Indian Fintechs Ride Digital Payment Wave to Expand to Lending, Wealth, Insurance

by Fintech News Singapore March 16, 2021With approximately 200 million active users and 30 million merchants, Indian payment players are now riding the growth of digital payments to expand to other financial segments beyond their core offerings, including wealth management, insurance and lending, says a new Credit Suisse report.

In a paper titled India Fintech Sector: A Guide to the Galaxy, the Swiss bank looks at the state of fintech in India, highlighting the phenomenal growth of digital payments and delving into some of the country’s top players growth tactics.

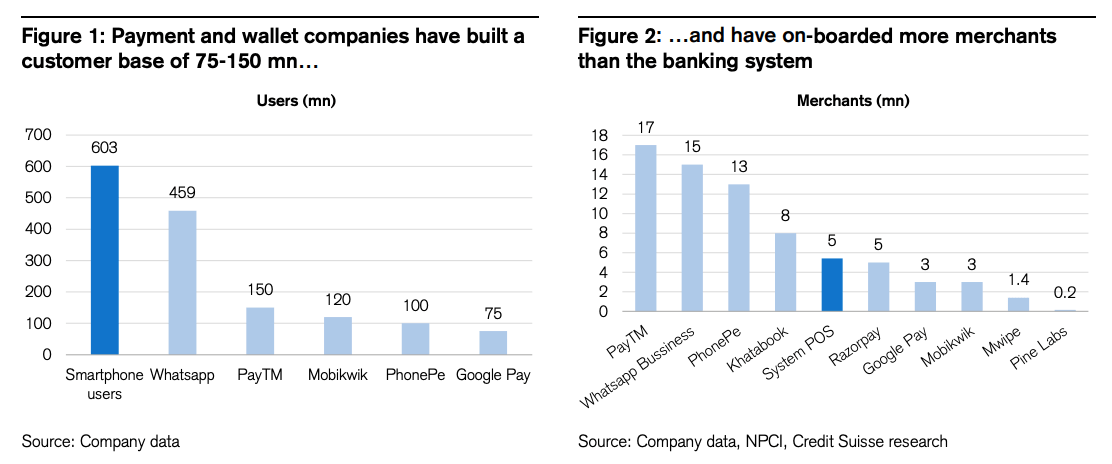

According to the paper, digital payment startups have largely led the scale up of fintechs in India with local payment companies now serving a customer base of about 100 million users each and having so far onboarded more merchants than the traditional banking system.

Indian payment and wallet companies user bases, Source: India Fintech Sector: A Guide to the Galaxy, Credit Suisse

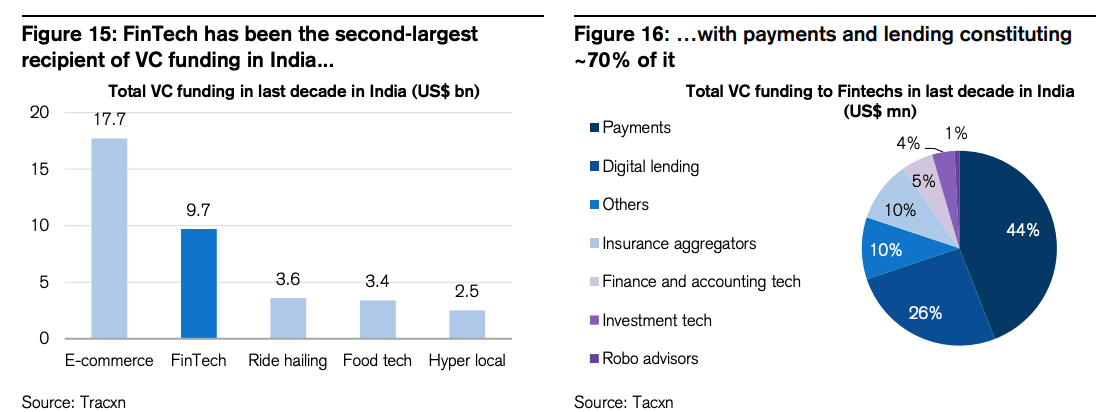

Indian payment players have been supported by investors, which poured a total of US$4.2 billion into these companies over the past decade. The figure represents nearly 50% of all funding raised by Indian fintechs during the same period (US$10 billion).

