Behind Singapore’s Ambitions to be Asia’s Leading Centre for Green Fintech

by Fintech News Singapore March 16, 2021Singapore is looking to leverage its position as one of the world’s most developed fintech markets to become a leader in green fintech, a vision part of a broader movement for the nation to become sustainable.

During a speech at the Singapore Fintech Awards Night on February 10, 2021, Grace Fu, Minister for Sustainability and the Environment of Singapore, highlighted Singapore’s massive fintech ecosystem, which currently represents more than 40% of all fintech companies in the Southeast Asian region. Simultaneously, the nation is ASEAN’s largest green finance market, accounting for close to 50% of cumulative green bond and loan issuances. These attributes make Singapore poised to become a leader in green fintech.

“Our vision is for Singapore to be a leading center for green finance in Asia and globally,” Fu said. “Technology can play an instrumental role in greening finance, and supporting the development of trusted, efficient green finance markets. For instance, good, strong data, and the use of fintech, including artificial intelligence (AI) and machine learning, to process, collect and analyze data, can inform decision making, and risk management practices.”

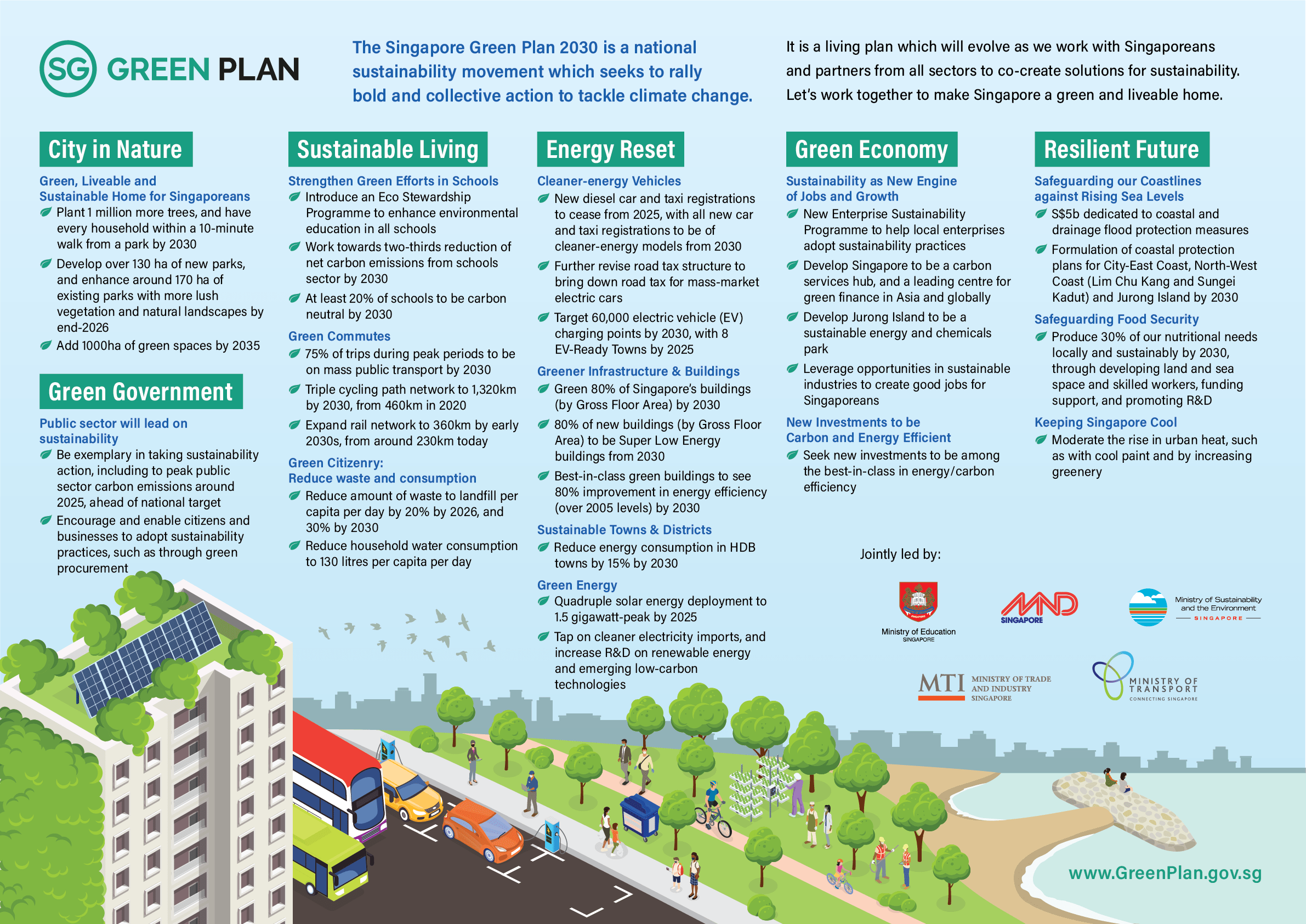

Fu’s statements came shortly before the announcement of the 2021 Budget, during which Deputy Prime Minister and Minister for Finance Heng Swee Keat outlined the Singapore Green Plan. The national sustainability effort has set out a number of ambitious goals around cleaner energy, green living, waste and consumption, green finance, and more.

Singapore Green Plan 2030, Source: greenplan.gov.sg

Singapore’s green finance ambitions are being led by the Monetary Authority of Singapore (MAS), which has already unveiled several initiatives focusing on harnessing technology to enable trusted and efficient sustainable finance flows.

At the Singapore Fintech Festival last year, MAS announced Project Greenprint, a technology platform aimed at promoting a green financial ecosystem through green fintech. The central bank also earmarked S$50 million to support green fintech projects in Singapore.

These initiatives came on top of the Green Finance Action Plan, announced in November 2019, which comprises four key thrusts: strengthening the financial sector’s resilience to environmental risks, developing markets and solutions for a sustainable economy, harnessing technology, and building a strong base of knowledge and capabilities in sustainable finance.

Under the Green Finance Action Plan, MAS is encouraging fintechs and financial institutions to develop green fintech solutions.

Green Finance Action Plan illustration, Source: Monetary Authority of Singapore (MAS)

In the private sector, numerous fintech startups are beginning to include environmental, social and corporate governance (ESG) criteria within their business and processes. Hashstacs, a blockchain development company and technological solutions provider for the financial world, recently teamed up with Deutsche Bank for a proof-of-concept project related to digital assets.

