iPrice Group collaborated with App Annie, an app market data and insight company, to summarise updates on e-wallet app platforms in Indonesia from Q2 2019 until 2020.

Here are 7 major findings on e-wallets in Indonesia:

1. Local Players Dominate the E-Wallet Competition in Indonesia

A previous study showed local players getting the top billing in the e-wallet rankings in Indonesia. This can be attributed to the promotions and campaigns done by them as well as the government’s support in enabling Indonesia to become a cashless society.

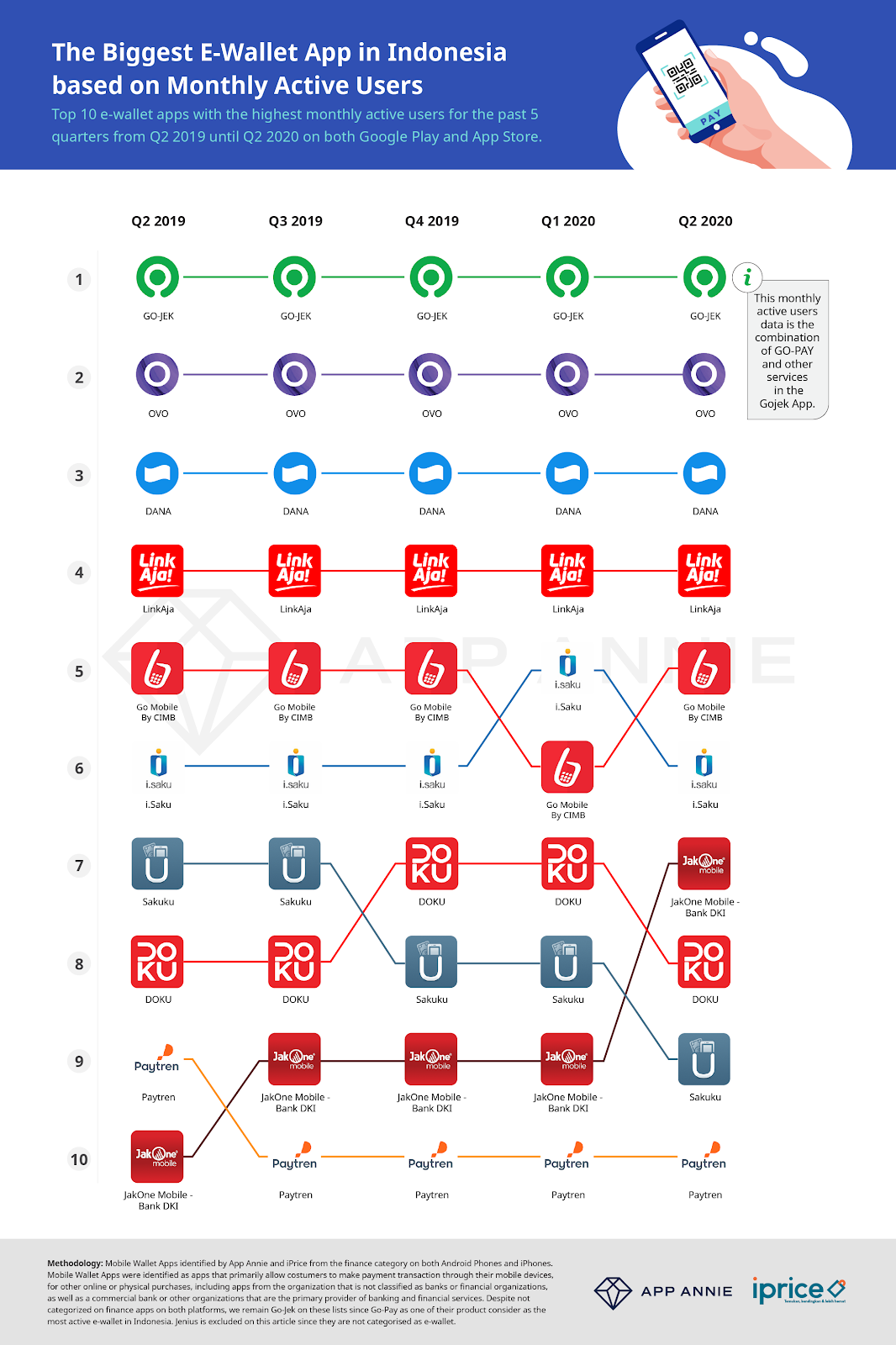

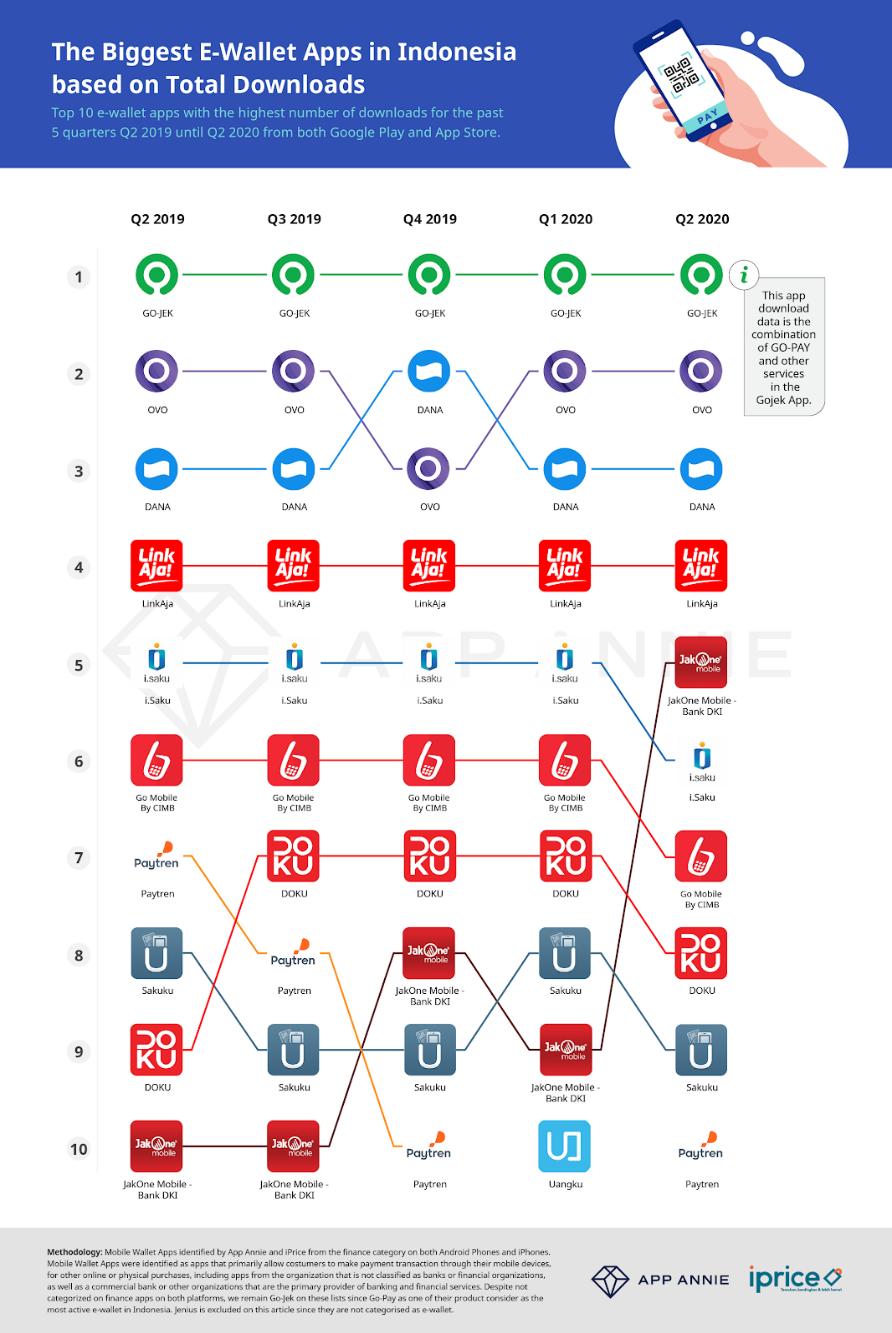

GOPAY, OVO, Dana, and LinkAja are the top 4 e-wallets with the most number of downloads and the highest number of MAU during the Q2 2019 to Q2 2020 period.

In line with the data on the highest MAU, Ipsos also conducted a research about the popularity of e-wallet players in Indonesia. The research showed that 58% of respondents chose GOPAY as the most familiar e-wallet, followed by OVO (29%), DANA (9%), and LinkAja (4%).