India private equity/venture capital funding over the past decade, Source: India Fintech Sector: A Guide to the Galaxy, Credit Suisse

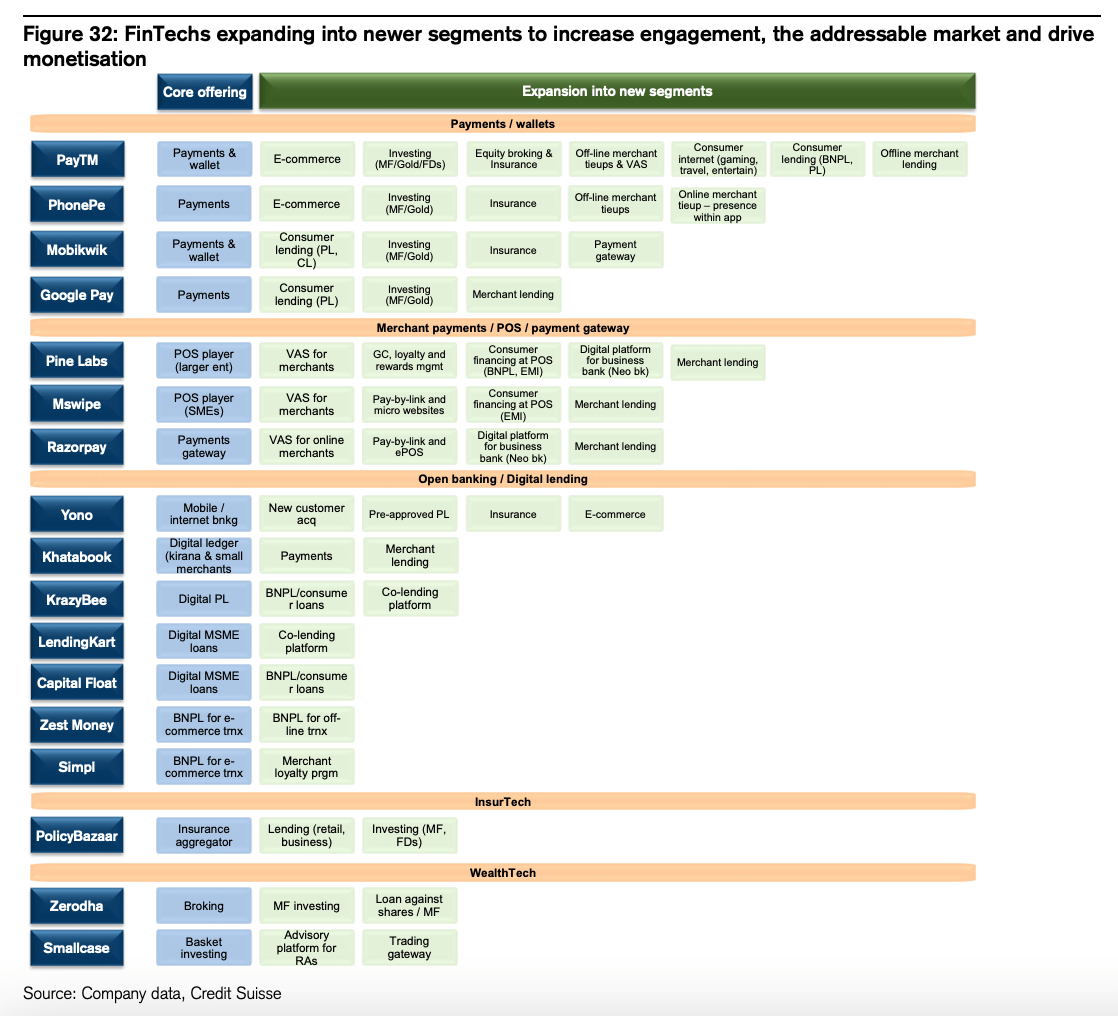

Riding the digital payment boom, retail consumer payment startups including PayTM, PhonePe and Mobikwik have expanded into new segments, including e-commerce, investing, insurance and consumer lending.

Similarly, merchant payment players such as Pine Labs, Razorpay and Mswipe have introduced value-added services for businesses, and launched loyalty and rewards management services, neobanking platforms, and consumer financing at point of sale (POS) like buy now pay later (BNPL) solutions.

Fintechs expanding into newer segments to increase engagement, the addressable market and drive monetization, Source: India Fintech Sector: A Guide to the Galaxy, Credit Suisse

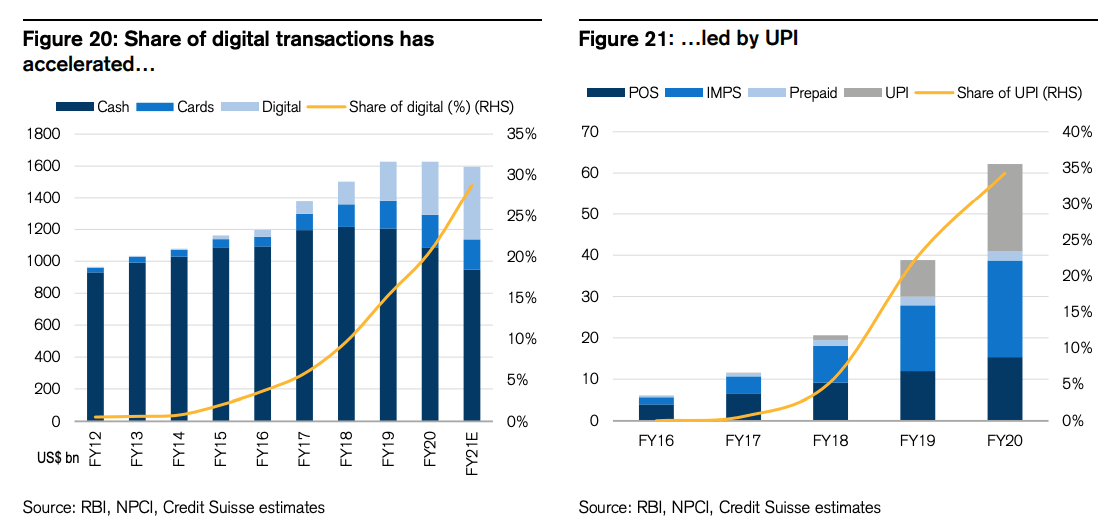

In the past five years, digital payments have grown 10 times to reach US$450 billion. Digital payments now constitute about 30% of retail transactions, a leapfrog that’s largely been driven by public payment infrastructure modernization initiatives such as the United Payments Interface (UPI).

UPI is an instant, real-time payment system developed by the National Payments Corporation of India to facilitate inter-bank transactions. The system has been a major driver of this accelerated payment digitalization as it opened up an interoperable payment network to large tech companies.

Share of digital transactions in India, Source: India Fintech Sector: A Guide to the Galaxy, Credit Suisse

Digital lending, wealthtech startups get boost from COVID-19

Fintech segments including retail digital lending, wealthtech and insurtech have also taken advantage of the fintech revolution triggered by the digital payment boom.

