In Southeast Asia, New Digital Habits Boost Digital Payments and Consequently Fraud

by Fintech News Singapore September 13, 2021COVID-19 has sparked a global spike in e-commerce sales and online businesses as lockdowns force consumers to turn to online channels to shop. As everyone embraces e-commerce, cashless payment methods including cards and digital wallets have surged, bringing with it new fraud and security risks.

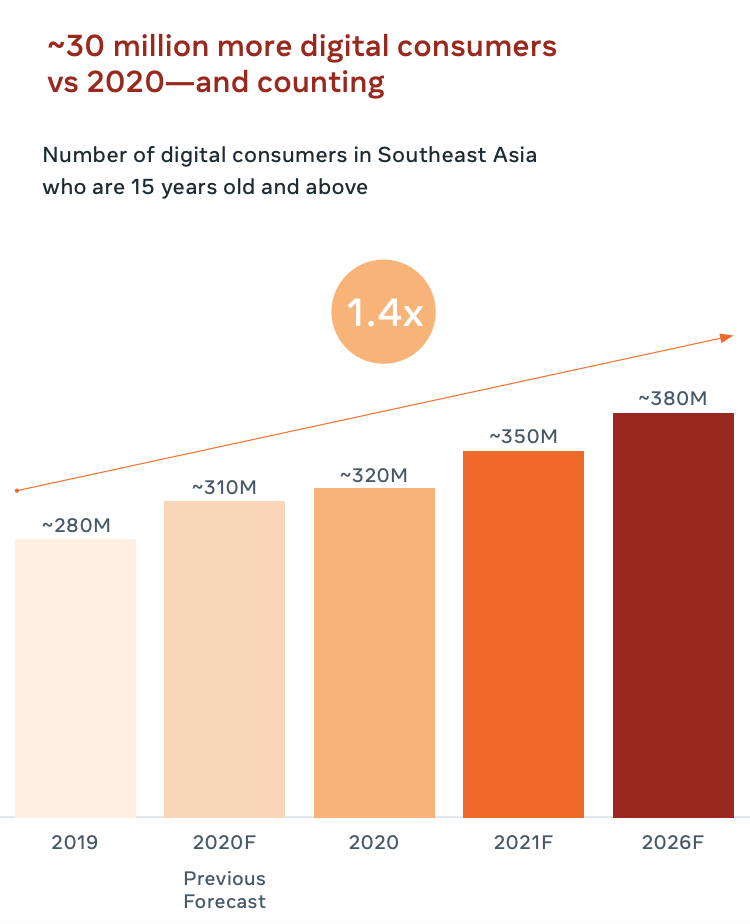

Since the start of the pandemic, 70 million people in Southeast Asia have become digital consumers, according to Facebook and Bain & Company’s 2021 Digital Consumer Report. Nearly half of them, or around 30 million people, became digital consumers from 2020 to 2021 alone.

By the end of 2021, the report projects that there will be 350 million digital consumers in Southeast Asia, which means that almost 80% of consumers in the region will have gone digital. By 2026, Southeast Asia’s digital consumer population is expected to reach around 380 million, which is 1.4x bigger than it was in 2019.

Number of digital consumers in Southeast Asia who are 15 years old and above, Source: 2021 Digital Consumer Report, Facebook and Bain and Company

