Are These 2 Vietnamese E-Wallet Alternatives Better Than Paypal?

by Fintech News Singapore August 28, 2016E-wallets are becoming a key staple for expats, travelers and digital nomads all over the world. But what is the easiest, safest and most convenient E-Wallet for managing your money away from home?

The thing about E-wallets is that they make such a lot of sense – they are affordable, convenient, safe, etc, and since there are now so many options, it can be hard to know which one to choose. Many of the bigger, more well-known corporations like PayPal and Apple Pay do not actually offer the lowest rate or the best range of facilities for you, especially as an expat or traveler in Southeast Asia. But most people use these providers, perhaps for lack of a better option.

A major percentage of the Vietnamese population uses E-Wallets in their daily life. There are also a number of E-Wallet startups here, but despite this, most people are still using big, foreign names – PayPal, Apple Pay, PayPass, AliPay, etc.

We wanted to take a closer look at PayPal – perhaps the biggest of these names – and compare it to the Vietnamese startups Mo Mo and Payoo, to discover whether or not expats and locals in Vietnam should be turning to local providers.

Image Source: www.starterincubator.com

First, let’s look at PayPal

According to them, PayPal now boasts over 100 million active accounts in 190 markets worldwide. It pioneered the modern concept of online payment systems, using encryption software to facilitate financial transactions between computers. PayPal is huge, used all over the world, and almost a family name, but what exactly can you do with it and how much does that cost?

What can you do with PayPal?

You can use PayPal to send money, request money, use auction tools, make payments from a website, or even as an e-wallet directly attached to a debit card. You will be offered three different account types on joining PayPal: Personal, Premier and Business, and each one has different levels of functionality.

Here is a full list of the things you can do:

- Buy or bid for items on eBay

- Shop online at a huge number of partners worldwide, from big corporations to little local boutiques

- Shop on the go using mobile apps, paying using PayPal just like you would with a computer

- Accept payments on your own website/app

- Create and email professional invoices to your customers

- Send a payment request to anyone with a simple email address

- Send money to any PayPal user

- Accept MasterCard, Visa and American Express card payments from your clients using your PayPal

- Here card reader

- Take out a loan from PayPal

Is it easy to set up and use?

Signing up is quick and easy, all done online via the PayPal website. You don’t have to enter any bank account information, but if you want to make use of PayPal’s instant transfer option you will need to add and verify a checking or credit account.

PayPal guides you through the steps of signing up well, from choosing your plan to deciding the currency to use for your accounts. And no matter what plan you choose you can always upgrade if you need to.

In terms of use, Paypal aims to make everything as seamless and intuitive as possible. To quote them, “Millions of people around the world use PayPal for one simple reason: it’s simple. Just an email and password will get you through checkout before you can reach for your wallet.”

The fees:

There are usually no transaction fees for sending and receiving money between PayPal accounts, unless you are using a PayPal debit card or receiving money that requires a currency exchange. Here is a table of the basic fees you can expect with PayPal, but it often depends on the currencies you are converting from or to, and who you are sending to. PayPal does not operate in VND, so anyone working from Vietnam would need to deal in USD.

PayPal calculates fees based on percentages, so the fees adjust according to the amount of money you move. Different account levels have different capabilities, and while it is free to open an account you have the option to pay for a superior upgrade.

| Action | Fees |

| Open an account | Free |

| Send money to another PayPal | Free |

| Add funds | Free |

| Receive $0 to $30000 USD | 3.4% + $0.30 USD |

| Receive $3000 to $10,000 USD | 2.9% + $0.30 USD |

| Receive $10,000 to $100,000 USD | 2.7% + $0.30 USD |

| Receive $100,000 + USD | 2.4% + $0.30 USD |

| Pay or send $0 to $30000 USD | 4.4% + $3.0 |

| Pay or send $3000 to $10,000 USD | 3.9% + $.30 |

| Pay or send $10,000 to $100,000 USD | 3.7% + $.30 |

| Pay or send $100,000 + USD | 3.4% + $.30 |

You can work out the specific cost of your transaction using this fee calculator.

