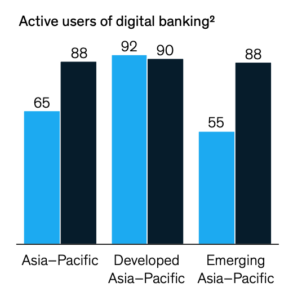

In Asia-Pacific (APAC), the COVID-19 pandemic has brought the digital banking industry to a new level of maturity with penetration now approaching 90% across the region. This surge was largely driven by emerging markets, where adoption soared 33% points between 2017 and 2021, a new survey by McKinsey found.

This year’s Personal Financial Services Survey, which defines digital banking as the use of online or mobile channels to conduct banking operations, revealed that while adoption of digital banking in developed markets such as Australia, Hong Kong and Singapore, has remained stable since 2017 at around 90%, emerging markets like mainland China, Indonesia, Malaysia, the Philippines and Vietnam, have seen penetration soar over the past years, rising from just 54% in 2017 to 88% in 2021.

This jump pushed the region’s overall digital banking penetration rate from just 65% in 2017 to 88% in 2021.

Active users of digital banking, Source: McKinsey Asia-Pacific PFS survey 2021

A new generation of digital banks

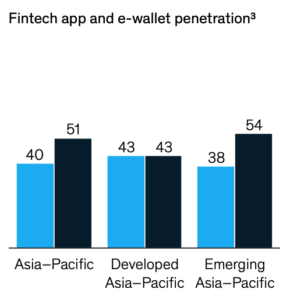

Not only has digital banking usage soared in APAC, but non-traditional financial services like fintech apps and e-wallets also have seen booming adoption. Between 2017 and 2021, the penetration rate of non-bank financial services apps rose from 40% in 2017 to 51% in 2021, driven by emerging markets where adoption jumped from 38% to 54%, the survey found.

In APAC, a new generation of digital banks is emerging on the back of a changing regulatory landscape. Hong Kong has welcomed eight digital banks, Singapore awarded four digital banking licenses in late-2020, the Philippines has begun issuing digital banking licenses, and Malaysia is expected to issue five digital banking licenses by the first quarter of next year.

Fintech app and e-wallet penetration, Source: McKinsey Asia-Pacific PFS survey 2021

