Southeast Asia Fintech Opportunity Pushes Startup Valuations Further Up

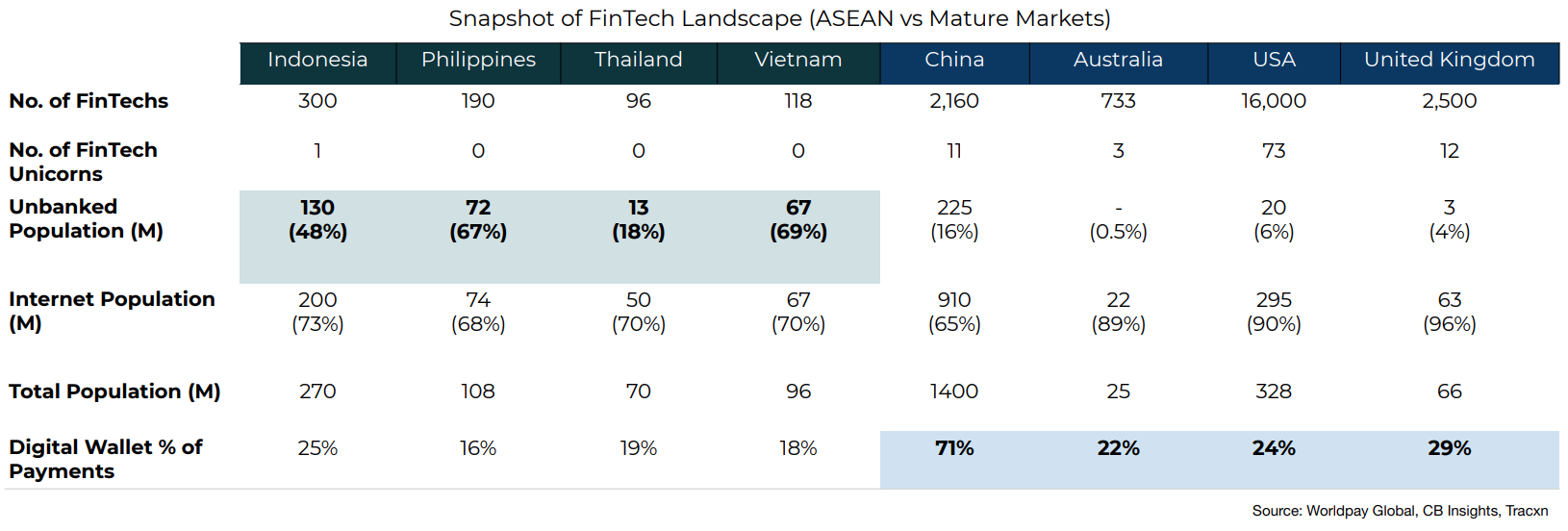

by Fintech News Singapore October 18, 2021Southeast Asia’s large population of unbanked and growing Internet penetration make it a hotbed for fintech innovation and an attractive market for e-wallets and neobanks.

Despite currently lagging behind more developed markets like Australia, the US and the UK, the region is set to leapfrog in digital infrastructure and will see a slew of fintech-only unicorns being birthed within the next decade, says Golden Gate Ventures, a Southeast Asia-focused venture capital (VC) firm.

These predictions were shared in the VC’s new Southeast Asia: Startup Ecosystem 2.0 report which outlines 10 key forecasts for in the region.

According to the report, Southeast Asia’s massive unbanked population of 290 million people creates a big opportunity fueling fintech players. Compared to markets like China (71%) and the UK (29%), digital wallet penetration in countries like the Philippines (16%) and Vietnam (18%) remains low, leaving space for companies in the sector to grow.

Neobanks, buy now, pay later (BNPL) and financing products, in general, are other areas still open for disruption with plenty of growth potential, the report says.

Snapshot of Fintech Landscape (ASEAN vs Mature Markets), Source: Southeast Asia: Startup Ecosystem 2.0 report, Golden Gate Ventures