What about security and customer service?

There have been a lot of complaints in the past about PayPal’s lax security, allowing black market transactions and the spread of fraud. Their security services now are a lot more comprehensive, catering to a range of business and personal accounts, and even to debit card services and linked bank accounts.

PayPal also uses regular account monitoring to maintain security across the platform. They set a number of account limitations where necessary, usually for security reasons. For example, if you have a verified account, you can send up to $10,000 in a single transaction. If your account is unverified you have far more restrictive withdrawal limits. One thing to note is that if you are Vietnamese and someone sends you over 500USD you will have to provide a range of documents and other information to prove where the money came from.

Being a large, well-established corporation, PayPal does have a great customer service base. Under the “help” tab on their main page you can contact customer support, visit the resolution center or browse a range of questions and topics. They have a wide range of options available, but at the end of the day this can be overwhelming – sometimes it can be so much simpler to just talk to someone.

What are the alternatives?

There is an ever expanding number of alternatives to PayPal worldwide, including a revolutionary travel E-Wallet solution, Globcoin, that aims to open up the cheapest possible online medium for international transactions.

In Vietnam alone, a number of startups has emerged, catering to E-wallet and other FinTech needs, with the nation’s first bank Timo just taking off. Here is a list of three Vietnam’s most promising E-Wallet solutions, their fees and specifications.

1. Mo Mo

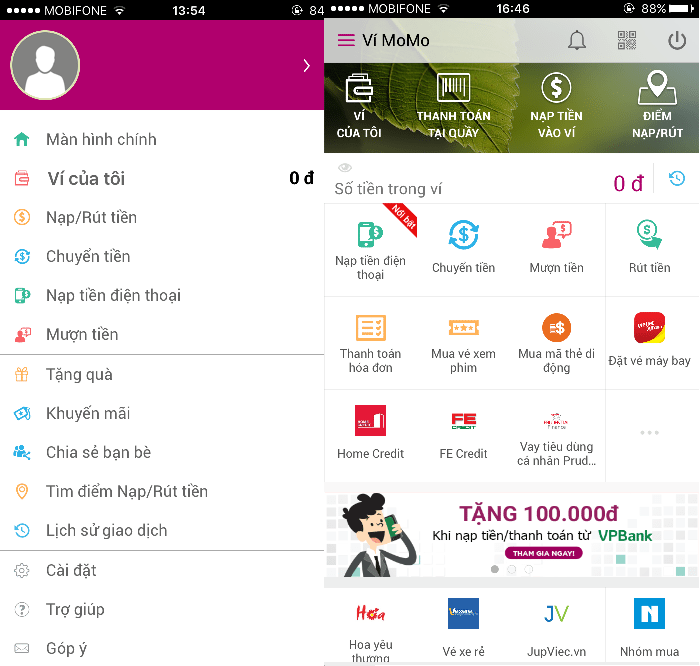

This E-Wallet works both as an in-person transaction service and a payment app. Like PayPal, Mo Mo facilitates online payments and withdrawals to bank accounts, but it has a number of other features too that cater specifically to the needs of the Vietnamese market. It claims to have 2.5 million users nationwide, one million of whom use the e-wallet.

What can you do with Mo Mo?

You can do a range of things with Mo Mo. There are two main functions to your Mo Mo account – one is Mo Mo shop transactions and the other is e-wallet payment app transactions. The payment system is integrated with 24 domestic banks, and the big names in international payments networks including Visa, MasterCard and JCB, and users can either add money to their wallet directly via their Mo Mo app or visit a MoMo store and do it in person.

Image Source: www.momo.vn/ung-dung-momo/cac-ngan-hang-ket-noi/

The only difficulty with Mo Mo is that it is currently only available in Vietnamese, but with their local rates and range of services they are well worth considering even if you have to hit google translate every time you want to pay your phone bill!