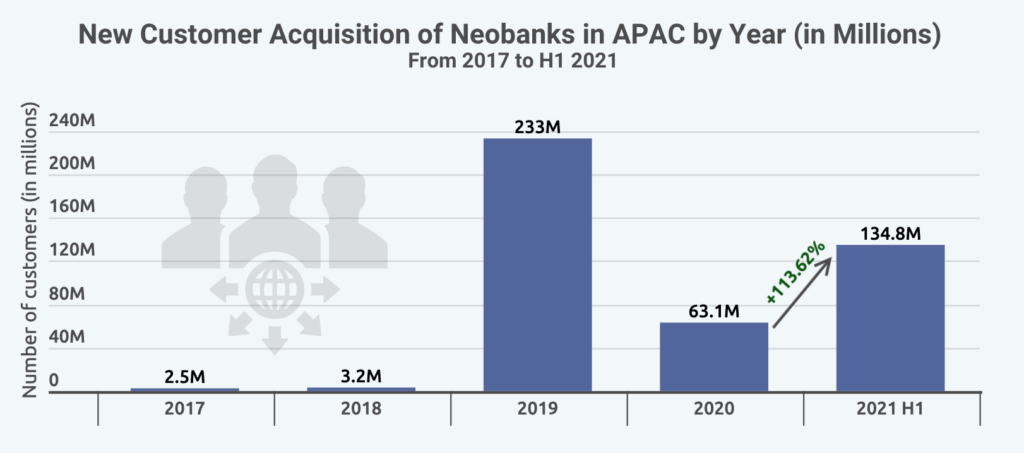

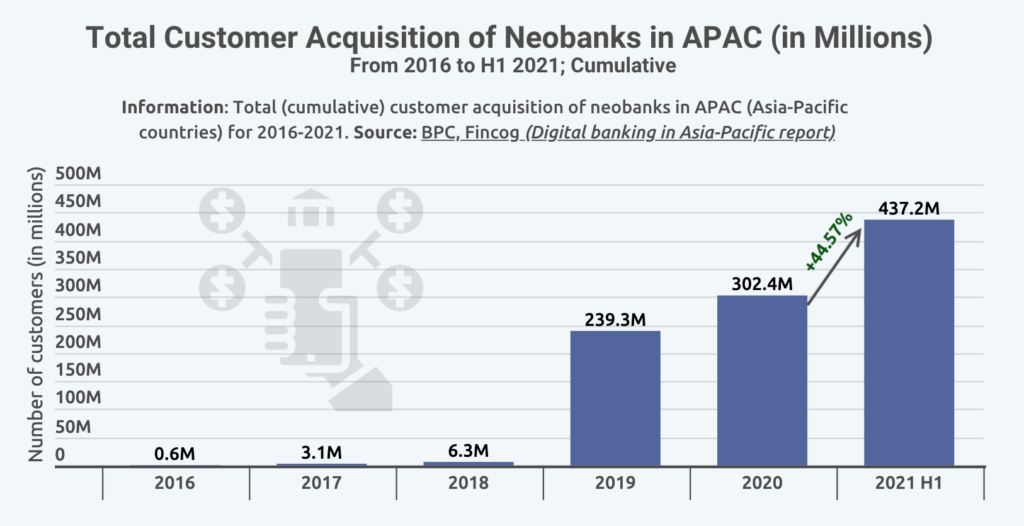

These digital challenger banks and neobanks are rapidly gaining ground. Separate research from paytech company Banking Payments Context (BPC) and the Fintech Consultancy Group (Fincog) found that between 2020 and H1 2021, 134.8 million new customers were onboarded onto APAC neobanks. This represents a 113.6% surge in new customer acquisition compared to 2020’s figure of 63.1 million new customers.

New Customer Acquisition of Neobanks in APAC by Year (in Millions), Source: BPC, Fincog (Digital banking in Asia-Pacific report)

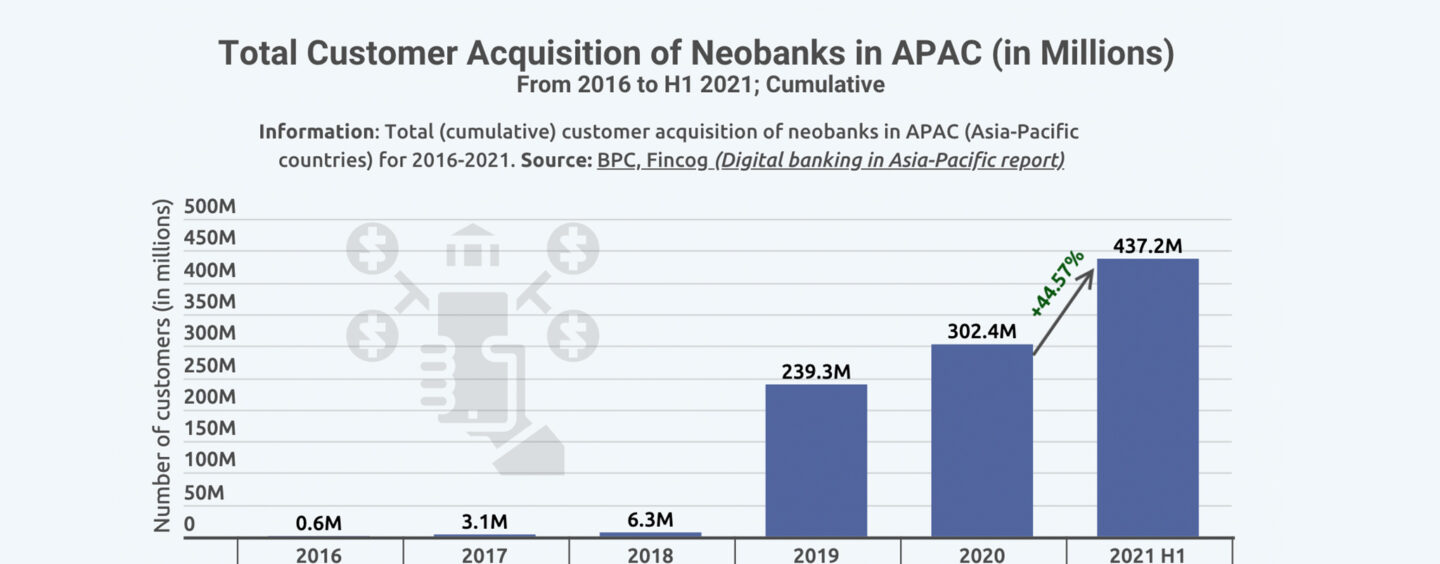

The figure brought the total number of APAC neobank in H1 2021 to 437.2 million, up 44.57% from 2020 at 302.4 million.

Total Customer Acquisition of Neobanks in APAC (in Millions), Source: BPC, Fincog (Digital banking in Asia-Pacific report)

Robo-advisors gain traction

Robo-advisors, or artificial intelligence (AI) and machine learning (ML)-powered digital platforms for wealth management, are also gaining momentum in APAC, and may very well reach scale over time, McKinsey predicts.

In Indonesia, digital advisory platform Bibit has amassed a customer base primarily comprising millennials and first-time investors. StashAway, another robo-advisor operating in Singapore, Malaysia and Hong Kong, attracted more than US$1 billion in assets under management (AUM) in just 3.5 years. And Endowus, from Singapore, has grown to US$740 million AUM in just 20 months.