Furthermore, Go Mobile by CIMB, i.saku, JakOne Mobile- Bank DKI, Doku, Sakaku, and Paytren rank as the 6th to 10th e-wallets with the highest MAU on Q2 2020.

2. GOPAY Is the E-Wallet With the Highest Monthly Active Users?

GOPAY is one of the services available in the Gojek super app, which snagged the top spot of having the highest number of MAU from Q2 2019 to Q2 2020. Although the available data is an accumulation of the app’s users, its total number of downloads also topped both Android and iOS platforms.

First-time e-wallet users frequently chose GOPAY as their first choice (60% of respondents). In addition, GOPAY also has the most number of organic users (54%) despite not offering promos or cashbacks to their users.

Since the data includes lumps the users of Gojek and GOPAY together it is difficult to ascertain exactly what proportion of that are also GOPAY active users despite the survey data indicating that 60% uses them as their first choice. Therefore it may be difficult to conclusive say that GOPAY is the ultimate winner in Indonesia.

3. Non-Bank E-Wallets, OVO and Dana, Have the Next Highest Monthly Active Users

OVO and Dana consistently ranked in the top 3 e-wallets with the highest MAU. These two e-wallets are non-government e-wallets providing financial services that focuses on transactions and fund transfers.

During Q2 2019 to Q2 2020, OVO was ranked second with the most MAU per quarter, followed by Dana, which also managed to consistently rank third in the same period.

4. Government and Non-Government E-Wallets

As the only e-wallet owned by BUMN (a state-owned enterprise), LinkAja had a static ranking from Q2 2019 to Q2 2020, both for MAU and total app downloads in Android and iOS.

LinkAja already has existing users as it is a combination of 4 bank-based e-wallets which are quite well-known in Indonesia.

Data shows that privately owned e-wallets have a fluctuating surge of monthly active users in a year, especially those in ranks 5 to 10.

5. JakOne Mobile Bank DKI Climbed up Four Ranks in Highest Monthly Active Users

JakOne is a bank-based e-wallet and it can be used either by the Bank DKI’s existing or prospective customers.

The existence of a government assistance policy affects the ranking of JakOne Mobile’s MAU. In Q1 2020, the JakOne Mobile was ranked ninth, but in Q2 2020, it climbed up four ranks, positioning it as the fifth e-wallet with the most MAU. For total app downloads, it also increased in ranking, from ninth to seventh. The increase in rankings can be attributed to the recommendation of the DKI Jakarta government to use the JakOne Mobile’s app to monitor the receipt of government-aided funds.

The participation of Bank DKI in helping to ease the financial burden on students in Jakarta makes the JakOne e-wallet app an alternative to cash transactions for Jakarta residents.

