15 Upcoming Fintech Webinars and Virtual Events to Watch Live in APAC Time Zones

by Fintech News Singapore November 10, 2020With the ongoing COVID-19 pandemic, a growing number of webinars and virtual events are being hosted to provide industry participants with networking opportunities all the while ensuring people’s health and safety.

For those stuck at home but who still want to keep up with the rapidly changing fintech landscape, we’ve compiled a list of the top 15 fintech webinars and virtual events to attend if you are located in an Asia Pacific (APAC) time zone.

Blockchain & Distributed Ledger Technology in Financial Services

On Demand

Join industry experts from R3, Sygnum, and Temasek in this session moderated by Zuhlke for key insights out of the DLT market. This webinar is intended to provide business leaders in the financial sector with a perspective on the evolving DLT market and discuss how they can rethink business models and strategies, work with ecosystem partners, and leverage on DLT solutions to better serve their customers’ needs.

- State of the DLT market in Asia and expert insights on key trends and developments

- Technologies, solutions, and experience of building DLT solutions driving recent developments

- Use cases of DLT solutions within financial services, e.g. hedge funds and new product offerings, central bank digital currencies, arbitrage trading, ETF efficiency, etc.

Register to watch now

What’s Next for Hong Kong’s Open Banking and Financial Ecosystem?

January 28, 2020, 1100 SGT

A recent HKIMR’s research reported that innovations relating to open banking and open APIs have been commonly applied by over 50% of incumbent banks in Hong Kong.

Two years into HKMA’s Open API framework how far has Hong Kong come to Open Finance? What are the lessons learnt from the adoption of Open Banking API initiatives and How are the non-bank financial participants view the progress? How will the recent introduction of the Commercial Data Interchange CDI further impact the sector?

Register here: http://bit.ly/3pVIVHR

Ep #4: Reinventing Digital Insurance ft: Walter de Oude, Group CEO Singlife

January 14, 2021 , 11:00 SGT

A relatively new kid on the block digital insurer Singlife has been making waves in the insurance scene.

Having completed Singapore’s largest insurance deal of $SGD 3.2 Billion with the merger of SingLife and Aviva, we speak to SingLife’s Group CEO and Founder, Walter de Oude to look at how his company is reinventing the insurance sector.

Register here: http://bit.ly/2XaDUPn

ti&m breakout session: TransferWise for Banks

December 15, 2020, 16:00 SGT

The webinar series «ti&m breakout sessions» refreshes you with topics related to digitization and shows you more about our products. Our experts will be available during and after the webinars for an exchange.

Satisfy your thirst for knowledge and sign up for one or more ti&m breakout sessions. You will receive the access details by e-mail shortly before the event.

They are looking forward to an exciting exchange on Dec 15, 2020, at 4:00 – 4:30 PM (SGT).

TransferWise for Banks

Optimize foreign payment transactions with TransferWise for Banks

- Situation and trends in foreign payment traffic

- How banks can work effectively with Fintechs and create added value for all parties involved and especially the customer

- Blueprint for successful implementation

Register here: https://bit.ly/39ohMbx

Singapore Fintech Festival 2020

December 7 – 11, 2020

The Singapore Fintech Festival (SFF) is the world’s largest and most inclusive fintech event that brings together heads of state, financial and technology leaders, fintech founders, policy makers, investors and multilateral agencies. Last year, the week-long event brought together over 60,000 attendees from 140 countries.

This year, SFF returns from December 7 to 11, 2020, with a unique hybrid format combining a 24-hour online event platform and over 40 global satellite events in fintech hubs around the world.

Finovate Fintech Fulltime Review

December 7 – 11, 2020

As we approach the end of 2020, Finovate will be reviewing what’s happened in the fintech industry throughout the year and look at future trends and opportunities, with a specialized focus on the latest in paytech, lending, bankingtech, fraud, cybercrime and prevention tech, wealthtech, as well as customer experience.

All Finovate Fintech Fulltime Review registrants will get access to the Fulltime Review eMagazine at the end of the week, featuring key session recordings from FinovateFall Digital and FinovateWest Digital, plus an exclusive discount to Finovate events in 2021.

2020 xAI Conference

December 9, 2020, 15:30 – 20:00 +07

The 2020 xAI Conference will bring together global thought leaders for an analysis of the latest AI applications and key questions for the future.

