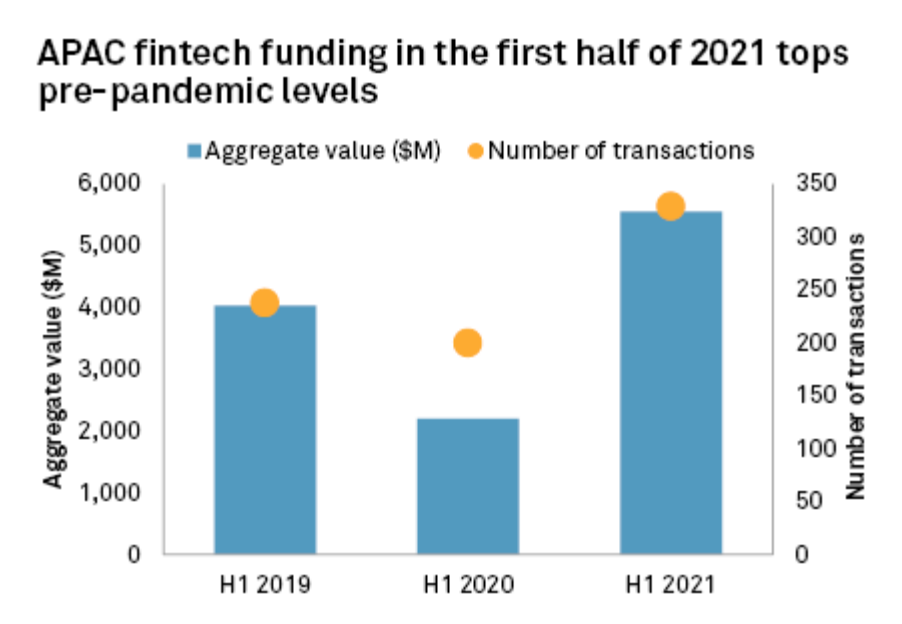

Fintech Funding in APAC Has Doubled This Year to over US$ 5 Billion

by Fintech News Singapore September 21, 2021In H1 2021, fintech funding in Asia-Pacific surged to US$5.56 billion, more than double the same period last year. The figure puts the year 2021 well on track to surpass pre-COVID-19 levels during which fintechs in APAC raised a total of US$9.3 billion in 2019, according to a new report by S&P Global Market Intelligence.

APAC fintech funding in the first half of 2021, Source: S&P Global Market Intelligence, August 2021

Increased digital adoption catalyzed by the pandemic has resulted in APAC’s fintech startups raising mega-rounds to accelerate growth and prompted the more mature ones to go on acquisition sprees.

Indian payment gateway Razorpay announced a US$160 million in Series E funding round in April after raising US$100 million in a Series D in late-2020. With fresh funds in hand, the firm acquired in July TERA Finlabs, a digital lending software-as-a-service (SaaS) provider, in a bid to scale up its lending business. Razorpay has also announced its intent to broaden its reach to Southeast Asia.

In India still, NextBillion, an online brokerage operating as Groww, announced in May the acquisition of the mutual funds business from Indiabulls Housing Finance for US$23.6 million. The move came just one month after the closing of its US$83 million Series D funding round.

The transaction, which was approved by regulators earlier this week, aims to help NextBillion fast track its entry into the asset management space by allowing it to launch its own mutual funds and expand its revenue channel with management fees. Groww currently generates revenue by charging transaction fees on securities trading.

Pine Labs, an Indian digital payments service provider, secured a total of US$600 million this year after announcing in April the acquisition of Malaysia-based Fave Asia Technologies in a US$45 million deal.

The company is reportedly eyeing additional fundraising by the end of 2021 as it looks to expand into West Asia next year. Amrish Rau, CEO of Pine Labs, said in July that he plans to take the startup public within the next 18 months.

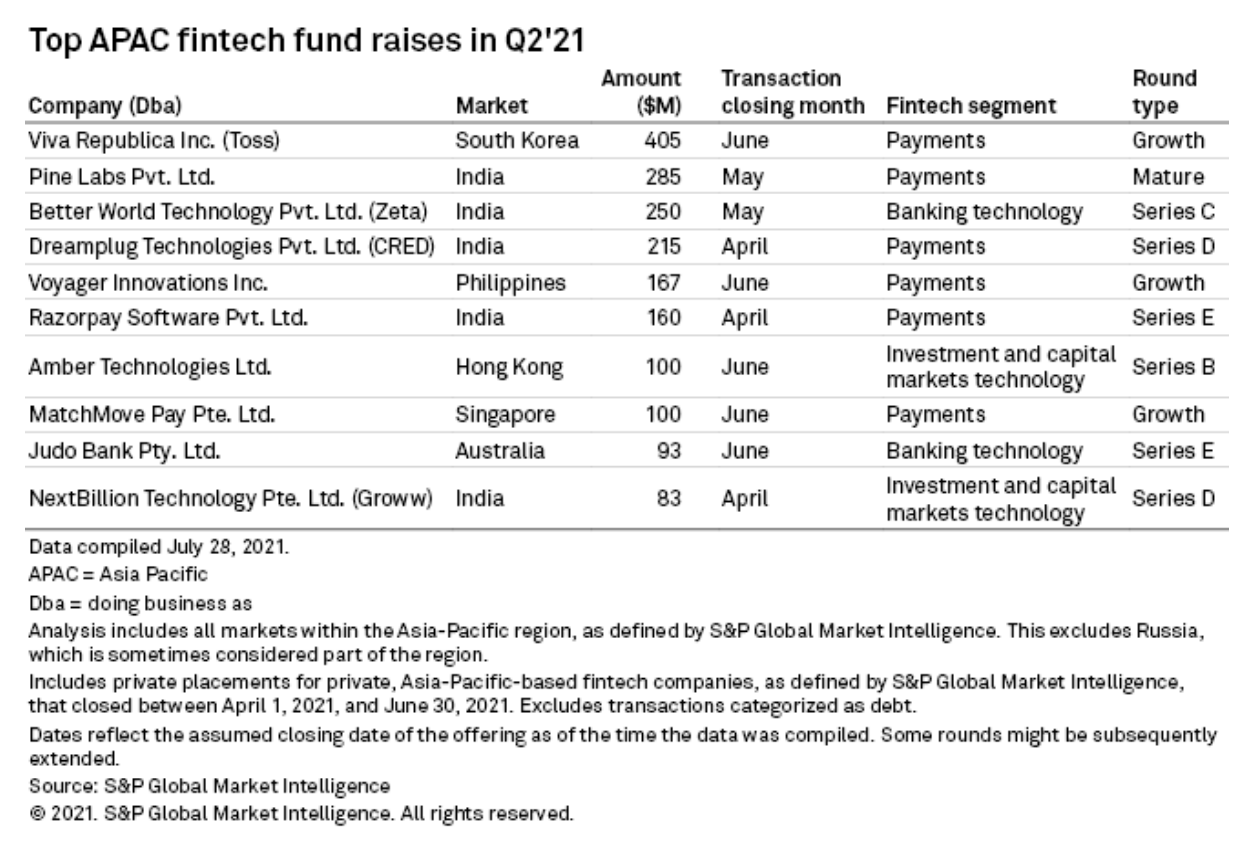

Q2 2021’s top fintech rounds

Out of the top 10 largest fintech funding rounds of Q2 2021, half went to Indian fintech companies.

In addition to NextBillion, Razorpay and Pine Labs, other Indian fintechs that raised massive rounds this past quarter include Better World Technology, a banking technology provider doing business as Zeta, and Dreamplug Technologies is the owner and operator of Cred.

Better World Technology closed the third largest round of the quarter, announcing a US$250 million Series C funding round in May that propelled it to unicorn status. Zeta, which provides the backbone technology for credit and credit-card processing, core banking, loans, mobile banking and personal financial management, plans to expand in the US and Europe, according to a Bloomberg report.

Another Indian fintech startup that reached unicorn status this past quarter is Dreamplug Technologies. It runs Cred, a credit card management and bill payments platform that rewards users for paying their credit card bills on time. The startup closed a US$215 million round in April at a US$2.2 billion valuation.