The collaboration focuses on exploring the technological and practical feasibility of digital assets interoperability, liquidity, cross-border connectivity, and smart contract templates, including the support of sustainability-themed digital bonds.

Fintech incubator and accelerator F10 announced earlier this month a partnership with New Energy Nexus to form the first global green and climate fintech program. The climate fintech program will accompany F10’s existing core curriculum, and the Zurich, Singapore, Madrid and Barcelona-based banking and insurance incubator will also extend its current open call for applicants.

Moody’s ESG Solutions Group, the ESG and climate insights arm of the credit rating agency, is building a comprehensive suite of ESG resources out of Singapore to spearhead its sustainable finance agenda in Asia Pacific. Key initiatives in Singapore include an ESG-focused innovation Lab and Technology Accelerator to develop ESG analytical solutions and assessment tools in partnership with local fintech firms.

Other green fintech hubs in Asia

While Singapore is well on track to become a leading green fintech hub in Southeast Asia, other locations across Asia are seeing the development of green fintech ecosystems.

In China, Ant Group recently unveiled its intention to become carbon neutral by 2030 and pledged to help bring down emissions through technological innovations. The company said it will set up a carbon neutrality fund to support the research and development of renewable energy and other green technologies, and work with industry partners to promote green finance.

In 2016, Ant Group launched Ant Forest, a green initiative on the Alipay mobile app which combines mobile transactions and gamification to encourage a low-carbon lifestyle. As of March 2020, more than 550 million people had joined Ant Forest. The project has become China’s largest private sector tree-planting initiative.

Today, China is home of a burgeoning green fintech landscape where startups like Dipole Tech, Uni Inclusive, NengLian and Mixis Link are using technologies including blockchain, AI and big data, to help finance climate-friendly companies and provide banks with ESG data and technology platforms.

This landscape is emerging on top of green finance initiatives launched by the Chinese government and regulators themselves. Among the most notable ones is the Green Finance Information Management System launched by the People’s Bank of China in August 2019.

The Green Finance Information Management System is a green lending information management platform that utilizes big data, AI, cloud computing, and other technologies to make data traceable, comparable, and measurable for participants on the platform. It functions as a repository for green lending statistics and analytics, green lending regulations, and reviews of green lending policy implementation across the country.

Featured image credit: Photo by Victor Garcia on Unsplash