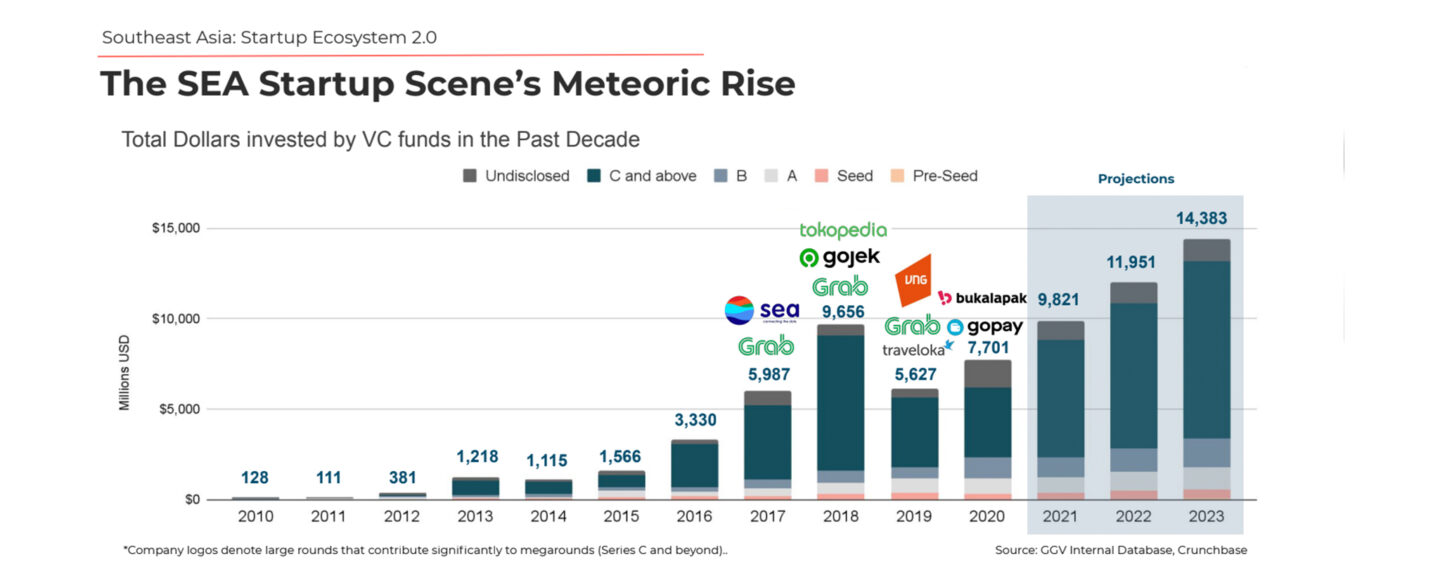

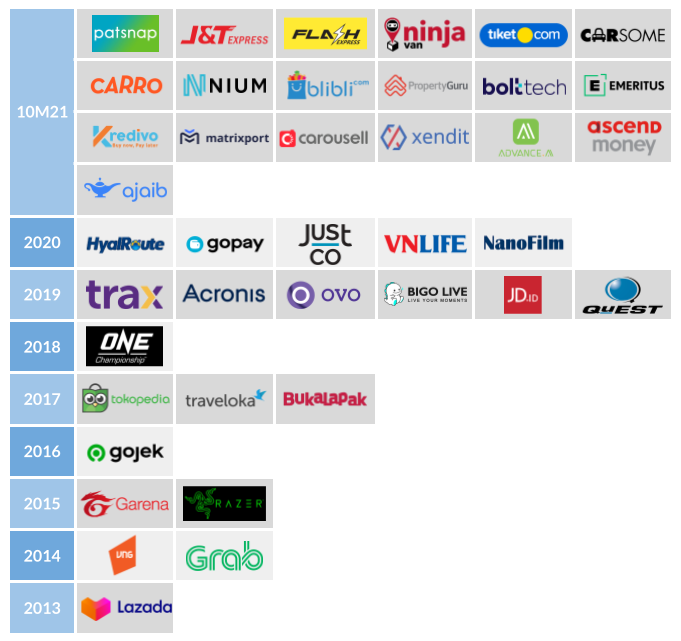

New data collected by DealStreetAsia show that Southeast Asia has minted 19 unicorns so far this year, well on track to surpass the total number of startups that reached unicorn status over the past decade (21).

The fintech and insurtech industries, in particular, have emerged as key unicorn makers. Out of these new 19 unicorns, eight are either fintechs or insurtechs: Bolttech, an insurtech company from Singapore; Nium, a payment startup from Singapore; Kredivo, a BNPL platform in Indonesia; Matrixport, a crypto-finance venture from Singapore; Xendit, a payment startup from Indonesia; Advance Intelligence Group, a regtech startup from Singapore; Ascend Money, a payment startup from Thailand; and Ajaib, a stock trading app from Indonesia.

Southeast Asia Unicorns Timetable, Source: DealStreetAsia

Several other fintech startups are expected to reach unicorn status soon, according to the research, including Malaysia-based e-wallet TNG Digital, Filipino fintech provider Voyager Innovation, and Vietnam’s mobile payment leader MoMo.

Grab Financial Group (GFG), the fintech unit of the ride-hailing giant, is also reportedly worth over US$1 billion. GFG was valued US$3 billion after raising US$300 million in January, according to the Financial Times.