APAC is home to about 15 million high net worth individuals (HNWIs), the second largest concentration in the world after North America, with an expected growth of 39% by 2024, the highest growth forecast globally, according to KPMG.

The region also has a growing pool of affluent investors who are demanding low cost and convenient digital wealth management solutions. This demographic has driven the growth of robo-advisors and embedded wealth.

Embedded wealth refers to the offering of regulated wealth products by a non-wealth entity. These products can be integrated within pretty much any digital ecosystems, but always aim to provide the most frictionless, convenient purchasing experience. Swiss digital wealth firm Additiv estimates that in APAC alone, embedded wealth represents a US$32 billion opportunity per annum.

Digital shift will remain after the crisis

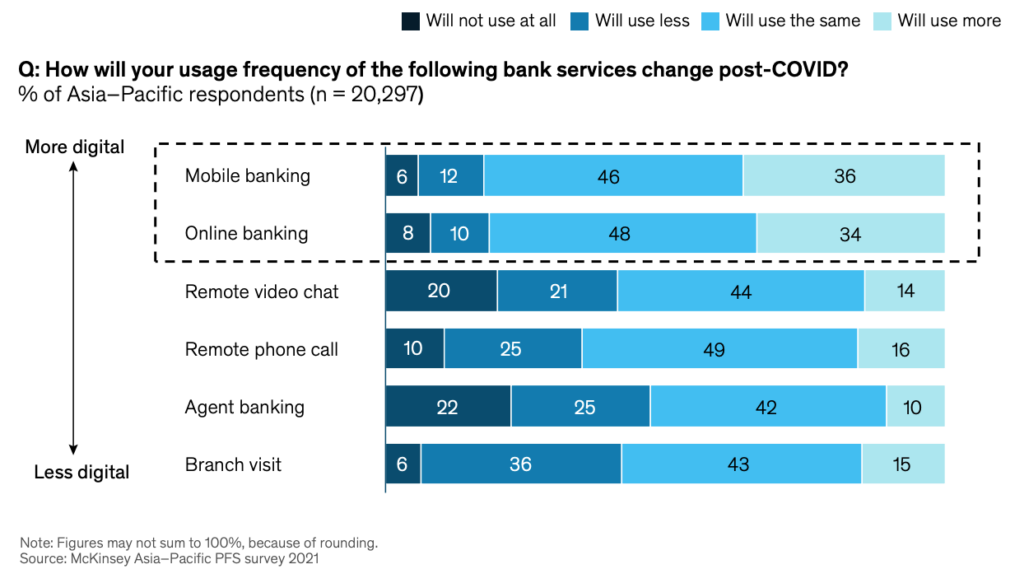

Findings from the McKinsey survey suggest that the digital shift induced by COVID-19 will likely be long-lasting. About 80% of APAC consumers expect to maintain or increase their use of mobile and online channels post-COVID-19, and 42% of respondents anticipate to visit their bank branch either less or not at all when the pandemic ends.

How will your usage frequency of the following bank services change post-COVID?, Source: McKinsey Asia-Pacific PFS survey 2021

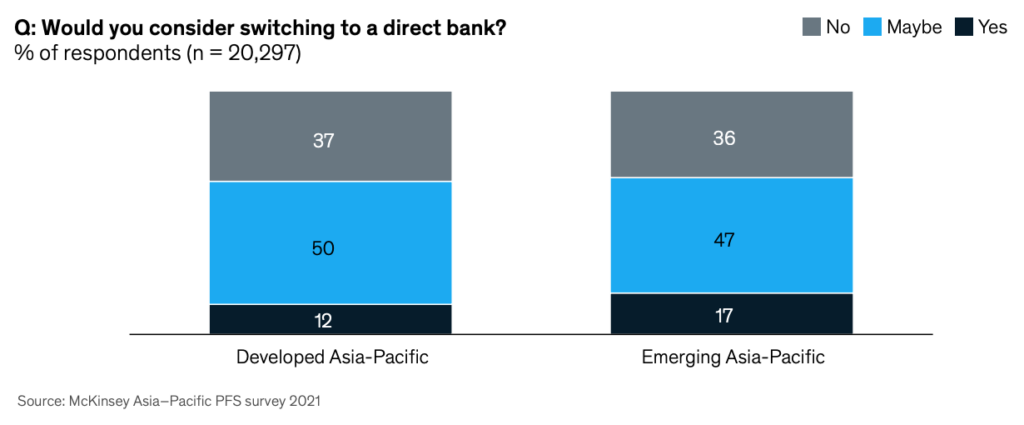

Showcasing the stiffer competition that new digital banks and fintech companies are putting on incumbents, approximately 60% of consumers across APAC said they would consider or might consider switching to a direct bank. Consumers in mainland China, Singapore and India were found to be the most inclined to consider shifting to a digital-only bank.

Would you consider switching to a direct bank? Source: McKinsey Asia-Pacific PFS survey 2021