Mo Mo is a lot more specific about what they can do than PayPal, partnering with a range of businesses in different sectors around Vietnam, from insurance providers to ticket sellers, in an attempt to totally capture the Vietnamese transaction market.

Customers can do the following with their Mo Mo app or Mo Mo account online:

- Transfer or receive money: customers can perform intra-provincial or inter-city cash transfers nationwide. There is a 100% safety guarantee and the transferred money is available in cash immediately. You can transfer between Mo Mo users, and also to people without Mo Mo.

- Load money into your Mo Mo account.

- Pay more than 100 types of bills and most domestic services (water, electricity, mobile and fixed, internet, cable TV …).

- Recharge prepaid phone account at a forever discounted price.

- Pay personal consumer loans (Home Credit, Credit FE, Doctor Dong, Prudential Finance, ACS …).

- Pay for a range of other services such as airline tickets, movie tickets, online services, life insurance, etc.

- Go Shopping Online: Shop with a range of businesses online

- Insurance payments: PTI, PVA

There are a also over 4,000 Mo Mo shops in 45 provinces and cities around Vietnam, at which customers can do most of the above actions using their Mo Mo account and ID. Unlike PayPal, Mo Mo is both digitally and tangibly available to its customers.

This is great if you’re an English-speaking customer – it’s so much easier to make sense of any FinTech service if you are able to communicate with an expert face to face, especially if it is written in a foreign language! You can find out more about what services Mo Mo offers at their website.

Is it easy to set up and use?

Like PayPal, you set up your Mo Mo account online, the only difference is in language. There is a written guide with screenshots available on the Mo Mo website to take you through registration and app installation. It’s actually quite legible in English if you use the google translate function, and the screenshots help too.

According to this guide, the app can operate on Android and IOS and you simply download it from the App Store or Google Play. Sign up for an account via the app, provide your phone number and a verification code will be sent to you. Activate your account with the code, and start managing your Mo Mo.

The fees:

Fees change according to where you are making your transaction. Mo Mo does not charge the recipient of funds if you are sending them, only you. Check out the following table for a list of the fees you can expect from Mo Mo, as per their website.

Like PayPal it is free to open an account with Mo Mo and free to reload it. There are no annual fees, and the rates for transactions are as fixed numbers rather than percentages, saving you money if you send larger amounts. There are no annual fees on any account, and unlike PayPal, Mo Mo operates in VND – this makes it a more convenient and a cheaper system for anyone using the E-Wallet in Vietnam since you avoid currency conversions.

| Service | Cost |

| Transfer Money in a Mo Mo Store 100,000 to 500,000 VND | 30,000 VND |

| Reloading your Mo Mo Account | Free |

| Withdrawing 50,000 to 1,000,000 VND | 8,000 VND |

| Withdrawing 1,000,001 to 2,000,000 VND | 12,000 VND |

| Withdrawing 2,000,001 to 3,000,000 VND | 20,000 VND |

| WITHDRAWING 3,000,001 to 5,000,000 | 35,000 VND |

| Annual Fees | FREE |

What about security and customer service?

Like PayPal, Mo Mo applies a number of typical E-Wallet security measures to keep your account safe, from transaction limits to money returns. One of the most popular transactions in Vietnam is to send money around the country to family and friends. If a Mo Mo customer sends money to someone and it doesn’t reach its target or is unclaimed within 30 days of sending, it will be returned to them.

There are also a number of limits applicable:

- Withdrawal limit of 20,000,000 VND per day.

- Loading limit of 20,000,000 VND per day.

- A range from 15 maximum transactions to an unlimited number depending on your account type.

Unlike PayPal, Mo Mo’s customer service provision is limited and if you don’t speak Vietnamese it barely exists at all. There is a Mo Mo helpline available via their website, and there are guidelines available in Vietnamese. You can also get in touch with Mo Mo via email, or walk into their branch in HCMC or Hanoi.

2. Payoo

Payoo is a product of VietUnion Online Services Corporation. Like PayPal this is an E-Wallet solution, catering solely to online transactions providing services to both individuals and businesses.

