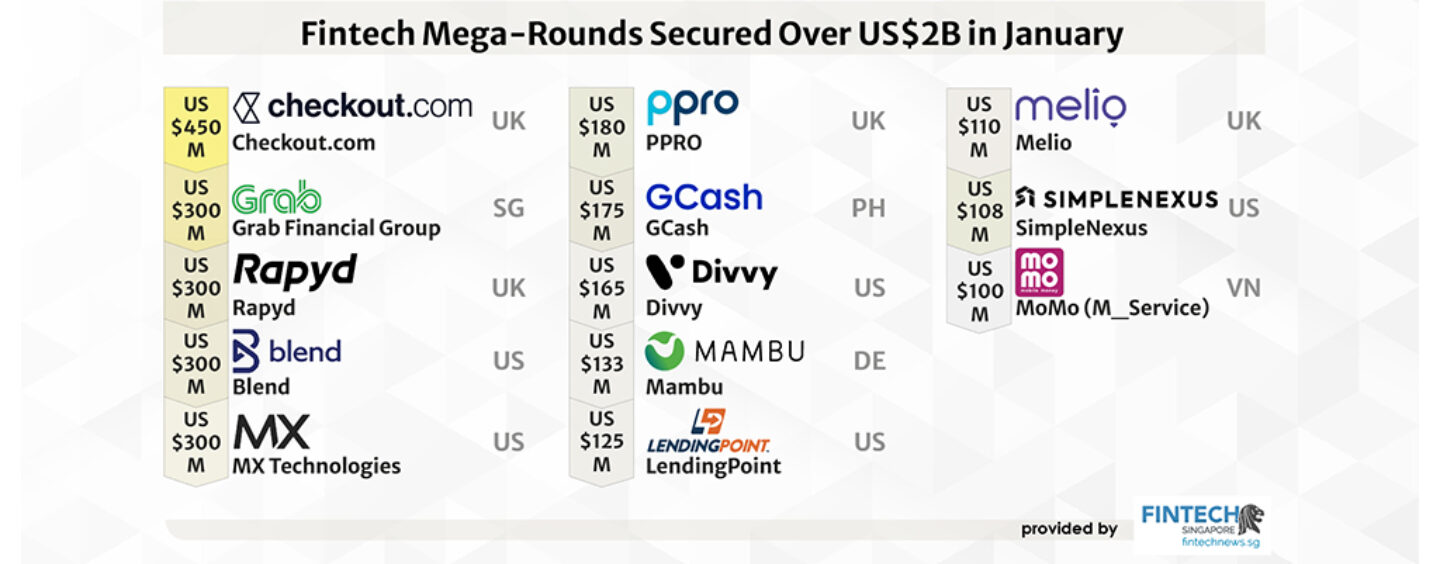

Fintechs Have Raised US$ 2 Billion in Mega Rounds in January Alone

by Fintech News Singapore January 28, 2021January 2021 has been a blockbuster month for fintech fundraising, with at least 13 mega-rounds worth US$100 million or more so far this month. These secured a combined US$2,746 million of funding. The figure excludes funding rounds that are below US$ 100 Million, but there were many other who has also raised substantial rounds for their Series A and Series B funding rounds.

This builds off momentum from last year when VC-backed fintech companies raised US$41.7 billion, the second largest annual total of the past decade, according to Pitchbook.

Below are the mega-rounds that have taken place this January.

Checkout.com: US$450 million

London-based payment solution provider Checkout.com closed a US$450 million Series C that gave it a post-money valuation of US$15 million. The company said it will use the proceeds to further grow its balance sheet and drive new innovative opportunities.

Checkout.com is the operator and developer of an online payment platform intended to track and secure digital payments across the Internet. The platform integrates with an end-to-end payment technology that eliminates intermediaries, accepts multiple credit and debit cards, connects retailers with shopper’s bank accounts and supports all major e-wallets. It also provides fraud management tools, analytics, and comprehensive reporting features.

Grab Financial: US$300 million

Grab Financial Group, the fintech arm of the Singaporean super app Grab, raised more than US$300 million in a Series A funding round, which it said it will use to hire new talents and expand its offerings in Southeast Asia.

Grab Financial Group said its total revenues increased by over 40% in 2020 on the back of key milestone developments including the launch of its retail wealth management product AutotInvest and the growth of its insurance business. Adding to this momentum, the Grab-Singtel consortium was recently selected by the Monetary Authority of Singapore (MAS) to set up a full digital bank.

Rapyd: US$300 million

“Fintech-as-a-service” company Rapyd raised a US$300 million Series D, which the company said it will use to expand its team, build out more technology and make selected acquisitions.