Southeast Asians’ new digital habits

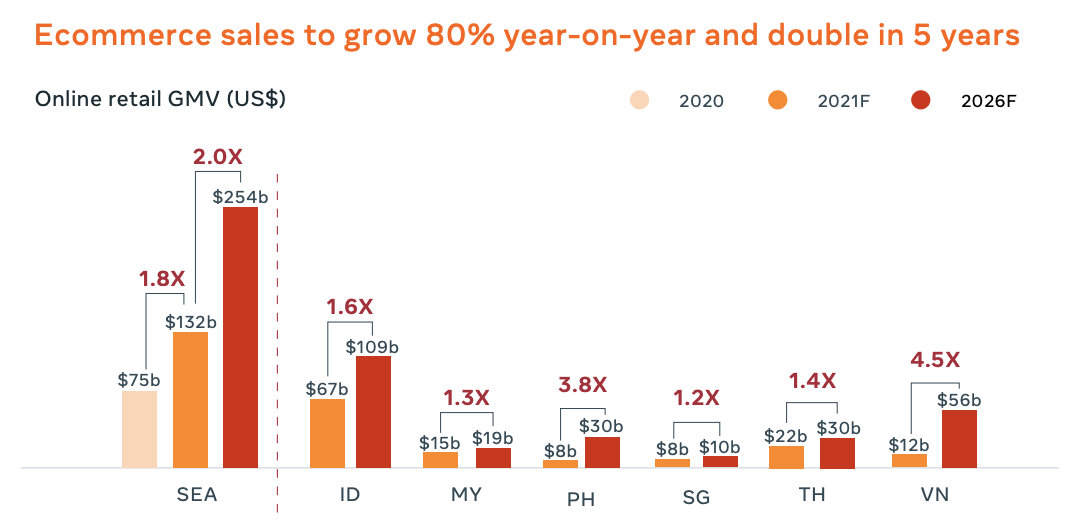

By the end of this year, Southeast Asia’s e-commerce gross merchandise value (GMV), which refers to the monetary value of goods or services sold through online marketplaces, is projected to reach US$132 billion, which represents a 1.8x increase compared to the US$75 billion recorded in 2020.

In five years, e-commerce GMV is expected to reach US$254 billion, nearly doubling what it is set to be by the end of 2021. Growth will be particularly strong in emerging markets, including Vietnam, the Philippines and Indonesia, where e-commerce GMV is set to grow 4.5x, 3.8x and 1.6x, respectively.

Online retail GMV (US$), Source: 2021 Digital Consumer Report, Facebook and Bain and Company

Strong e-commerce activity will continue to fuel cashless payments, which have already experienced significant growth over the past two years.

Visa’s Consumer Payment Attitudes Study 2021 found that 64% of consumers in Southeast Asia have attempted to go cashless, particularly consumers in Vietnam (84%), Thailand (82%) and the Philippines (79%).

The shift has been largely driven by rising consumer adoption of contactless payments (63%) and card payments (46%), as well as the increase in digital payments acceptance by merchants (41%) and perceived safety of digital payments (40%).

Payment fraud on the rise

Joe Cunningham, regional risk officer for Visa’s APAC operations, warned however that this changing commerce environment is bringing new risks which must be addressed. As digital commerce becomes mainstream, payment security will be key to building trust.

“Fraudsters evolve their methods faster than consumers and most businesses can prepare for,” Cunningham said during the Asia Pacific Visa Security Summit in May. “To stay ahead of the curve, the payments ecosystem must buttress existing infrastructure with enhanced and trusted fraud management solutions.

“In an increasingly digital world, payments security is crucial for consumer trust and must be the foundation of business and commerce, now and in the future.”

Several research have found skyrocketing card not present (CNP) fraud since the beginning of the pandemic. CNP fraud is a category of fraud made via online transactions, telephone or mail where a card is not presented to a merchant for a visual check.

In 2020, CNP fraud accounted for US$6.4 billion in losses, up from US$5.5 billion in 2018. Juniper Research projects that between 2018 and 2023, retailers will be losing up to US$130 billion in digital CNP fraud.

To prevent payment fraud, the 3-Domain Secure (3D Secure/3DS) protocol was introduced nearly 20 years ago by the payment networks. 3DS is a card payment industry specification for CNP transactions designed to strengthen security by allowing cardholders to authenticate their identity.

On September 23, 2021, industry leaders from payment network Visa, Netcetera, a global software company specialized in the areas of secure digital payment, and Cherri Tech Inc., the company behind Taiwanese online payment platform TapPay, will come together to discuss how banks or card issuers can meet the evolving expectations of cardholders and offer protection against card fraud during online payments.

During this webinar, these experts will delve into how merchants can reduce fraud and increase conversion, the new methods for card issuers and banks to authenticate cardholders in case of online payment transaction with higher accuracy, and the various types of authentication methods available.

Participants will also get to learn more about 3DS2, the next authentication protocol for online card payments designed to improve upon 3DS.

Join industry leaders Visa, Netcetera and Cherri Tech Inc. as they delve into how banks or card issuers can meet the evolving expectations of cardholders and offer protection against card fraud during online payments in this webinar.

Featured image: Hand photo created by tirachardz – www.freepik.com