, who spend over 5 hours on the Internet on a daily basis. These digital trends represent an opportunity for tech startups to deliver new, innovative products, notably in the financial services vertical.

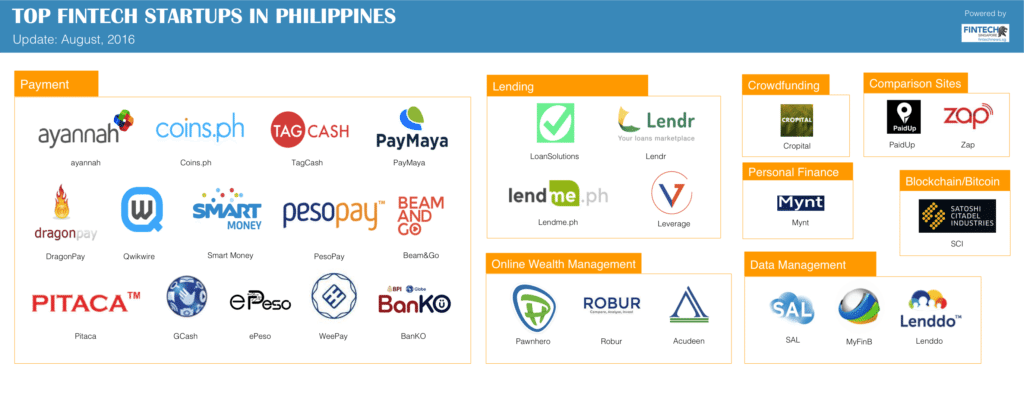

The Philippines’ fintech startup landscape

Although relatively small and nascent, the Philippines has got a fintech scene with players that are tackling sub-segments that include lending, online wealth management, data management, payments, personal finance, crowdfunding and blockchain technology.

Image credit: Mobile payments by LDprod, via Shutterstock

Like in other locations, payment remains the most crowded sub-segment with nearly half of all Filipinos fintech startups focusing on this particular area. Notable startups include Ayannah, a digital commerce and payment services providers targeting unbanked populations; PayMaya, a mobile app that lets you pay online with a virtual payment card; and Pitaca, a trademark of Filipino company MobileVentures that delivers on mobile payments solutions.

In lending, LoanSolutions.ph aims at facilitating fast and easy access to credit for different financial needs through the country’s largest network lenders. Lendr is targeting financial institutions and credit providers with its end-to-end loans origination and loans management platform.

In bitcoin and blockchain technology, Satoshi Citadel Industries is providing most of the retail products currently available in the country with varied solutions that include Rebit, a bitcoin remittance service, BuyBitcoin.ph, a platform to sell and buy bitcoins, and Bitmarket.ph, the first bitcoin payment processor in the country with nearly 100 merchants. Another startup is Coins.ph, which leverages Bitcoin to allow faster and cheaper mobile payments and money transfers.

Other notable fintech startups in the Philippines include Lenddo, a startup that has developed an algorithm that pulls and analyzes social media data to determine credit worthiness; Mynt, a startup that aims at addressing financial inclusion through mobile money, micro-loans and technology; Pawnhero, the first pawnshop that operates essentially online; and Cropital, a crowdfunding platform connecting investors to Filipino farmers.

All Fintech PHP Startups can be found also here.

New fintech program launches in the Philippines

A SPACE Philippines via Facebook

A new program has just launched in the Philippines initiated by A SPACE Philippines, a chain of coworking spaces in the country, to build up and foster the development of the Filipino fintech startup community.

Named “_PASSPORT to Fintech“, the program is targeted at fintech entrepreneurs, teams and businesses which are invited to undertake a number of “trips.” A “trip” is a three-month program consisting of a series of interrelated events designed to educate and connect the community.

These events include a foundational bootcamp, workshops, a debate, and other activities designed to teach how to launch or grow a fintech business, or understand the impact of fintech on our businesses.

These events will be held at A PACE Greenbelt and A SPACE Palet with confirmed speakers that include John Bailon of of Satoshi Citadel Industries, Ray Refundo of Qwikwire, and Miguel Warren of Payoneer.

See the Full Fintech Phlilippine Fintech Startup Report here: