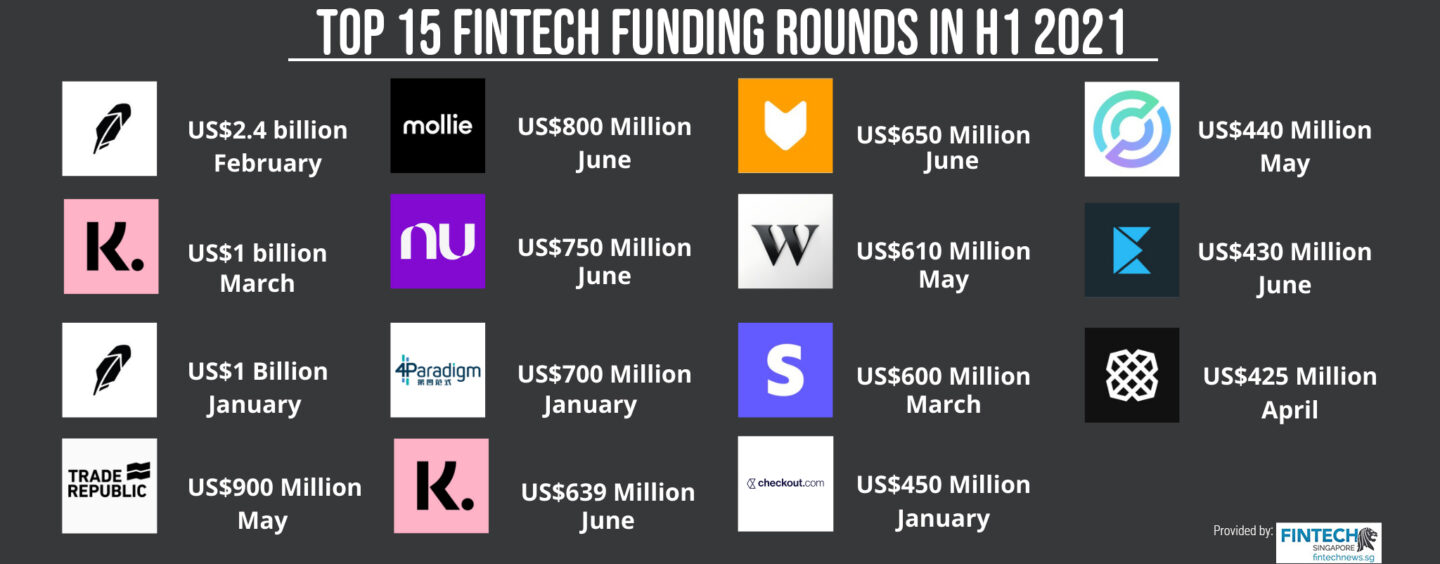

Top 15 Fintech Funding Rounds in H1 2021 Exceed US$ 11 Billion

by Fintech News Singapore July 7, 2021Fintech companies are having a record year 2021. In Q1’21, venture capital (VC)-backed fintech companies raised US$22.8 billion, making it the largest funding quarter since 2018, according to CB Insights. Fintech funding growth was global with nearly every continent recording an increase, and mega-rounds of US$100 million and over drove the quarter funding surge, accounting for 69% of total funding globally.

The momentum continued in Q2’21 with massive rounds being closed by the likes of Trade Republic, Mollie, Nubank and Klarna. Now looking at the first half of 2021, the top 15 largest fintech funding rounds raised a cumulated US$11.7 billion, an analysis by Fintech News shows.

These mega-rounds went towards fintech companies operating in various segments ranging from payment and trading, to open banking and cryptocurrencies. Most of them received funding to support their growth after experiencing massive surge in activity during the COVID-19 pandemic.

Robinhood – US$2.4 billion (Feb)

Trading app Robinhood raised the largest fintech funding of H1 2021, closing a US$2.4 billion round in February on the back of booming retail trading activity. Robinhood has become hugely popular since COVID-19. The capital injection was aimed at supporting surging consumer demand.

Klarna – US$1 billion (Mar)

Buy now pay later (BNPL) leader Klarna raised the second largest funding round of H1 2021, bagging US$1 billion in March. The round turned it into the highest-valued European private fintech and came on the back of booming online shopping activity during the global pandemic. Klarna has over 90 million global active users, and processes 2 million transactions a day.

