Google Pay Launches All-In-One P2P Payments Solution in Singapore

by Fintech News Singapore September 24, 2020Google has launched its all-in-one peer-to-peer funds transfer service in Singapore in order to streamline transactions from different banks on one platform with via its PayNow feature.

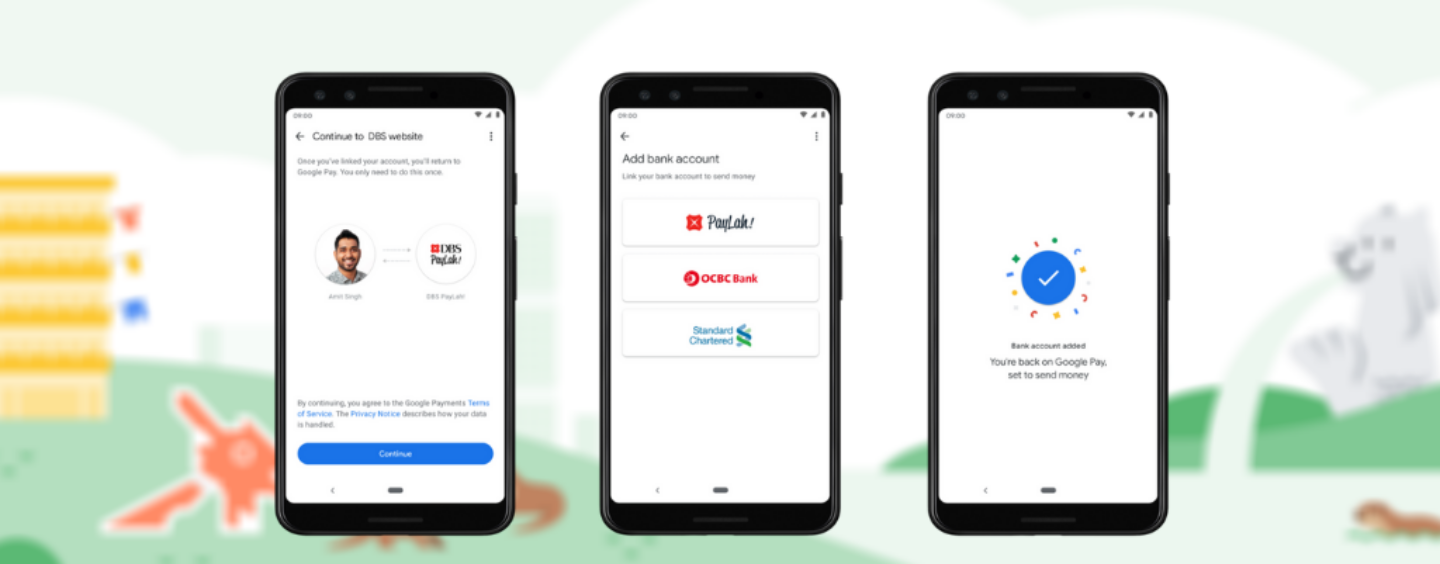

Customers of DBS PayLah!, OCBC Bank and Standard Chartered can link their bank accounts to Google Pay to transfer funds to anyone in Singapore through PayNow. They can also pay their favourite merchants through UEN or PayNow QR codes.

App users on Android and iOS devices can send and receive money even if the recipient is not on Google Pay. This integration helps Singaporeans who have more than one bank account to streamline money transfers from different banks on one platform.

Patrick Teo, Director of Engineering, Google Pay, said,

Patrick Teo

“We are excited to launch a new Google Pay experience that builds on Singapore’s robust payments infrastructure – PayNow and SGQR. Designed and built for Singaporeans, the new Google Pay enables a consolidated payment solution that is simple, secure and helpful. By working closely with our banking partners and merchants, we hope to deliver a more rewarding payment experience that works for every Singaporean.”

Singapore is the first country in Southeast Asia and second in the world to offer the new version of Google Pay, following India. The launch comes at a time when the number of PayNow users is said to be at an all time high with four million people in Singapore using the service, and nearly three- quarters of all organisations are on PayNow Corporate.

Google Pay is also touted to be more than just a payments app as it includes features such as browsing restaurant menus to order takeout or delivery, split bill payments, movie ticket booking as well as cashback rewards for friend referrals.