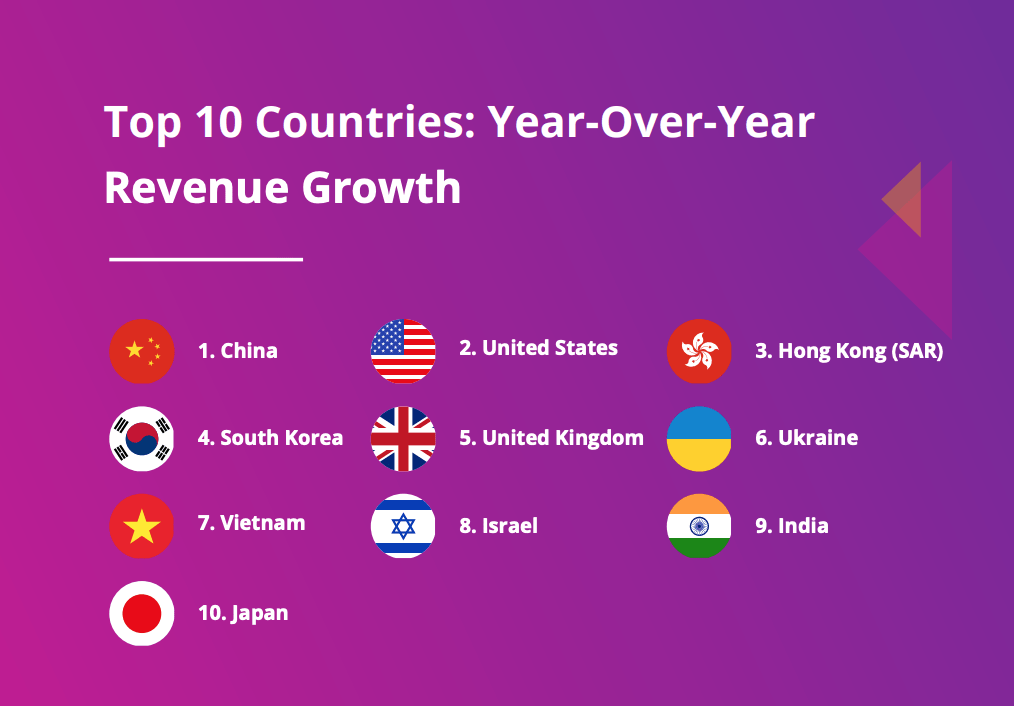

Global E-Commerce Revenues Surge; Asian Nations Lead in Growth Rate Ranking

by Fintech News Singapore May 7, 2021Global e-commerce sales have surged amid the COVID-19 pandemic, with China, Hong Kong, South Korea, Vietnam, India and Japan recording amongst the highest revenue growth rates in the world, a Payoneer whitepaper says.

Top 10 Countries: Year-Over-Year Revenue Growth, One Giant Leap: The Growth of eCommerce Amidst the COVID-19 Pandemic and Beyond, Payoneer

Chinese sellers saw sales volumes surged 65% and 50% year-over-year (YoY) in Q2 and Q3 2020, respectively, while South Korea recorded a 65% and 129% YoY increase during the same periods. In Vietnam, e-commerce sales spiked more than 90% YoY in Q2 2020, and 45% in Q3 2020.

Booming e-commerce activity in Asia Pacific (APAC) came alongside a surge in digital payments, with cross-border payments platform Payoneer recording strong growth in markets including Singapore (126% YoY volume growth from 2019 and 2020), India (170%), the Philippines (90%) and Malaysia (70%).

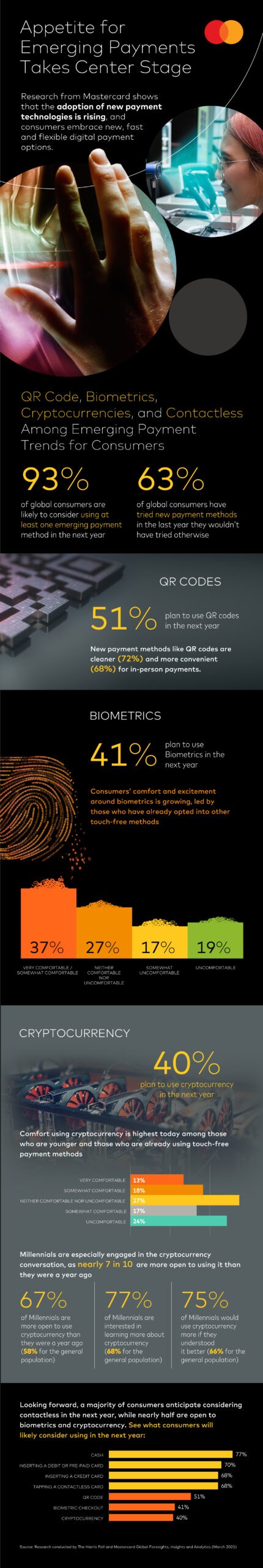

COVID-19 pushes consumers to adopt digital payments

As the world went into lockdown in 2020, consumers shifted their spending habits to embrace online shopping and contactless payments. In 2021, adoption of new payment technologies continues to rise on the back of growing consumer appetite for new, fast and flexible digital experiences, a new research from Mastercard found.

The Mastercard New Payments Index, conducted across 18 markets, shows that 63% of consumers have tried a new payment method they would not have tried under normal circumstances. In the next year, 93% said it will consider using at least one emerging payment method, such as cryptocurrency, biometrics, contactless, or QR code payment. 71% expect to use cash less moving forward.

The research found that contactless payments are driving most of the digital payment momentum. Between Q1 2020 and Q1 2021, more than 100 markets saw contactless as a share of total in-person transactions grow by at least 50%. In Q1 2021, Mastercard saw 1 billion more contactless transactions as compared to Q1 2020, while Visa said contactless transactions grew 500% in Vietnam from the H1 2019 to H1 2020.

Changing consumer habits

Digital currencies, biometric payments and QR code payments are also trending as emerging payments technologies, the Mastercard research found.

40% of consumers are planning to use cryptocurrency in the next year, while the perception of safety and convenience of biometric payments is rising with now 53% of consumers agreeing that it is secure. Meanwhile, QR code payments are picking up especially in APAC where 76% of respondents perceive it as being cleaner and 71% feel it is more convenient than cash for in-person payments.

With consumer behavior rapidly changing, businesses around the world are embracing new payment methods at an accelerated pace.

A study on 5,500 major Mastercard merchants found that between Q1 2020 and Q1 2021, more than fifth of these merchants increased the number of ways they connect with consumers either by enabling an e-commerce channel or accepting contactless transactions.

In Singapore, over half of the city-state’s 18,000 stallholders have adopted digital payments. In January 2021, transactions volume and value crossed the 1.2 million and S$14 million mark respectively for the time, a four times increase compared to June 2020.

The Mastercard research found that millennials are particularly open to cryptocurrencies. 77% of millennials said they are interested in learning more about cryptocurrencies, while 75% agree they would use them if they understood it better.

Mastercard New Payments Index 2021 Infographic: