What Are NFTs? Behind the Trend That’s Taking the World by Storm

by Fintech News Singapore August 30, 2021In March 2021, Mike Winkelmann, a digital artist, sold a piece of his digital art for a whopping $69.3 million. The buyer of the piece called ‘Everydays: The First 5,000 days’, was Vignesh Sundaresan, a blockchain entrepreneur who is based in Singapore. Prior to this historic sale, Winkelmann, also known as Beeple, used to sell his print for only $100. However, things took a turn when he first sold his series of non-fungible tokens (NFTs) in October 2020 for $66,666.66 each. By December, he had successfully sold a series of works for a total of $3.5 million.

In an interview with CNBC, Sundaresan explained that the reason behind his willingness to pay such a high amount of money for the work is his belief that the rise of NFTs has signalled a new era where technology is enabling easier and more democratic art transactions for artists and collectors.

It is undeniable that NFTs are certainly rising in popularity in recent times, that even famous brands such as Coca Cola and Taco Bell have launched their own NFTs. But what exactly are NFTs and what’s behind the trend that’s taking the world by storm?

What are NFTs?

NFTs are digital assets, including JPEGs and video clips, on the blockchain that have unique identification codes and metadata. They are powered by smart contracts, generally on the Ethereum blockchain. Among other NFT blockchain platforms are the Flow and Wax blockchain platforms. Representing real-world objects such as art, music, and videos, they are bought and sold online, usually with cryptocurrencies.

Generally, anything that is unique and requires proof of ownership can be minted as an NFT. For example, Jack Dorsey, the founder of Twitter, sold his first ever Tweet, with the iconic words, “just setting up my twttr” as an NFT for $2.9 million in March 2021, fifteen years after the tweet was first posted in March 2006.

How do NFTs work?

NFTs basically create a digital certificate on the blockchain for the asset they represent, with information such as the owner and the seller of the asset. Each NFT can only have one official owner at a time.

The process of converting an asset from a basic file to an NFT is called minting. For example, in the case of common NFTs such as digital graphics, the file is simply uploaded and minted directly onto the NFT marketplace. The process is also similar for music, but in this case, a high-quality MP3 file and audio art are required.

NFTs and Ethereum

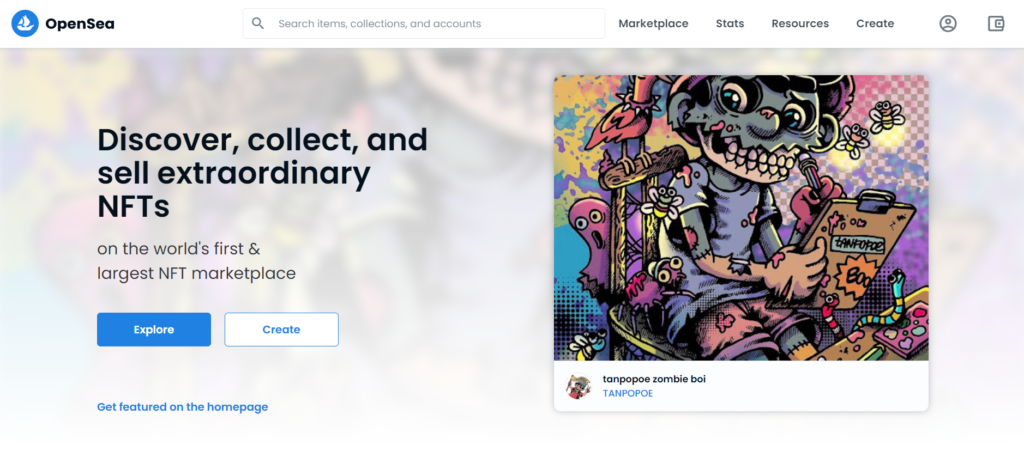

Ethereum is one of the more popular blockchain platforms for creating NFTs. In fact, CryptoPunks was one of the first NFTs on the Ethereum blockchain. Additionally, some of the more popular NFT marketplaces have also been built on Ethereum, such as OpenSea and Rarible.

The Difference Between NFTs and Fungible Tokens

NFTs differ from fungible tokens such as cryptocurrencies, namely in these three areas:

Interchangeability

Fungible tokens can easily be exchanged with another token of the equivalent kind. For example, one Bitcoin can be exchanged with another Bitcoin, just like a $10 bill can be interchanged with another $10 bill. One can use fungible tokens to make payments, making fungibility an important feature for currencies. However, this is different when it comes to NFTs as they are not interchangeable with another NFT of the same type, as each NFT is unique.

Uniqueness

Each fungible token has identical features and traits, but as explained earlier, each NFT is unique. An NFT with rare and desirable features typically has a higher value due to its scarcity, just like how a rare antique item has a higher market value in the market. However, it is also worth noting that what makes an NFT valuable and appealing to one person may not necessarily be the same for another person, unlike fungible tokens that have a universally equal value.

Divisibility

Unlike NFTs that are not divisible, each fungible token is divisible into smaller units to form the same value.

Why are NFTs getting popular?

As of August 25, OpenSea, the largest NFT trading platform, has reached a sales volume of $1.9 billion. In comparison, the platform only achieved $148 million in March and over $8 million in January 2021. So, what could be behind this growing appeal of NFTs?

For one, NFT allows for exclusive ownership rights because NFTs can only have one owner at a time. Proof of ownership is managed via the unique ID and metadata that cannot be replicated. This unique data also allows for easy verification of the ownership and transfer of tokens between the owners. Secondly, NFT also prevents the forgery of items as the transactions that are recorded on the blockchain are impossible to tamper with.

More importantly, the creation of NFTs also mutually benefits both creators and buyers by removing the role of intermediaries who take a commission. For example, by creating an NFT, an artist can directly access potential buyers on any marketplace platform without needing the services of an intermediary. Additionally, creators can also program the NFTs so that they receive royalties every time the NFT is sold to another owner.

Popular NFT Trends

One of the more popular sensations when it comes to NFTs are CryptoPunks, which are 10,000 uniquely collectable characters with the proof of ownership stored on the Ethereum blockchain. Each unique CryptoPunk is generated algorithmically and measures 24 pixels by 24 pixels.

Most of the CryptoPunk NFTs are males and females, but there are rare types such as apes, zombies and aliens. CryptoPunks is described as an inspiration for the ERC-721 (Ethereum Request for Comments) standard behind most digital art and collectables. Although initially anyone with an Ethereum wallet could claim a CryptoPunk for free, now they can only be purchased on the marketplace that is embedded in the blockchain. In August 2021, Visa also jumped on the NFT bandwagon by purchasing the CryptoPunk 7610.

Pudgy Penguins are another favourite NFT trend. As the name implies, they are basically NFTs of chubby penguins recorded on the Ethereum blockchain. Similar to CryptoPunks, these penguins are limited in number, with only 8,888 of them in existence.

