In 2021, Singapore continued to pursue its ambition to become a world leader in fintech innovation, multiplying initiatives to foster green fintech, explore opportunities related on central bank digital currency (CBDC), and lay the foundation for open finance.

Leading fintech finding in Southeast Asia

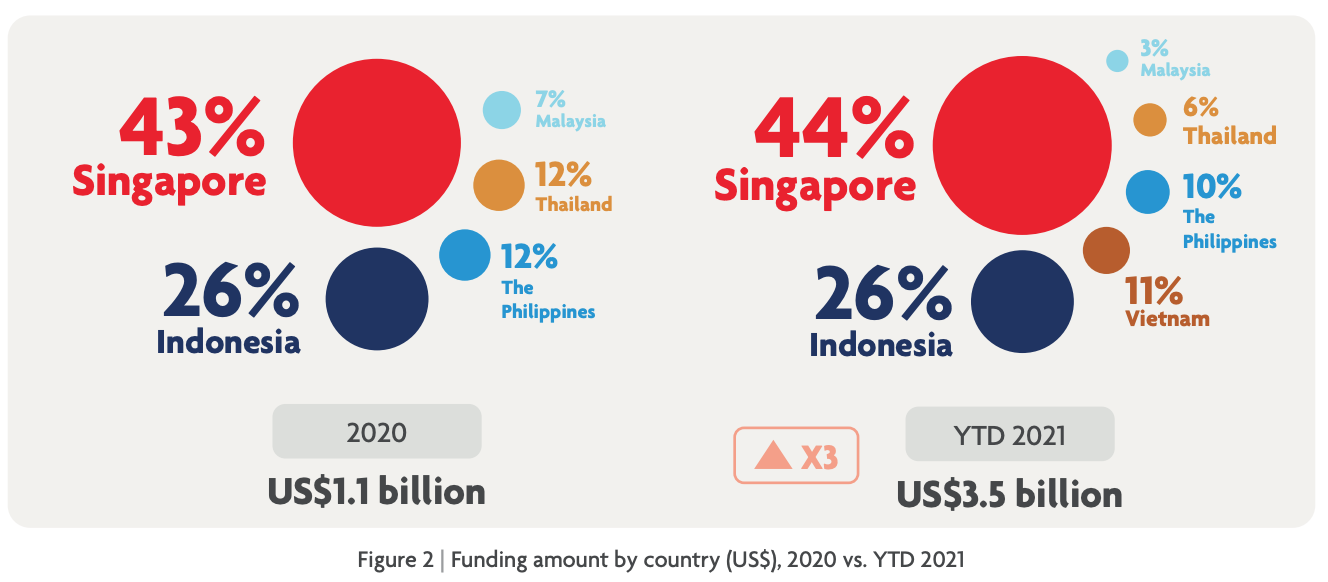

2021 was a blockbuster year for fintech funding globally. In Southeast Asia, fintech companies received a record-breaking US$3.5 billion, three times the amount raised last year, according to the Fintech in ASEAN 2021: Digital Takes Flight report by the United Overseas Bank (UOB), PwC and the Singapore Fintech Association. Of that amount, 44% or US$1.6 billion was secured by Singaporean fintech companies.

Funding amount by country (US$), 2020 vs. YTD 2021, Source: Fintech in ASEAN 2021- Digital takes flight, UOB, PwC, Singapore Fintech Association, Nov 2021

This year’s fintech funding activity was driven by mega-rounds of US$100 million and larger closed by later stage companies. Out of the ten largest rounds closed in the first nine months of the year, seven were secured by Singaporean fintech companies: Grab Financial Group (US$300 million, Series A), Nium (US$200 million, Series D), M-Daq (US$147 million, Series D), FinAccel (US$125 million, Series C), BigPay (US$100 million, Series A), Matrixport (US$100 million, Series C), and MatchMove (US$100 million, Series D).

