Fintech Apps See a Surge in Downloads Amidst the Pandemic

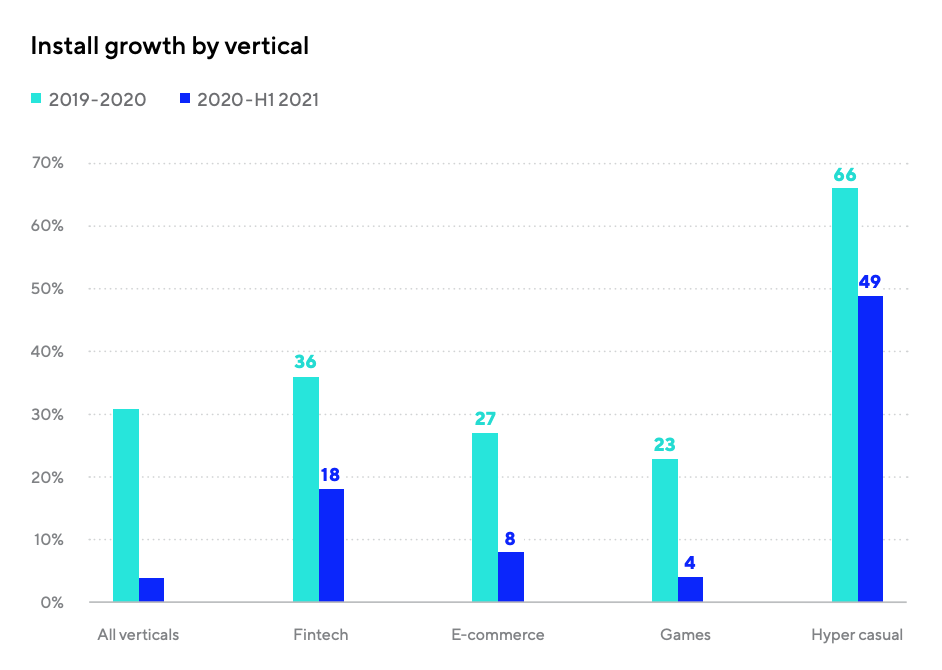

by Fintech News Singapore September 21, 2021Mobile app usage habits and trends have seen a drastic uptick amid COVID-19 and lockdown measures. In Asia-Pacific (APAC), fintech mobile app installs grew 36% in 2019-2020 and 18% in 2020-H1 2021, the second highest growth rates for the period across four key mobile app verticals, according to a report by Adjust, a mobile attribution and analytics company.

The Mobile App Trends 2021: A focus on APAC report looks at emerging trends in seven major APAC markets – India, Indonesia, Japan, Singapore, South Korea, Thailand and Vietnam –, and delves into four key mobile app verticals, namely hyper casual gaming, fintech, e-commerce and non-hyper casual gaming.