Robinhood – US$1 billion (Jan)

The third largest round went towards Robinhood. The US$1 billion cash infusion came after high volumes and volatility of trading strained it during the month of January. Robinhood has been one of the hottest venues in the retail-trading frenzy. The company filed for an initial public offering (IPO) last week.

Trade Republic – US$900 million (May)

Broker app Trade Republic raised a US$900 million Series C funding round in May, becoming Germany’s biggest private fintech firm by valuation at US$5.3 billion, according to CB Insights data. Trade Republic, which allows users to trade stocks, ETFs, cryptocurrencies and other financial products through a mobile app, serves over one million customers.

Mollie – US$800 million (Jun)

Dutch payment startup Mollie raised a US$800 million Series C funding round in June, becoming the biggest private company by valuation at US$6.5 billion, according to CB Insights data. Mollie, which allows businesses to integrate payments into sites, documents and other services through an API, currently has 120,000 monthly active merchants, and is adding between 400 to 500 new customers each day.

Nubank – US$750 million (Jun)

Brazilian digital bank Nubank raised in June a US$750 million extension to its Series G (which rang in at US$400 million this past January), bringing its valuation to US$30 billion. This makes Nubank the third most valued fintech companies. Nubank, one of the biggest digital banks in the world serving some 40 million customers, has reportedly initiated preparations for a US stock market listing which could come as early as this year.

4Paradigm – US$700 million (Jan)

Artificial intelligence company 4Paradigm raised a US$700 million Series D funding round in January to support its enterprise-grade AI-based digital services. Since its founding six years ago, the company has worked with clients in virtually every major sector, including finance, retail and manufacturing, helping firms solve business problems and drive digital transformation.

Klarna – US$639 million (Jun)

Following its massive US$1 billion cash injection announced in March, BNPL leader Klarna raised an additional US$639 million in June, lifting its valuation to about US$46 billion. The company is expected to make a stock market debut either later this year or next year, and will likely take the direct listing route.

Wefox – US$650 million (Jun)

Germany’s digital insurance company Wefox closed a US$650 million Series C funding round in June, resulting in a post-money valuation of US$3 billion. The company claims the round is the largest Series C to date for an insurtech globally. Wefox, a fully licensed digital insurance company that sells insurance through intermediaries, said it will use the proceeds to expand into the US and Asia.

Wealthsimple – US$610 million (May)

Canadian online brokerage Wealthsimple hit a US$4 billion valuation after raising a US$610 million round in May. Wealthsimple currently serves two million users, providing them with trading and automated-investing capabilities. The company said it may use some of that money to make acquisitions as it works to expand its userbase more than sevenfold.

Stripe – US$600 million (Mar)

In March, payment giant Stripe became the most valuable startup in the US after closing a US$600 million round at a US$95 billion valuation. Stripe, which competes with Square and PayPal, is used by businesses to access payments, serving the likes of Amazon.com, Salesforce.com and Lyft. Stripe said it will use the funding to expand its business in Europe, with a focus on its European headquarters, and also to beef up its global payments and treasury network.

Checkout.com – US$450 million (Jan)

Payment solution provider Checkout.com raised a US$450 million Series C funding round in January. The deal gave it a post-money valuation of US$15 billion and turned it into the UK’s most valued private company. Checkout.com, which wants to build a one-stop-shop for all things related to payments, said it will use the proceeds to further grow its balance sheet and drive new innovative opportunities.

Circle – US$440 million (May)

Crypto firm Circle completed a US$440 million fundraising in May. The company, which builds digitally-native payments and financial solutions on public blockchain, said its platform has supported more than 100 million transactions by over 10 million retail customers and more than 1,000 businesses. Circle is also a principal developer of stablecoin USD Coin (USDC).

Ebanx – US$430 million (Jun)

Brazilian payment company Ebanx closed a US$430 million funding round in June. The company plans to use the proceeds from acquisitions to further expand operations in countries such as Mexico, Colombia and Argentina. Ebanx, which focuses mainly on processing online payments form large firms including Aliexpress, Airbnb and Spotify, is likely to launch an IPO in the US by the beginning of 2022, reports Reuters.

Plaid – US$425 million (Apr)

US open banking leader Plaid raised a US$425 million Series D funding round in April. The new funding pushed Plaid’s valuation to US$13.4 billion, a huge jump from the US$5.3 billion for which Visa had agreed to buy Plaid just over a year ago. The company, which lets users connect their bank accounts to finance apps, integrates with 11,000 financial institutions.