2021 also saw a trend for consolidation and fintech exits. During H1’21, super app company Grab announced the largest merger with a special purpose acquisition company (SPAC) ever: a US$40 billion deal with US-based Altimeter Growth. Grab began trading on New York’s Nasdaq on December 2, making it the largest US market debut by a Southeast Asian company.

Advancing digital payment innovation

With COVID-19 forcing consumers and businesses to turn to digital channels, adoption of digital payments accelerated in Singapore. Transaction volume through PayNow, a peer-to-peer (P2P) instant fund transfer service, reached S$20 billion in H1 2021, nearly surpassing 2020’s total.

Rising digital payment activity came on the back of various government initiatives launched throughout the year to encourage the shift to cashless transactions. In February 2021, PayNow was extended to three non-bank financial institutions, allowing customers of Grab Financial Group, Liquid Group and Singtel, to top up their digital wallets directly from their bank accounts and transfer funds between these e-wallets via PayNow.

The year also saw Singapore continue to pursue its cross-border instant payments ambitions, announcing linkage initiatives with Thailand’s PromptPay, Malaysia’s DuitNow, India’s Unified Payments Interface (UPI), and the Philippines’ real-time and QR payment systems.

Secure data flows

Recognizing the role of data in driving the digital economy, Singapore started laying the foundation for the trusted and secure sharing of data.

In late-2020, the Singapore Financial Data Exchange (SGFinDex) was launched to allow data sharing to be conducted securely, in compliance with regulations, and with consumers’ consent. Since its inception, the infrastructure has spurred financial planning among participating bank customers with over 150,000 unique users sign ups, 290,000 bank accounts linked and 620,000 data retrievals made.

The launch of SGFinDex was followed in July 2021 by the go-live of the Singapore Trade Data Exchange (SGTraDex), a platform aimed at facilitating sharing of data between supply chain ecosystem partners to strengthen the financing integrity of trade flows, optimize logistics functions across partners and improve visibility on transactions.

Other data exchange infrastructures are currently in the works, including ChekFin, a blockchain-based credentials platform of fintech firms, and COSMIC, a platform for financial institutions to share information on customers and transactions to fight money laundering (ML), terrorism financing (TF) and proliferation financing (PF).

A green fintech hub

Singapore is thriving to become a leader in green fintech, an ambition that’s part of the city state’s broader sustainability agenda unveiled in 2019.

Singapore’s commitment to green fintech was materialized with the launch of Project Greenprint in December 2020. As part of the project, four digital platforms will be piloted by MAS in partnership with the industry:

- The Greentprint Common Disclosure Portal, which aims to simplify the environmental, social and governance (ESG) disclosure process;

- The Greenprint Data Orchestrator, which will aggregate sustainability data from multiple data sources;

- The Greenprint ESG Registry, which will record and maintain the provenance of ESG certifications with the use blockchain technology; and

- The Greenprint Marketplace, which will connect green technology providers in Singapore and the region to a community of investors, venture capital (VC) firms, financial institutions, and corporates.

The pilots are expected to be completed in the second half of 2022.

Advancing research on CBDCs and real-time cross-border instant payments

Since 2016, MAS has been experimenting with blockchain technology and CBDCs through Project Ubin, an initiative that seeks to apply distributed ledger technology (DLT) to payments and settlements

This year, MAS unveiled more projects related to blockchain and CBDCs, including Project Orchid, which explores the merits of retail CBDCs, Partior, a blockchain-based interbank clearing and settlement network jointly established by DBS Bank, JP Morgan, and Temasek, and Project Dunbar, a partnership among MAS, the Bank for International Settlements (BIS)’ Innovation Hub, and other central banks around the world to use CBDCs for cross-border payments.

With BIS, MAS is also involved in Project Nexus, which seeks to create a common blueprint for how countries can connect their real-time payment systems onto a single cross-border network.

Year End Message to Our Readers

Fintech News Singapore would like to take this opportunity to wish all our readers a Merry Christmas and a very Happy New Year.

We will be taking a break from the 23rd December 2021 to 2nd January 2022.

We look forward to seeing you all again on the 3rd January 2021!