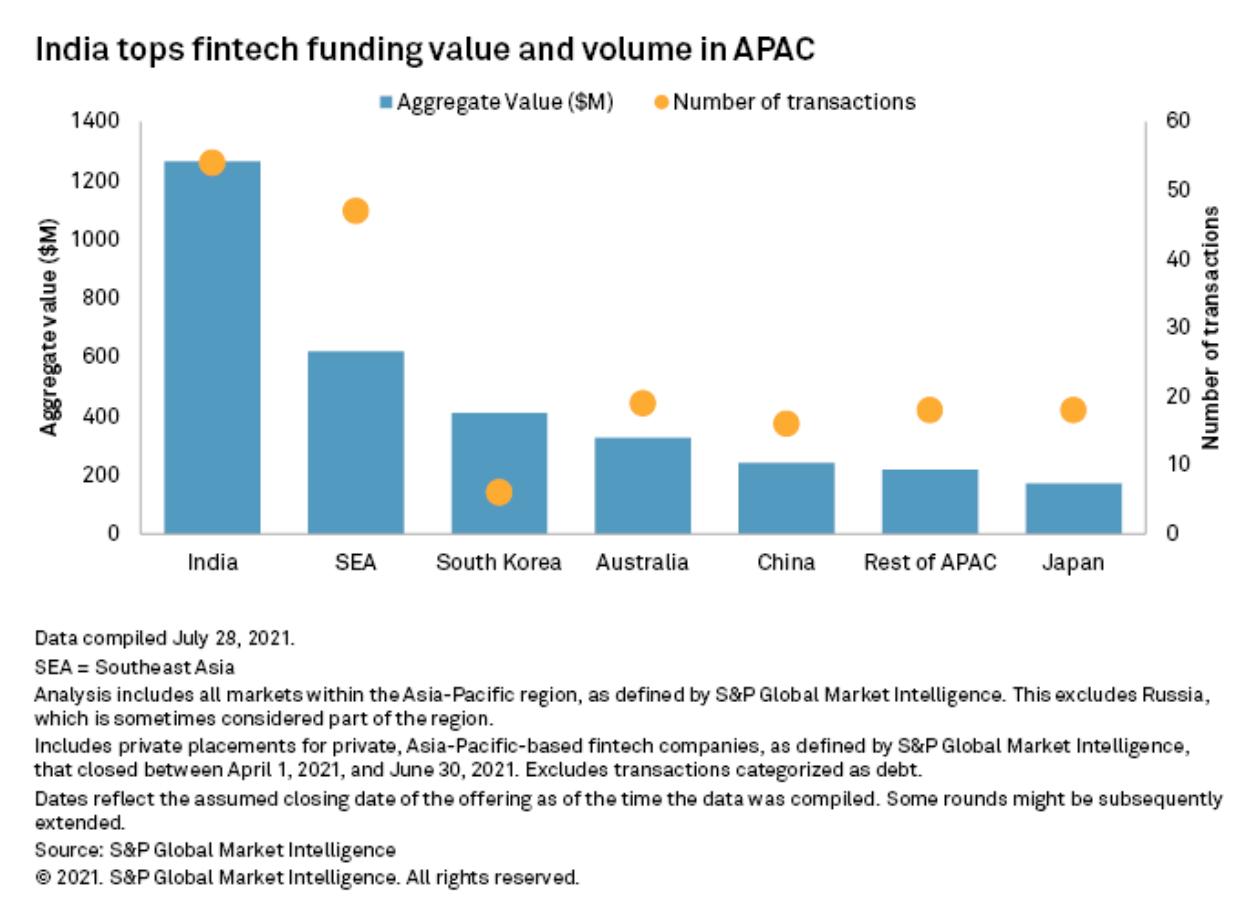

In Q2 2021, India fintech companies drew in US$1.26 billion across 54 deals, topping the chart in both funding value and volume, according to the S&P Global Market Intelligence report.

India tops fintech fund value and volume in APAC, Source: S&P Global Market Intelligence, August 2021

Other notable deals in Q2 2021 included Viva Republica’s US$405 million round in June, the largest funding round of the past quarter – and of H1 2021 –, Voyager Innovations’ US$167 million round, Amber Group’s US$100 million Series B, and MatchMove Pay’s US$100 million funding round in June.

Viva Republica is the Seoul-based fintech company behind super app Toss and South Korea’s most valued private company worth US$7.4 billion, according to CB Insights data. The company is reportedly eyeing a public listing in its home country.

Voyager Innovations is the Manila-based owner of PayMaya, one of the Philippines’ most popular super-apps, providing a range of financial services including digital payments, remittances, bill payments, bank transfers and prepaid cards. The proceeds will go in part towards entering the digital banking space.

Amber Group is a cryptocurrency trading and technology firm from Hong Kong, and MatchMove Pay is a Singaporean company that provides a proprietary banking-as-a-service (BaaS) platform.

Top APAC fintech fund raised in Q2 2021, Source: S&P Global Market Intelligence, August 2021

Featured image credit: People photo created by rawpixel.com – www.freepik.com