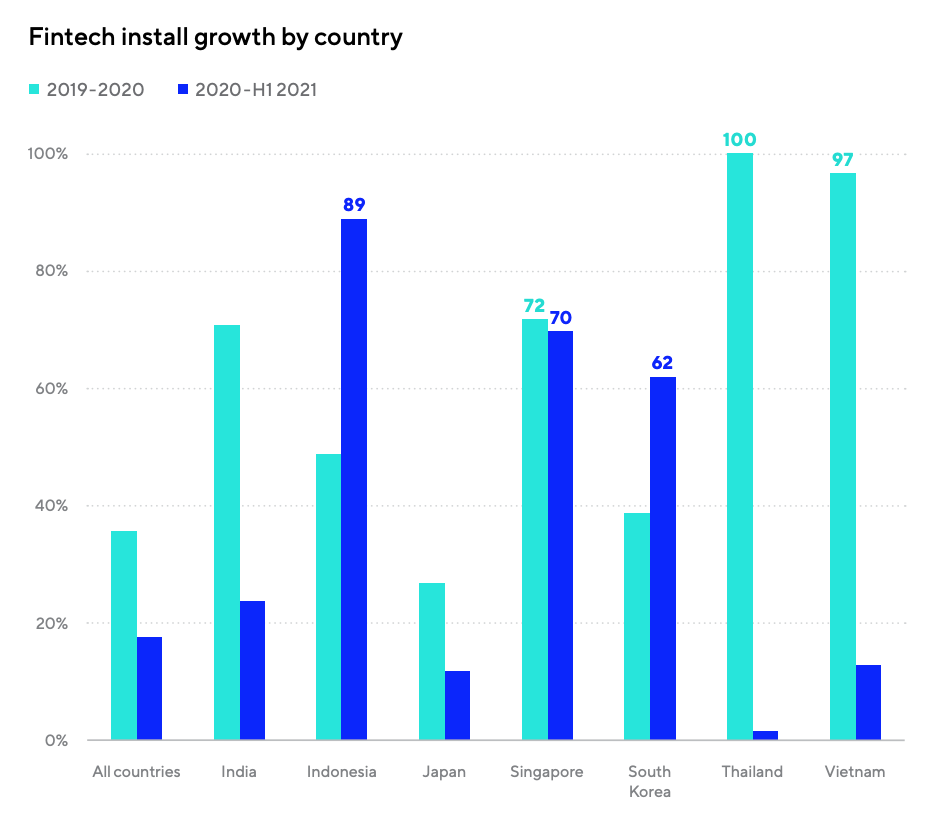

According to the report, Thailand and Vietnam recorded the strongest rise in fintech app installs in 2019-2020, which surged 100% and 97%, respectively. In the 2020-H1 2021 period, growth in these two markets slowed down, but accelerated in other countries, including Indonesia (89%) and Singapore (70%).

Fintech install growth by country, Source: Mobile App Trends 2021: A focus on APAC, Adjust 2021

