MSIG Insurance (MSIG) has introduced Freelancer CashPlus, an insurance plan that dispenses daily cash benefits to help gig workers safeguard against income loss during a prolonged illness or injury.

According to the Ministry of Manpower, the number of freelancers stood at 211,000 in 2019 which made up 8.8% of the total resident workforce. This number is likely to trend up as more people go through a career change or seek alternative sources of income through contract or short-term work assignments.

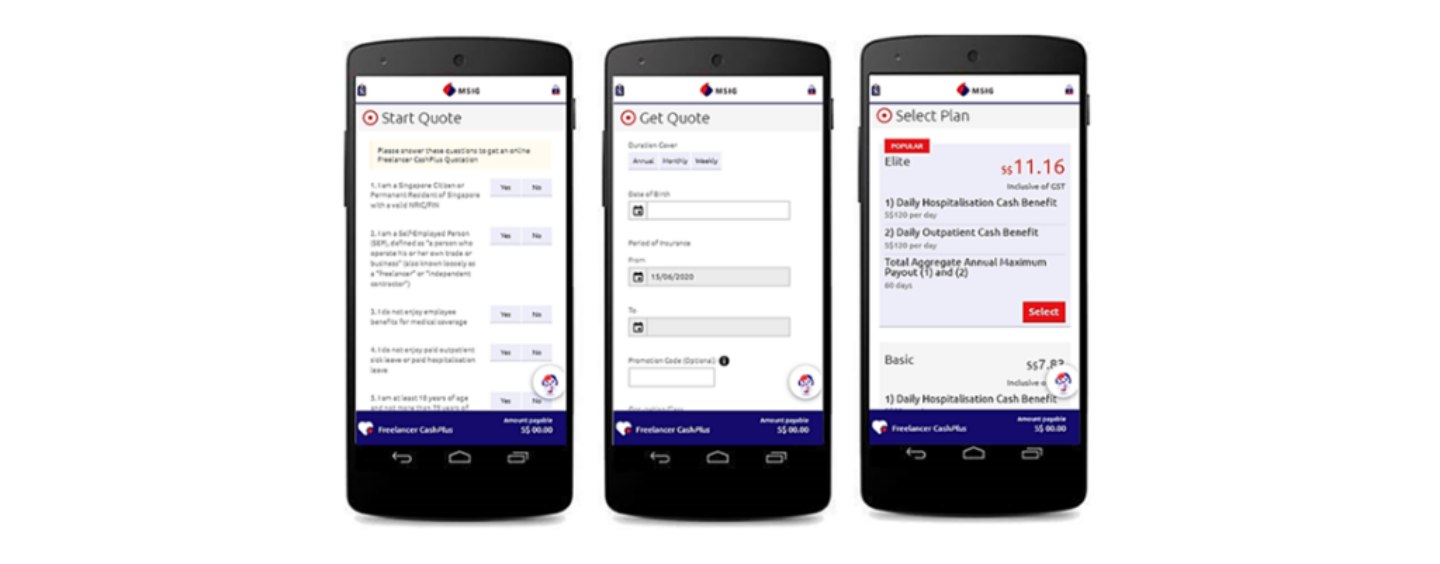

Understanding the unique needs of this underserved segment, Freelancer CashPlus aims to simplify insurance for gig workers with flexible options, affordable premiums and hassle-free policy issuance.

Given the variability in gig work, MSIG has weighed up the potential concerns that customers may have over an annual policy commitment. With MSIG’s Freelancer CashPlus, a gig worker can stay protected with weekly premiums from as low as S$6.89 for a basic plan.

With two plan types to choose from, policyholders can expect to receive daily income benefit of S$120 per day for up to S$7,200 under the higher tiered Elite plan, in the event they are on hospitalisation or medical leave for a prolonged period.

MSIG offers a simple purchase experience for this product which is only available through its website. Approval of cover is instant and there is no medical examination required.

As part of MSIG’s commitment to help Singaporeans tide through this difficult period, Freelancer CashPlus will also expand cover for hospitalisation and outpatient leave due to COVID-19.

Mr. Steven Leong, Senior Vice-President, Consumer and Digital Distribution, MSIG Singapore said,

Steven Leong

“Amidst the changing norms and emergence of digital platforms, a sizable number of workers have turned towards self-employment or flexible short-term model of work. While full-time employees might benefit from paid sick leave and hospitalisation leave, gig workers have no income to fall back on should they fall ill for a prolonged period. These are real challenges that gig workers face, which we hope to bridge through Freelancer CashPlus.”