Southeast Asia as a leading Islamic fintech hub

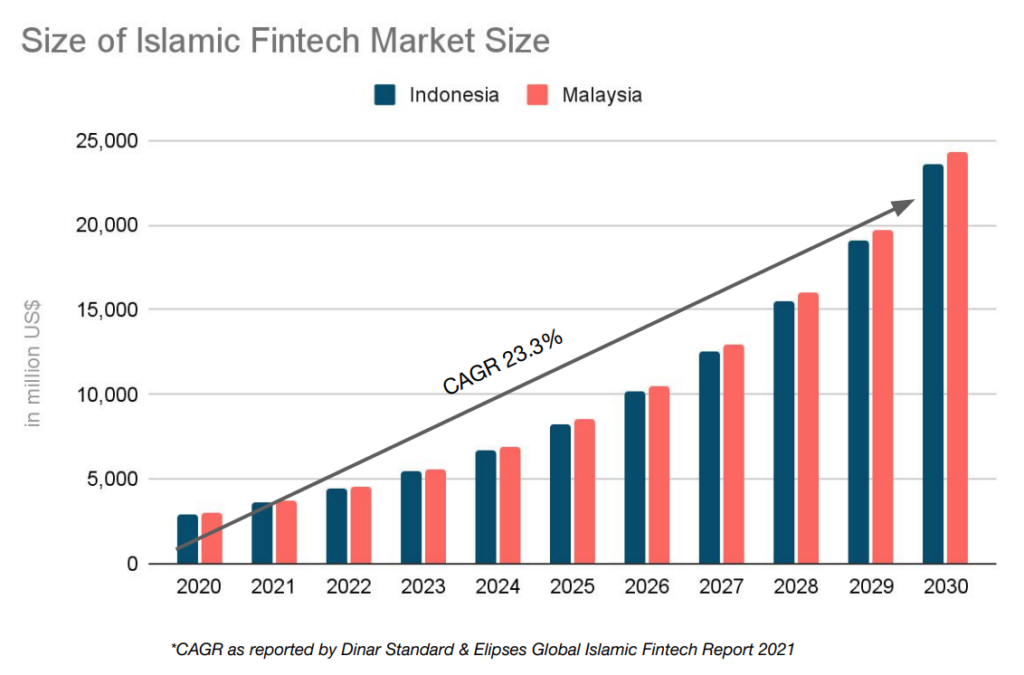

Driven by Indonesia and Malaysia, Southeast Asia will become a global Islamic tech hub in the years to come on the back of the rise of the Muslim lifestyle and Halal economy in industries including fashion, food and finance, says Golden Gate Ventures.

The Islamic fintech market, in particular, will grow at a compound annual growth rate (CAGR) of 23.3% between 2020 and 2030.

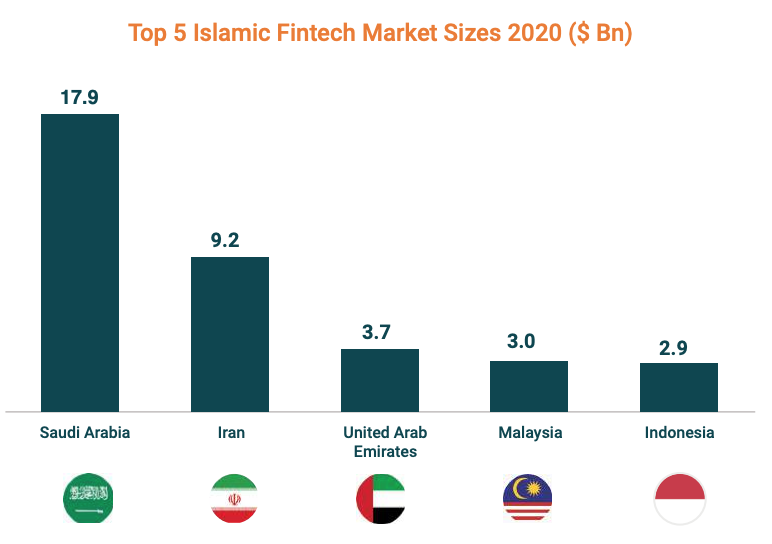

Size of the Islamic fintech market, Source: Southeast Asia: Startup Ecosystem 2.0 report, Golden Gate Ventures

Malaysia has led the Global Islamic Economy Indicator (GIEI) for now eight consecutive years. Today, the country boasts a burgeoning Islamic fintech and Islamic economy sectors which continues to flourish on the back of governmental support, Malaysia Digital Economy Corporation’s (MDEC) continuous push to expand the digitalization of the economy, and abundant talent.

In May, the Securities Commission Malaysia (SC) and the United Nations Capital Development Fund (UNCDF) launched an accelerator program to develop the Islamic fintech space. The program, called the FIKRA Islamic Fintech Accelerator Programme (FIKRA), aims to identify and scale relevant Islamic fintech solutions that can help address three main challenge areas: new Islamic capital market offerings, accessibility and social finance integration.

In 2020, Malaysia was the fourth largest Islamic fintech market, worth US$3 billion. This figure is set to surge to US$8.5 billion by 2025.

Indonesia, the world’s fifth-largest Islamic fintech market worth US$2.9 billion, has the largest Muslim population globally with 225 million Muslims. Its Islamic fintech industry is projected to rise to US$8.3 billion by 2025.

Top 5 Islamic Fintech Market Sizes 2020 ($B), Source: Global Islamic Fintech Report 2021