APAC Banks Race to Revitalise Their Digital Transformation Programmes

by Fintech News Singapore March 3, 2021The second edition of the Fintech and Digital Banking 2025 in Asia Pacific report by IDC commissioned by Backbase, reveals that APAC banks are going back to the drawing board on their digital transformation programs.

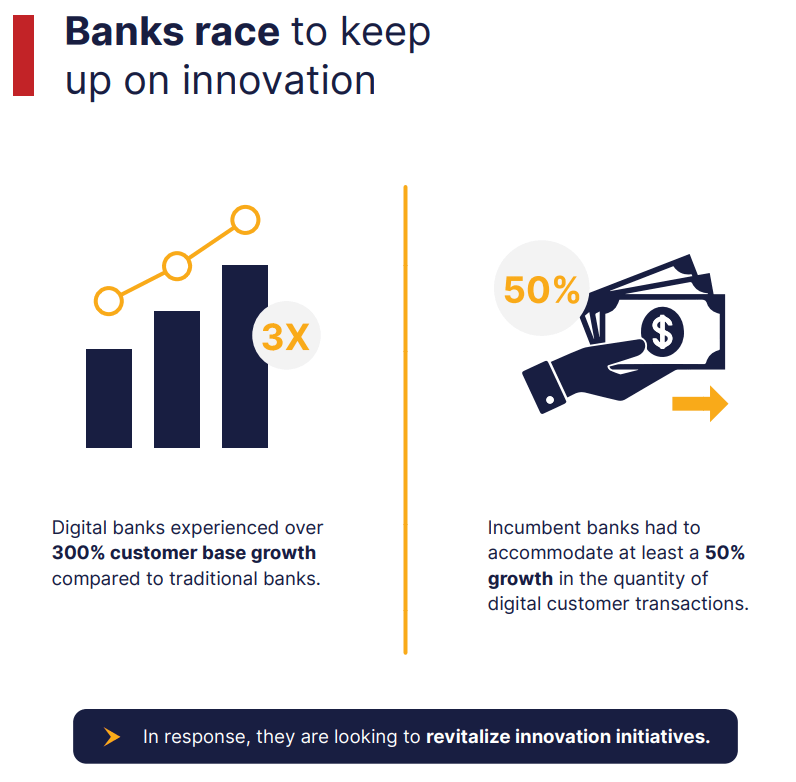

Digital banking fitness has been the key factor, with digital banks enjoying three times the growth in customer bases compared to traditional banks.

In response, incumbent banks are reinvigorating digital transformation initiatives, having had to accommodate at least a 50% growth in the quantity of digital customer transactions and interactions.

It is expected that organisations will undertake a comprehensive realignment of customer engagement projects, with the report having highlighted that digital capabilities are the key to resilience and winning the race to recover from pandemic-related setbacks.

New competition in an evolving banking landscape

While the APAC banking landscape saw the departure of some neobanks and fintechs due to COVID-19 challenges, the report predicts that we will still see 100 new challengers across the region by 2025.

With new challengers presenting stronger post-pandemic propositions, there will be at least two digital banks in every APAC market that will pose a significant challenge to incumbents.

The remaining neobanks and second-round players are expected to compete on being digital-first.

Some fintechs that had gained sufficient size by 2019 found success, gaining more market share than expected. Fintech categories that have typically shown success include payments, wealth advisory, alternative data, lending platforms, and account origination.