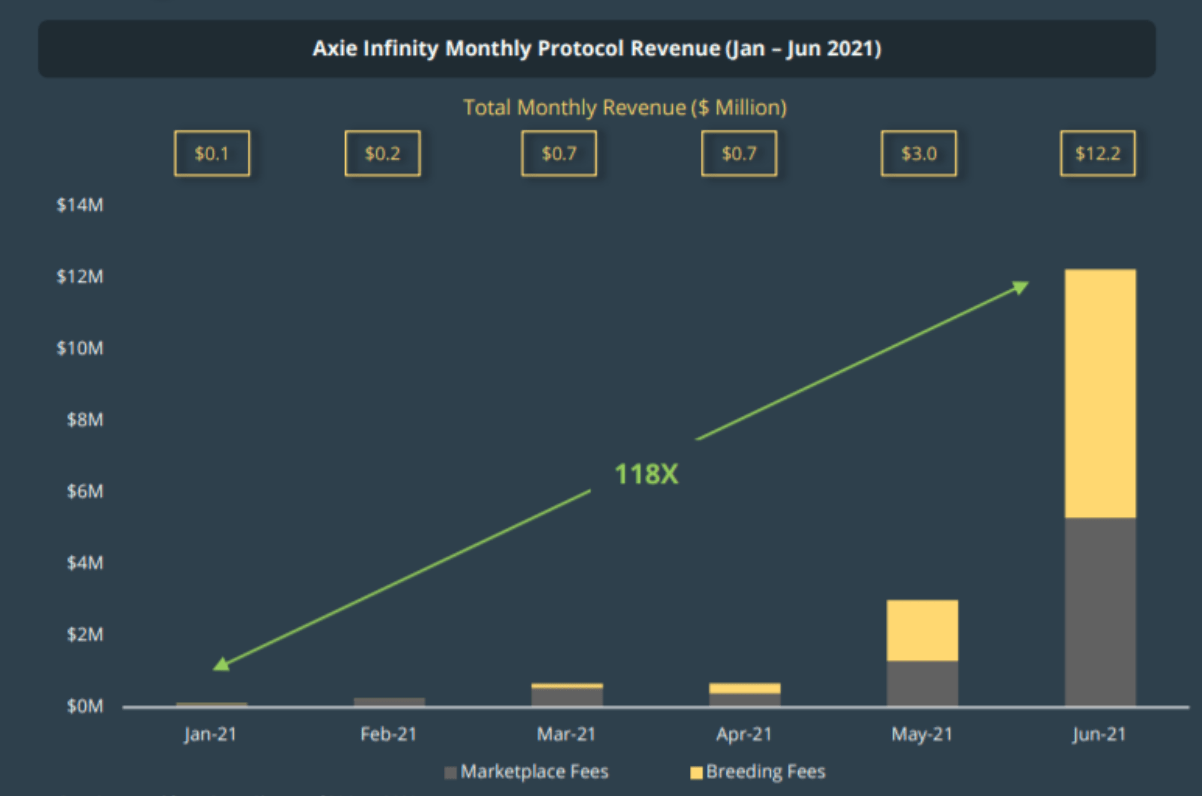

In recent days, Axies are also becoming very popular in the NFT space. Axies, or Axies Infinity Monsters, are NFTs in the blockchain-based game, Axie Infinity. It appears that the growing appeal of this game lies in the fact that users can cash out the coins that they earn. Additionally, they also have the option of selling their Axies on the game’s marketplace. One user from the Philippines reportedly earned more than $732 in his first two weeks of playing this game.

Axie Infinity Monthly Protocol Revenue from January to June 2021, where the revenue is generated from breeding fees and trading fees, Source: CoinGecko

What Lies Ahead for NFTs?

The use of NFTs has been expanding into various sectors of the economy as well. For example, in the DeFi space, LandOrc, a company that is headquartered in the United Arab Emirates, provides digitalised real estate solutions by incorporating NFTs in Decentralised Financing (DeFi) technology. The land NFT represents the land title on the blockchain to facilitate easy tracking in changes of ownership and subsequently using it as collateral for lending.

In another sector, EY has announced that it is helping to develop a blockchain platform for one of its clients, WiV Technology, to help consumers ascertain the quality, authenticity, and provenance of the wines. The blockchain components that have been developed by EY include an NFT structure called WiV Wine Asset Tokens, deployed on the Ethereum blockchain. Using a smart contract, information such as the ownership, provenance, and transaction history can be tracked, and each case is given a token that has a unique identifier, and its properties are stored as detailed metadata. Through this, the WiV solution will address the issue of counterfeiting and substitutions, which is a major hurdle in wine investments.

However, despite the growing popularity of NFTs, there are still pertinent issues surrounding NFTs that are yet to be addressed. One such issue lies in copyright ownership, which is a key factor for creative work. Even though NFTs represent a digital certificate, buyers do not own the copyright or intellectual property rights of the asset. For example, in the case of an artwork, the original artist still retains the copyright and reproduction rights of the art piece.

So, while the world of NFTs continues to evolve and garner its share in the spotlight, it will certainly be interesting to see what the future holds for NFTs.

Featured image credit: Network vector created by pikisuperstar – www.freepik.com