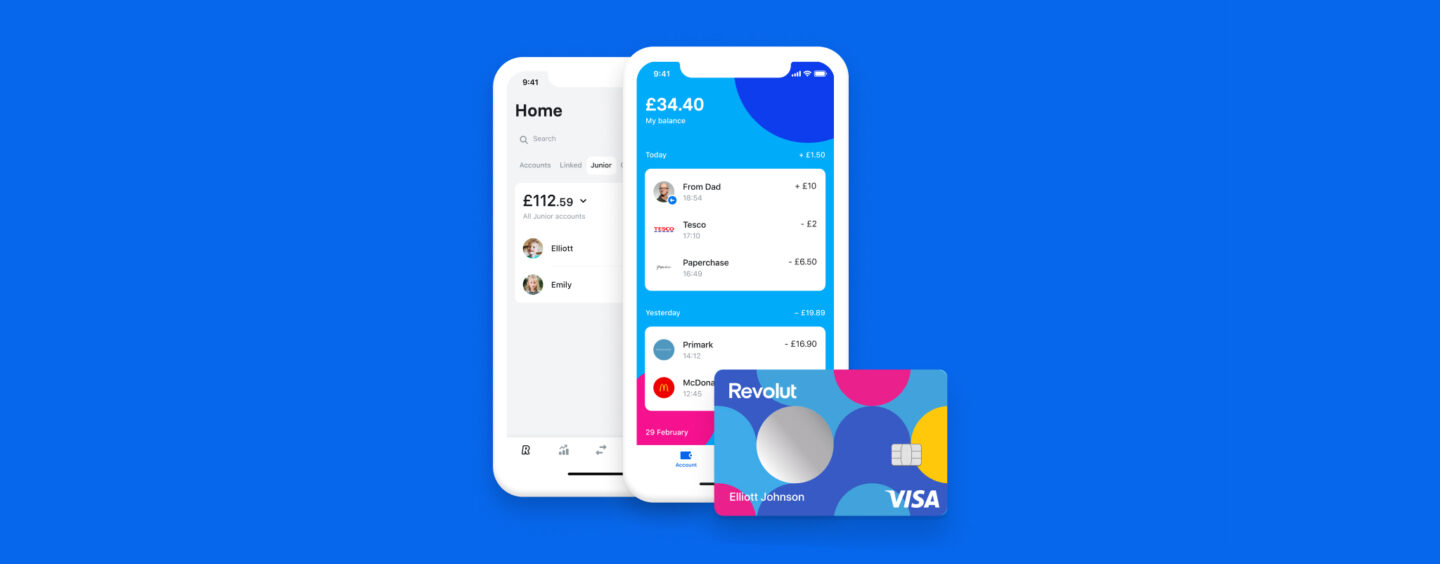

Revolut has introduced a financial app designed for kids which is controlled by a parent or a legal guardian and is now available to its customers in Singapore. Revolut customers can set up a Junior account for free.

Revolut Junior enables children to make independent financial decisions while giving parents a way to track and manage security settings remotely.

The app has already launched in more than 30 markets globally.

The company said that the average child in Singapore starts receiving pocket money at 7 years old making it the perfect age for parents to begin engaging their children in conversations about money.

Revolut Standard customers can set up 1 complimentary Junior account, Revolut Premium customers can set up 2 complimentary Junior accounts, and Revolut Metal customers can set up 5 complimentary Junior accounts. They will also be able to order a specially designed Revolut Junior Visa debit card for their child or ward.

Features of the Revolut Junior App

Revolut said that its customers will be able to draw parallels between the money deposited in their child’s Junior account and their own salary credits, to educate their children on the importance of earning and managing money, and demonstrate the concept of opportunity cost.

Additionally, Revolut’s digital money tools have been adapted to make learning fun for youngsters. Revolut Premium and Metal customers will have access to additional features on the Revolut app, such as “Tasks” and “Goals”, to inspire their children to work towards and save up for a goal.

Using this feature, parents can assign a task and corresponding e-money reward to their child. When the child checks off the task as “complete” on their Revolut Junior app, parents simply have to acknowledge this on their own Revolut app and the promised reward is transferred to the Junior account.

If the youngster desires a big ticket item, parents or guardians can agree to meet them halfway and have them save up a portion of the cost as a Goal.

Children can track, “earn”, and manage their allowances while their parents will be able to add and withdraw money, utilise security features such as the ability to freeze/unfreeze the Junior card, and appoint a Co-Parent to give another adult the ability to control the Junior account.

Featured image: Revolut