Rapyd provides a API-based platform covering payments, banking services, fraud protection and more. The company serves about 5,000 businesses, including marketplaces and e-commerce businesses.

Blend: US$300 million

US-based digital lender Blend raised US$300 million in a Series G funding round, doubling its valuation to US$3.3 billion since its last funding round and bringing its total funding raised so far to more than US$650 million. The company said it will use the money to grow and support investment in products and services in demand by financial institutions.

Blend offers a platform that focuses on mortgage lending and the home buying process for both buyers and lenders, and its digital lending platform is used by more than 285 leading financial institutions.

MX Technologies: US$300 million

US-based fintech data startup MX Technologies closed a US$300 million Series C funding round, quadrupling its valuation to US$1.9 billion. MX has raised a total of US$475 million in funding so far.

MX is the developer of a digital transformation platform built for banks, credit unions, partners and financial technology innovators. The platform allows financial institutions to connect to the world’s financial data through account aggregation, bank APIs and transactional data enhancement.

The company works with more than 2,000 financial institutions and 43 of the top 50 digital banking providers.

PPRO: US$180 million

London-based payment infrastructure provider PPRO raised US$180 million, pushing its valuation to over US$1 billion. The company said it will use the capital to continue its global expansion push and support the development of borderless payment tech and services.

PPRO has built a platform to make it easier for marketplaces, payment providers and e-commerce players in more than 190 countries to enable localized payments including e-wallets, bank transfers, local cards and cash.

GCash: US$175 million

Filipino mobile wallet GCash raised more than US$175 million, pushing its valuation to close to US$1 billion.

GCash is a mobile app that allows users to pay bills, buy load, send money, shop, and more. It is one of the Philippines’ biggest mobile wallets.

GCash reported a record year 2020 on the back of COVID-19 restrictions and booming usage of digital payments. The company recorded PHP 1 trillion in transactions in 2020 and a customer base that grew to more than 33 million people.

Divvy: US$165 million

US-based fintech startup Divvy closed a US$165 million Series D funding round at a US$1.6 billion valuation. The company said it will use the proceeds to invest heavily in product development and engineering in order to accelerate their future roadmap.

Divvy offers corporate cards and expense-management software to small businesses. In 2020, the company said it recorded a 120% customer growth and over 100% growth in platform spend.

Mambu: EUR 110 million (US$133 million)

Software-as-a-service (SaaS) banking platform Mambu raised EUR 110 million (US$133 million), giving it a post-money valuation of EUR 1.7 billion (US$2 billion). The company said it will use the proceeds to double its team by 2022 and expand into new markets including Brazil, Japan and the US.

Mambu is a German startup that provides by way of APIs lending, deposit and banking products, serving banks and other financial services companies.

In 2021, Mambu said it will continue focusing on the Southeast Asian region and deepen its footprint in markets including Japan, Singapore, Vietnam, Thailand, Indonesia, Australia, New Zealand and Malaysia.

LendingPoint: US$125 million

US-based LendingPoint raised US$125 million from Warburg Pincus, which the company said it will use to invest in artificial intelligence (AI) and the user experience, develop new features and capabilities for its mobile app, as well as ramp up its balance sheet and forward-flow agreements.

LendingPoint has developed a fintech platform that provides financing origination solutions for its e-commerce, point of sale, and financial institution partners.

Melio: US$110 million

Melio, a fintech with presence in New York and Israel, raised US$110 million in funding at a valuation of US$1.3 billion.

Melio provides a platform for small and medium-sized enterprises (SMEs) to pay other companies electronically using bank transfers, debit cards or credit cards.

Melio’s monthly active users grew by over 2,000% in 2020. The company said it will use the new funding to support growth and continue to build out a platform that will enable partners to offer B2B payments to their clients.

SimpleNexus: US$108 million

US-based SimpleNexus closed a US$108 million Series B funding round. SimpleNexus offers a digital mortgage platform and mobile app designed to connect lenders with borrowers and real estate agents.

SimpleNexus serves a user base of more than 29,000 loan originators, 123,000 real estate agents and over 3 million borrowers. To date, the platform has handled over 13 million loans totaling over US$3 trillion in volume.

MoMo operator M_Service: US$100 million

M_Service, the operator of Vietnam’s biggest e-wallet MoMo, raised more than US$100 million from six global investors, including Warburg Pincus. The deal aims to support MoMo’s growth as an all-in-one mobile app offering multiple services, following the leads of Southeast Asia’s super apps Grab and GoJek from Indonesia.

MoMo counts about 20 million users. The company hopes to go public in the 2021-2025 period.