Traditional banks double down on digital

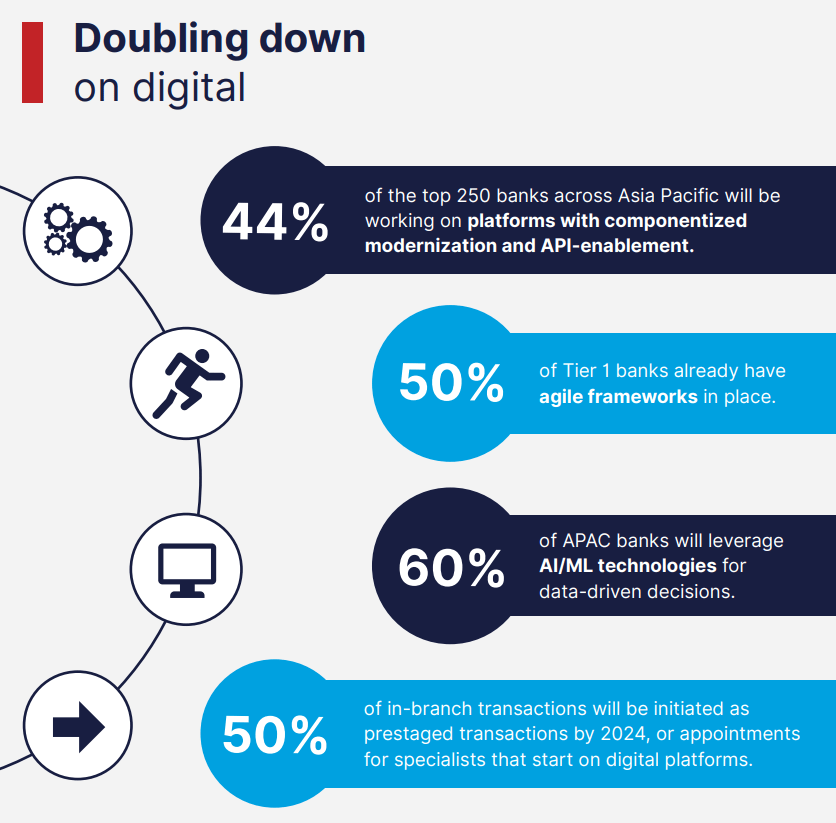

Meanwhile, traditional banks are increasingly focused on being digital-first. Innovation initiatives are expected to re-accelerate in 2021, and will most likely have a higher chance of

success as banks restructure their agile and DevOps teams. 50% of Tier 1 banks already have agile frameworks in place.

The report also found that digital banks have seen three times the growth in their customer bases compared to traditional banks in 2019 and 2020.

Investments in digital channels have paid off as banks have been growing strength to acquire new customers, expand share of wallet, and push more products.

44% of the top 250 banks in APAC will leverage platforms with componentised modernisation and API-enablement.

Strategic investments and growth priorities for 2025

Technology spending on governance, risk, and compliance saw double-digit growth in 2019 and 2020, while other areas of investment lagged behind.

The report found that 60% of banks in Asia Pacific will leverage artificial intelligence (AI) or machine learning (ML) technologies for data-driven decisions, compared to 48% from the previous year. One result of this is a more humanistic type of customer centricity, as the economic downturn required banks to communicate with customers in an empathetic, trustworthy and reliable way.

This has been complemented by the increased integration of human agents into customer engagement strategies, as contact centers saw surges in usage.

A back-to-basics trend has also overtaken the need for new revenue sources. Banks will be focusing on digitalising their core business of lending with some focus, subsequently, on deposits.

New capabilities will be acquired from fintech partners by the middle of 2021, 50% of lending decisions in retail banking will be supported by fintech propositions, underscoring the accelerating bank-fintech collaboration.

Jouk Pleiter

Jouk Pleiter, CEO of Backbase said,

“This report highlights the COVID-19 challenges faced by the various players in the banking and fintech landscape, as well as the need to accelerate digital transformation initiatives to thrive in a post-pandemic world.

At Backbase, we are committed to future-proofing the banking industry for a digital-first world. We will continue to focus our efforts on helping our customers in Asia Pacific adapt and innovate at the speed of digital.”

Michael Araneta

Michael Araneta, Associate Vice-President of IDC Financial Insights, Asia Pacific added,

“The events of 2020 have shown the resilience of the financial services industry, and that organisations must refocus their efforts on becoming even more customer-driven and platform-oriented.

The insights from this report will help banks, neobanks and fintechs identify key areas of investment in preparation for 2025 and beyond.”