What can you do with Payoo?

Payoo is for paying, plain and simple. Personal users can reload their Payoo account via direct bank transfer and use it to buy or sell online, while for businesses the software acts as an intermediary for businesses to receive payments online. A bit like PayPal. Luckily, this app is available in English, although the English Payoo website is far less comprehensive than the Vietnamese one.

Payoo is partnered with over 25 domestic banks, 35 Vietnamese service providers and over 180 e-commerce websites across the nation, so the range of services and networks it provides is conveniently wide. Check out their partners at their website. Like Mo Mo you can interact with Payoo on your phone or online, or at a Payoo partnered store.

You can use your Payoo account for the following:

- Pay your electricity, water, phone, tv, internet and other bills online or at any 24/7 convenience store (this can also be done without the app, just take your cash to a convenience store and they will use

- Payoo to process your payment.)

- Make purchases or receive payments online (similar to how you would use PayPal)

- Pay@Store – a unique function where users can buy things online and pay for them at one of many selected local stores.

Pay@Store and convenience-store bill payments are both enabled by Payoo’s POS payment gateway service, connecting 25 Vietnamese banks and covering over 95% of the Vietnamese banking customer base.

Is it easy to set up and use?

Payoo is quite easy to set up. To register for Payoo simply download the app from the App Store or Google Play, register and connect your bank account. You can also register online via the Payoo website, and there are some guidelines available online that take you through the 3 main steps.

Once downloaded you can choose your language – Vietnamese or English – and set up your own passcode. Next register your E-Wallet using your phone number and email, and enter your account.

The fees:

There are a number of fees associated with moving money to and from your Payoo account. This table is based on their website run-down, in Vietnamese but easily legible using trusty Google translate! Payoo does actually charge to reload your account, but the highest charged is 1.1%.

Transactions vary greatly depending on your bank, who you send to, what card service provider is used and what transaction you are making. Withdrawals are also chargeable but, like Mo Mo, there are no annual fees on any account, and the system works in VND so domestic transfers are a lot cheaper and easier than those using PayPal.

| Sevice | Cost |

| Recharge via bank transfer | Ranges from FREE to 1.1% depending on the bank and method of transfer. More information is available at the Payoo website. |

| Payment transactions with VDT Payoo | FREE |

| Payment using bank account VCB | 1,760 + 1.2% |

| Payment using bank account Vietinbank, BIDV, Eximbank … | 1.2% |

| Payment using MasterCard (Paybill) | 2.8% x value deals |

| Payment by credit card Visa, JCB (Paybill, Paycode) | 2.8% x value deals |

| Payment by credit card Visa, JCB (On the e-commerce websites) | 1.5% x value deals |

| Withdrawal to bank accounts by bank transfer: Dong A Bank, Vietcombank, Techcombank, A Chau Bank, Eximbank, Sacombank, Maritime | 2.200VND / gd |

| Withdrawing funds to other bank accounts | 8.800VND / gd |

| Annual fees | Free |

| Security services | Free |

What about security and customer service?

According to them, Payoo takes your financial security very seriously. They keep their app and website updated, achieving the international security certificates PCI – DSS and ISO 27001.

Their customer service platform is available in Vietnamese, although the Payoo hotline is listed on the English site so your best option is probably to go ahead and call. For native Vietnamese speakers there are a number of FAQs available via the VN website, and if you have google translate installed in your Chrome browser then hop online to see their guidelines and Help section. Like Mo Mo, Payoo‘s customer service support is poor compared to that of PayPal.

The verdict

At the end of the day, Mo Mo and Payoo both hold one big advantage over PayPal – they are local. If you are moving money around Vietnam these are your best options, both for their pricing and for the functions they provide. You can’t use PayPal to pay a local Mobifone phone bill, but Payoo will do it just fine.

There is, however, the issue of customer service and ease of use with these two providers. Most expats don’t speak Vietnamese, and since these platforms target a Vietnamese market it can be hard to navigate them successfully.