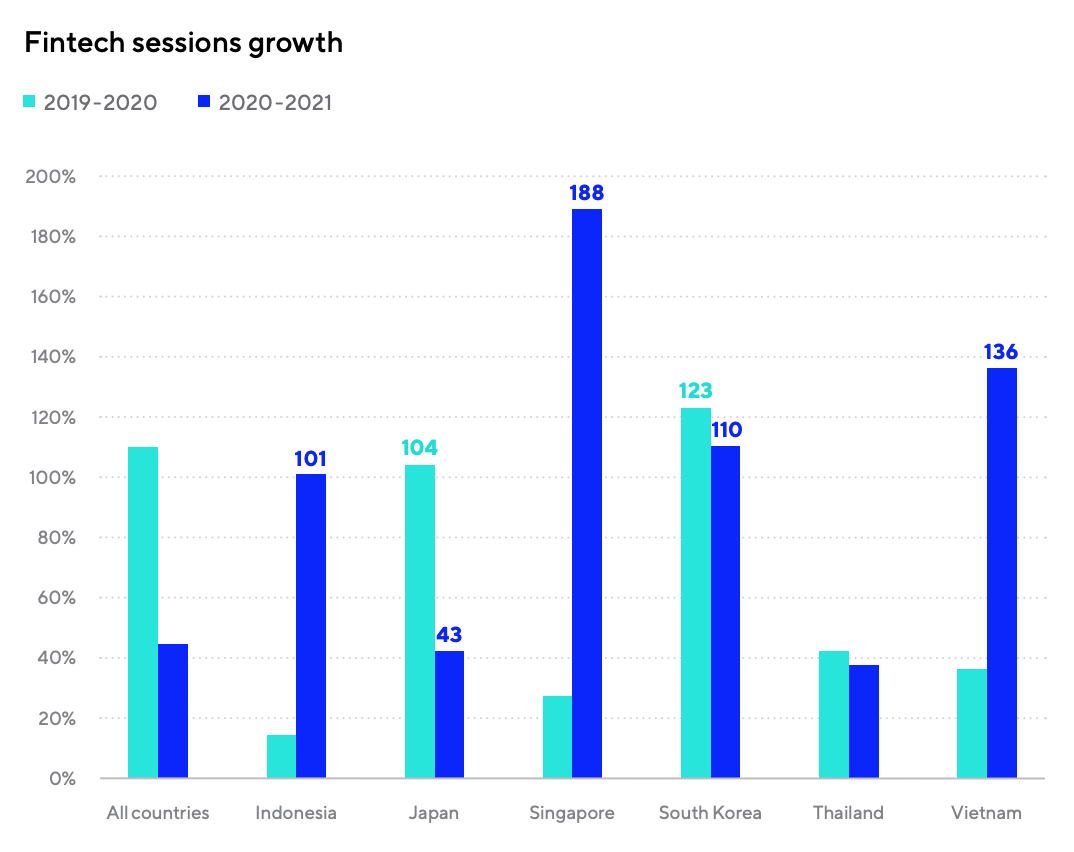

Mobile app sessions increased for all verticals but growth was stronger for fintech mobile apps where sessions rose 110% in 2019-2020 and 45% in 2020-H1 2021.

South Korea and Japan saw the biggest growth rates of 123% and 104%, respectively, in 2019-2020. For the 2020-H1 2021 period, Singapore (188%) and Vietnam (136%) were the ones that stood out.

Fintech sessions growth, Source: Mobile App Trends 2021: A focus on APAC, Adjust 2021

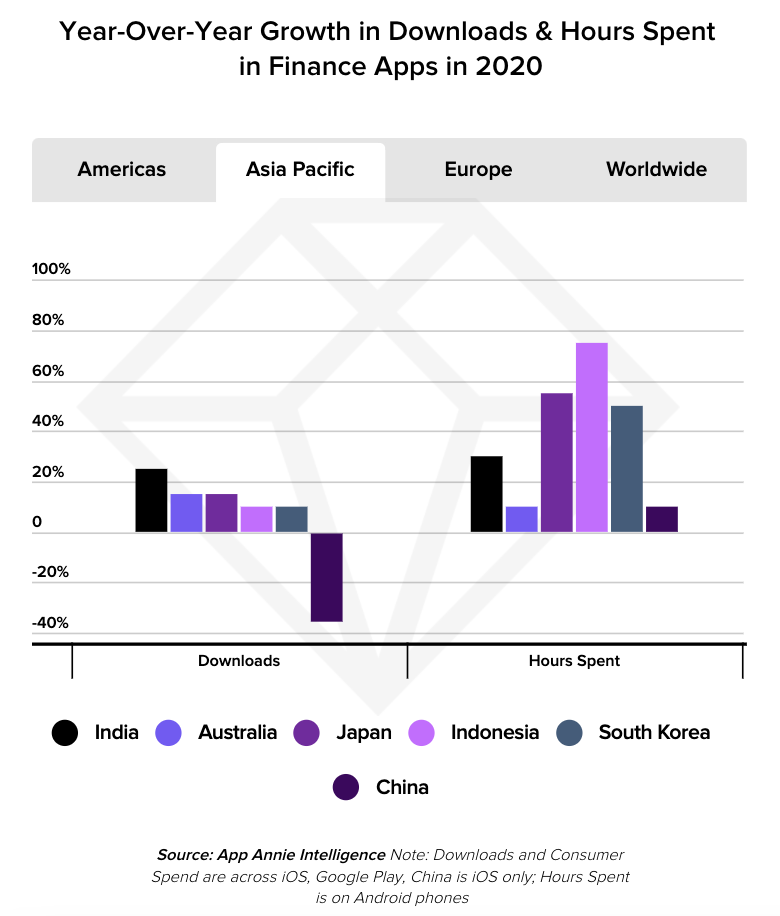

These figures coincide with App Annie’s State of Mobile 2021 research, which also found booming usage of finance mobile apps not just in APAC but globally.

During 2020, time spent on finance apps rose 45% worldwide outside of China. In APAC, the research found that last year, finance mobile app downloads and hours spent grew in nearly all of the six key markets studied. The only exception was China where the decline in downloads was attributed to new legislation in the peer-to-peer (P2P) lending space.