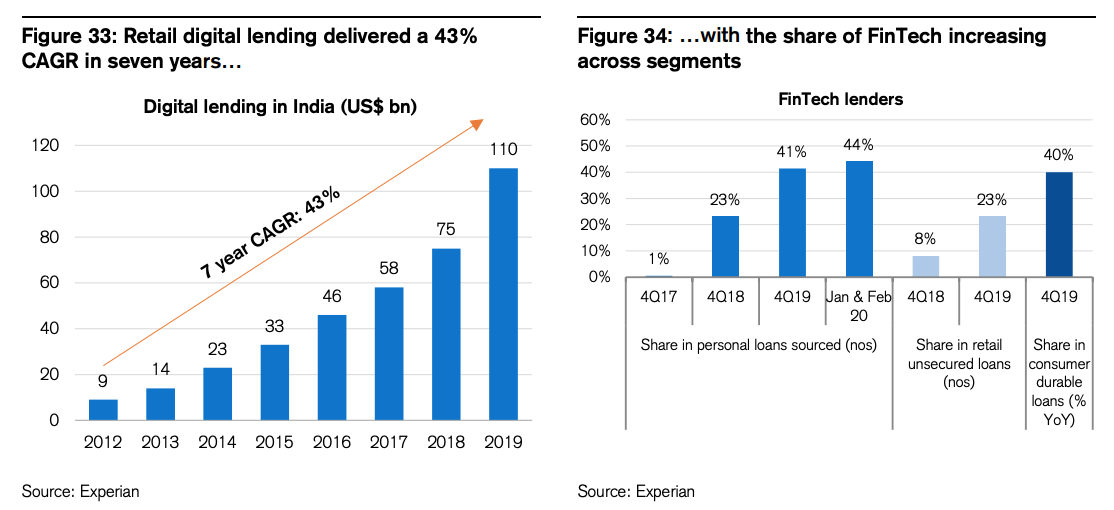

In 2019, retail digital lending reached US$110 billion in size, growing at a compound annual growth rate (CAGR) of 43% since 2012. Digital lending players have seen their market share consistently grow over the past years.

Indian retail digital lending, Source: India Fintech Sector: A Guide to the Galaxy, Credit Suisse

But a separate report by Singapore-headquartered big data and artificial intelligence (AI) company Advance Intelligence Group suggests that the pandemic further accelerated the growth of India’s digital lending startups.

Faircent.com, one of India’s largest peer-to-peer (P2P) lending startups, saw its revenue increase by 50 times between January 2019 and January 2020 with the monthly loan amount climbing from INR 250 million (US$3.5 million) to INR 1.2 billion (US$16.4 million).

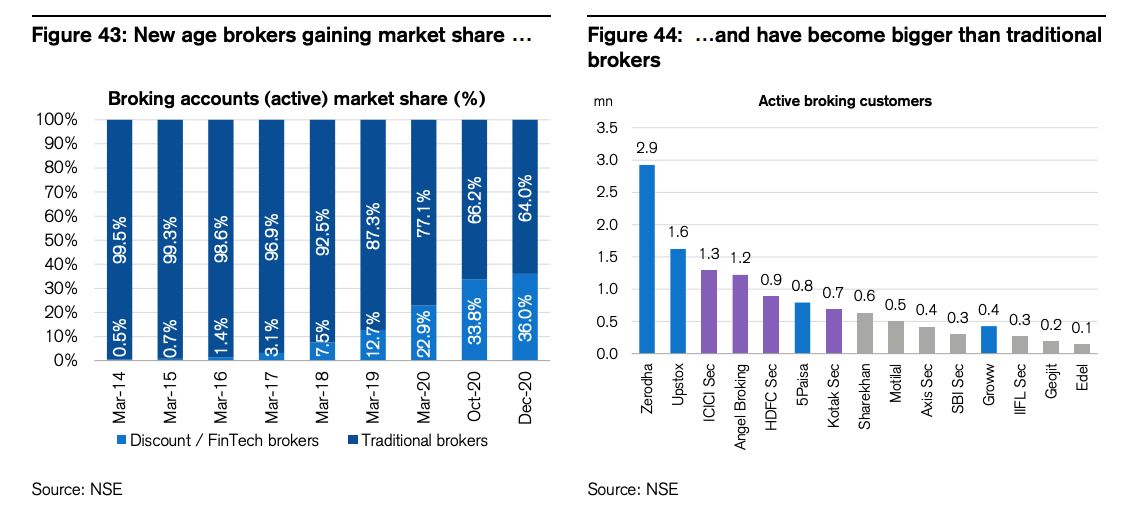

With COVID-19 pushing customers to turn to online channels, wealthtech startups and fintech brokers saw a surge in user signups. Total broking accounts at fintech brokers surged about 50% within a nine month period post pandemic. Startups Zerodha and Upstox led most of the growth, recording a surge of 100% and 160%, respectively, in their user bases.

Today, they are the largest retail brokers in India and are part of the new generation of broking players now commanding about 36% of total broker accounts in the country.

Indian fintech brokers gain market share, Source: India Fintech Sector: A Guide to the Galaxy, Credit Suisse

The accelerated evolution of fintech in India has been driven by the so-called India Stack, a project aimed at creating a unified software platform to bring India’s population into the digital age.

The India Stack is being implemented in stages, starting with the introduction in 2009 of the Aadhar “universal ID” numbers, followed by the introduction of electronic know-your-customer (eKYC), electronic signatures (e-Sign), UPI, and DigitalLocker, a platform for the issuance and verification of documents and certificates.