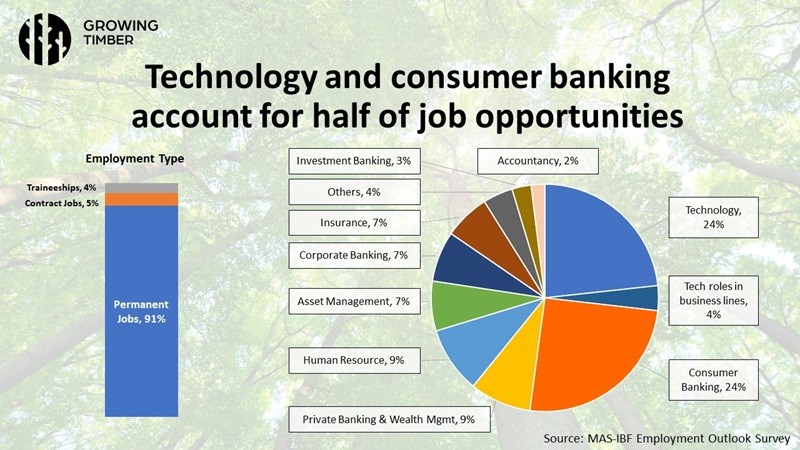

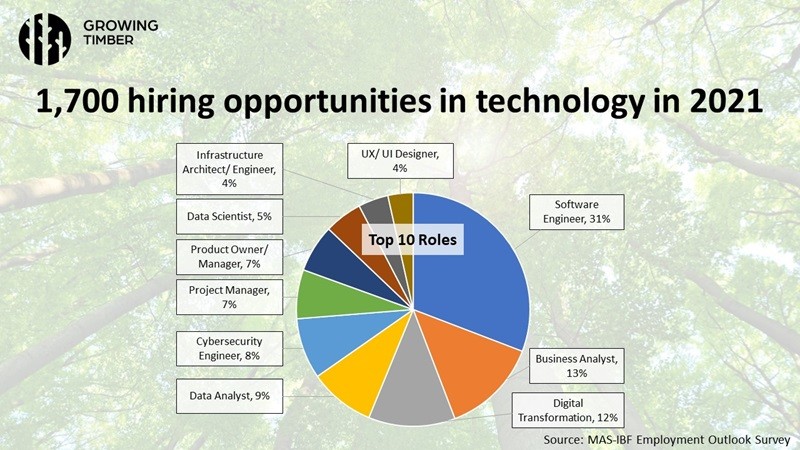

In Singapore, technology continues to lead hiring demand in the financial services industry with about 1,700 job opportunities in 2021. This represents more than a quarter of all newly created positions at Singapore’s financial institutions this year, and showcases how tech has become central to how financial services are produced, distributed, and consumed in the city-state, Ravi Menon, Managing Director of the Monetary Authority of Singapore (MAS), said in a speech.

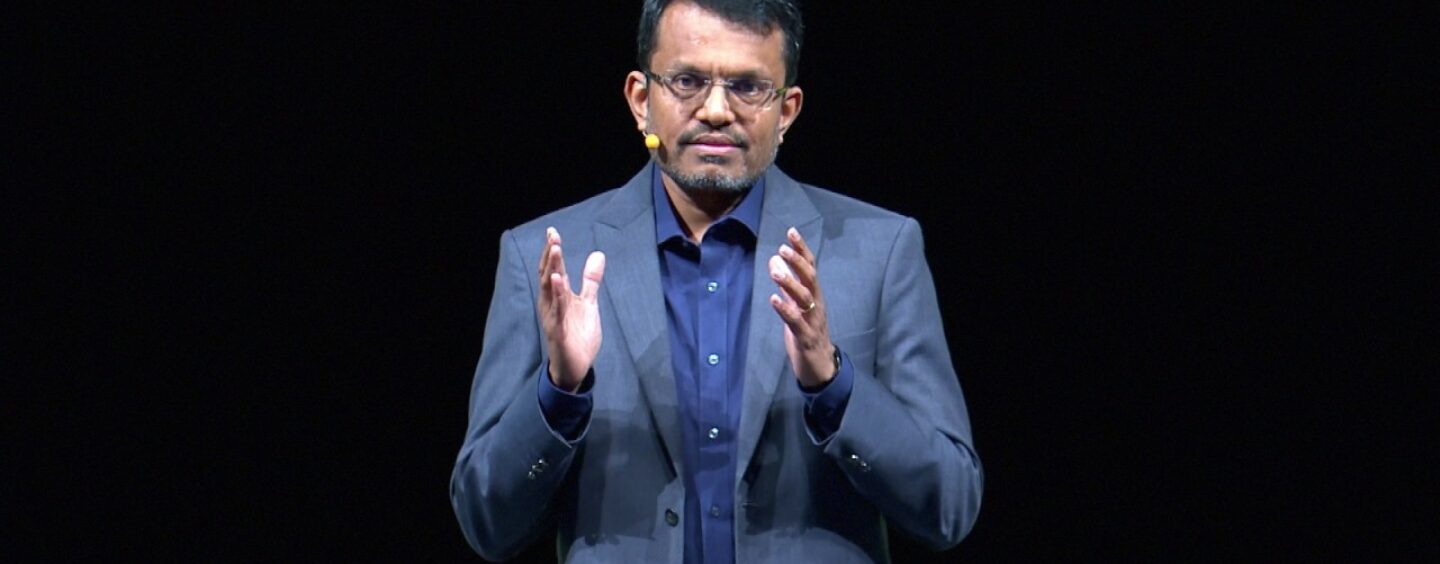

Tech and Consumer Banking Account for Half of Job Opportunities at Singapore Financial Institutions, MAS presentation slide, Growing Timber webinar series, Credit: Monetary Authority of Singapore (MAS)

The remarks were made during one of the episodes Growing Timber, a webinar series organized by MAS in partnership with the Institute of Banking and Finance (IBF), which focuses on the jobs and skills agenda for the financial services sector.