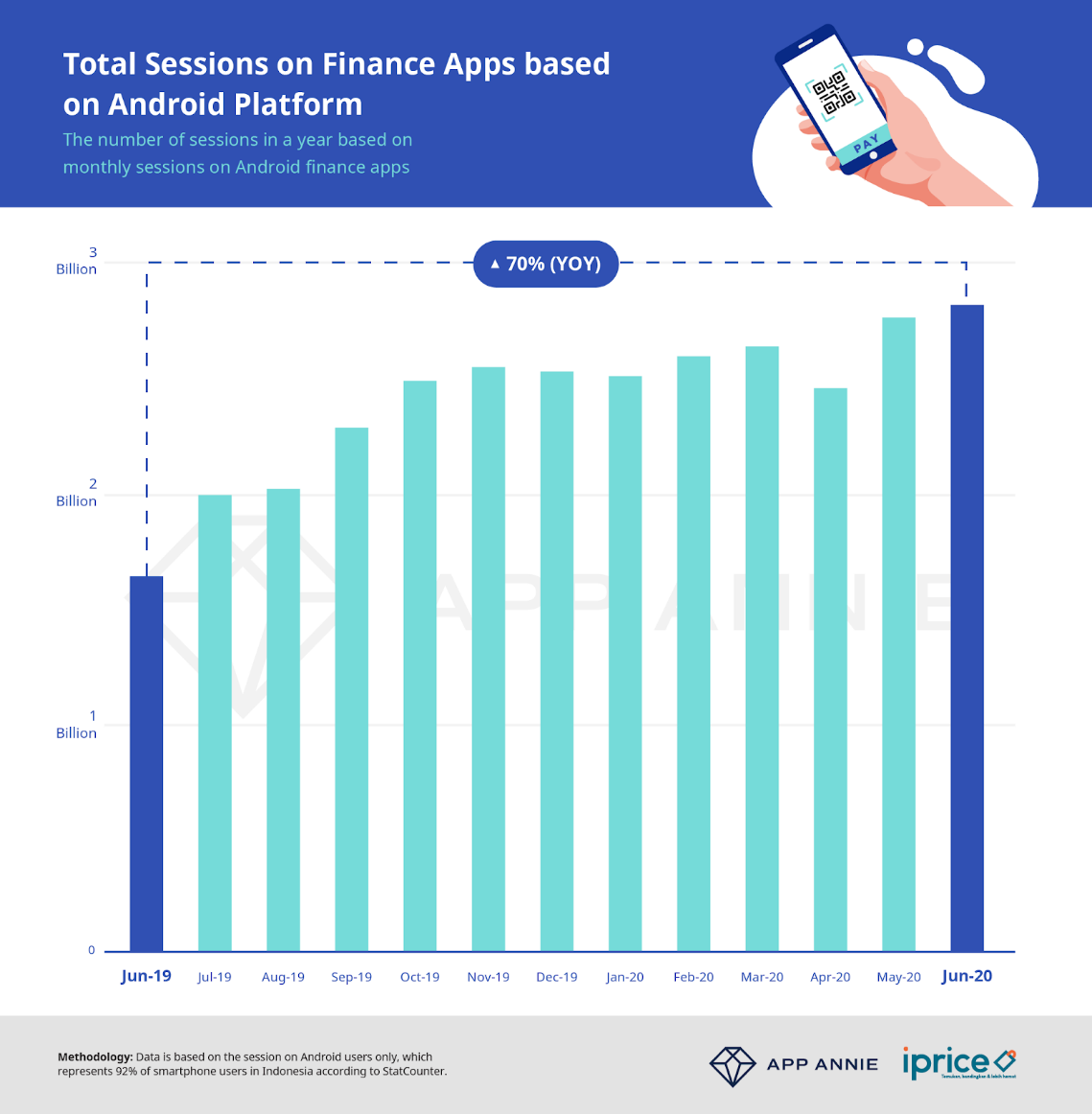

6. Total Annual Financial App Sessions in Indonesia

The use of financial apps in Indonesia has increased in total sessions month after month. iPrice, together with App Annie, analysed to find out how big the improvement was by comparing Year over Year (YoY) data. Data is obtained by analysing the total sessions spent by Indonesians on financial apps using Android devices as they have a very large dominance in Indonesia. Data from StatCounter said that about 92% of smartphone users use Android devices.

Indonesian tend prefer their mobile devices compared to desktops when they access their internet. Data from Statcounter showed that 64.16% of Indonesians used mobile, meanwhile only 35.15% used desktops to access their internet during the lockdown period.

The analysis of sessions on financial apps in Indonesia showed an increase of up to 70% from June 2019 to June 2020. The total sessions in 2019 was 1.67 billion, had increased to 2.83 billion as of June 2020. The growth kept increasing since January 2020, to a total of 2.53 billion sessions in that month. Meanwhile in April, there was a slight decrease from 2.65 billion in March to 2.47 billion by April 2020.

The use of more than one e-wallet brand in Indonesia can be attributed to the increase in these sessions. In Indonesia, 47% of e-wallet users have 3 or more e-wallets on their smartphones. According to research from Ipsos, 28% among 1,000 respondents use 2 e-wallets to shop and only 21% have only one e-wallet on their smartphones.

