In Asia-Pacific (APAC), sustainable financing has gained momentum over the past years as regulators across the region step up efforts to promote the development of green finance and facilitate the transition to a sustainable future.

In Singapore, the Monetary Authority of Singapore (MAS) launched in December 2020 Project Greenprint, a collection of initiatives that aims to harness technology and data to enable a more transparent, trusted and efficient environmental, social and governance (ESG) ecosystem to enable green and sustainable finance.

Singapore wants to leverage its position as one of the world’s most developed fintech markets to become a leader in green fintech, a vision part of a broader movement for the nation to become sustainable.

In Hong Kong, promoting green and sustainable banking was one of the initiatives announced by the central bank in May 2019. Since then, several initiatives have followed including the establishment of the Green and Sustainable Finance Cross-Agency Steering Group, which is responsible for coordinating the management of climate and environmental risks to the financial sector and accelerating the growth of green and sustainable finance in Hong Kong.

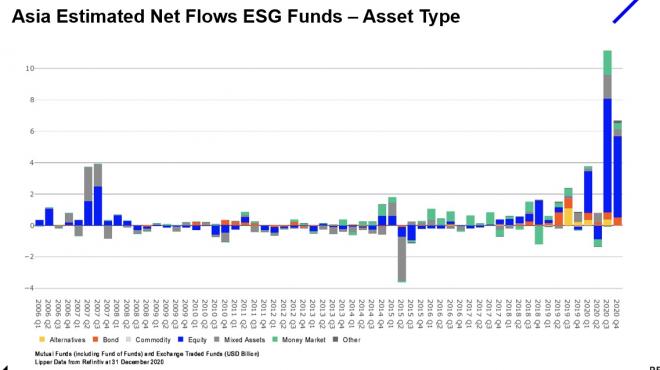

These developments come on the back of rising demand for sustainable investing. Data from Refinitiv Lipper show that assets under management for ESG funds in Asia reached more than US$60 billion in end-December 2020, doubling that of 2019.

Asia Estimated Net Flows ESG Funds – Asset Type, Source: Asian Development Bank

Though green fintech remains a nascent space in APAC compared to Europe, the ecosystem is evolving rapidly. To get a sense of the region’s climate fintech industry, we’ve compiled a list of startups and projects that are making waves and which are worth following very closely.

STACS (Singapore)

Hashstacs, also known as STACS, is a Singapore fintech company specialized in blockchain technology and tokenization. Its clients and partners include banks, stock exchanges, asset managers, and corporates in different sectors.

STACS is currently developing an industry-wide blockchain-based environment, social, and governance (ESG) data and certification registry in partnership with the Monetary Authority of Singapore’s (MAS) Project Greenprint.

The ESG Registry aims to provide accessibility to quality ESG data of various industry sectors through an aggregated platform.

It will include sector-specific industry recognized certifications and real-time processed dynamic data from other integrated technologies and sectorial platforms. Through APIs, the ESG Registry will be able to support various downstream integrations such as to support financial institutions in trade financing and portfolio monitoring. The ESG Registry is currently deployed in its beta phase.

CO2X (Singapore)

CO2X, from Singapore, is a new joint venture formed by STACS, Ascent and Evercomm in October. CO2X is developing a platform that will provide local small and medium-sized enterprises (SMEs) with accessible carbon tracking solutions and green financial services through a data-driven approach.

CO2X, which began testing its beta platform in November, uses Internet-of-Things (IoT), blockchain, and data analytics to help businesses and the financial sector navigate the regulatory and certification frameworks.

CO2X aims to be the world’s most inclusive sustainability platform where businesses, technology and finance meet to drive sustainable change, accelerating the adoption of data-driven sustainability solutions across businesses of all sizes, across all sectors.

Energy X (South Korea)

Energy X is a South Korean online energy startup. Energy X is the developer of an artificial intelligence (AI)-driven platform that allows corporate and individual users to invest in renewable energy projects worldwide.

Energy X’s online-to-offline platform lets investors find crowdfunding, private funding, and exchange opportunities to profit from low- to mid-risk renewable energy projects. In turn, independent power producers (IPPs) gain better access to investors and contractors, and can start projects more easily.

Energy X was named one of the 1,000 most promising climate tech startups in the world by HolonIQ.

MioTech

MioTech uses artificial intelligence to solve the sustainability, climate change, carbon emissions reduction, and social responsibility challenges faced by financial institutions, corporations, and individuals.

Its comprehensive coverage of ESG data helps financial institutions make the right decisions in green finance and responsible investments. Its software helps corporations manage ESG reporting, improve energy efficiency, track and reduce carbon emissions. Its app builds green-conscious communities and promotes low-carbon lifestyles among individuals.

MioTech has offices in Hong Kong, Shanghai, Beijing, and Singapore. Its world-renowned investors include ZhenFund, Horizons Ventures, TOM Group, Moody’s, HSBC, Guotai Junan International, and GIC.

Powerledger (Australia)

Powerledger is a fast growing tech startup from Australia that has developed a blockchain-enabled energy and environmental commodity trading platform.

Created in 2016, Powerledger helps people transact energy, trade environmental commodities and invest in renewables. It has created software that enables peer-to-peer (P2P) energy trading from solar rooftop panels. Powerledger aims to create a democratized energy system, enabling greater control and ownership for consumers and producers alike.

Powerledger has received global recognition including winning Richard Branson’s international Extreme Tech Challenge in 2018, and, like Energy X, was named one of the 1,000 most promising climate tech startups in the world by HolonIQ.