How Will PayPal and Citi Fare in Australia’s Crowded BNPL Space?

by Fintech News Singapore July 21, 2021Competition is heating up in Australia’s buy now, pay later (BNPL) market as US digital payments giant PayPal and incumbent bank Citi are entering the \vercrowded space.

Just last week, PayPal launched its BNPL service to retailers in Australia, a four instalments option for purchases between A$30 and A$1,500. PayPal says PayPal Pay in 4 incurs no interest, no late payment fees and no sign-up fees, with only currency conversion fees potentially applicable to international purchases.

PayPal started rolling out the service in the US in October 2020 and has since offered it in the UK and France.

Boasting over 9 million active accounts and with strong expertise in fintech and deep insights into customers’ spending habits, analysts and industry observers have said that PayPal Pay in 4 could be a strong contender to homegrown leaders Afterpay and Zip Pay.

“PayPal will also offer a much higher borrowing limit than its peers, which positions them more competitively,” John Lobb, portfolio manager for Insync Funds Management, said in statement.

“I think PayPal has a potentially better BNPL than its competitors given their customer base, their knowledge of clients’ spending behavior and their credit worthiness. They won’t charge retailers any extra fees. PayPal will charge 2.9% p.a. instead of Afterpay’s 3-5%. It can be used anywhere in the world where PayPal is accepted.

“Customers can borrow up to A$1,500 depending on their credit rating, which they will already know for existing users. Afterpay and other new entrants have much more modest lending limits.”

The launch of PayPal Pay in 4 in Australia follows the announcement that Citi Australia, the country’s fifth-largest provider of credit cards, will be entering the BNPL arena, following the lead of other incumbent banks including the Commonwealth Bank of Australia (CBA) and Westpac.

Citi said in June that it will launch a BNPL business through a Mastercard proposition. The business, which will run under a new brand, will give customers access to up to A$1,000 initially to be repaid in four installments over six weeks. It will not charge customers any interest, though for a small fee, consumers will be able to access longer-term repayments or larger lines of finance.

Australia’s overcrowded BNPL industry

PayPal and Citi are joining Australia’s overcrowded BNPL market, which not only comprise pure players like Openpay and Payright but also traditional banks and tech firms.

CBA is planning to launch its BNPL StepPay service soon, which will be offered side-by-side with Klarna. Tech giant Apple is preparing a BNPL product called Apple Pay Later, which will be available as an option on Apple Pay, according to Bloomberg.

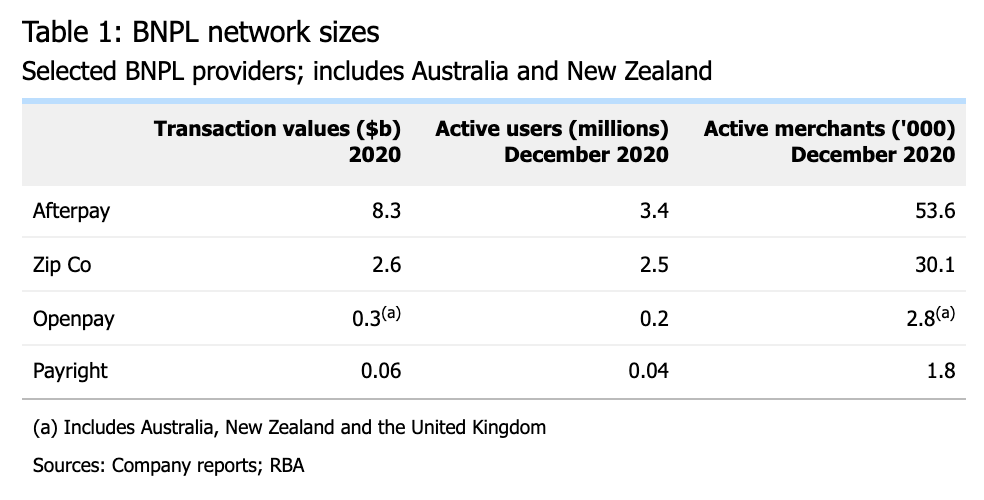

The Reserve Bank of Australia estimates that there are about 20 BNPL services in the Australian market offered by more than a dozen providers. The two largest providers are homegrown Afterpay and Zip Pay, which combine a customer base of around 6 million active BNPL user accounts as of December 2020.