7. E-Wallet as a Payment Method When Shopping Online

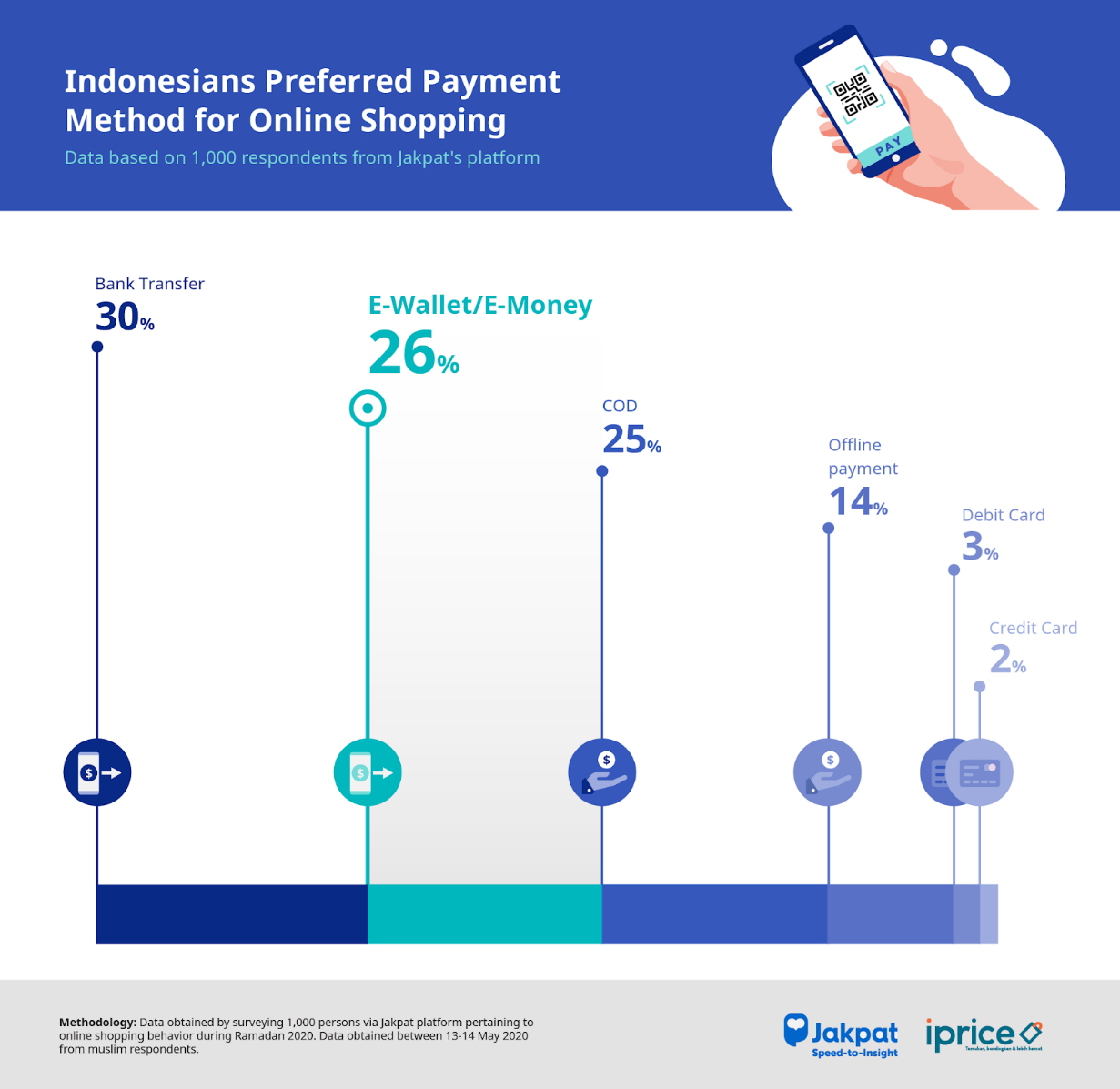

E-wallet as an alternative online payment is evidenced by an increased number of cashless transactions. Based on data that iPrice and Jakpat collected, 26% of the 1,000 respondents said they chose to use e-wallets/e-money as a payment method when shopping online. This will give a lot of room for e-wallets in Indonesia to grow further.

Likewise, Tempo mentioned that debit card transactions had declined, where the growth was 4.14% in 2019, while in the previous year, it almost reached 10%. This is in line with a previous iPrice research where it shed light on the lack of access to bank accounts and the high number of “unbanked” population in Indonesia, which proved the country’s potential demand for digital wallet service companies. E-wallet is now able to provide convenience in both online and offline transactions through only one platform in Indonesia.

From the result of the recent survey, iPrice also found that only 3% of respondents use debit cards as their payment method when shopping online and only 2% of respondents use credit cards.