Indonesia recorded the strongest rise in hours spent on finance mobile apps (75%), followed by Japan (55%) and South Korea (50%).

Year-over-year growth in downloads and hours spent in finance apps in 2020, Source: State of Mobile 2021, App Annie, 2021

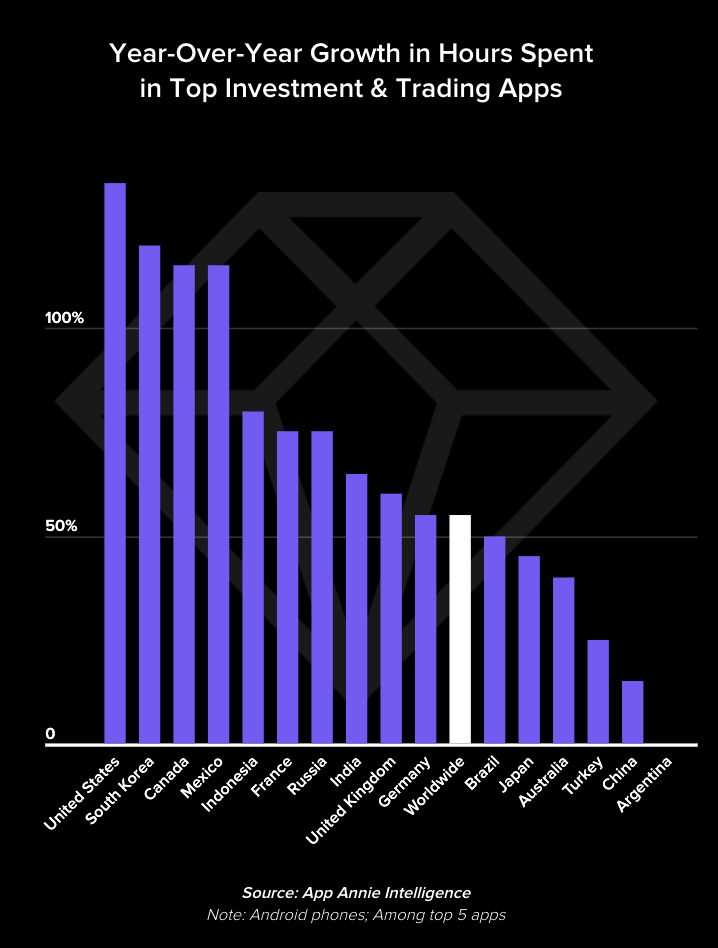

In particular, the past two years have witnessed a surge in the usage of investment and stock trading apps. Globally, participation in the stock market grew 55% worldwide in 2020, according to App Annie.

South Korea led the APAC region last year, recording a year-over-year (YoY) growth of 120% in hours spent in top investment and trading apps. Indonesia and India as well saw significant growth in stock trading apps usage, witnessing a YoY rise of 80% and 65%, respectively.

Year-over-year growth in hours spent in top investment and trading apps, Source: State of Mobile 2021, App Annie, 2021

The pandemic has driven a flood of new retail investors into the stock market. JMP Securities estimates that the brokerage industry added roughly 10 million new clients in 2020, according to app download data from SimilarWeb. More than 6 million of those clients flocked to commission-free stock trading app Robinhood.

In 2021, the retail trading boom continued with an estimated 7.8 million new retail clients entering the market in January and February alone.

The past two years have been rather prosperous for APAC’s mobile app industry. In 2019 and 2020, installs and sessions grew by 31% and 54%, respectively, according to the Adjust report.

All vertical grew but hyper casual gaming, fintech and e-commerce performed exceptionally well in 2020 and 2021. Hyper casual gaming app installs rose the most in both time periods – 66% in 2019-2020 and 49% in 2020-H1 2021 –, followed by fintech, e-commerce (27% and 8%), and non-hyper casual gaming (23% and 4%).

Install growth by vertical, Source: Mobile App Trends 2021: A focus on APAC, Adjust 2021