BNPL network sizes, Table by the Reserve Bank of Australia, March 2021 Bulletin

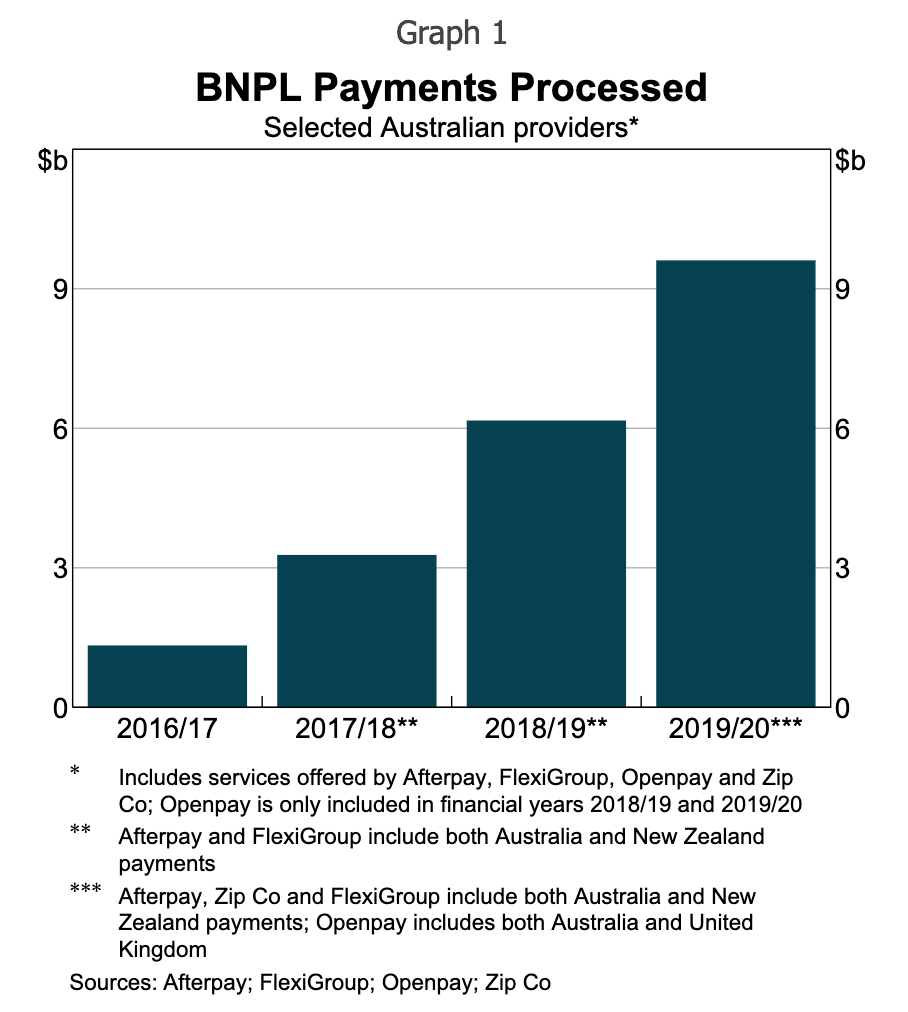

While industry-wide data are not readily available, company reports for a number of listed BNPL providers indicate that the value of BNPL transactions in Australia grew by around 55% in 2019/20 and tripled over the previous 2 financial years. In 2019/20, these listed BNPL entities processed around A$10 billion of purchases in Australia and New Zealand.

BNPL Payments Processed, Graph by the Reserve Bank of Australia, March 2021 Bulletin

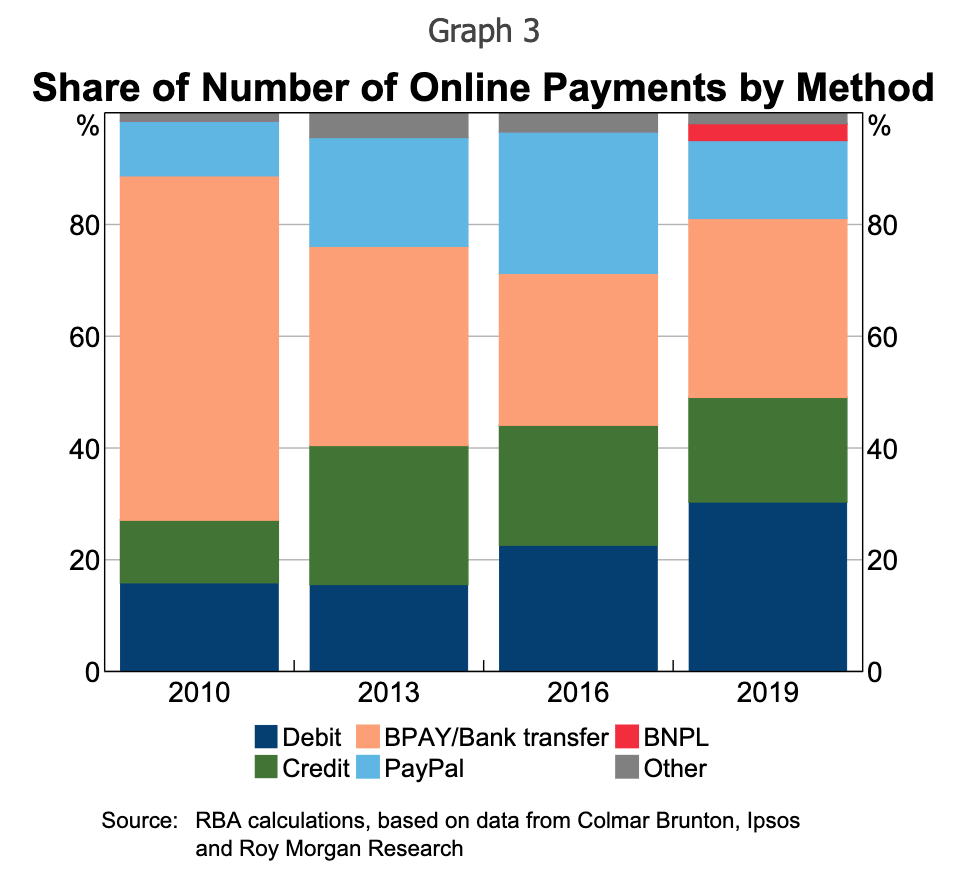

Though BNPL volumes have surged in recent years, their share in the broader consumer payments space remains small. Results of the Reserve Bank of Australia’s 2019 Consumer Payments Survey (CPS) found that less than 1% of the number and value of consumer transactions made over the survey week (including those made in cash) were made using BNPL.

Share of Number of Online Payments by Method, Graph by the Reserve Bank of Australia, March 2021 Bulletin

Respondents also reported using BNPL infrequently. Of the self-identified BNPL users, 70% made a BNPL purchase every few months or less often. Only 3% said they used BNPL at least once a week.