New Fintech Report Highlights Indonesia’s Untapped Digital Finance Opportunity

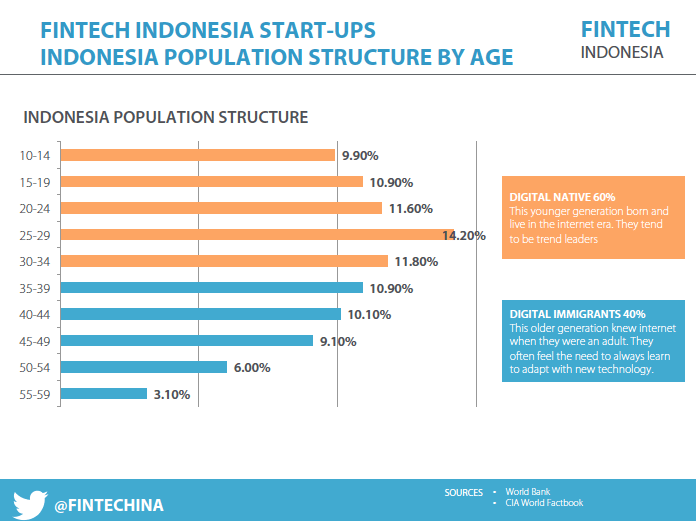

by Fintech News Singapore October 4, 2016With a population of over 255 million people – among which 60% are digital native – and growing mobile phone and Internet penetration rates, Indonesia has been perceived as an untapped market opportunity, according to a new report by Fintechnews.

Indonesia’s fintech startup community

With only 25% of the population – 60 million Indonesians – having a bank account, fintech holds the promise of delivering affordable financial services to the underbanked population.

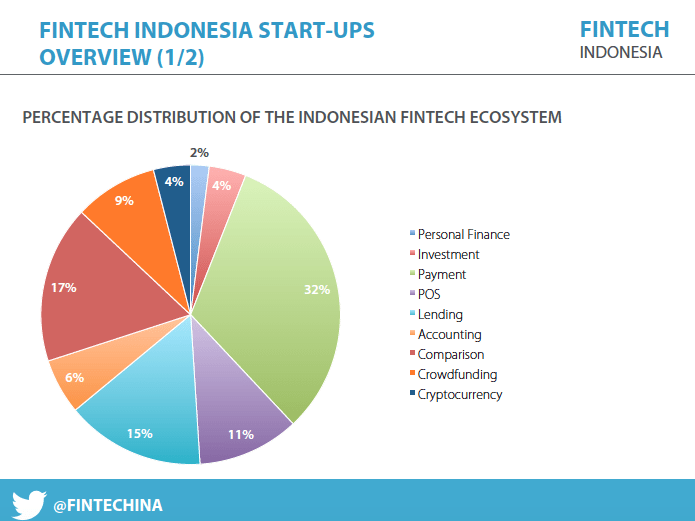

While the Indonesian startup community remains relatively small with a little over 45 ventures, it covers a wide range of sub-segments.

Similarly to other markets, payments remain the most crowded space, representing over 30% of Indonesia’s overall fintech startup community.

In the payments space, notable ventures include Doku, a provider of electronic payment processing and online and mobile applications serving some 800 businesses; Veritrans, which operates an online payment gateway for Indonesia’s booming e-commerce industry; Kartuku, one of the country’s oldest electronic payments firm; and PadiPay, a payment aggregator that has integrated with all the banks in Indonesia offering a wide range of payment channels.

Indonesia’s second largest fintech sub-segment is financial comparison portals, which currently counts eight players. These include HaloMoney, the Indonesian portal of Compare Asia Group; Cekaja, a comparison service for loans, credit cards, deposits, and syariah – a deposit that follows Islamic principles –, and RajaPremi, a startup acquired in 2013 by Singapore’s Fatfish Internet that focuses on car insurance products.

This is followed by peer-to-peer lending, which currently counts seven startups. These include Mekar and Modalku, which target SMEs and entrepreneurs; Taralite, UangTeman.com and Investree, which provides short-term microcredits and personal loan solutions to Indonesians; as well as Pinjam Indonesia, which provides an online platform for immediate cash solution and an online pawnbroking service.

In personal finance and investment, startups such as NgaturDuit are providing users with financial tracking and budgeting tools, while the likes of Stockbit, and Bareksa focus on gathering the traders community.

Other notable startups include crowdfunding platforms Kitabisa, which focuses on social projects, and Wujudkan, which focuses on creative projects. In Bitcoin, Bitcoin.co.id is the Indonesia’s biggest exchange platform. The company also provides merchant payments solutions and remittances services.

Fintech Startup Map Indonesia

While Indonesia’s Financial Services Authority (OJK) is preparing new rulings to foster financial innovation, Indonesia’s fintech sector is struggling to take off despite the market’s apparent opportunities.

Jakarta, Indonesia, via Wikipedia

Digital and mobile payments startups may be dominating the fintech sector, most Indonesians are still unfamiliar with mobile banking. This is in part due to the fact that 85% of the country’s transactions are still cash-based.

And yet, both the public and private sectors, have committed themselves to fintech development. In September OJK and the Indonesian Chamber of Commerce and Industry (Kadin) were hosting the Indonesia Fintech Festical and Conference 2016, a two-event that brought together fintech ventures, regulators, financial institutions, investors and academia to discuss the financial innovation.

The Indonesia Fintech Association, an organization aimed at representing the local community, currently counts eight members, among which Deloitte, Bareksa, Cekaja, Veritrans and Doku.

Want to Get the full Fintech Start-Ups Indonesia August 2016 report? Check out on Slideshare.

Also check Out the Fintech Indonesia Startup List here

Fintech Indonesia Startup Map

Interested in Fintech in Indonesia? Attend Digital Financial Services Indonesia 2016, this November in Indonesia

Special Offer: 10% Discount When Register With Code “FINTECH_10“

Attract new customers and drive revenue by developing a comprehensive digital strategy

Join us is this exciting discussion – led by bank, fintech, insurance, telco leaders and pioneers across Asia to emphasize technological trends, industry demands, and best-practice strategies. This is your chance to ask your burning questions and learn more about Digital Financial Services. The market is evolving so be among the pioneers in the changing face of the industry.