During this speech, Menon noted the increasing prominence of tech in Singapore’s financial services industry, stressing that demand for tech talent will only rise moving forward. MAS estimates that over the medium term, between 2,500 and 3,500 new tech jobs will be created in the financial sector each year.

“We are now among the most tech-enabled financial centers in the world, supported by a vibrant fintech ecosystem and strong foundational digital infrastructures,” Menon said. “Our financial sector has shown that technology creates far more jobs than it displaces. During the last 5 years, the financial sector created 21,000 net jobs. We estimate that about 1 out of 4 of these net jobs were in technology.”

Currently, software engineers are in the highest demand, accounting for about 30% of 2021’s hiring opportunities. Business analysts and jobs in digital transformation account for another 25%, reflecting the strong push in digitalization, Menon said.

1,700 hiring opportunities in technology in 2021, MAS pesentation slide, Growing Timber webinar series, Credit: Monetary Authority of Singapore (MAS)

Tech talent shortage

Tech talent is in high demand not just in the financial services industry but also the broader economy as more sectors embark on a digital journey, Menon stated.

Citing data from Singapore’s Infocomm Media Development Authority (IMDA), he said that they are currently an estimated 19,000 unfilled tech jobs across the economy each year. This indicates a large mismatch between demand and supply for tech workers and showcases Singapore’s high dependance on foreign talent. In financial services, Singaporeans make up just over a third of the tech workforce.

“Many of the tech skills required to do the jobs… are in short supply locally,” Menon said. “We are fortunate that global and local financial institutions have invested heavily to build up strong technology teams in Singapore. Technology talents from abroad have brought with them valuable experience and expertise that we do not have enough of in Singapore.”

Several initiatives have been launched by financial institutions to help grow the Singaporean tech talent pool, Menon noted. He cited the examples of JP Morgan, which has committed to hiring more than 30 polytechnic graduates this year through its apprenticeship program, DBS Bank, which offers a skills development program to train individuals with STEM (Science, Technology, Engineering, Mathematics) backgrounds, as well as Standard Chartered Bank, which launched last year a global learning hub called diSCover Lab that strives to train and upskill 8,000 employees in Singapore by 2022.

In addition to initiatives led by the private sector, the government is also helping grow the domestic tech talent pool by partnering with financial institutions to reskill professionals into tech roles. The TechSkill Accelerator (TeSA) initiative, for example, is led by IMDA and focuses on training and placing fresh and mid-career professionals into tech positions in the financial sector. Since 2016, more than 500 people have benefited from it.

Another initiative is the Technology in Finance Immersion Programme (TFIP) where MAS works with financial institutions to support individuals from outside the financial sector transit into tech jobs in the sector. There are currently 190 participants in TFIP, with an additional 400 training places offered across more than 20 financial institutions this year.

A tech workforce of 25,000 in the finance industry

The tech workforce in Singapore’s financial sector is an estimated 25,000, Menon said. So-called “Tech-Lite” or entry-level job roles, make up about 10% of the tech workforce, “Tech-Advanced” or senior leadership positions account for 15% of the tech workforce, and “Tech-Intermediate,” which are roles requiring good programming skills and understanding of business domains, represent about 75% of tech jobs in the financial sector.

Between 2016 and 2020, 21,000 net jobs were created in Singapore’s financial sector. This year, the employment outlook in the industry remains positive with institutions indicating a total of 6,500 newly created positions.

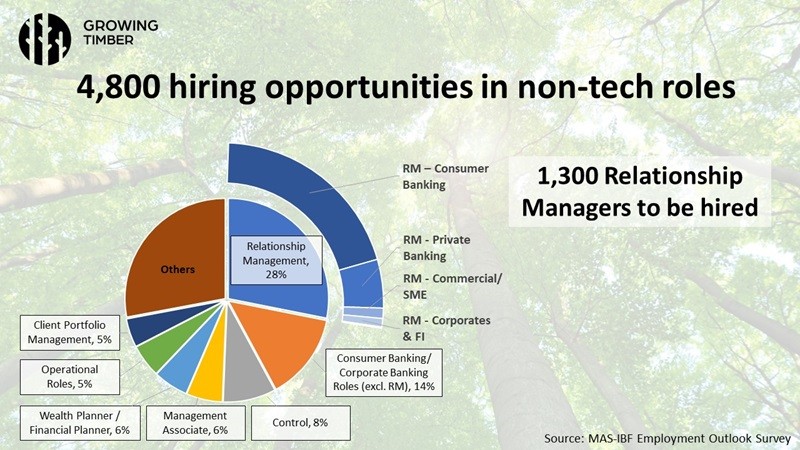

4,800 positions involve non-tech roles with relationship managers making up 28% of the hiring opportunities in non-tech roles, or 1,300 jobs. Strong demand for relationship manager is underpinned by the rapid growth of wealth management activities in Singapore, Menon said, citing for example Citibank, which recently opened its world’s largest wealth advisory hub in the city state. Citibank plans to hire 1,500 more employees by 2025, a spokesperson told Channel News Asia in April.

4,800 hiring opportunities in non-tech roles, MAS presentation slide, Growing Timber webinar series, Credit: Monetary Authority of Singapore (MAS).jpeg

Featured image: Ravi Menon