This half-day conference, supported by Moody’s, will discuss how will AI redefine the financial services industry, regulation and legislation, trust, transparency and ethics, and more.

Confirmed speakers include executives from Deloitte, Moody’s, Fintech Circle, IBM, Bright Blue Hare and Bace Group.

PayoneerGO APAC: Orchestrating an Open Payments World

December 8, 2020, 14:00 SGT

Expanding into new marketplaces requires the right payment provider but it can be difficult to choose. The good news is that Payoneer can deliver a world where you don’t have to. Payoneer’s truly global payment platform gives you access to the best payment providers and acquiring banks in every region so you can work with whoever fits your needs best. There’s only one integration needed to leverage Payoneer’s payment expertise and cutting-edge technology to analyze and protect your business. Take a digital tour of optile, the newest addition to their platform, to learn more about this exciting opportunity for your business.

Register here: https://bit.ly/38PO4vZ

Digital Identity: Building Financial Services for Asia’s Digital Generation

Dec 4, 2020 11:00 SGT

IDC Financial Insights predicts that by 2023, US$3.4 billion will be invested into digital channels for online and mobile development as well as platform capabilities in APAC.

The pandemic and movement restrictions that were put in place forced many of us to rely on digital banking channels and this trend is expected to be on the rise as the crisis does not seem to be abating.

With an increasingly digital population, digital onboarding becomes a bank’s first point of interaction with their customers, and it’s crucial for banks to ensure a seamless and secure

Register here: https://bit.ly/2HpQSEA

RegPac Revolution: 2020 RegTech Summit (Fall edition)

November 26, 2020, 9:00 – 17:30 SGT

RegPac Revolution’s 2020 RegTech Innovation Summit aims to bring together the global regtech communities and industry leaders, with the objective of establishing Singapore as an international regtech hub.

The summit will touch upon untapped potential applications of regtech that haven’t been explored before, as well as the most prominent problem statements in the ever evolving regtech environment within and beyond the financial services industry.

Cloud on Air: Let’s Get Solving – How to unlock strategy and technology for innovation and growth

November 25, 2020, 10:20 – November 26, 2020, 13:10 +7

With the sweeping changes and unprecedented challenges brought by 2020, it’s time to rethink the tools and technologies we use to innovate and grow.

This hands-on virtual event will feature business use cases and technology know-how, along with spotlights on finance and retail.

Participants will get to learn strategies and practical tips to help them reduce the cost of IT and innovate faster, and improve their readiness and resilience by learning how to build agility into their apps and infrastructure. They will also learn how to leverage automation and AI to provide improved customer experience, as well as how to modernize their e-commerce experience to retain customers and attract new ones.

Register here: https://bit.ly/2HWBlMs

Gearing up for a Digital Banking Transformation in Vietnam

November 25, 2020, 11:00 GMT +7

The digital banking race is heating up in Vietnam, spurred on by the COVID-19 pandemic which made it absolutely crucial for banks to step up their digital transformation strategies.

Incumbent banks have risen up to the challenge by ramping up technology adoption, while a handful of other banks took the approach of developing stand-alone virtual banks

With digital banking steadily penetrating in Vietnam and some estimates predicting that it rises to US$8 billion in 2020, Vietnam is a fertile ground for digitally focused banks to thrive.

In this exclusive webinar with Fintech News, we speak with some top industry leaders from MoMo and Digitech Innovation, to deep dive into the digital banking transformation efforts in Vietnam.

Key Discussion Points

- State of fintech and digital banking transformation in Vietnam

- Vietnam’s regulatory development for virtual banks and cloud adoption

- How incumbent banks react to opportunities and compete in the digital banking space

Register Here: https://bit.ly/2K4CHpq

Design Summit 2020

November 19, 2020, 16:00 – November 21, 2020, 4:00 +07

Design Summit 2020 will be all about finances and design hand in hand for greater customer experience. The summit will focus on the real-world applications through an exciting mix of talks, case studies and workshops.

Design Summit was created in the spirit of opening up a platform for industry professionals where they can share and acquire hands-on design and finance knowledge that they can successfully incorporate into their daily work and processes.

This year’s summit will feature hands-on educational content for professionals and young talents, new, exciting, and interactive virtual formats, cutting-edge speakers, virtual networking opportunities, peer-to-peer (P2P) exchanges, and more.

Embracing Disruption and Innovation – Are you a Future-Ready Bank?

November 18, 2020, 8:45 – 10:15 SGT

In this exclusive OpenGovLive! Virtual Breakfast Insight event, participants will get to learn how financial institutions can embrace and implement cutting edge tools and efficiency-creating technologies that will help them serve their customers, empower their employees, cultivate an internal culture of change and thrive in today’s increasingly competitive landscape.

The event will discuss open banking, smart banking, smart lending, smart advisory services, customer experiences, mobile technology, paytech, personalization, and more.

Cyber Security Threat Landscape for Fintechs and Financial Institutions

November 18, 2020, 10:00 – 11:00 SGT

Cyber security is a growing headache for any knowledge intensive business including fintech, private equity, hedge funds and other financial institutions. Such firms are faced with compliance obligations to protect their high value sensitive data as regulated by the Monetary Authority of Singapore; however, they also have low cyber security budgets and limited IT staff.

In 2020, ransomware and email compromise are among some of the top cyber threats businesses commonly face. These attacks often rely on human weakness, and COVID-19 is a perfect opportunity for fraudsters to act.

In this discussion-based event, experts from Cyber Risk and Identity Theft and Breach Notification will share their war stories and will delve into what the threat landscape for the fintech industry may look like under the current COVID-19 situation and beyond.

Register here: https://bit.ly/32fjJ5N

MoneyLIVE APAC: The Digital Sessions

November 17, 2020

MoneyLIVE APAC: The Digital Sessions are setting the scene for Asia’s leading professionals to connect and discuss the latest developments in banking, payments and fintech online. Whether it’s virtual banking licenses, new business models, partnerships, customer experience, agile operations, digital wallets or payments strategies, participants will find it all here.

Sign up now to watch the recordings of the first 2 Sessions “Beyond banking – new models for success” and “The next stage of digital banking transformation in Asia”, as well as being able to tune into the live broadcast of Session 3 “A new chapter in the evolution of payments,” which will be streamed live on November 17.

During Session 3, participants will get to learn how digital wallets are shaping up Asian economies, and understand how blockchain will affect payment infrastructure and streamline the KYC process.

Sign up here for free: https://bit.ly/35DLp53

Preparing for the “next normal”: Attracting & retaining the digital-first customer

November 17 2020, 6:00 +7

Our relationship with technology and remote interactions is continuously evolving as we move toward the “next normal.” Many retail banks have already taken steps to address the immediate impacts of COVID-19 on business continuity. Now, banks are focused on the next set of challenges, including how to reimagine account opening and account maintenance in a more remote world. Consumers are becoming digital-first, whether banks and financial institutions are ready or not.

In this webinar, Tiffani Montez, retail banking senior analyst at the Aite Group, and OneSpan will discuss how banks and financial institutions can build new digital experiences and optimize existing ones to meet the needs of today’s digital-first banking customer.

Topics covered will include consumer behaviors that will stick after the pandemic, practical tips on transitioning from in-person to remote processes while protecting the digital customer experience, novel approaches to identity verification and the electronic delivery and acceptance of account opening, lending, and maintenance agreements, as well as insights from the 2020 Aite Group survey.

COVID-19 Impact – AML & KYC

November 13, 2020, 21:00 – November 14, 2020, 23:30 +07

Most banks and fintechs are now entering full business continuity mode and are finding ways to support economic recovery. Financial crime has and is expected to rise during these unprecedented times. This has made all the players in the value chain to re-assess their operating models.

Those who are taking the right actions to stay vigilant and transform their anti-money laundering (AML) and know-your-customer (KYC) processes during the evolving regulatory scenario, will build the foundations of a more customer-centric, efficient, and resilient future.

This global virtual summit will bring together key decision makers from the banking and finance industry to confer, collaborate, and find innovative solutions to combat financial crime and ways to avoid imposing excessive friction to firms from delivering their key financial services.

