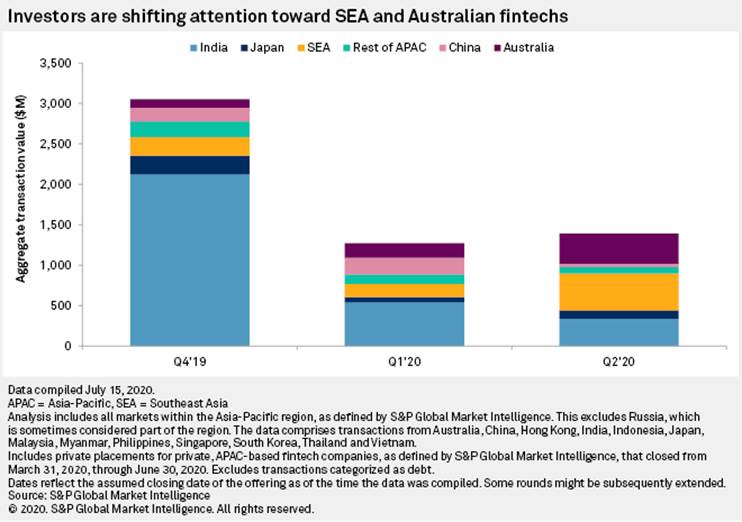

Investments in fintech companies in Asia-Pacific grew 9.1% to US$1.4 billion in the second quarter of 2020 when compared with the first quarter, according to the Q2 APAC Fintech Funding Report by S&P Global Market Intelligence. Deal activity remained flat in the region, with 107 transactions recorded in both quarters.

Fintech funding in Asia was predominantly led by South East Asia and Australia, with both regions drawing in US$455 million and US$369 million. This is roughly three-times and two-times the amount raised in the previous quarter respectively.

Fintech investments in India declined 38% to US$339 million as the government continued to scrutinise and clamp down on foreign investments. Funding in China also fell from US$205 million to US$41 million as the country saw fresh outbreaks of COVID-19 cases.

Celeste Goh, Fintech Analyst at S&P Global Market Intelligence felt that “fintech investments in Asia were primarily driven by India in the last quarter, but investors appeared to have shifted their attention to South East Asia and Australia”.

“Outlook for fundraising activities will largely remain the same as growing tension between China and India may continue to drive capital into Southeast Asia in the months ahead. Meanwhile, open banking developments in Australia may continue to spur investors’ interest in digital banks.”

she added.

Across South East Asia, e-wallets were a big draw for investors with the top two being Philippines’ PayMaya and Myanmar’s Wave Money accounting for 31% of investments in the payments sector.

In Australia, digital-only banks continue to drive fintech funding in the region with Judo Bank, 86 400 and Xinja raked in investments amounting to US$176 million for the quarter.