Participants will get key insights from industry leaders to allow their organizations to emerge from the current crisis and define the post-pandemic future.

ti&m breakout session: clevercircles

November 12,2020, 16:00 SGT

As a quick snapshot, clevercircles allows you to create portfolios based on your investment strategy, like standard Robo-Advisories, but clevercircles introduces the unique circle and a “voting” concept. These features allow clevercircles to understand the opinions of your peers on current market trends, financial news, global news etc. clevercircles then offers a rebalanced portfolio that combines your current strategies and the results of the voting. But only you can sign off on the revised portfolio or to keep your current portfolio. What’s more, based on voting results, the peers in your circle are given “trophies” and better rankings for predicting the market movements correctly. Essentially, clevercircles is the first investment platform for a generation that wants to, and now confidently can, decide what’s best for “themselves”.

clevercircles can act as a full-fledged solution, but can also be added as a social layer to your existing Robo-advisory platform.

ti&m webinar take placee on 2 November 2020, 4pm, introducing this new platformsto Singapore and SEA.

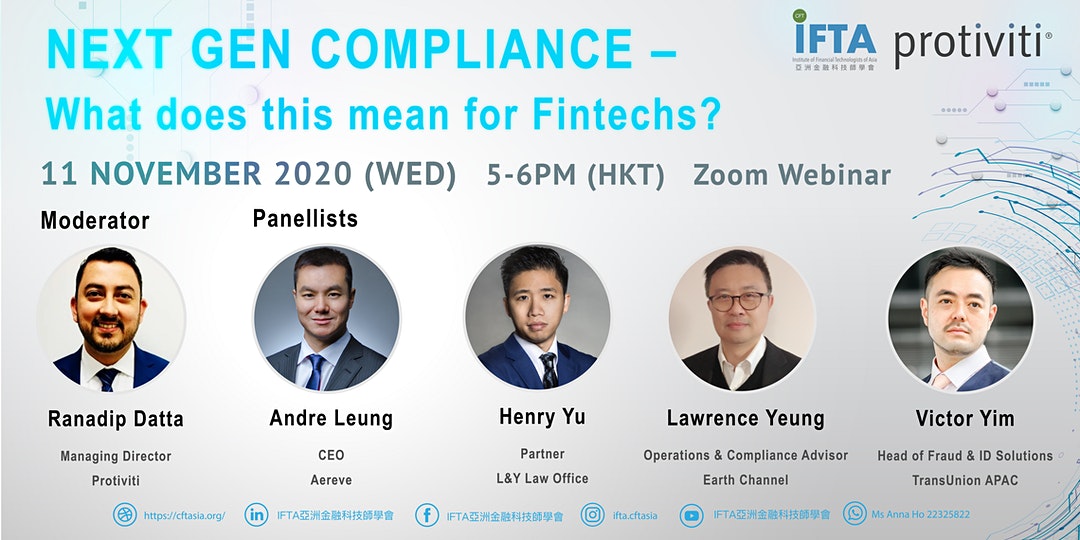

NEXT GEN COMPLIANCE – What does this mean for fintechs?

November 11, 2020, 17:00 – 18:00 HKT

In this panel discussion, executives representing the likes of TransUnion, Aereve, IFTA, and Earth Channel, will discuss next-gen compliance.

Topics covered will include establishing a technology led compliance program, managing data from a regulatory standpoint, correlating the business model to the operating model, building versus buying from a compliance technology standpoint, and the intersection between technology and compliance from a learning and development perspective.

Islamic Finance: Covid-19 – The catalyst for digital transformation and Open Banking

November 10, 2020, 14:00 SGT

The COVID-19 pandemic has caused a significant disruption to individuals, companies and its impact on the global economy are unprecedented. Islamic finance is of no exception. How are Islamic banks impacted and what role Islamic finance play in the post-COVID-19 economic road of recovery?

In this exclusive webinar, banking industry leaders from The Asian Banker, EY and Finastra will discuss the latest Islamic banking trends and the journey towards open banking and digitalization.

Key topics covered will include Islamic banking trends in Asia, the opportunities and challenges faced by Islamic banks in their digital journey, the impact of COVID-19 on

Digital Banking Asia 2020

November 10, 2020, 9:00 – November 11, 16:30 IT

The Digital Banking Asia 2020 online events series is set to feature more than 40 speakers, and 500 bank CxOs attending. Participants will get to hear the keynote, presentations, case studies and panel discussions from the leaders, thinkers, innovators and disruptors of Asia’s banking and fintech industry.

The events series will feature four sessions over the two-days courses:

- – “Contactless” Banking

- – Philippines Bank Leaders Talk

- – Indonesia Bank Leaders Talk

- – Digital Banking Innovation Asia Summit